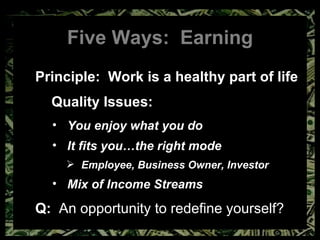

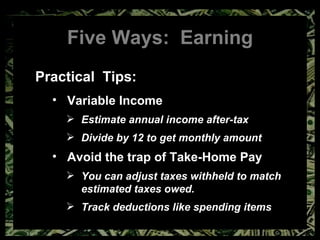

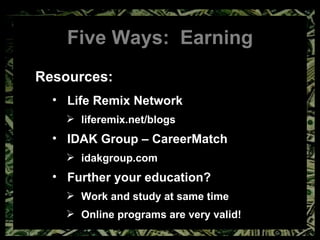

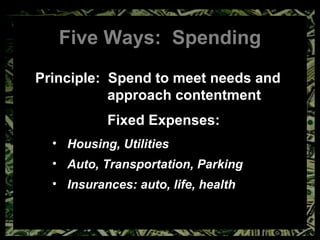

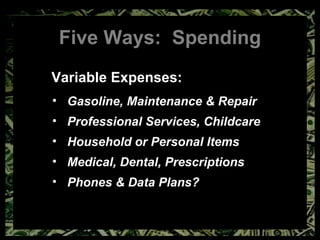

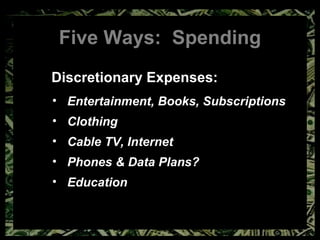

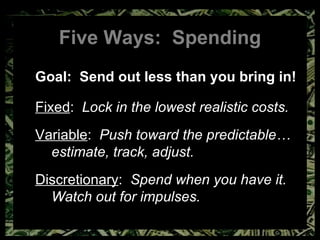

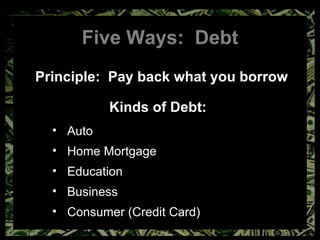

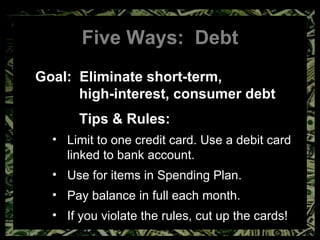

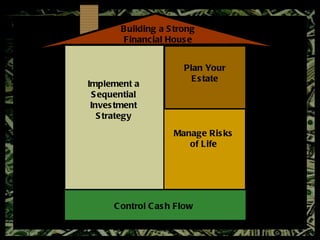

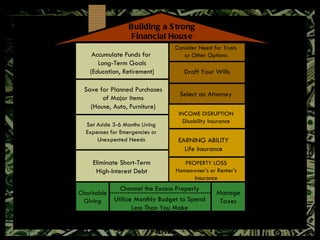

The document provides advice on building strong personal finances. It discusses five ways to handle money: earning, spending, saving, giving, and debt. It recommends developing a monthly budget to spend less than you earn, eliminating high-interest debt, and saving 3-6 months of living expenses as an emergency fund. The overall goal is to gain control over cash flow and implement a plan to meet long- and short-term financial objectives.

![Questions? Contact Tim: [email_address]](https://image.slidesharecdn.com/buildingastrongfinancialhouse4-29-2011-110429100307-phpapp01/85/Building-a-Strong-Financial-House-4-29-2011-41-320.jpg)