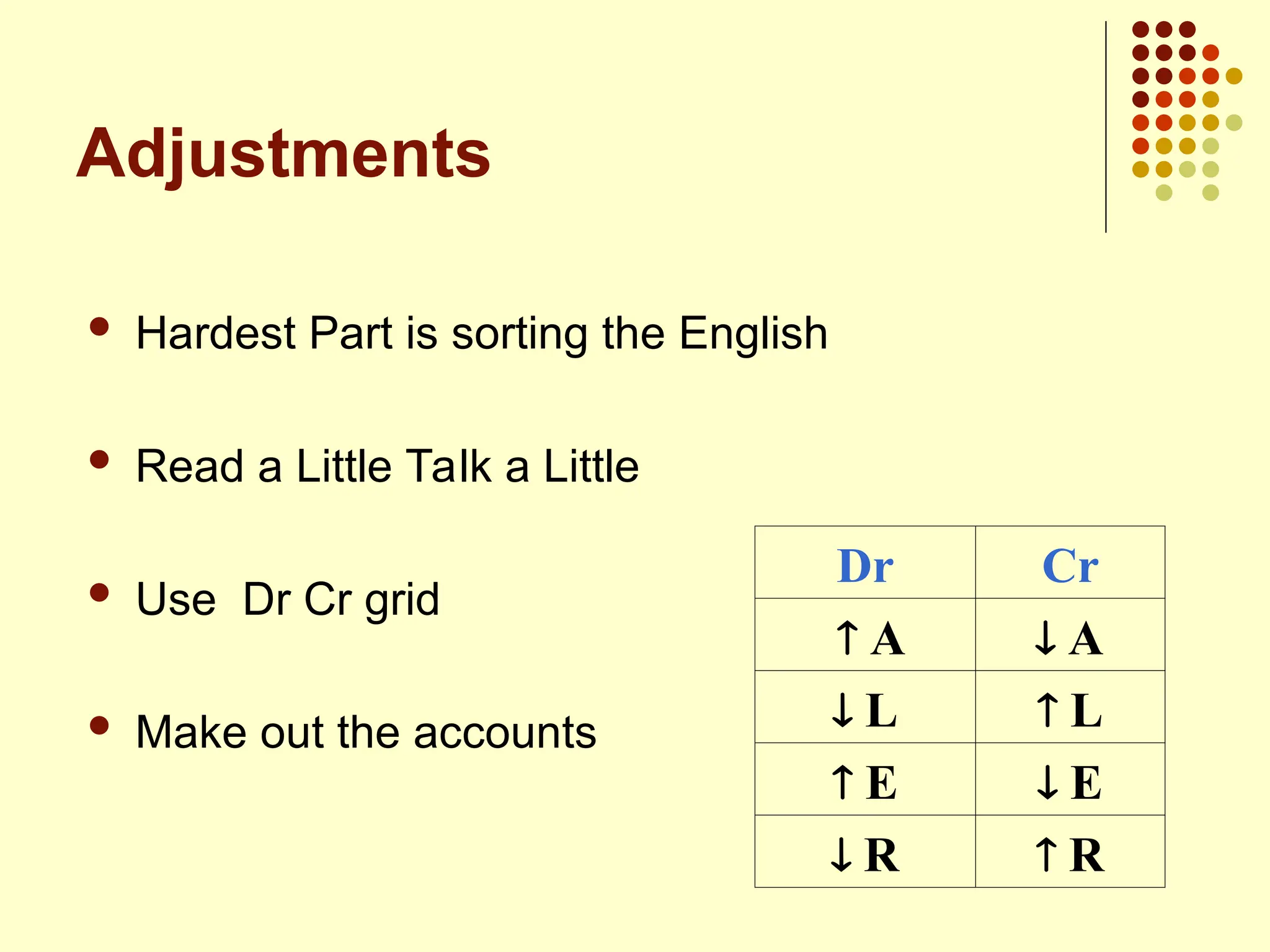

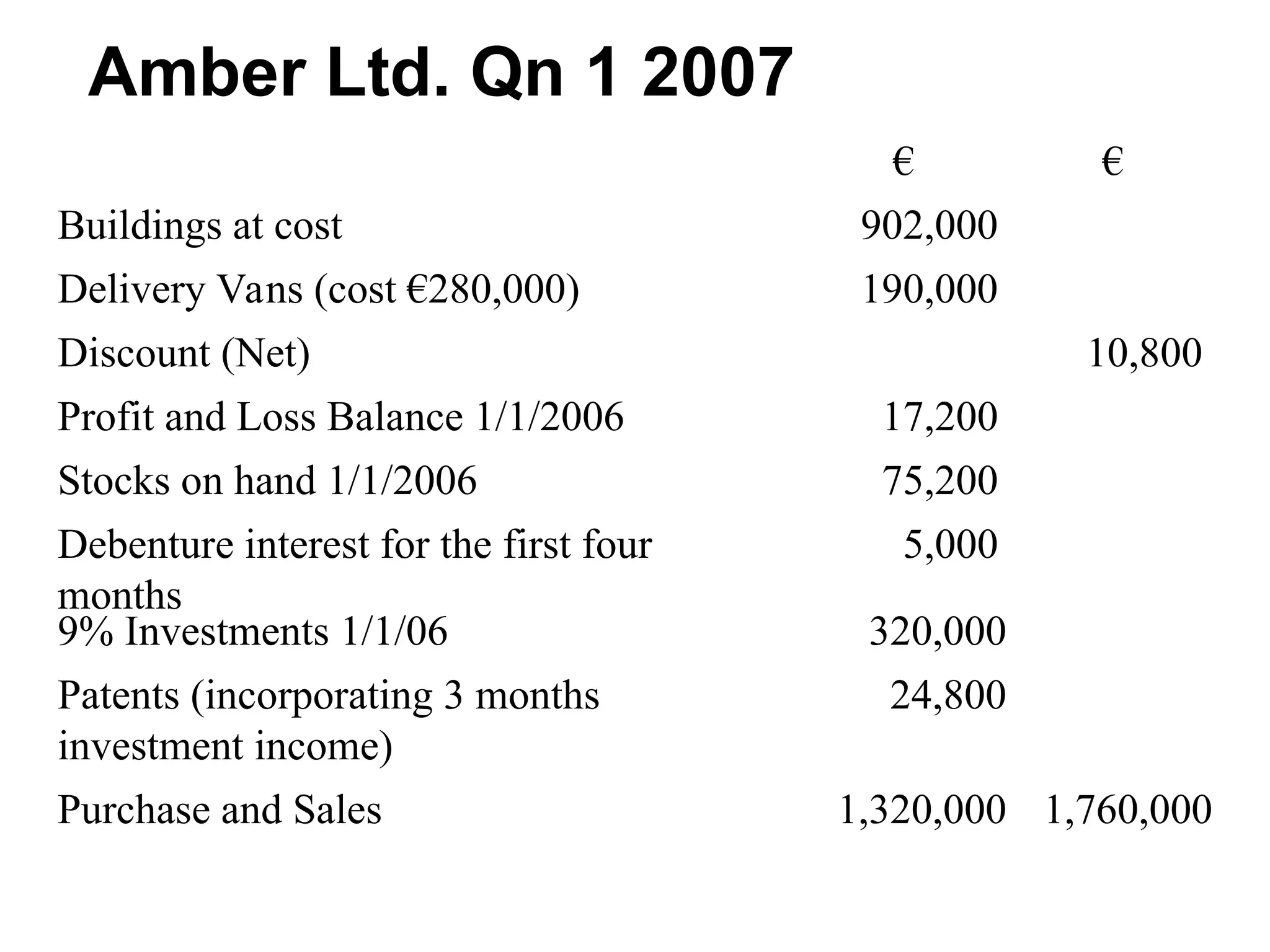

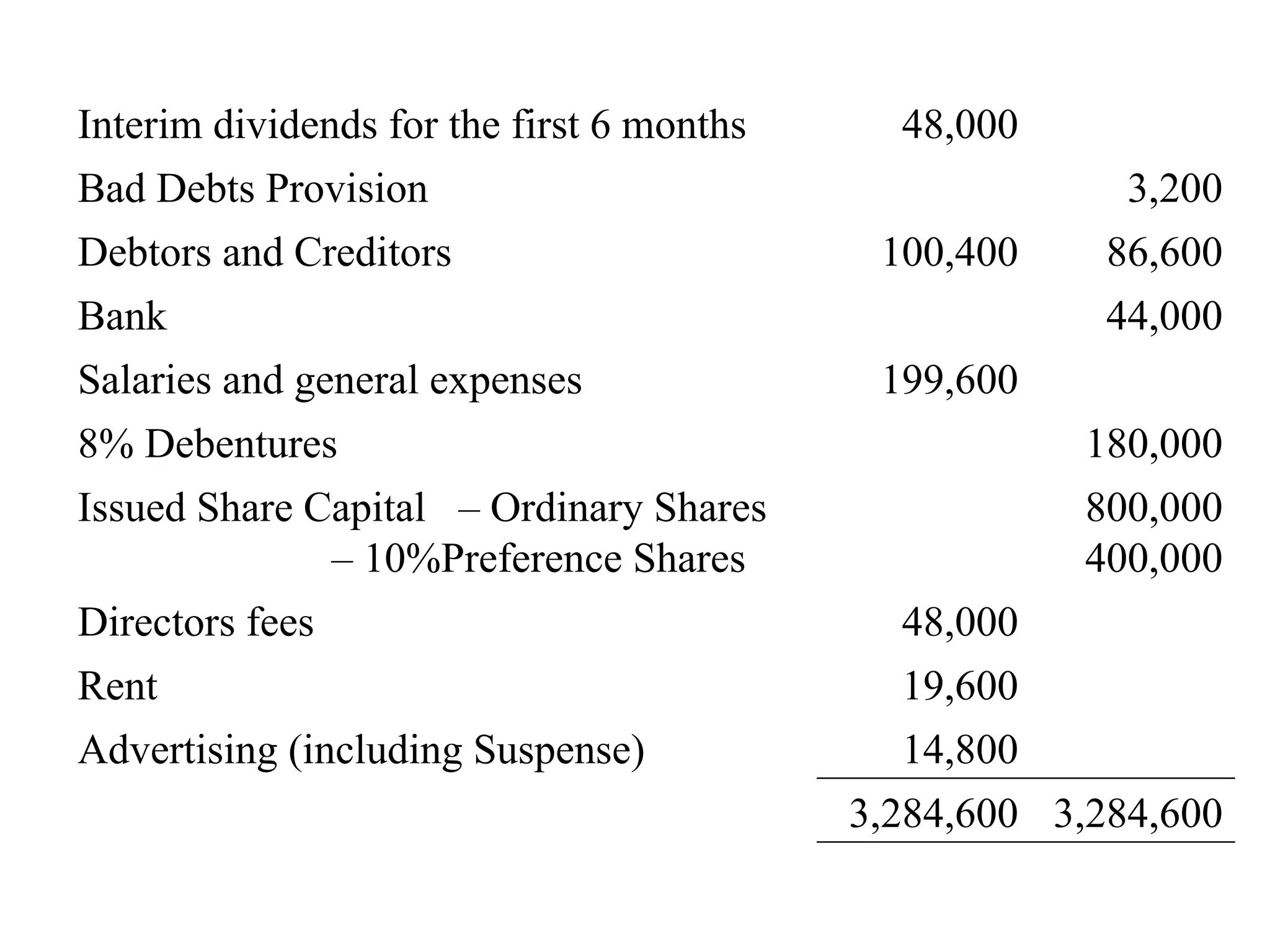

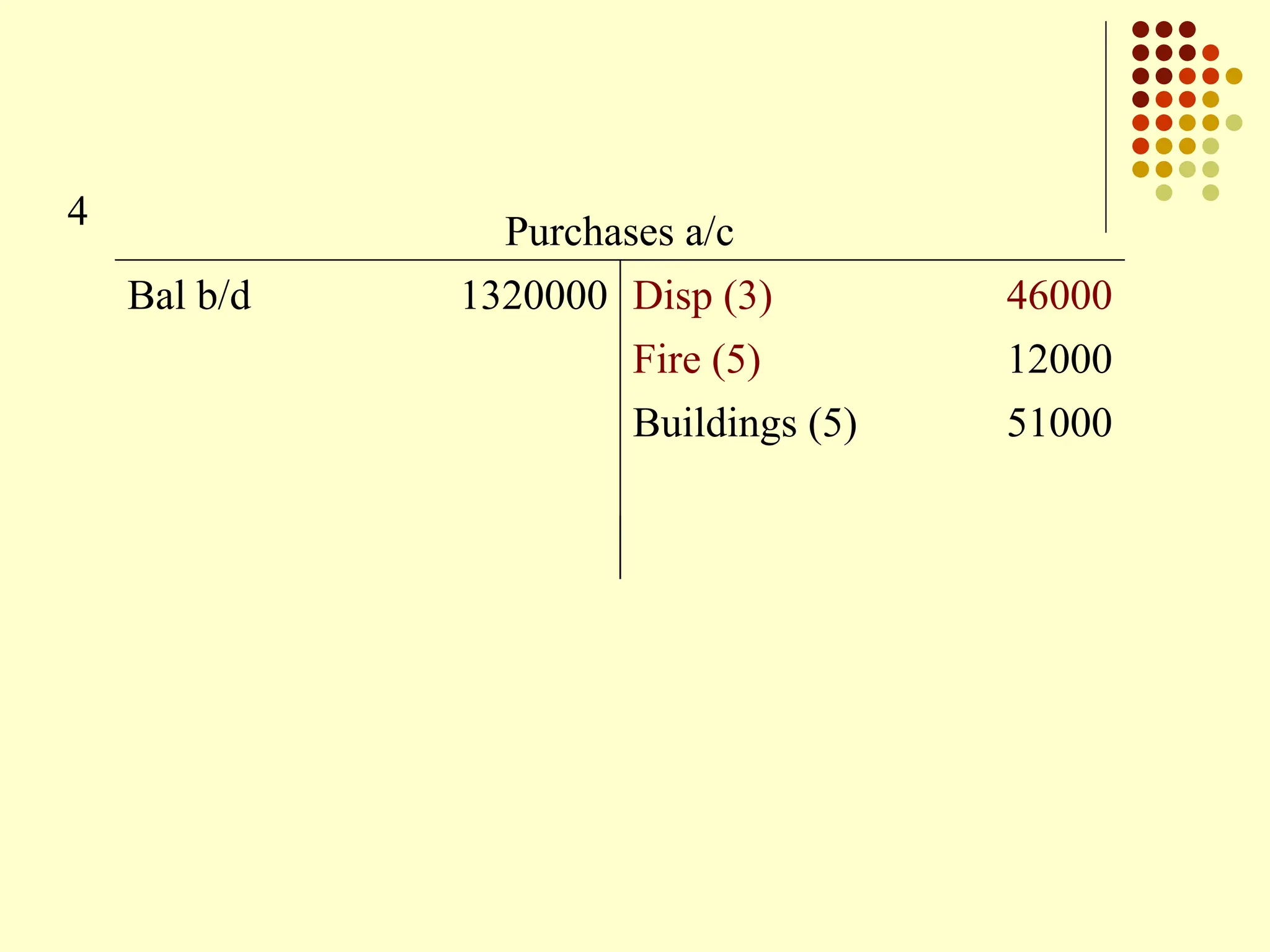

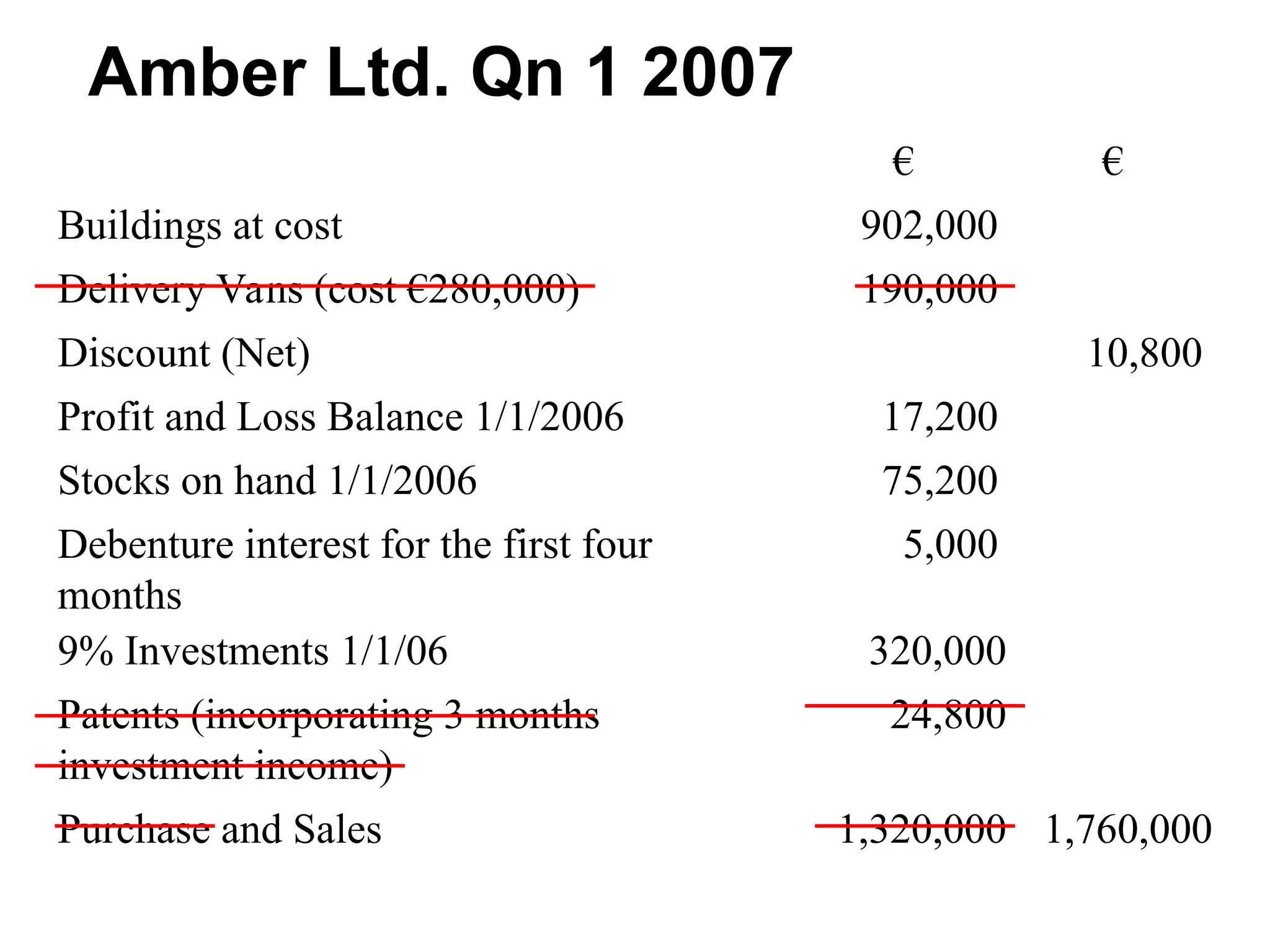

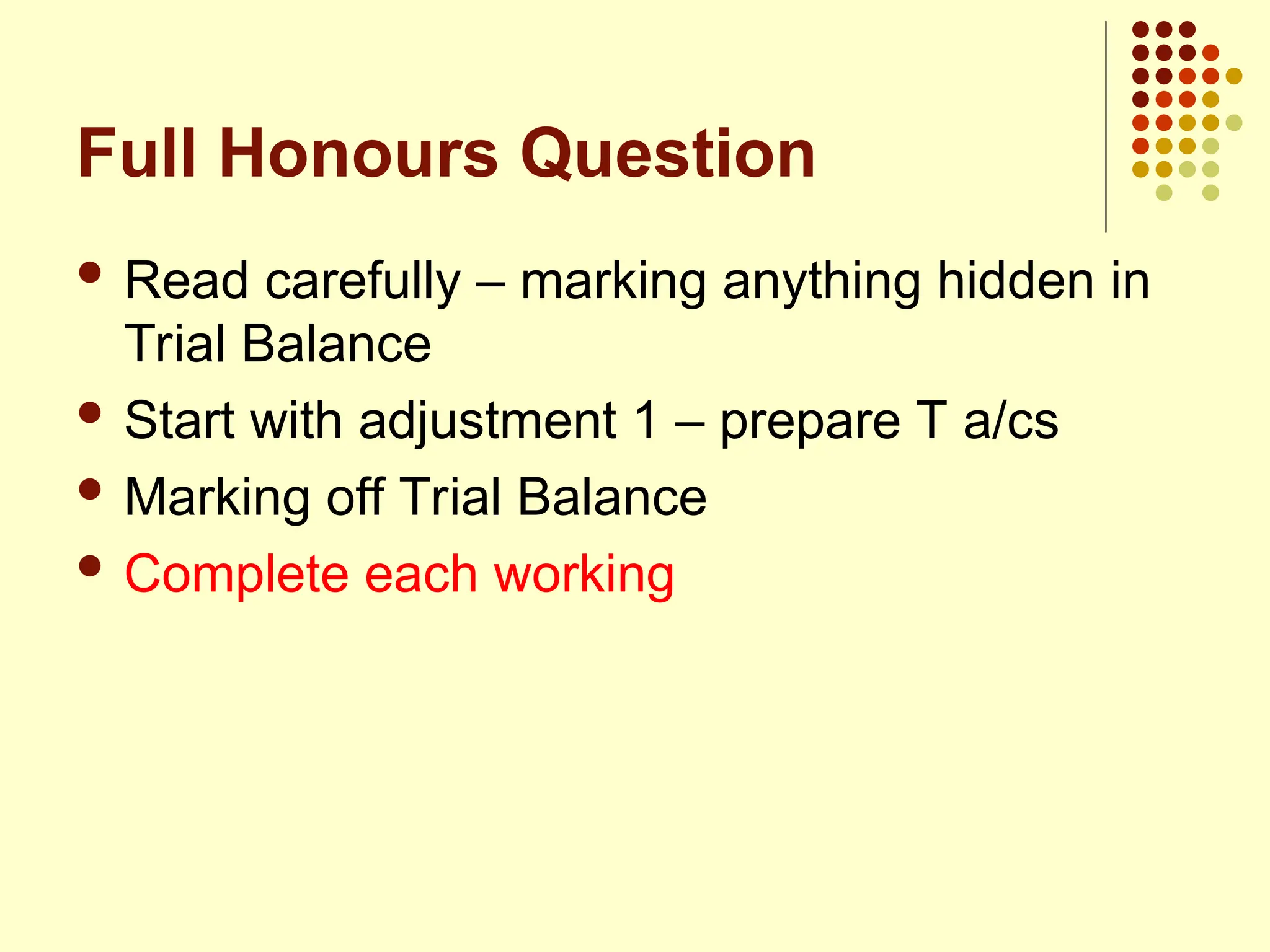

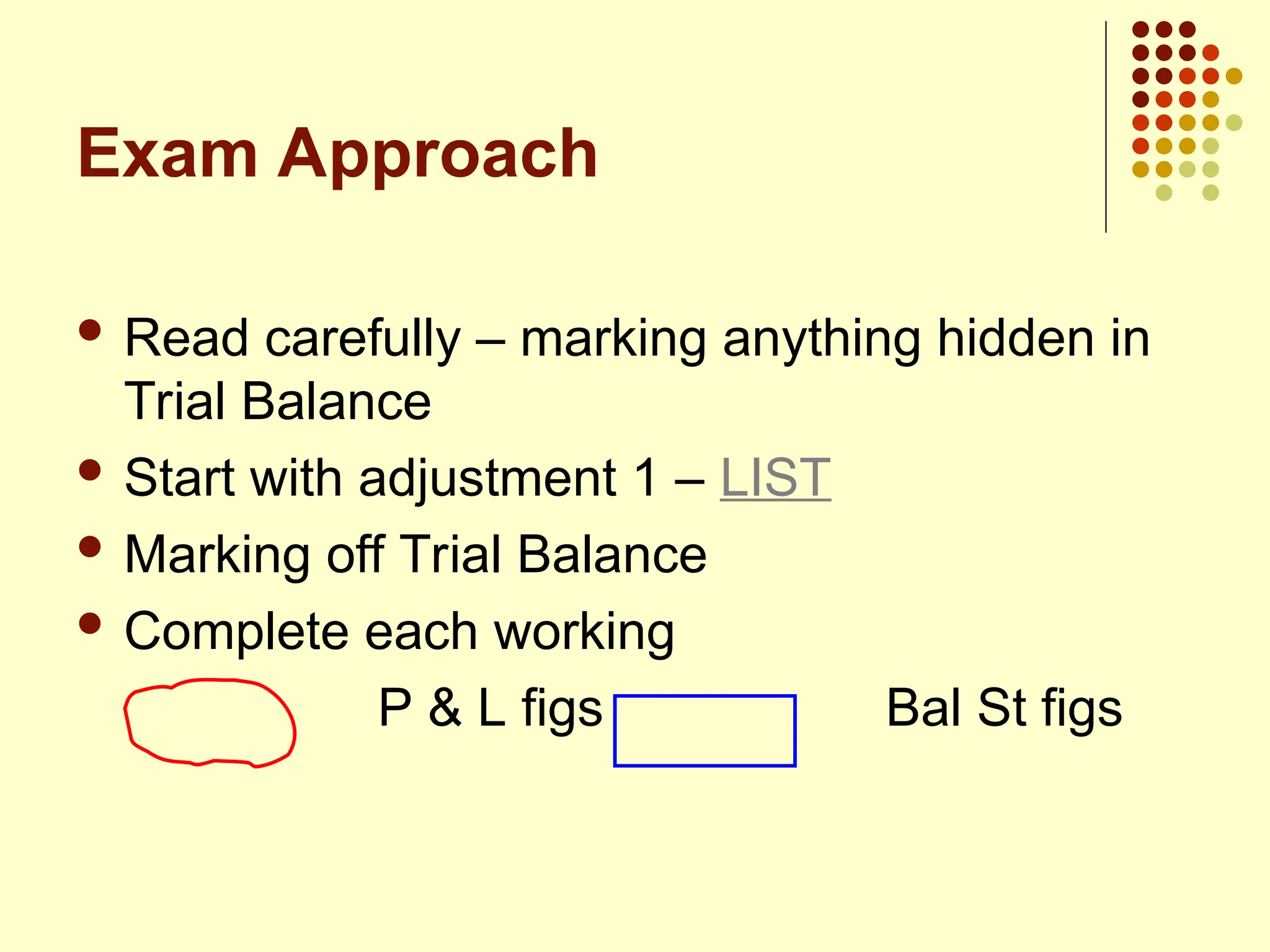

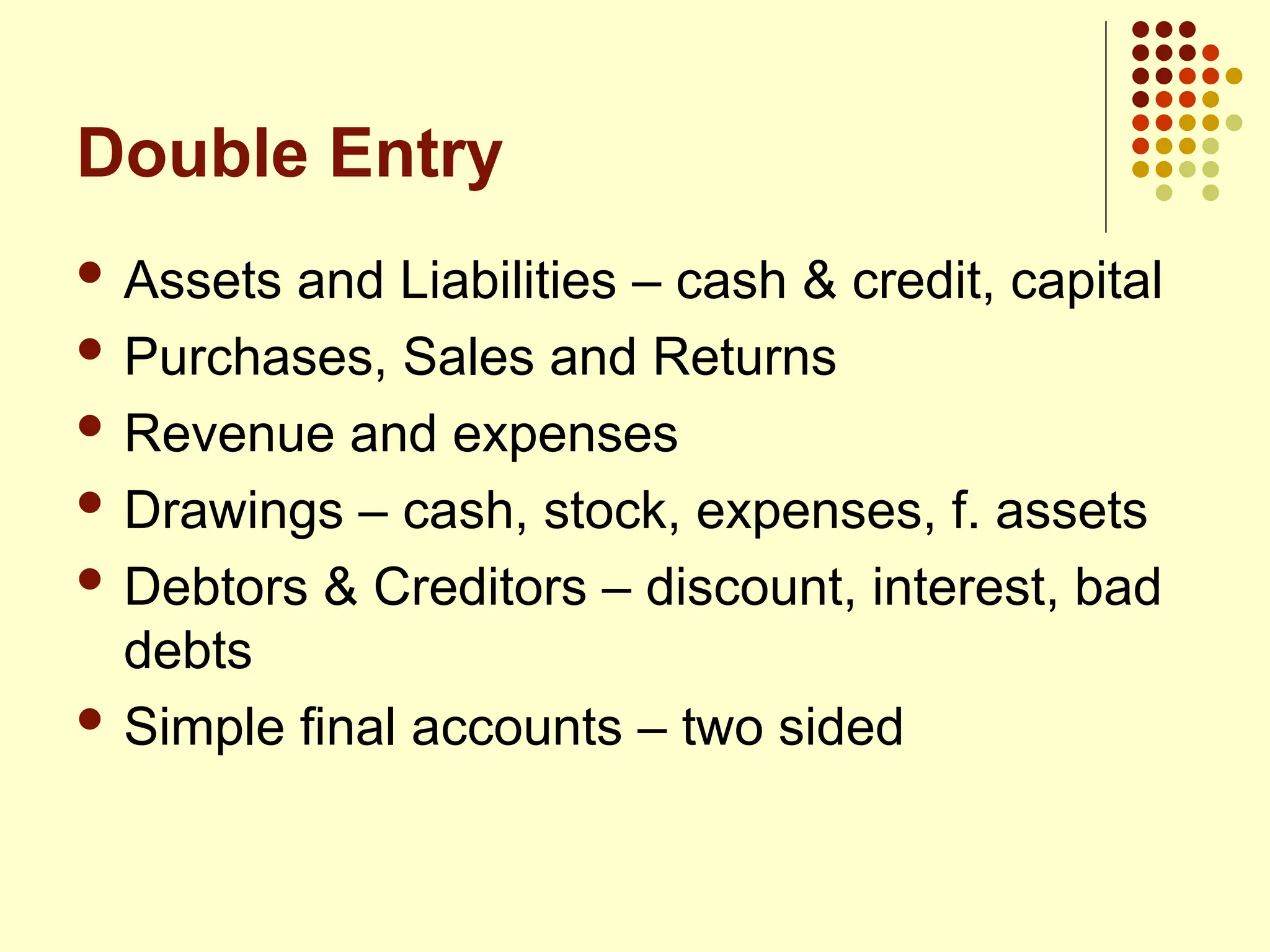

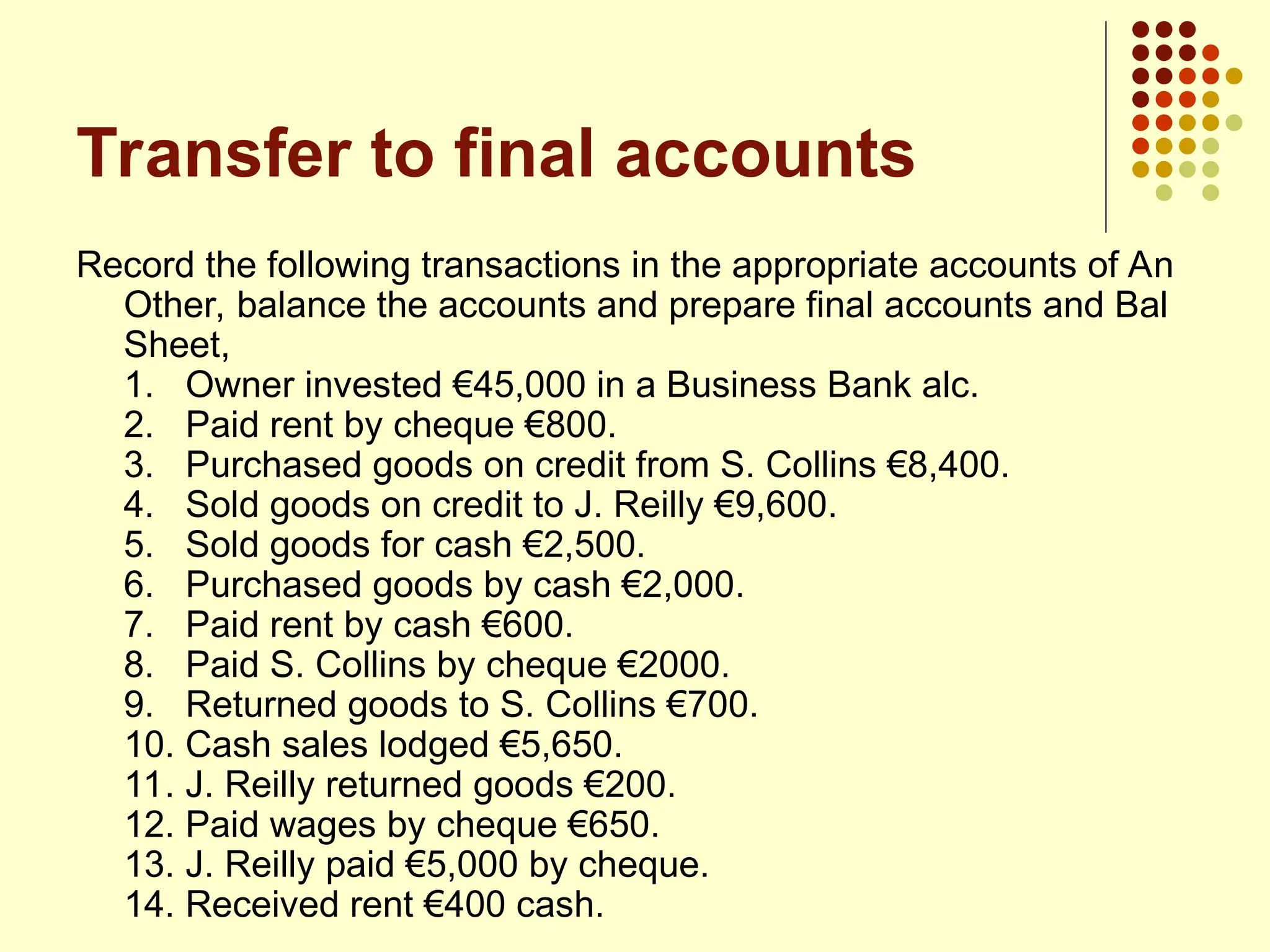

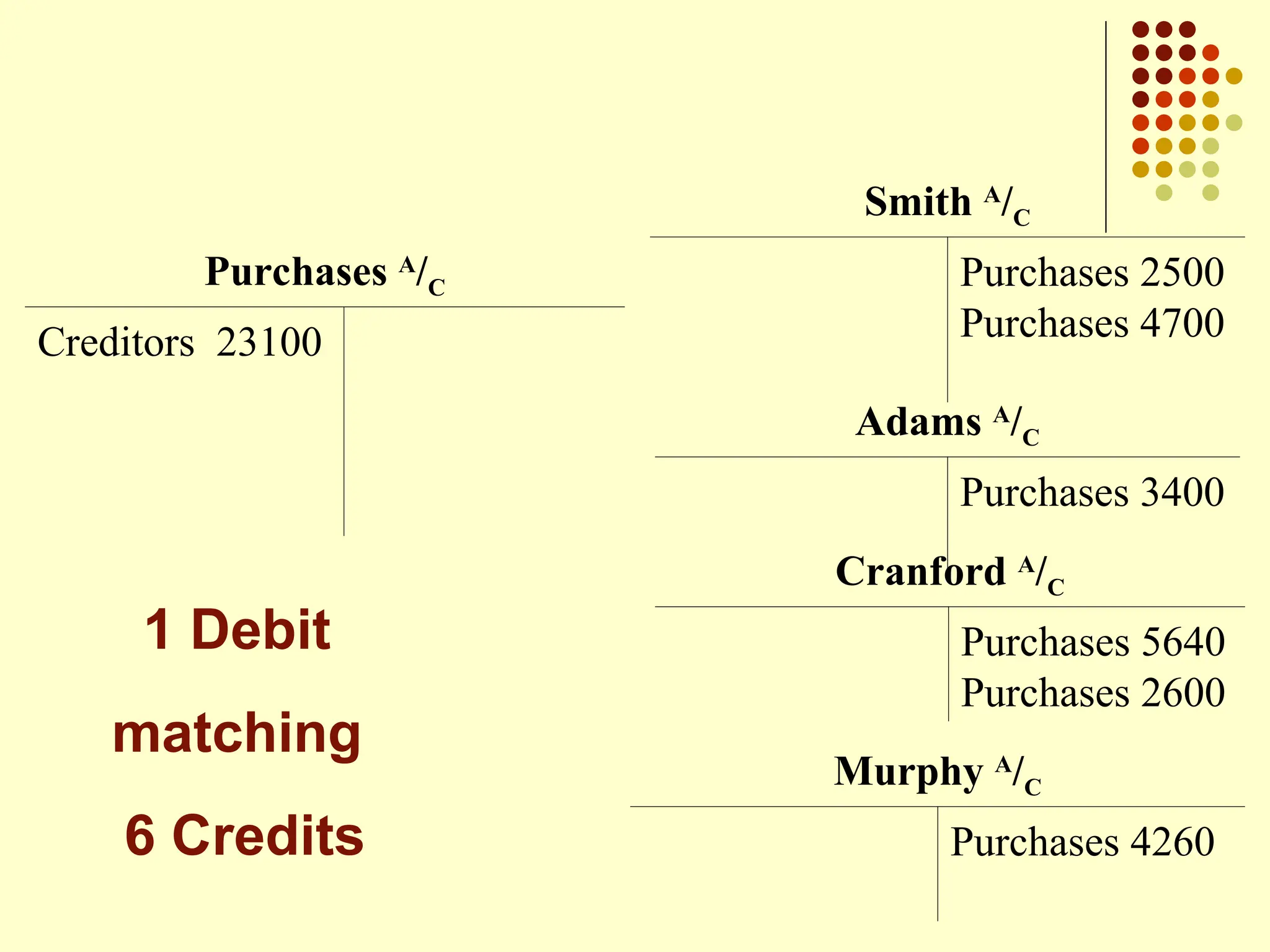

The document outlines the process of preparing final accounts using double entry accounting principles, highlighting key elements such as asset and liability management, matching transactions with appropriate accounts, and necessary adjustments for accuracy. It details how to record various financial transactions, prepare profit and loss accounts, and create a balance sheet to assess a firm's worth. Additionally, it offers guidance on handling specific adjustments and managing incomplete records while conducting a trial balance.

![Stage 1 Stage 2 Stage 3 Stage 4

Source Documents Subsidiary Books Ledger

Double Entry

Final Accounts

Balance Sheet

Invoices

[credit purchases and

sales]

Sales Book

Purchases Book Post these

transactions

using

Double Entry

Rules

Transfer

from the

Ledger to

ascertain

Profit for

the Year and

the Net

Worth of the

Company at

a point in

time

Credit Notes

Sales Returns Book

Purchases Returns

Book

Cheque Payments Cheque Payments Book

Receipts Cash Receipts Book

Anything Else General Journal

Recording Transactions](https://image.slidesharecdn.com/qn10-241113134730-0b074002/75/Qn-1_0-ppt-for-bba-mba-and-commerce-students-17-2048.jpg)