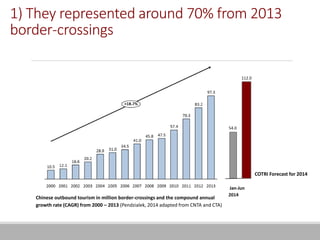

1) Young Chinese tourists represented around 70% of outbound Chinese tourists from 2013, with a focus on Asian destinations like Hong Kong, Macau, and Japan.

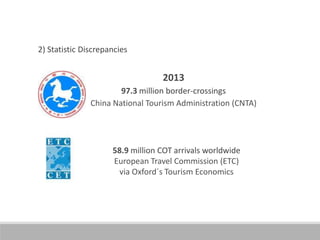

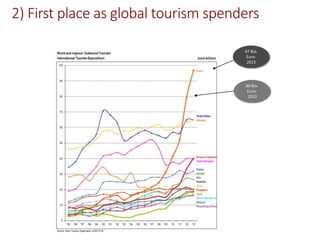

2) In 2013, there were an estimated 97.3 million outbound trips by Chinese tourists according to Chinese authorities, while European authorities estimated 58.9 million visits to Europe. Chinese tourists were the largest tourism spenders worldwide in 2013 and 2014.

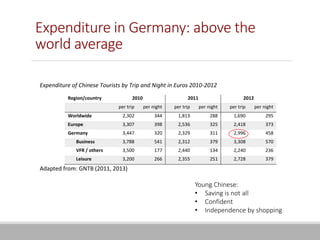

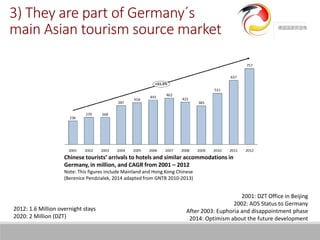

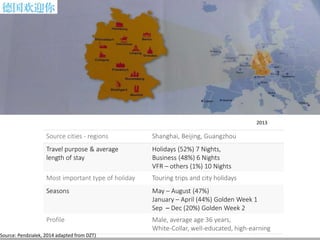

3) Germany has become a major destination for Chinese tourists, receiving over 1.6 million overnight stays in 2012, with cities like Munich and Frankfurt popular destinations. Most Chinese tourists to Germany travel for holidays or business.