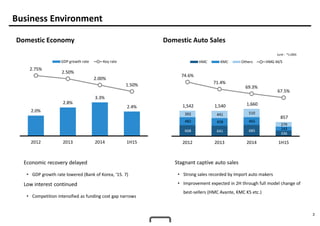

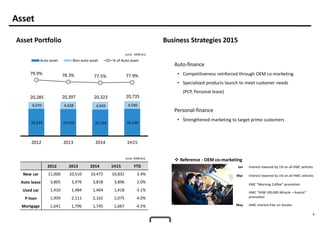

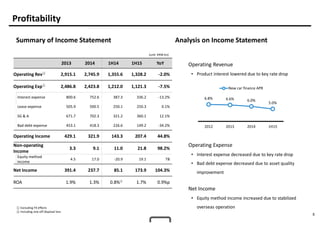

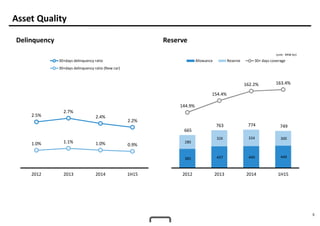

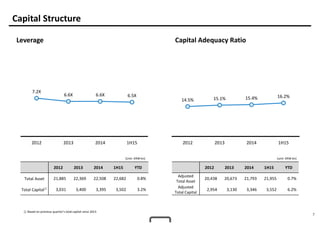

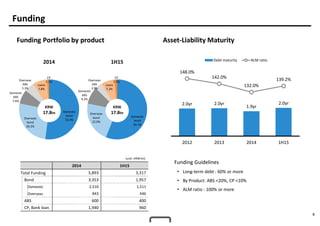

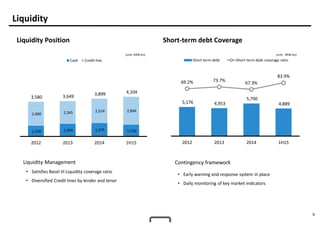

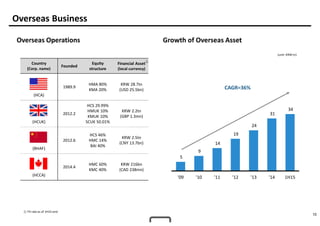

Hyundai Capital Services reported asset growth of 3.4% in the first half of 2015 despite unfavorable market conditions, with improvements in profitability through reduced bad debt expenses and better asset quality. The company also expanded its overseas operations through new subsidiaries and increased its global business capabilities. Liquidity and capital adequacy ratios remained strong with diversified funding sources.