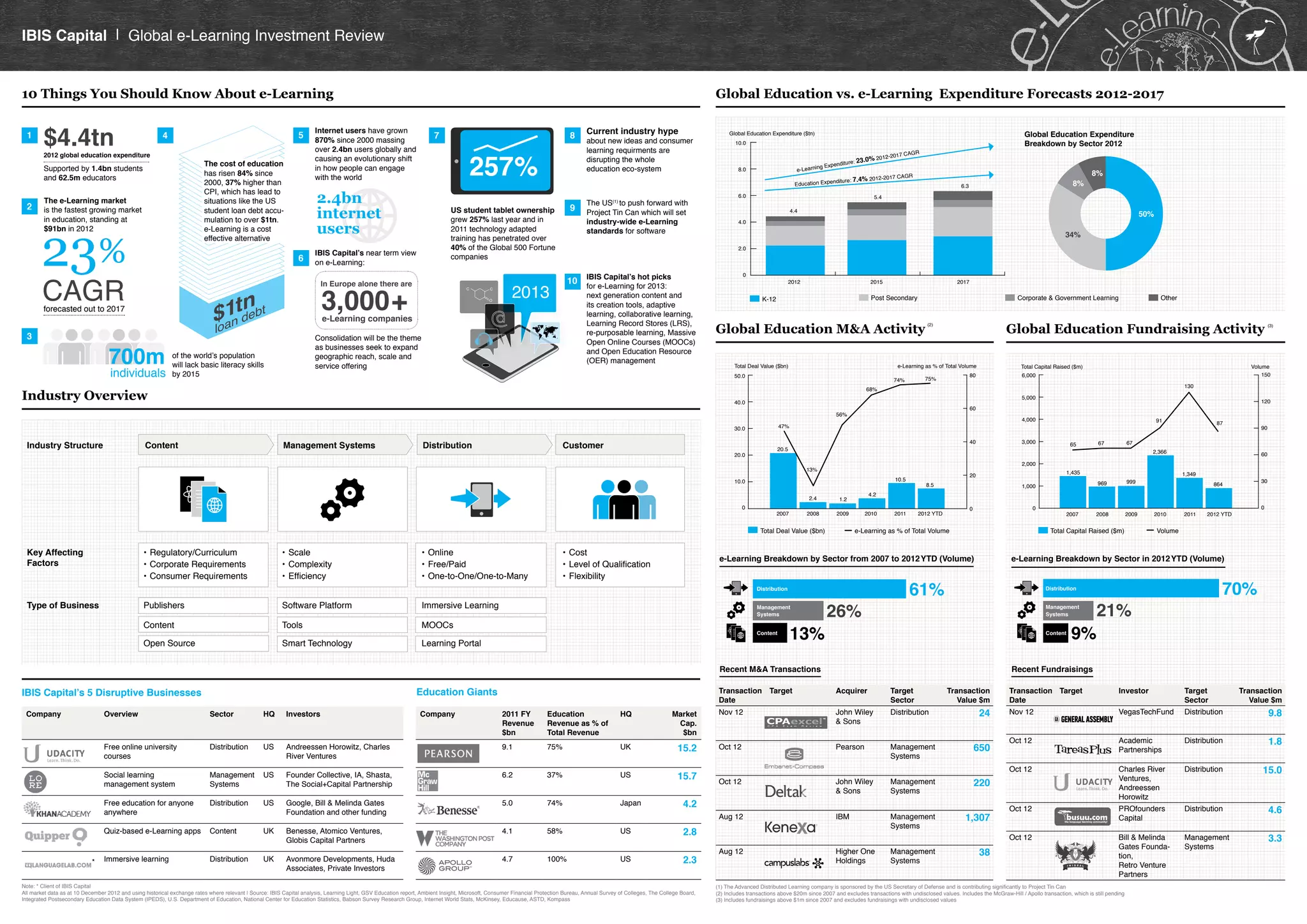

The document discusses key trends in the global e-learning industry from 2007 to 2012. It highlights that e-learning is the fastest growing segment of education, projected to increase at a 23% compound annual growth rate to $91 billion by 2017. Transaction volume and values have also grown steadily over this period. The document identifies several emerging technologies and models in e-learning seen as disruptive forces, such as MOOCs, adaptive learning, and the use of tablets in education. It also notes issues around the rising costs of traditional education and high student debt levels as drivers for the growth of e-learning.