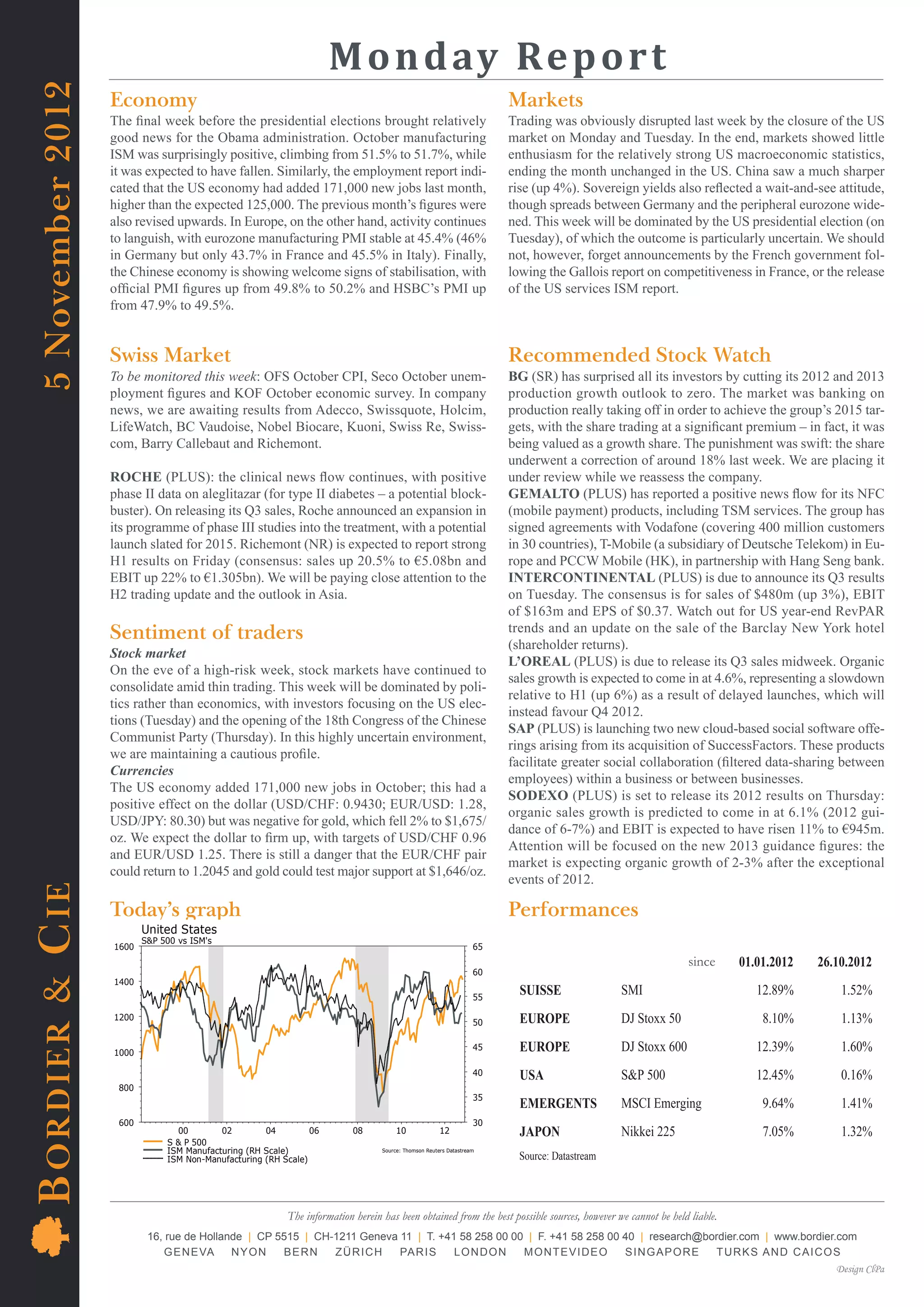

1) The US economy added more jobs than expected in October and manufacturing activity increased, while the eurozone continues to struggle with weak manufacturing.

2) Markets showed little reaction to the positive US economic data and ended the month flat as investors await the outcome of the US presidential election.

3) The report provides recommendations on several stocks to watch that are reporting earnings or announcements, including Gemalto, Intercontinental Hotels, L'Oreal, and Sodexo.