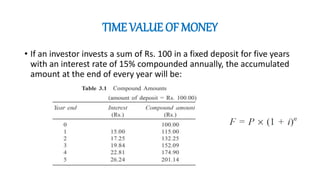

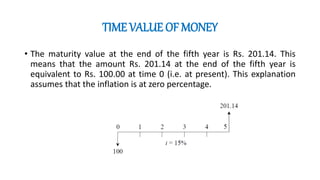

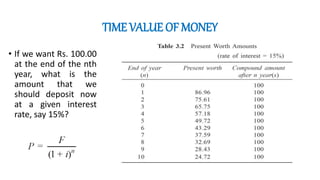

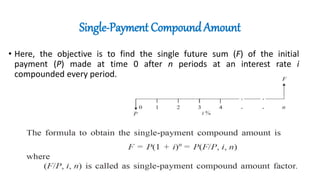

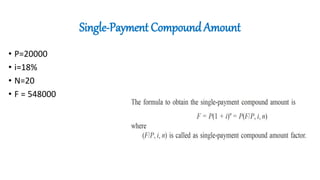

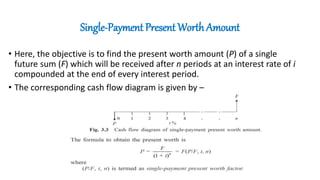

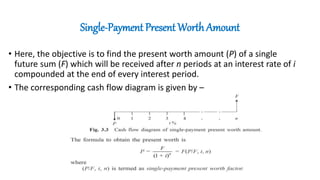

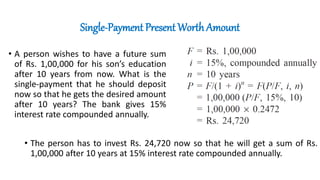

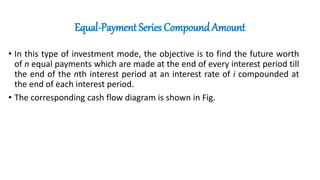

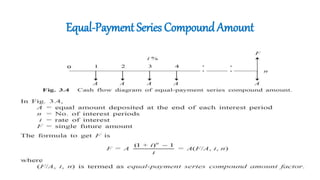

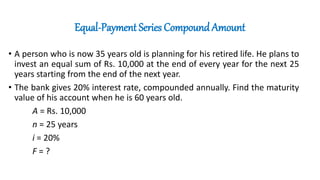

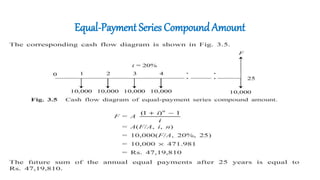

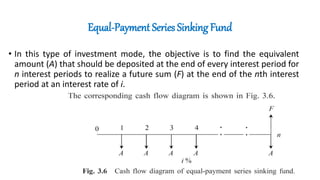

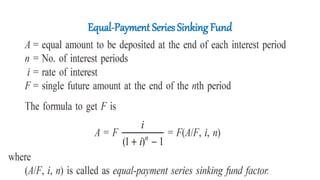

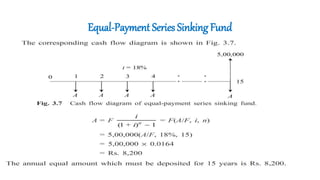

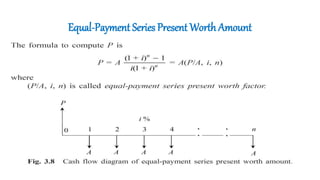

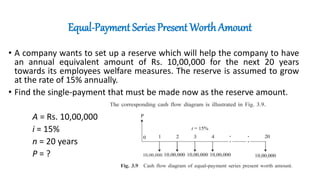

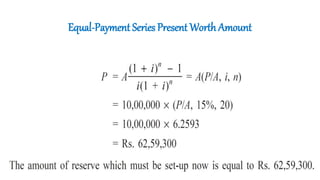

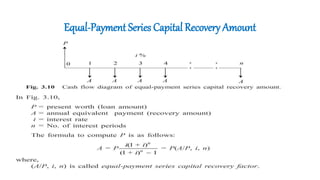

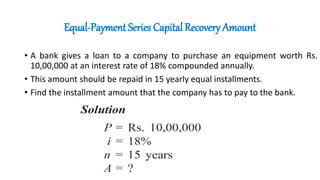

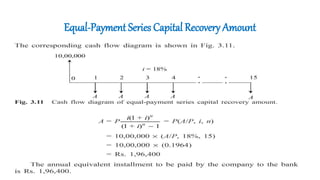

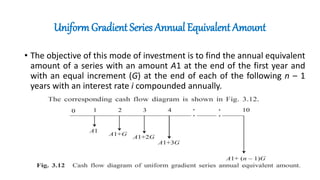

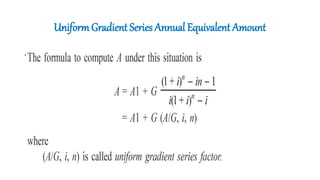

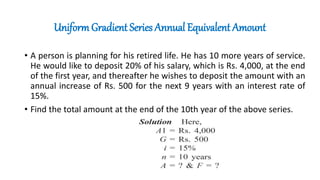

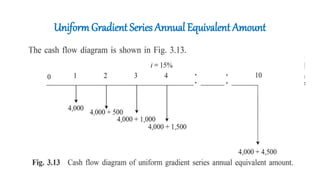

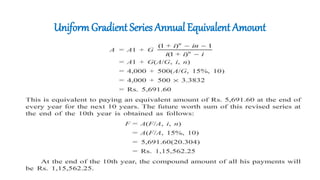

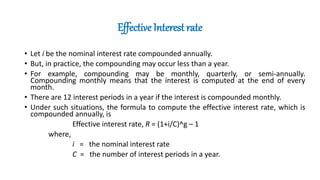

The document explains various interest formulas and their applications, including the concepts of simple and compound interest, time value of money, and different investment modes such as single-payment compound amounts and equal-payment series. It provides examples of how to calculate future values, present worth, and annuity payments based on different interest rates and compounding frequencies. Additionally, the document touches on the effective interest rate when compounding occurs more frequently than annually.