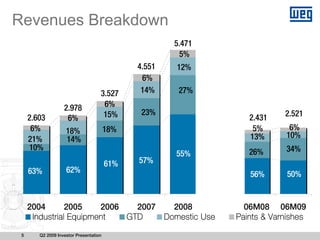

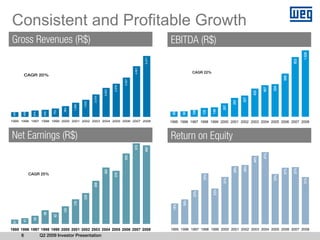

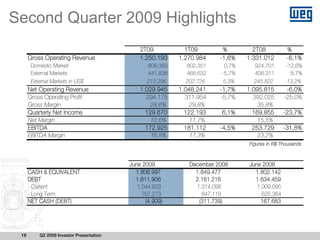

- WEG reported Q2 2009 revenues of R$1.25 billion, down 1.6% year-over-year, with domestic market revenues up 0.7% and external markets down 5.7%.

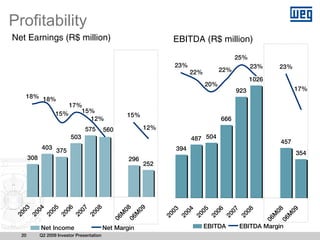

- Net income for Q2 2009 was R$129.7 million, up 6.1% from Q1 2009 but down 23.7% year-over-year. EBITDA was R$172.9 million, down 4.5% from Q1 2009 and 31.8% year-over-year.

- Gross margin was 28.6% in Q2 2009 compared to 29.8% in Q1 2009 and 35.8% in Q2 2008 as