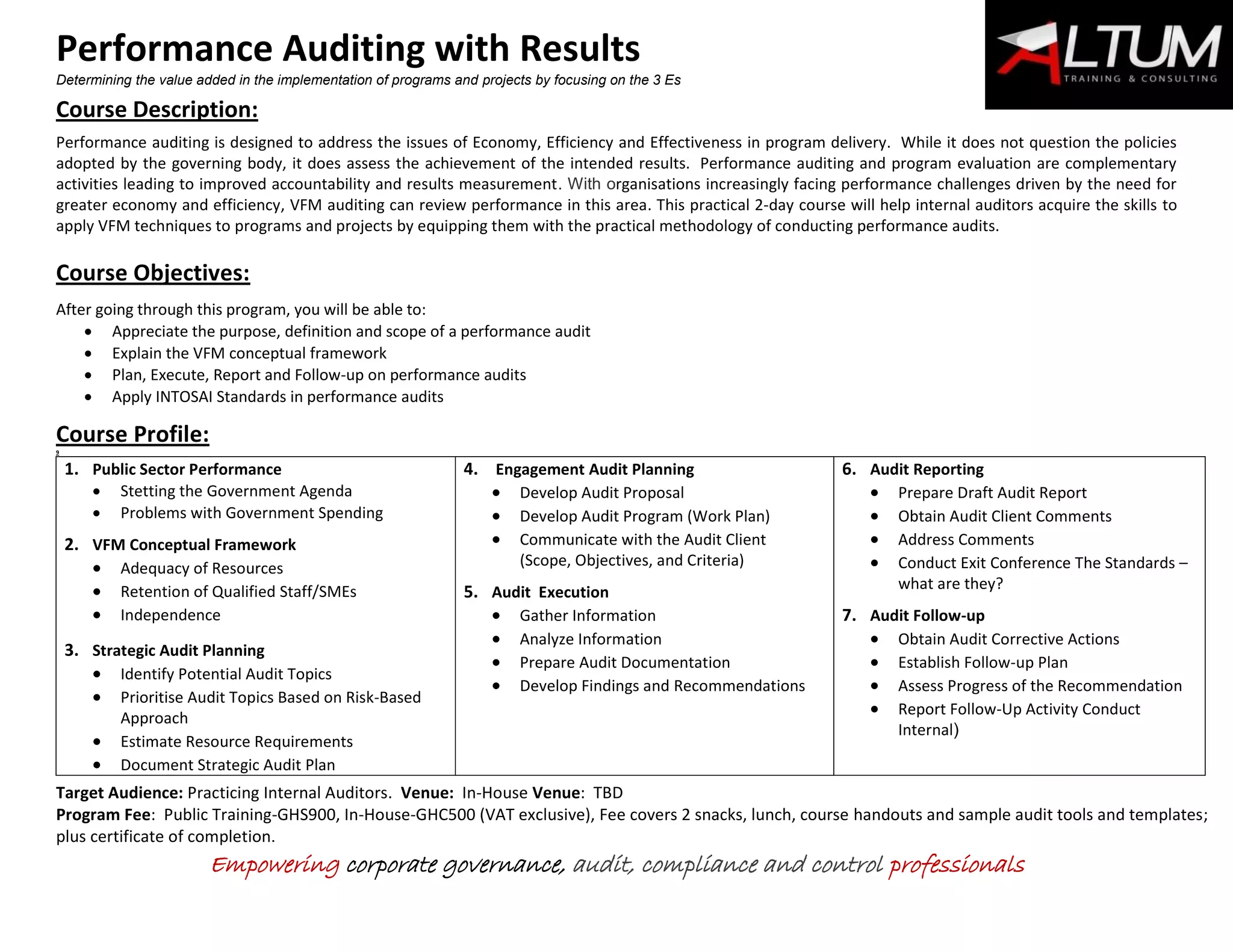

This 2-day course teaches performance auditing techniques to help internal auditors assess the economy, efficiency, and effectiveness of programs and projects. It covers planning, executing, reporting on, and following up on performance audits based on the INTOSAI standards. The objectives are to understand performance auditing concepts, apply a value-for-money framework, and gain the skills to conduct performance audits that evaluate the achievement of intended results and identify opportunities for improved accountability. The course content includes setting performance goals, strategic and engagement audit planning, information gathering and analysis, developing findings and recommendations, and reporting and follow up procedures.