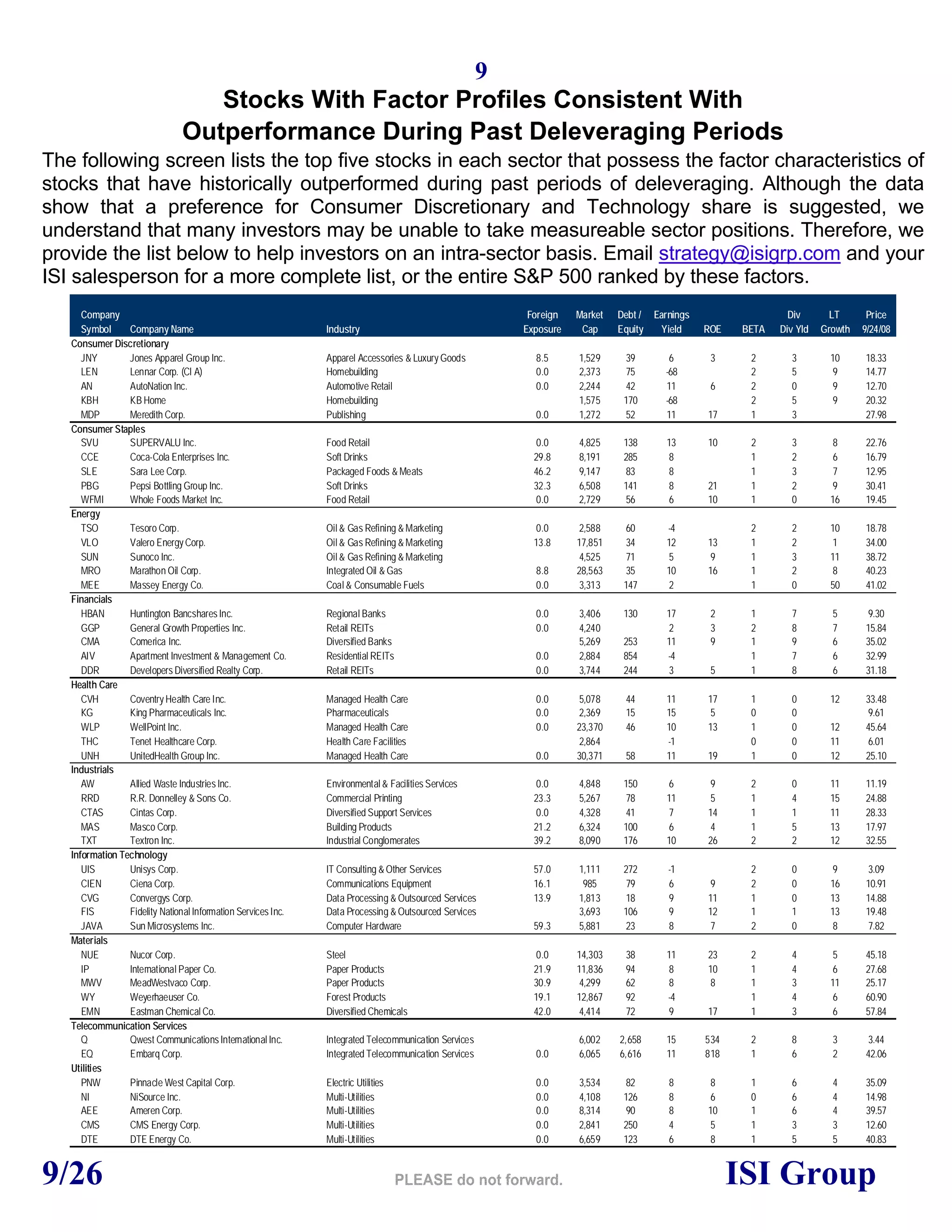

This document summarizes the key findings from an analysis of past deleveraging cycles in the US economy in the mid-1970s and early 1990s. Some of the main points include:

- Past deleveraging cycles were actually good periods for stock market performance and saw leadership from consumer discretionary and technology stocks.

- Deleveraging is a lagging phenomenon that typically occurs late in an economic slowdown.

- Housing activity, as measured by building permits, tended to bottom out early in past deleveraging cycles and then rise steadily through the cycle.

- Inflation tended to decline during deleveraging periods, suggesting disinflation may lie ahead.

- Mon