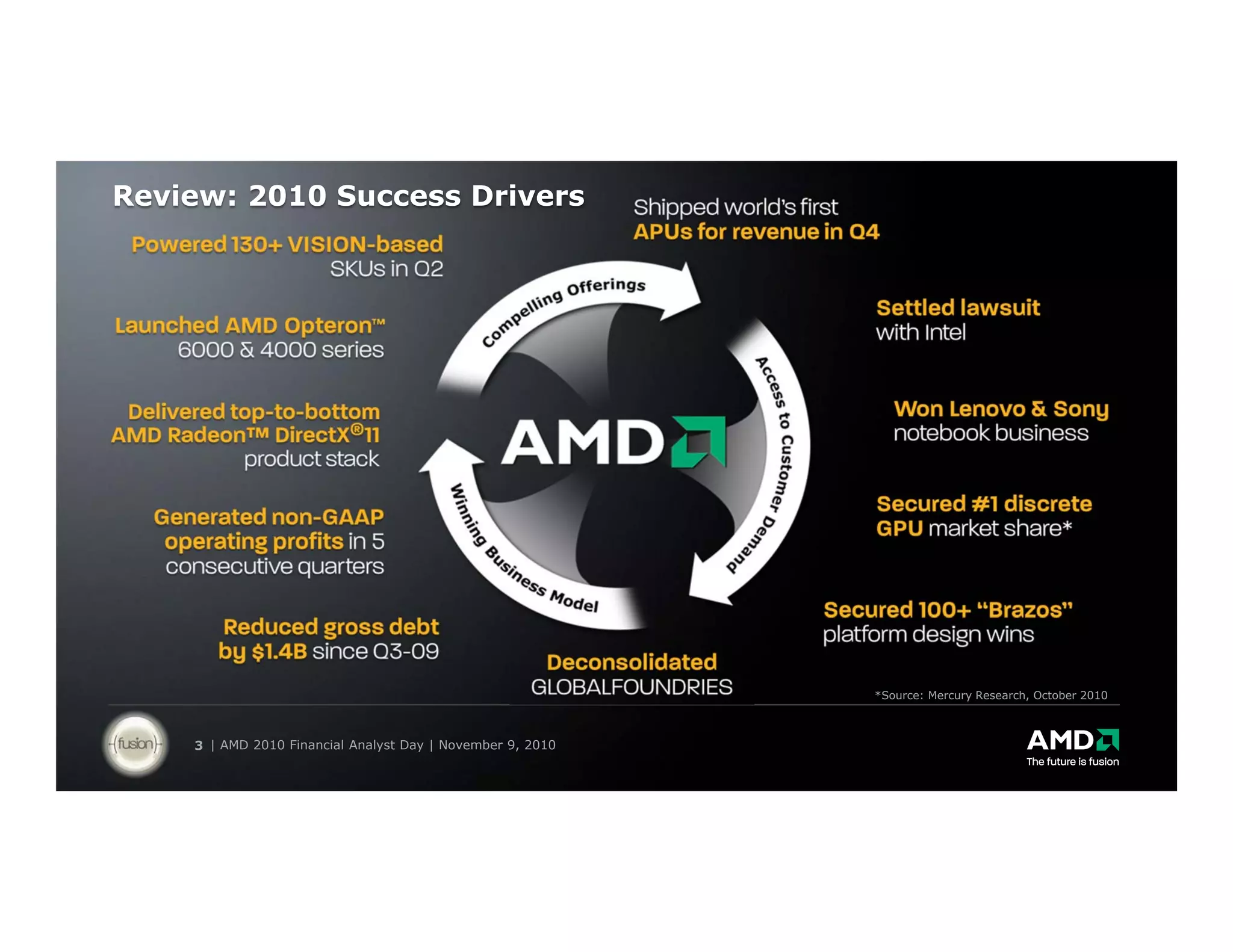

AMD held its 2010 Financial Analyst Day in November. Dirk Meyer, AMD's President and CEO, reviewed the company's success in 2010, driven by gains in market share for AMD CPUs and GPUs. Meyer noted that AMD's target markets of desktops, notebooks, netbooks, servers, game consoles and tablets were large and growing, totaling a $40 billion gross margin pool by 2014. Meyer introduced AMD's new Fusion family of APUs, which integrate CPU and GPU cores on a single chip to converge the trends of computing, graphics and communications.