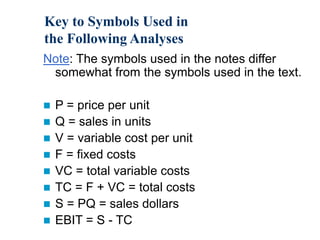

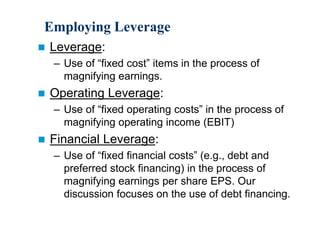

This document discusses operating leverage, financial leverage, and combined leverage. It defines key terms like operating leverage, financial leverage, fixed costs, variable costs, and provides examples and calculations for:

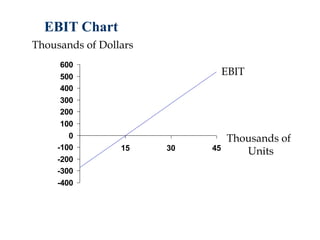

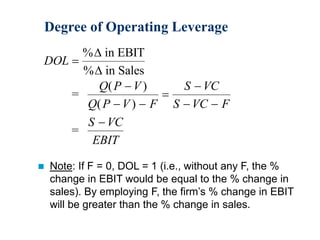

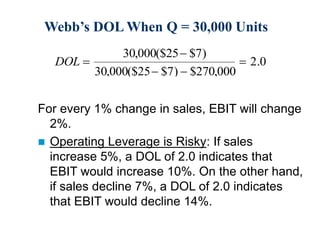

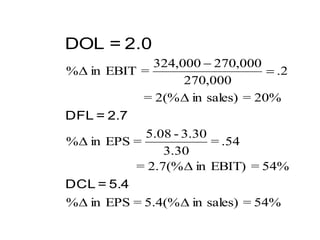

- Degree of operating leverage (DOL)

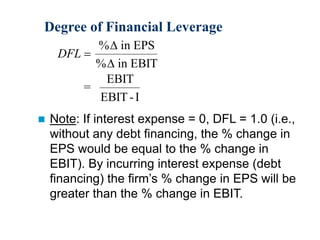

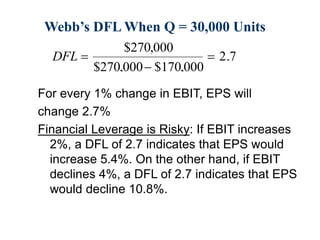

- Degree of financial leverage (DFL)

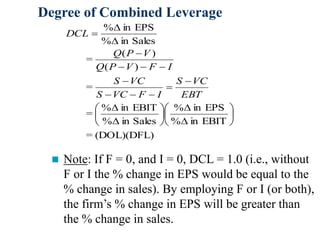

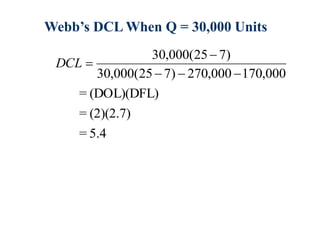

- Degree of combined leverage (DCL)

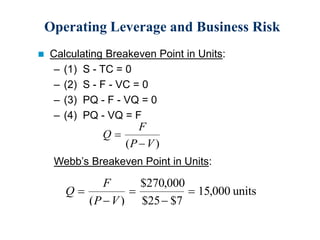

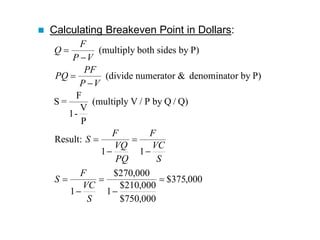

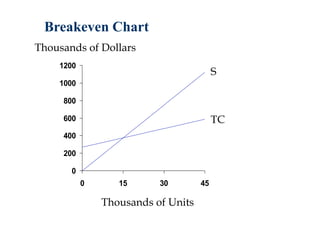

- Breakeven analysis and charts

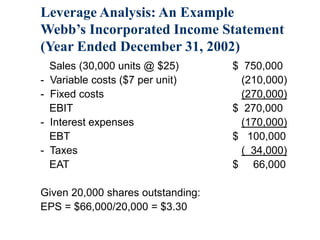

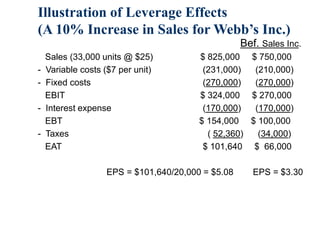

- An example calculation using financial statements for Webb's Inc. to illustrate the effects of a 10% increase in sales on earnings, operating income, and earnings per share through the application of leverage.

![Leverage and the Income Statement

Sales

- Fixed costs

- Variable costs

EBIT

- Interest

EBT

- Taxes

EAT

Note: EPS = EAT/(# shares) [assuming no pfd. stock]

Operating Leverage

Financial Leverage

Total

Leverage](https://image.slidesharecdn.com/133chapter052002-240123081725-207bbc9f/85/133chapter052002-ppt-4-320.jpg)