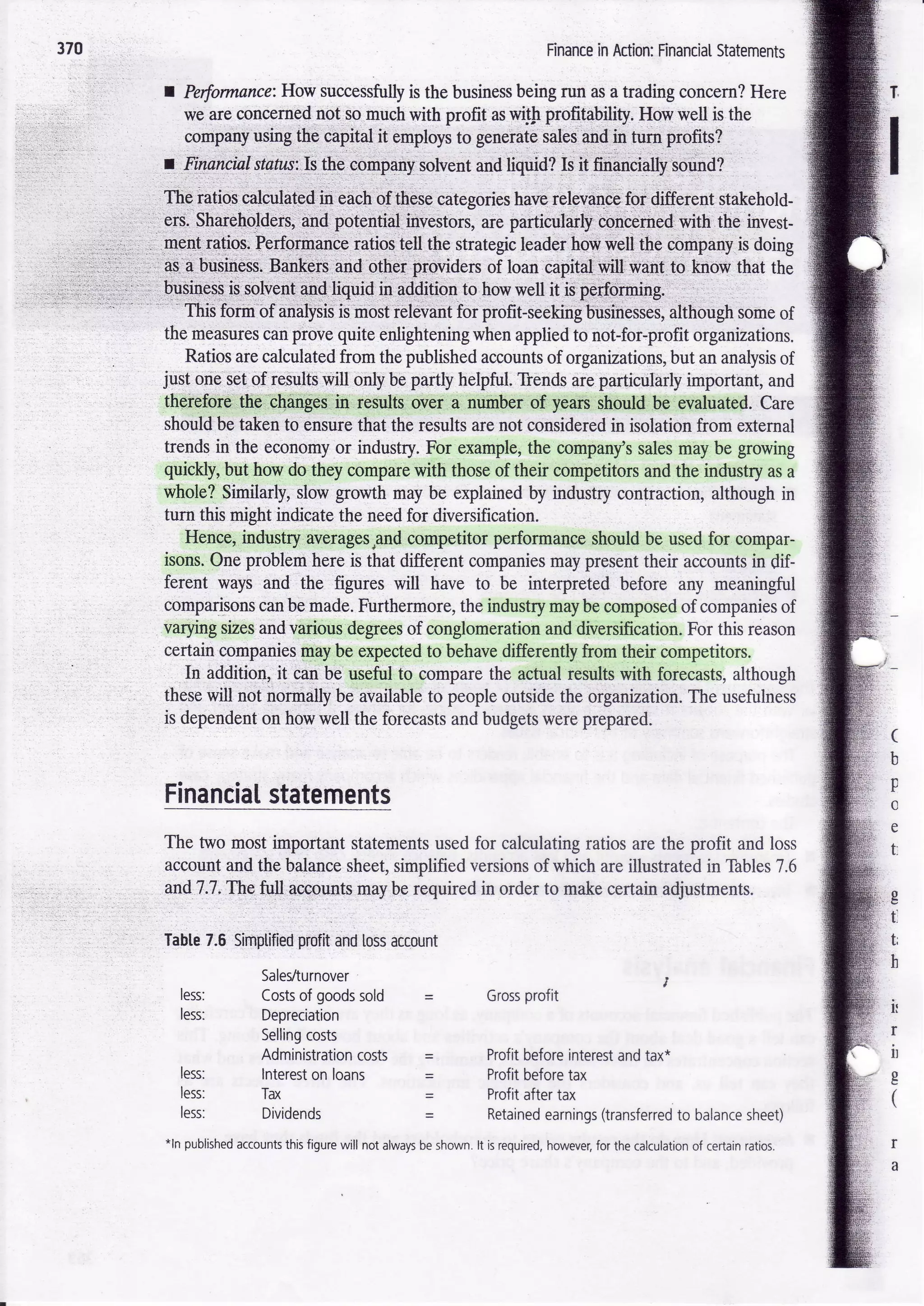

This document discusses key financial ratios that can be calculated from a company's financial statements to analyze its performance and financial position. There are three main categories of ratios: performance ratios that indicate how well the business is being run and generating profits; financing ratios that assess the company's solvency and financial soundness; and investment ratios that are particularly relevant for shareholders and investors. Ratios should be tracked over multiple years and compared to industry averages and competitors to fully understand a company's financial health. Key financial statements used to calculate ratios are the profit and loss account and balance sheet.