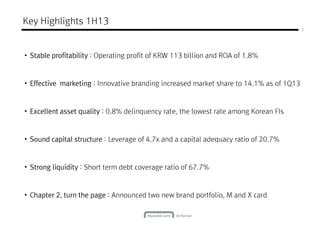

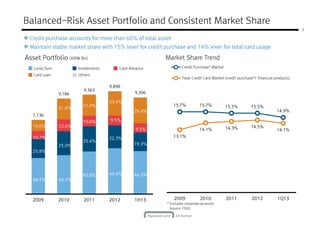

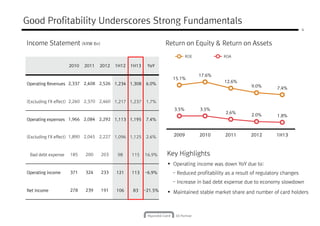

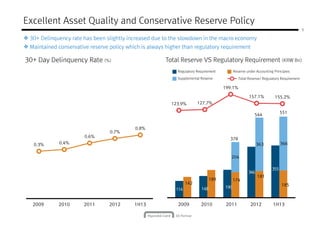

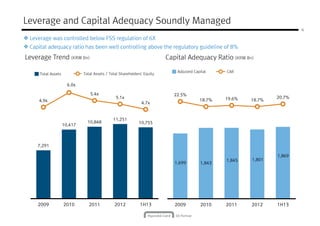

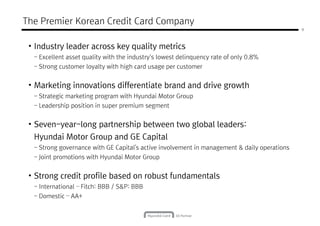

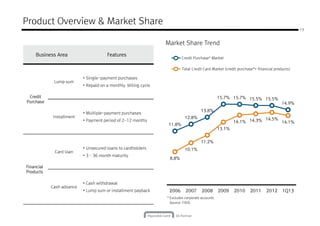

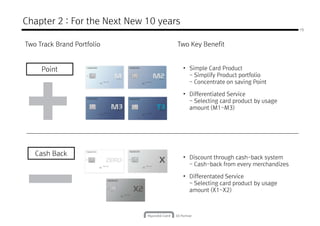

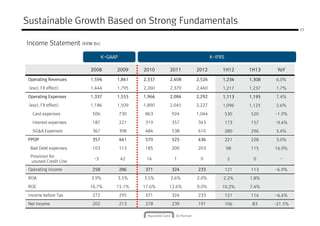

Hyundai Card is the leading credit card company in South Korea with over 14% market share. It has maintained stable profitability and excellent asset quality. To drive future growth, Hyundai Card recently announced two new brands - M Card and X Card - as part of a two-track brand portfolio strategy. M Card will offer a simple product focused on earning points, while X Card will provide differentiated services and the ability to select a card product. This portfolio approach aims to simplify Hyundai Card's offerings and concentrate on key customer benefits like savings and service.