- Chinese outbound travel has expanded rapidly in recent years, with over 97 million outbound trips made in 2013, more than double the number in 2009. By 2018, outbound trips are forecast to reach around 160 million.

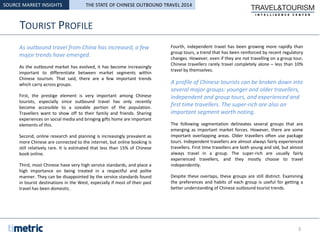

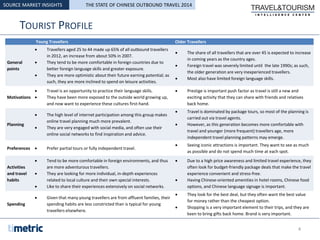

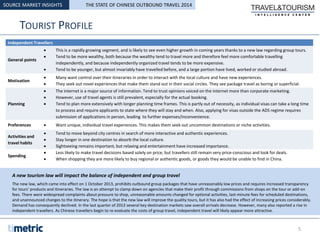

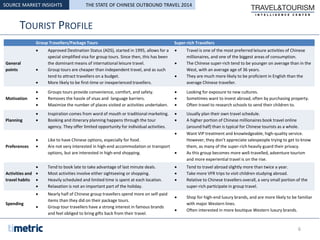

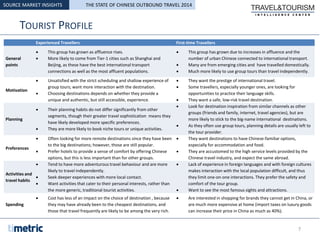

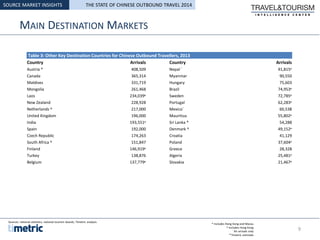

- Chinese tourists can be categorized into several groups - younger and older travelers, independent and group travelers, experienced and first-time travelers, and the super-rich. East and Southeast Asia remain the most popular destinations.

- While China's economy has slowed, continued urbanization and government policies are expected to further support the expansion of outbound travel. However, air connectivity outside major cities needs to be expanded to encourage more outbound travel.