The document discusses accounting standards for employee benefits and leases according to International Accounting Standards (IAS) 37, 17, and 19. Key points include:

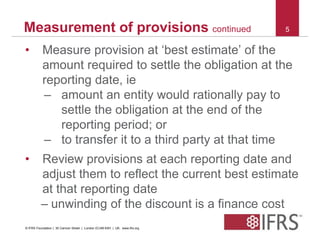

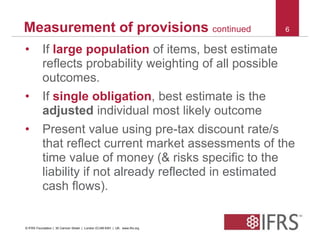

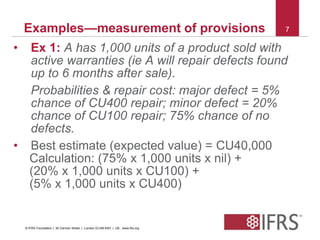

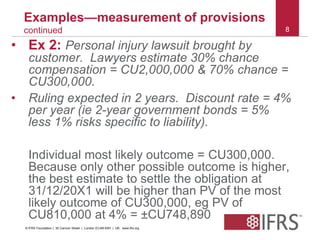

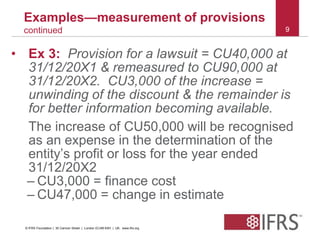

- IAS 37 covers accounting for provisions, contingent liabilities, and contingent assets, except those from executory contracts or covered by other IFRS.

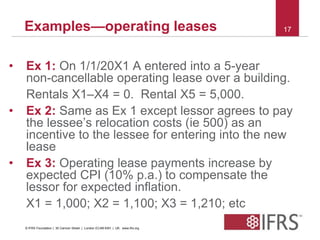

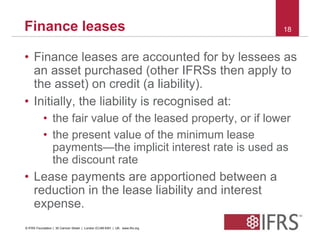

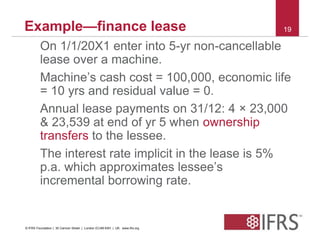

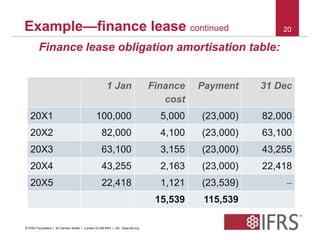

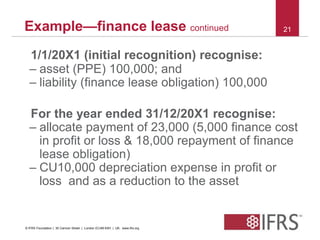

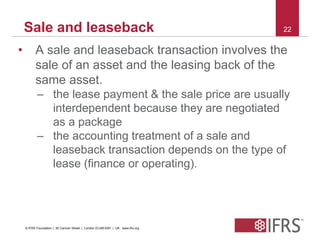

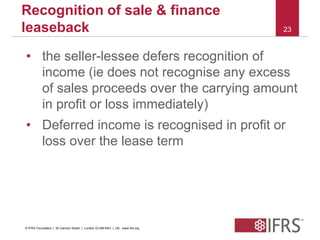

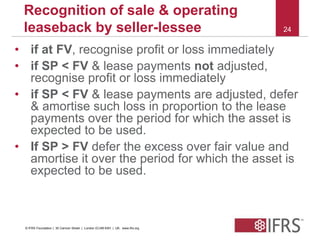

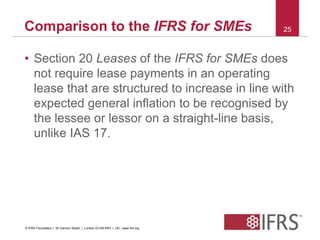

- IAS 17 establishes standards for classifying and accounting for leases as either finance or operating leases. Finance leases are accounted for similarly to purchases.

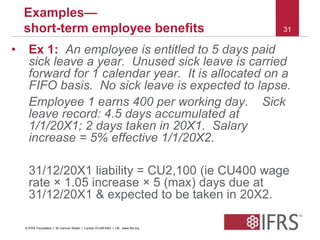

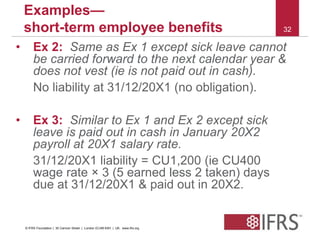

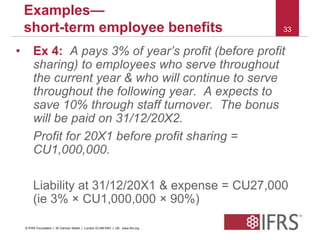

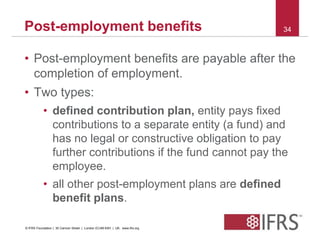

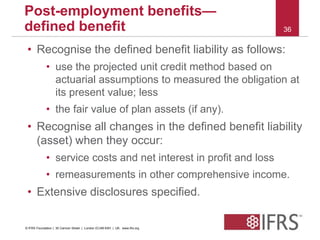

- IAS 19 provides guidance for accounting and disclosures of short-term employee benefits, post-employment benefits, other long-term benefits, and termination benefits.