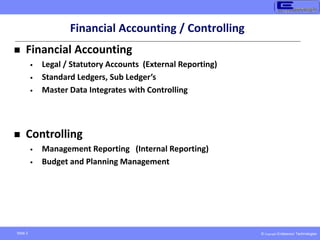

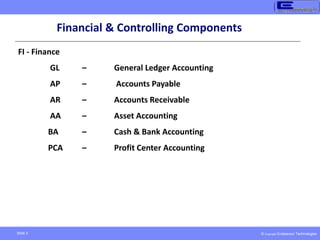

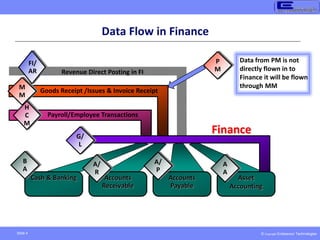

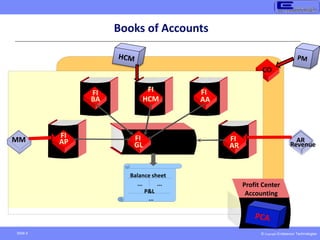

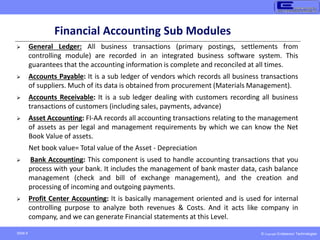

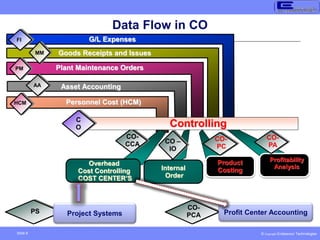

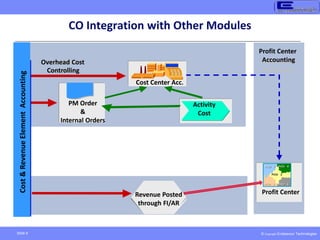

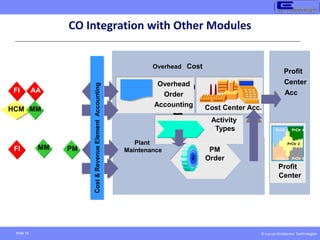

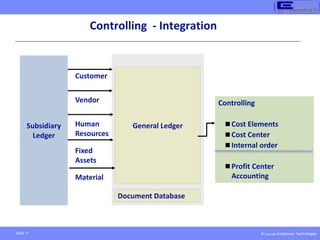

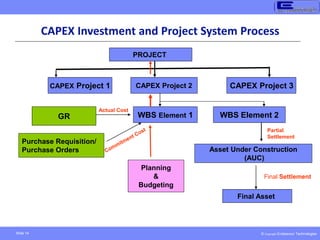

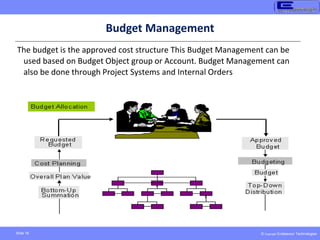

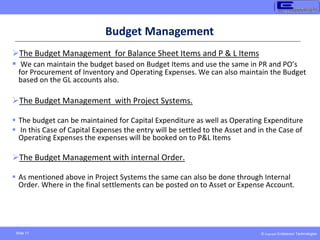

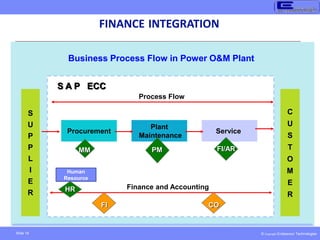

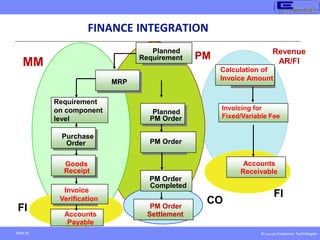

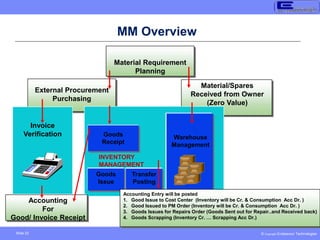

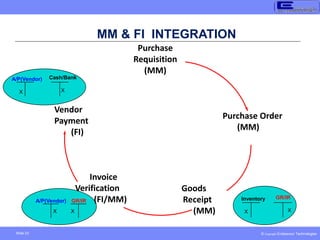

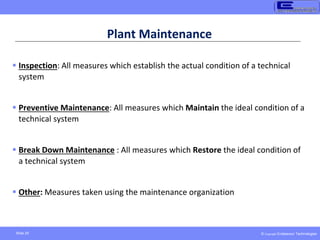

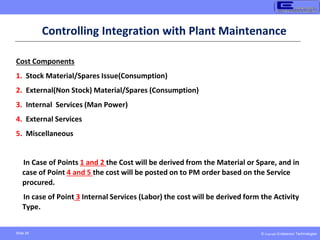

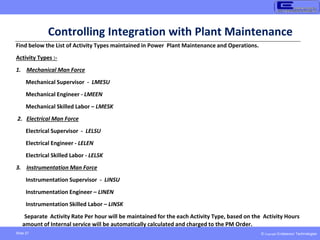

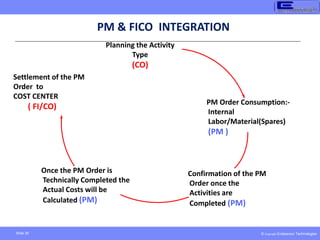

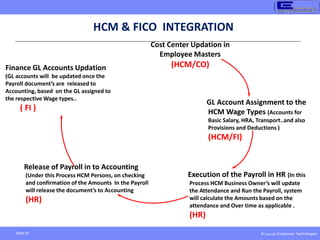

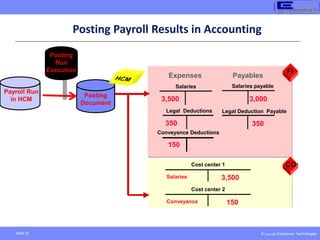

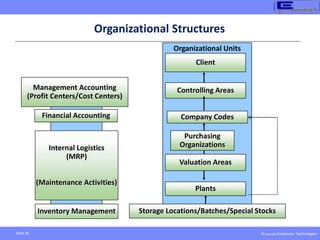

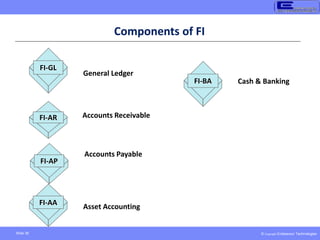

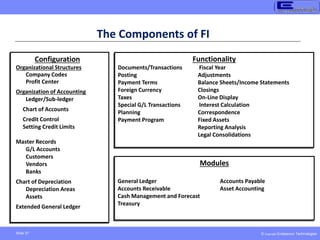

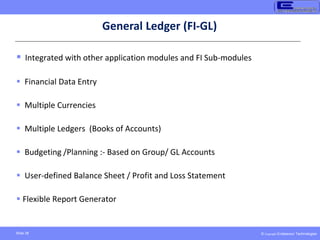

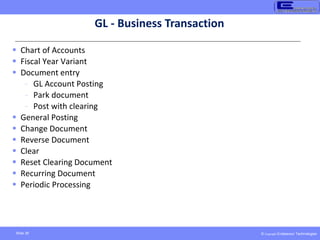

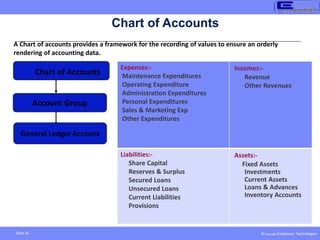

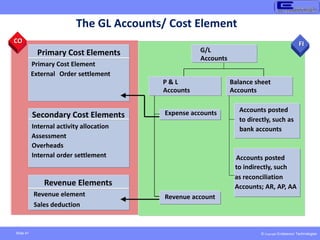

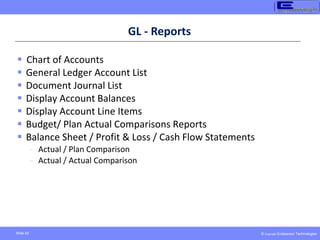

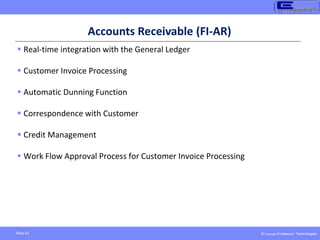

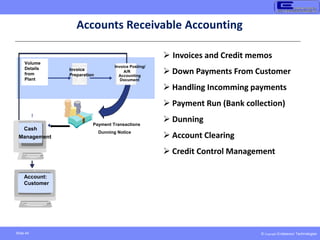

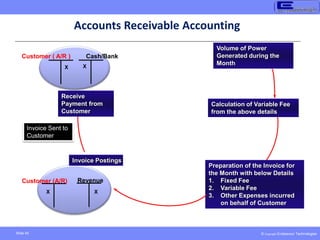

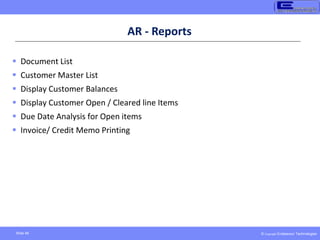

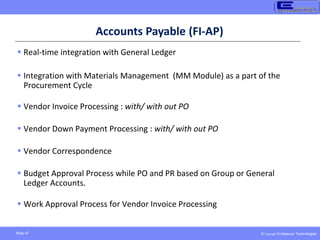

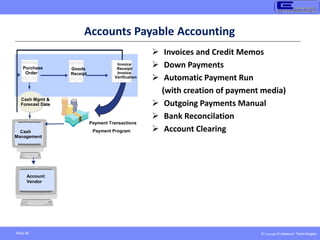

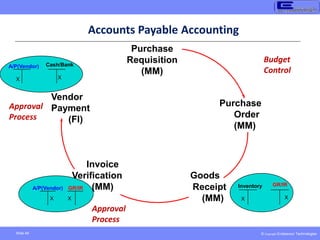

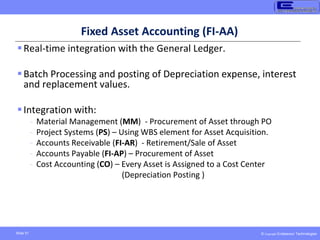

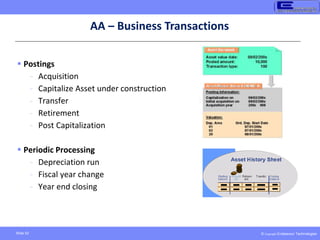

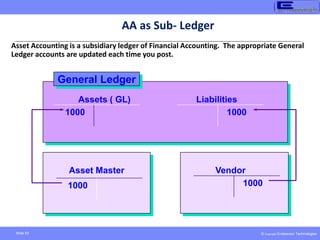

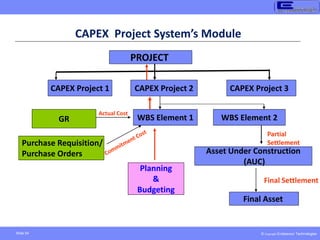

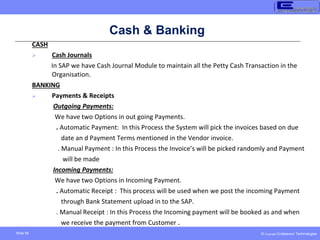

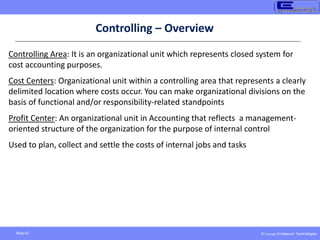

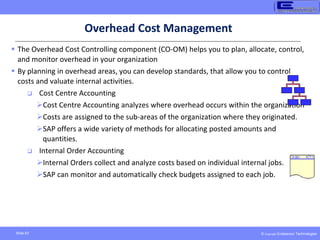

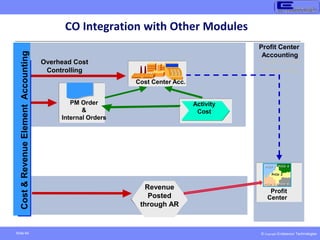

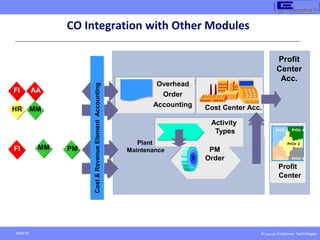

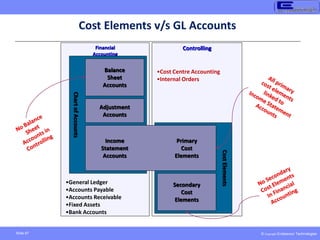

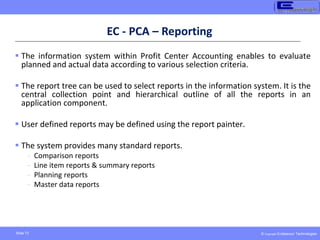

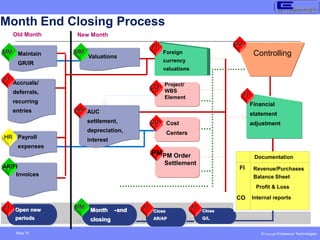

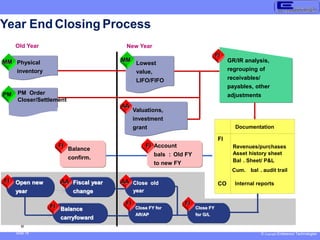

The document provides a comprehensive overview of the Finance and Controlling (FICO) modules in SAP for a power operations and maintenance company in India. It outlines key components such as financial accounting, controlling, budget management, and integration with other modules like materials management and human resources. Detailed descriptions of processes for accounts payable, accounts receivable, asset management, and project systems are also included, emphasizing their interconnectivity and importance in financial reporting and decision-making.