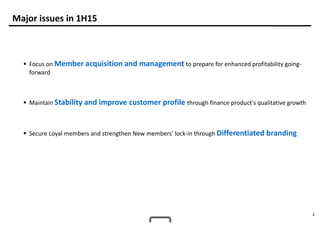

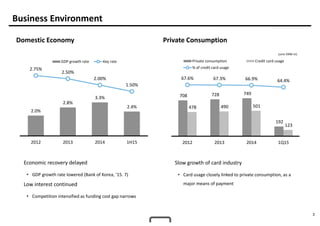

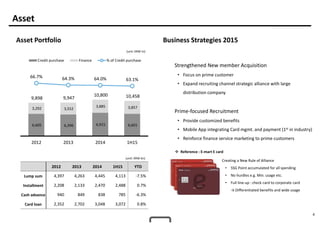

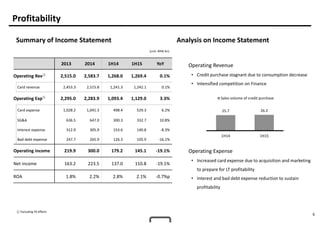

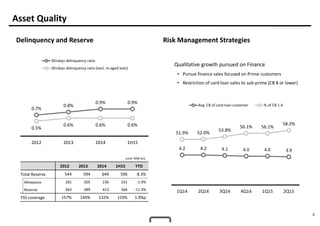

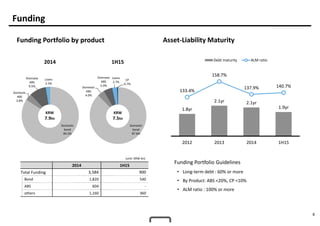

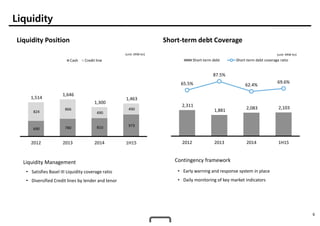

Hyundai Card Corporation reported its 1H15 earnings, with operating revenue remaining flat at KRW 1,269.4 billion year-over-year as credit purchase sales stagnated due to economic conditions. Operating expenses increased due to marketing spending to acquire new members and prepare for long-term profitability. Asset quality was managed through qualitative growth of finance products focused on prime customers and restrictions on sub-prime lending.