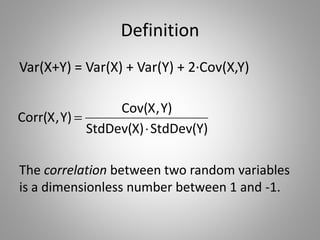

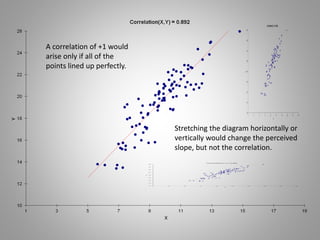

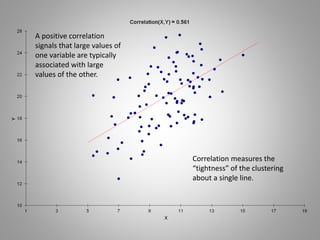

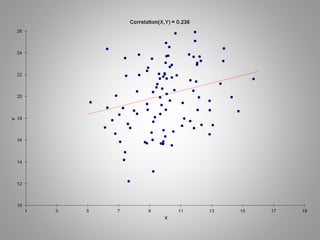

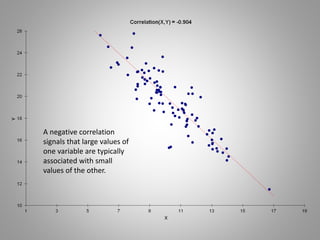

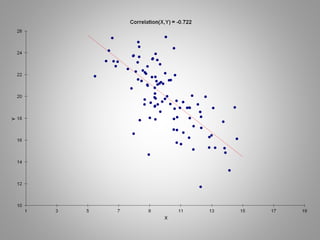

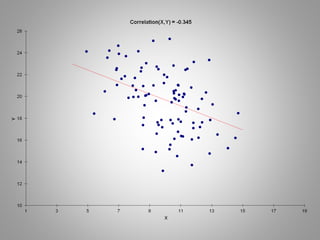

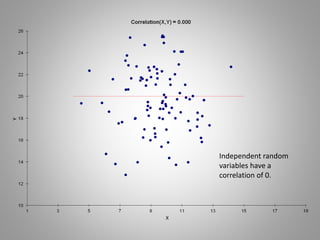

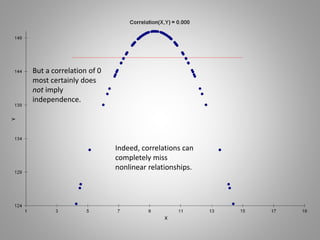

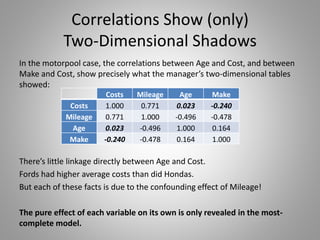

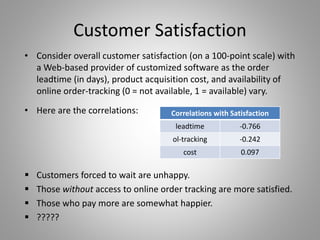

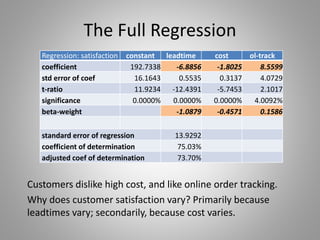

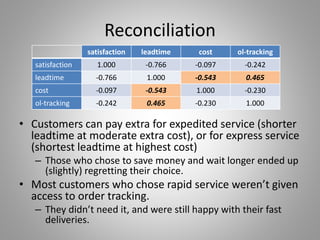

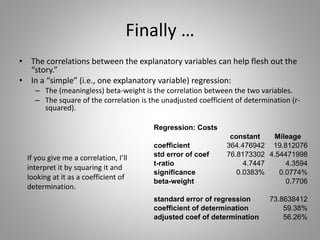

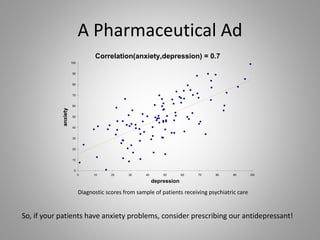

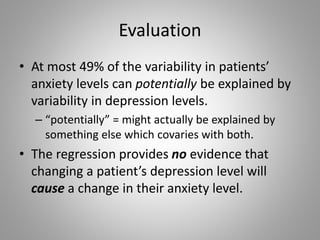

Correlation measures the strength of a linear relationship between two variables on a scale from -1 to 1. A correlation of 0 means there is no linear relationship, 1 means a perfect positive linear relationship, and -1 means a perfect negative linear relationship. Correlation only measures linear relationships and can miss nonlinear relationships. While correlation indicates association, it does not prove causation between the variables. Regression is needed to determine the relative weights and significance of predictors for a dependent variable.