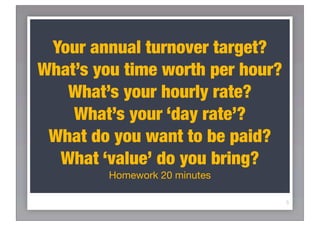

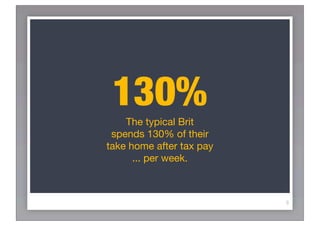

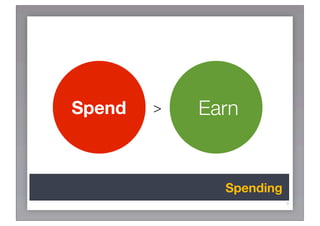

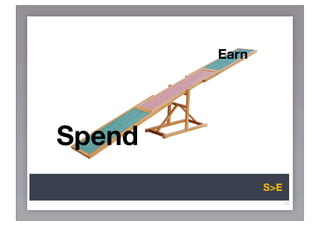

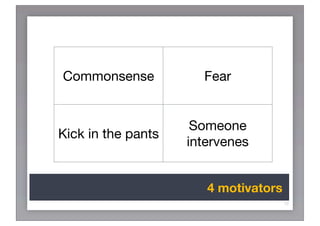

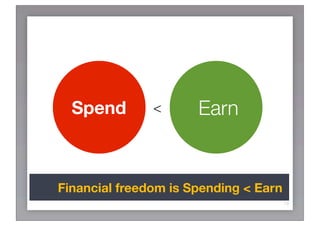

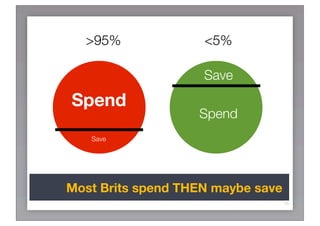

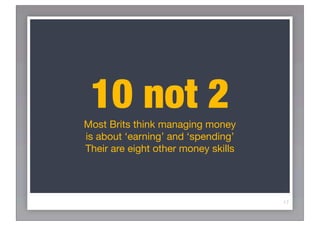

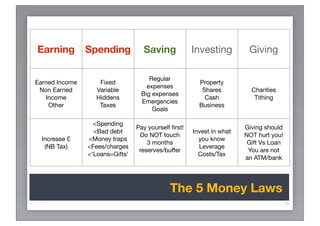

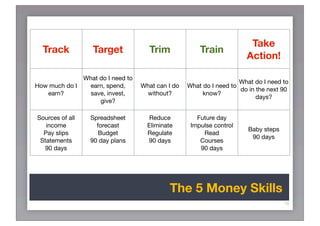

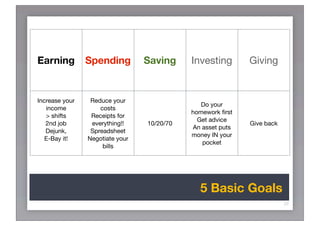

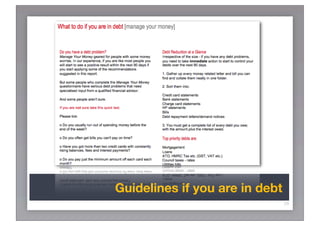

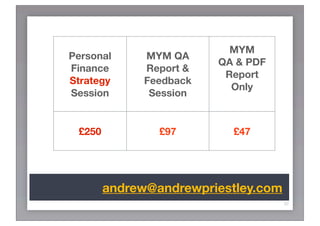

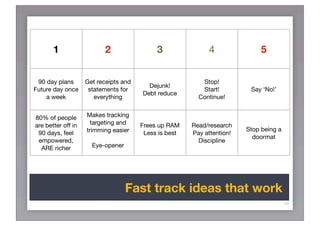

This document provides tips and strategies for managing personal finances. It discusses earning money, spending habits, saving, investing, and giving. Some key points include tracking expenses, setting financial goals to save 10-20% of take-home pay and live on 70%, paying yourself first by saving, reducing costs through eliminating unnecessary spending, getting out of debt, and creating a 90-day plan to improve money management skills and turn finances around. The document emphasizes taking action, getting started, and not putting off improving one's financial situation.