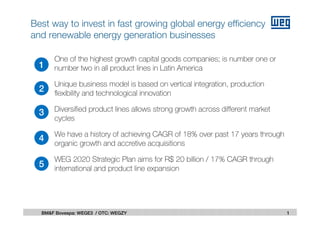

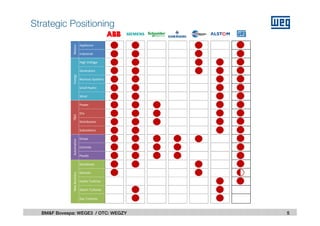

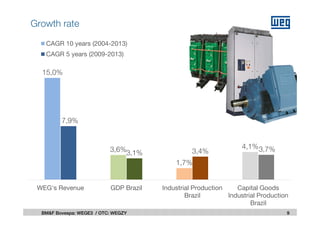

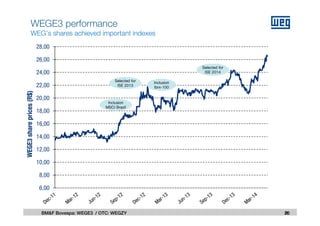

- WEG is one of the highest growth capital goods companies in Latin America and is number one or two in all of its product lines.

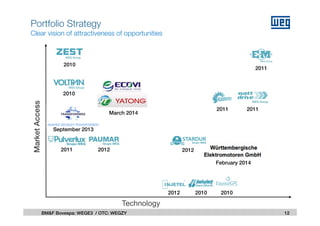

- It has a unique vertically integrated business model based on production flexibility and technological innovation.

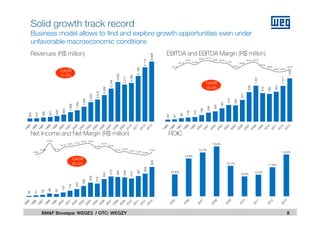

- Its diversified product lines allow for strong growth across different market cycles through organic growth and acquisitions.