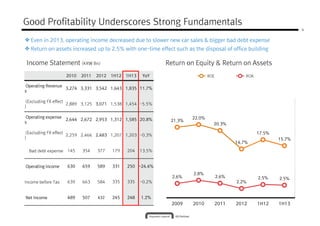

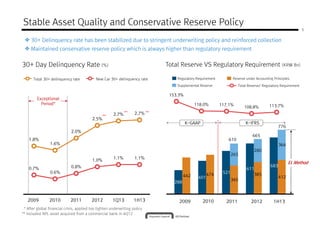

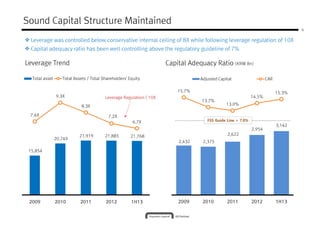

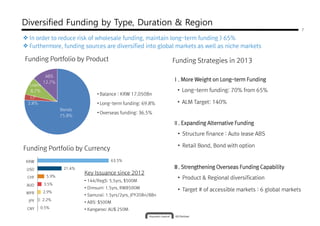

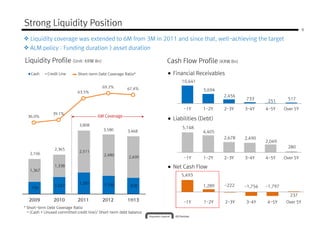

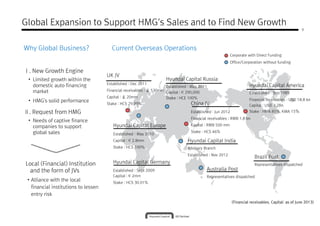

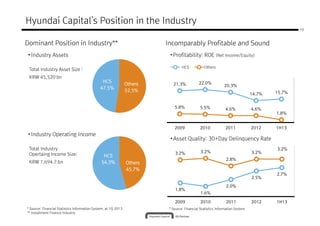

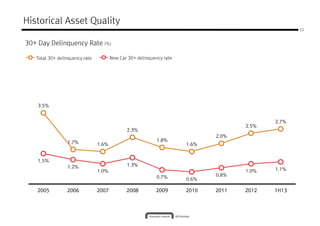

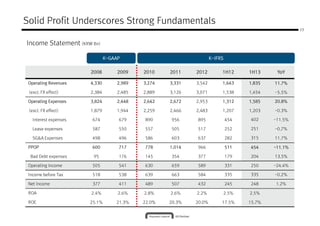

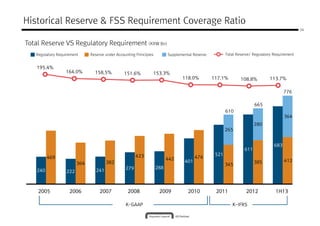

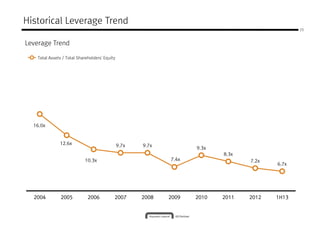

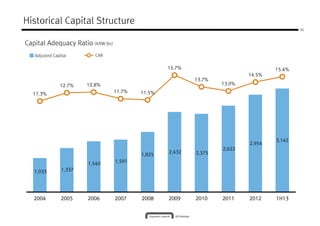

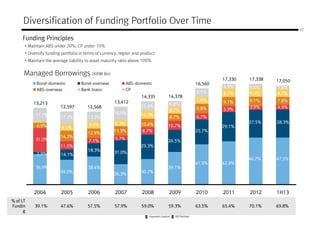

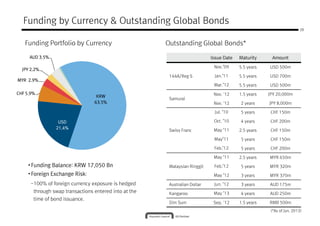

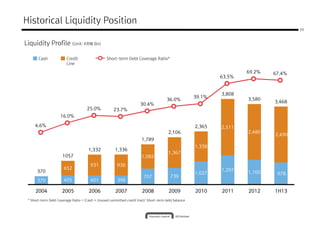

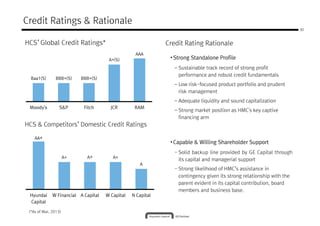

Hyundai Capital provides a summary of its financial performance in the first half of 2013. It achieved operating income of KRW 250 billion and a return on assets of 2.5%, despite slower new car sales. Asset quality remained stable with a 30+ day delinquency rate of 2.7%. The company maintains a conservative capital structure with a leverage ratio of 6.7x and a capital adequacy ratio above 15%. Hyundai Capital also discusses its diversified funding sources by type, duration, and region to reduce reliance on wholesale funding and expand its global funding capabilities.