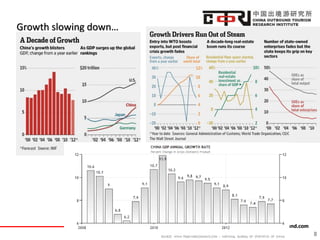

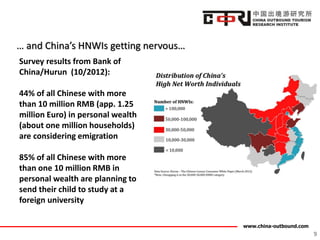

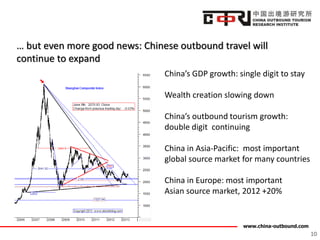

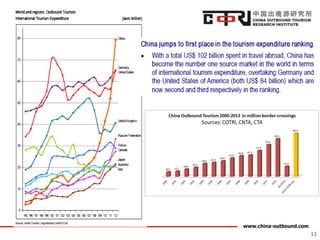

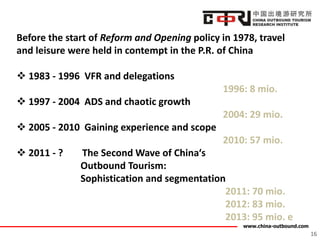

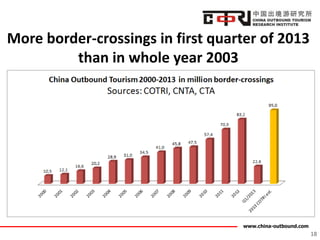

This document discusses Chinese outbound tourism trends. It notes that over the past 15 years, Chinese outbound travel has grown from 8 million border crossings in 1996 to over 83 million in 2012. It segments the Chinese outbound travel market and notes that travelers are seeking prestige and demanding respect from their travels. Destinations that can offer prestige and a return on investment in terms of a memorable experience will be more successful attracting Chinese tourists. The document predicts that by 2017, Chinese outbound travel will continue to grow, with travelers seeking confirmation and experiences rather than just fun.