Embed presentation

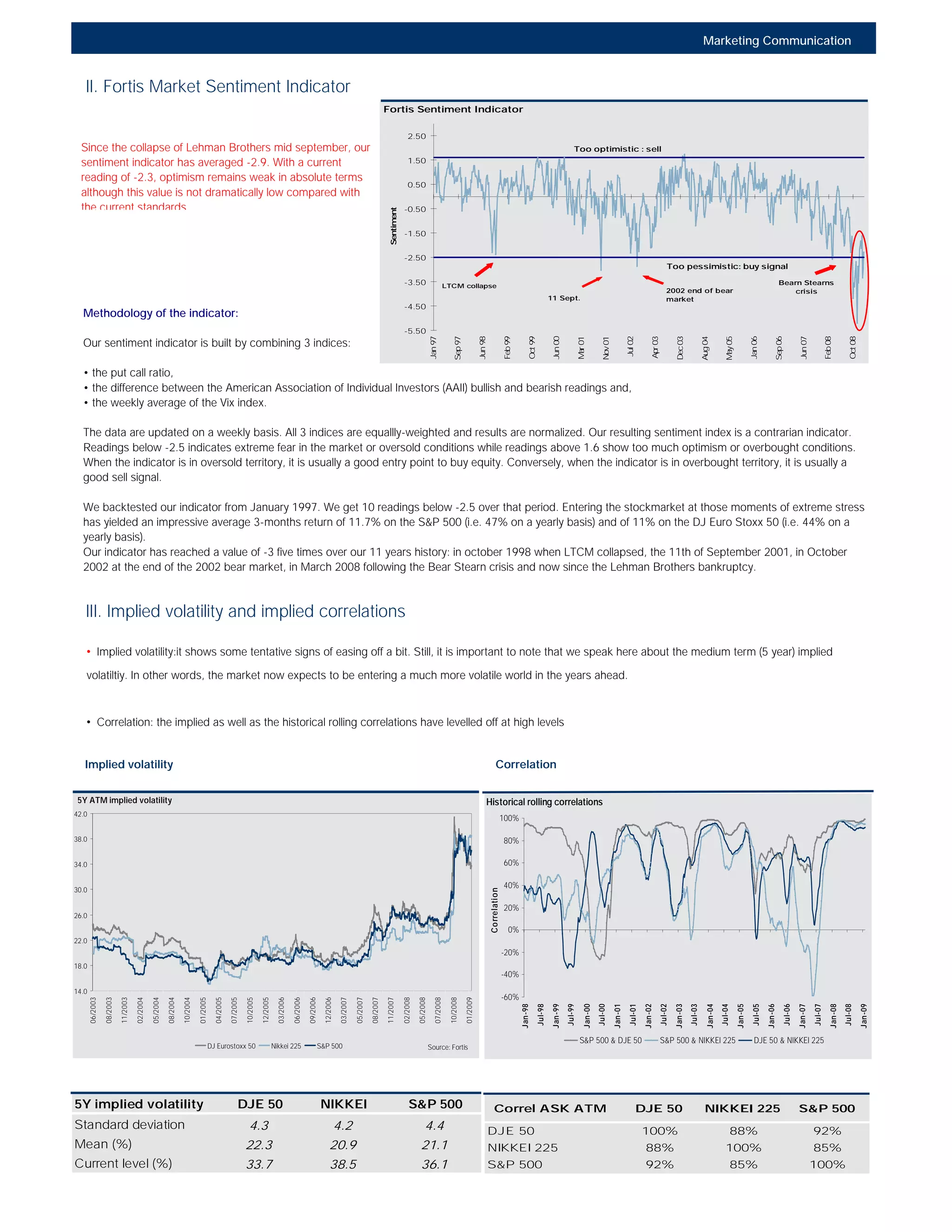

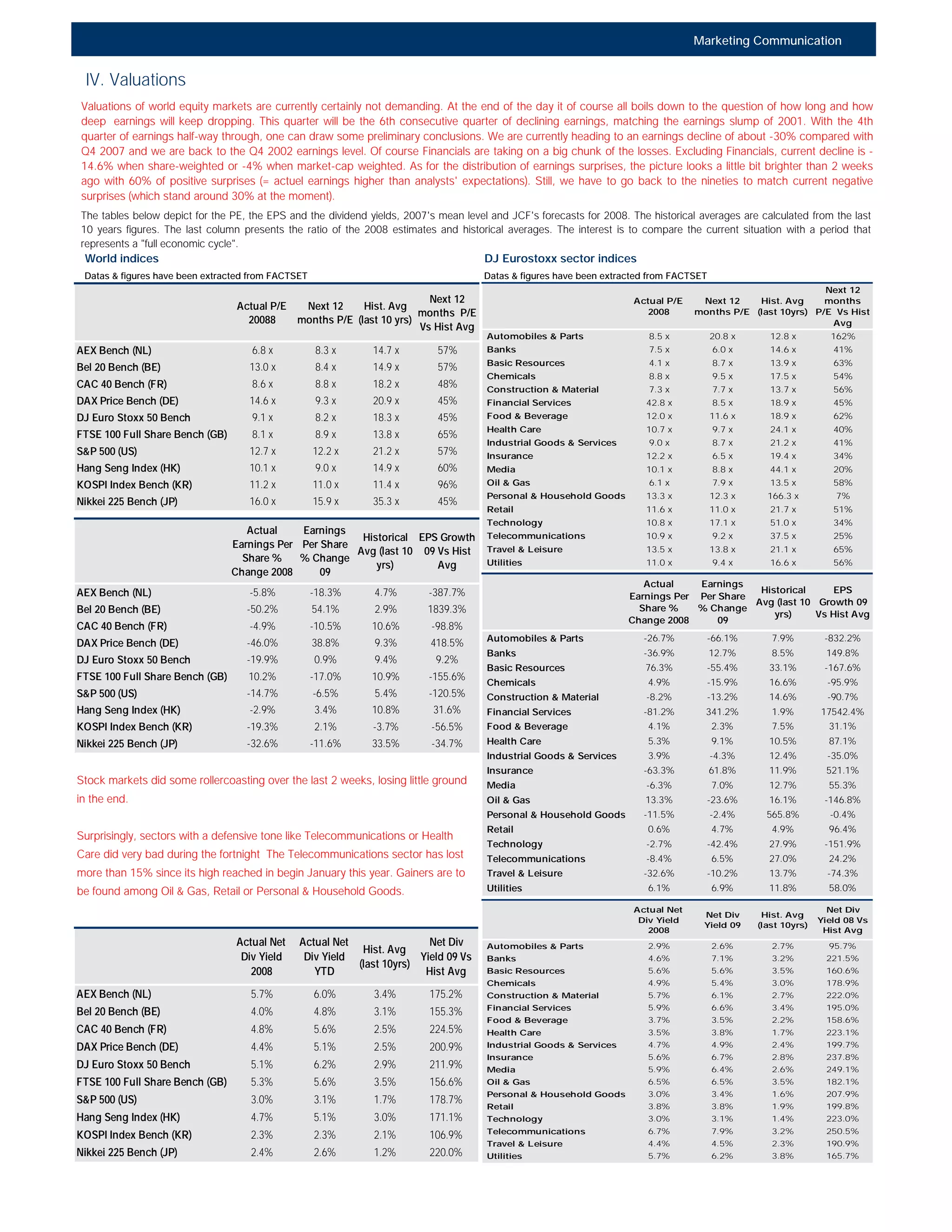

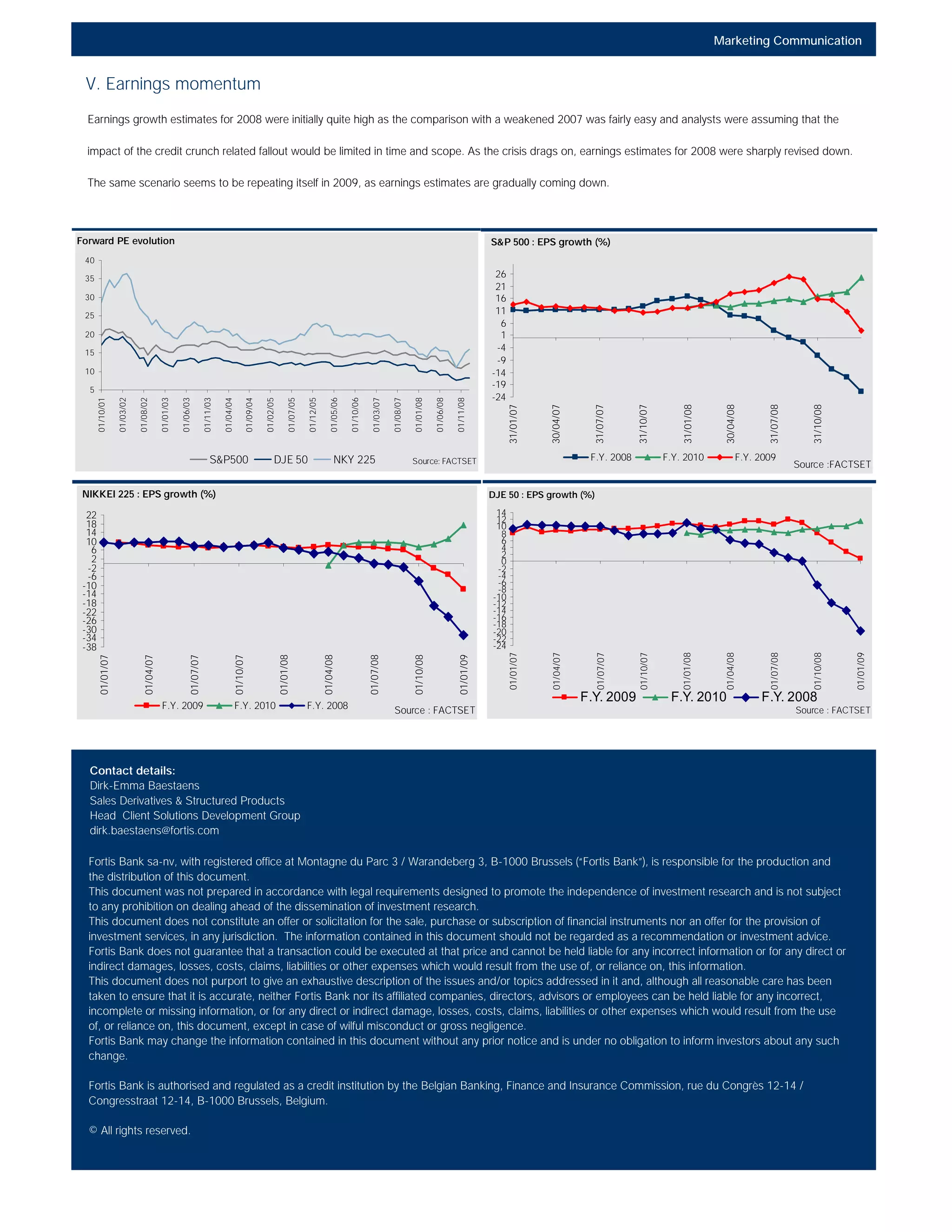

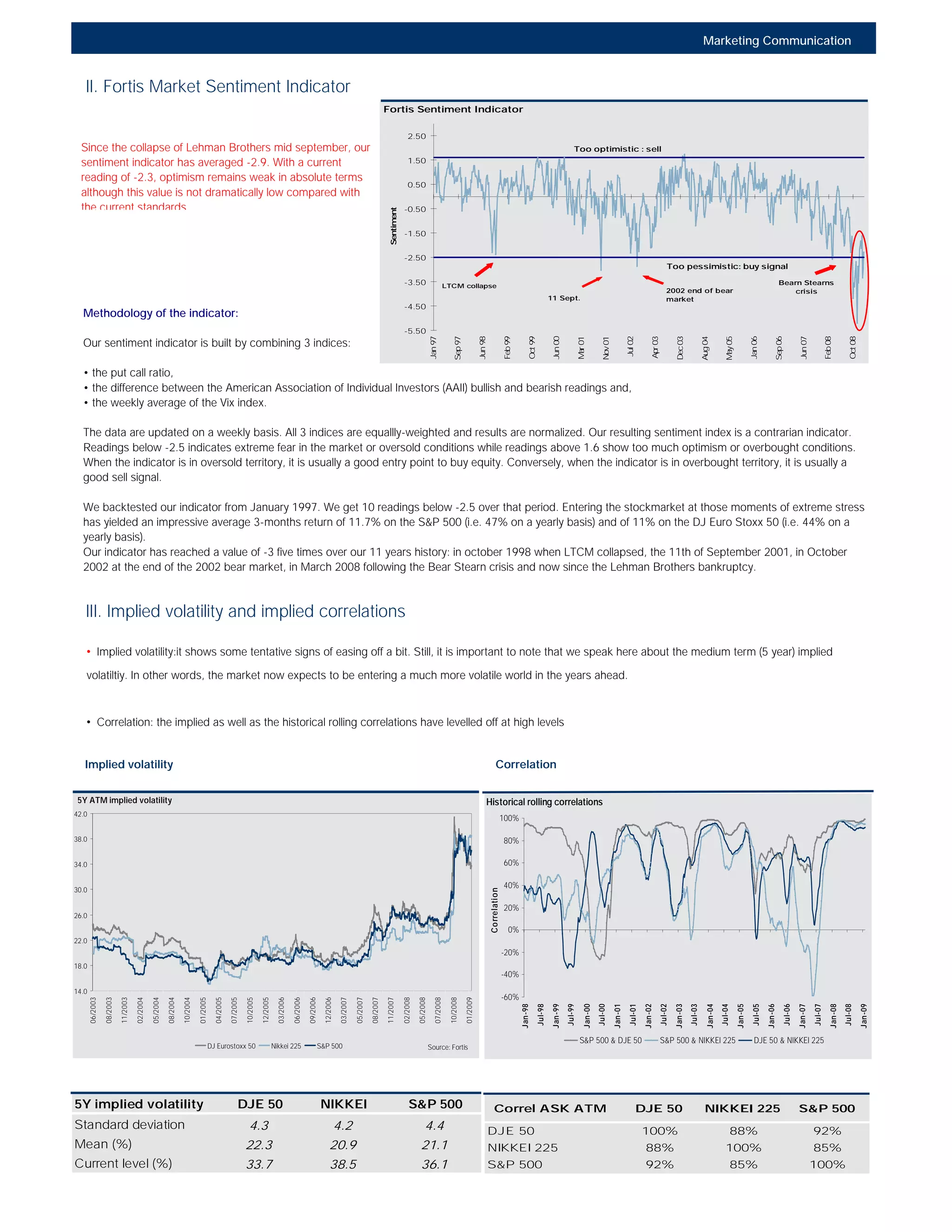

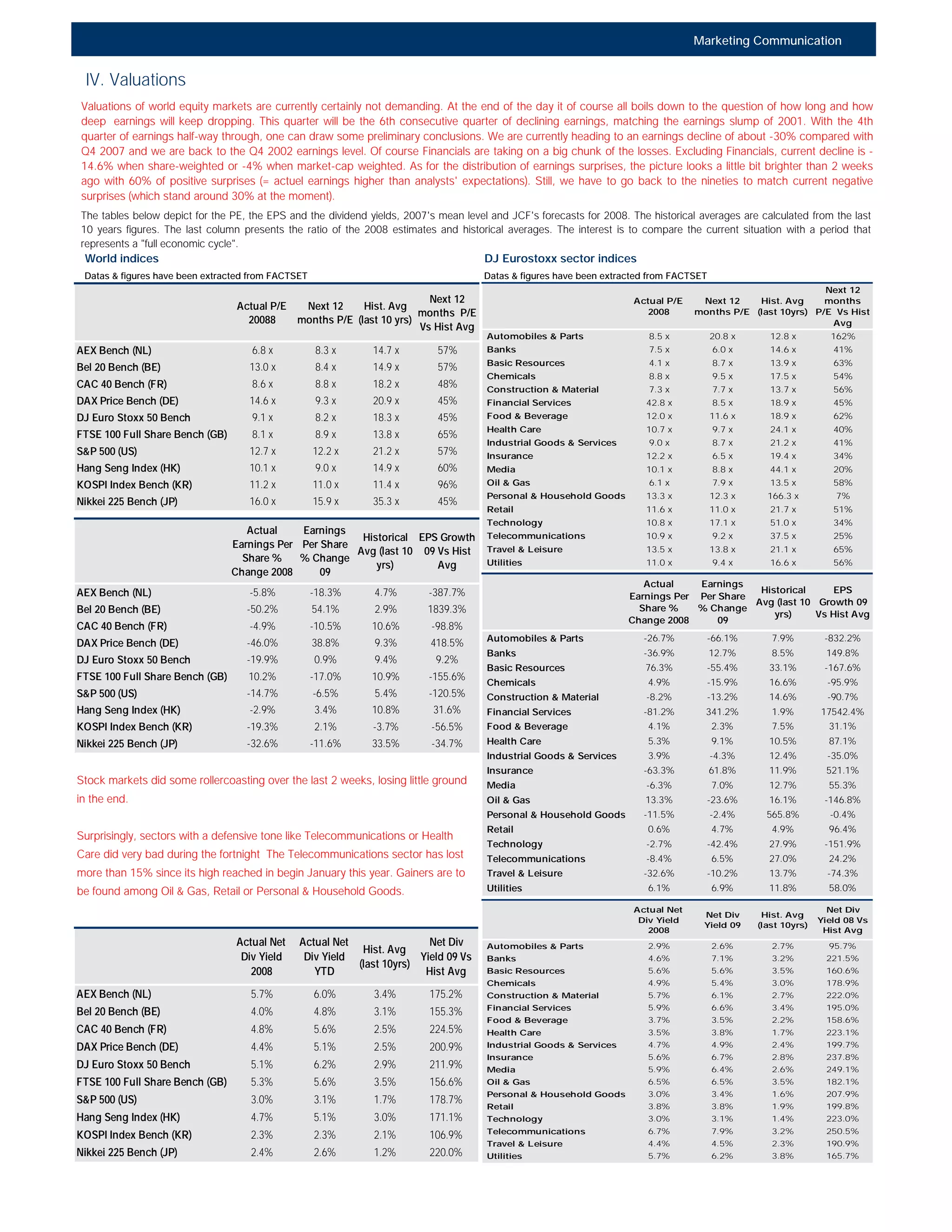

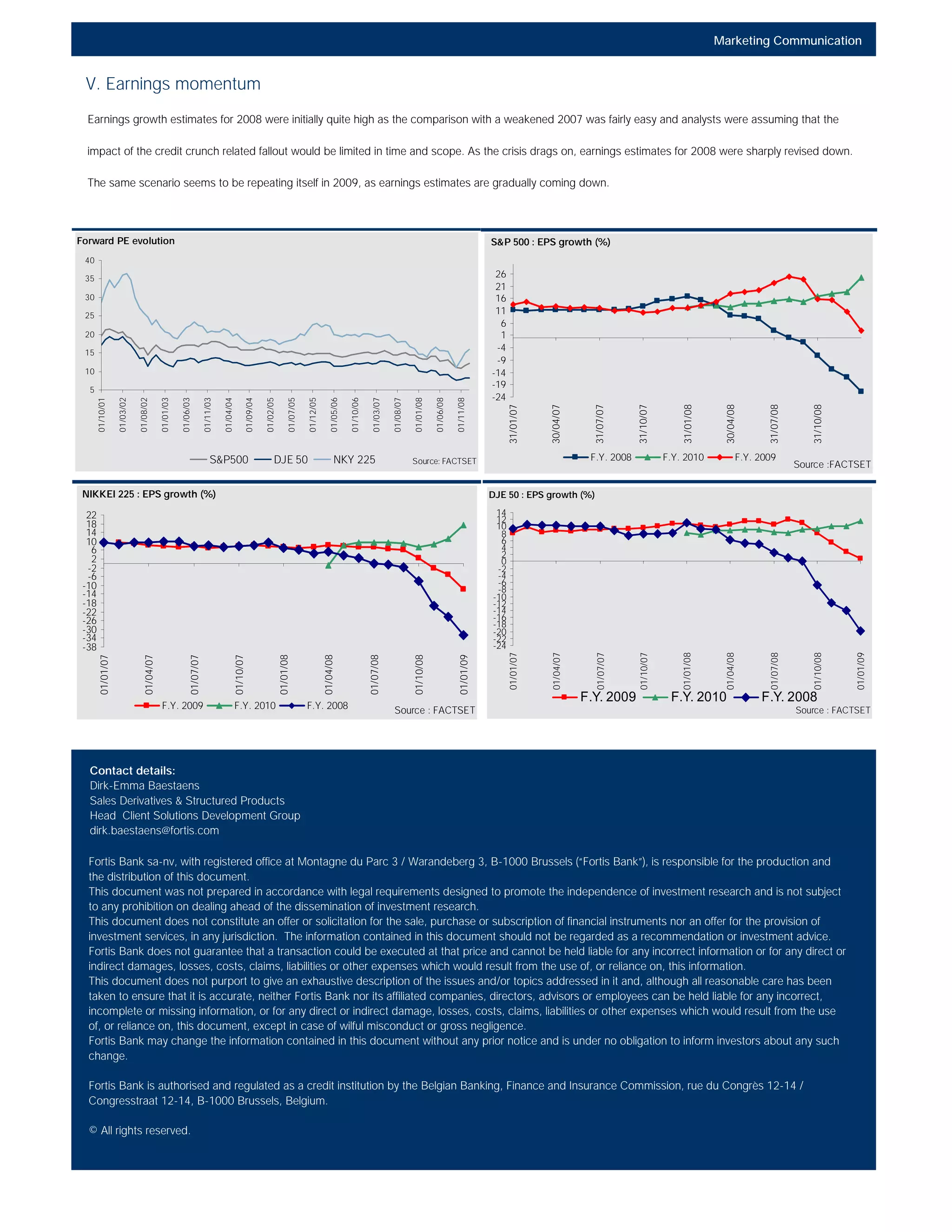

1. The document provides an overview of structured equity markets and discusses recent economic and market developments. It notes that stock markets declined for a fourth straight week due to bad economic data and cautious earnings guidance. 2. A sentiment indicator created by the author remains weak, though not at dramatically low levels compared to recent standards. The indicator suggests markets remain fearful but not overly so. 3. Implied volatility is showing tentative signs of easing but remains elevated, suggesting continued volatility ahead. Correlations between markets have also remained high. 4. Company earnings continue declining significantly compared to prior years. Valuations have become less expensive but depend on how long earnings drops persist.