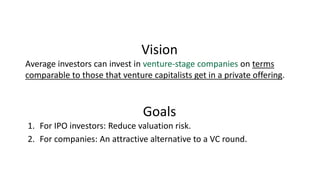

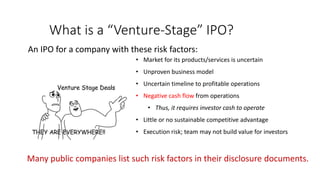

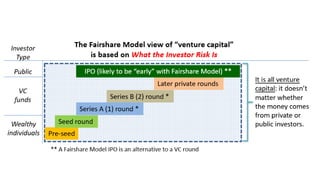

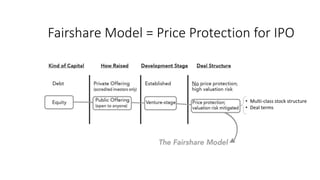

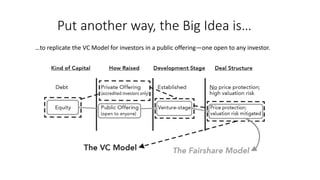

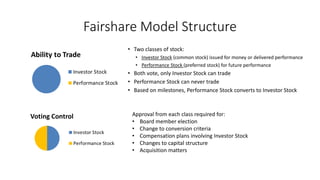

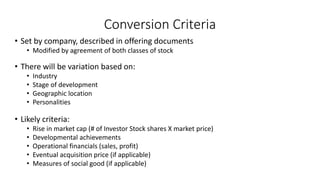

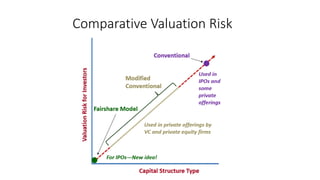

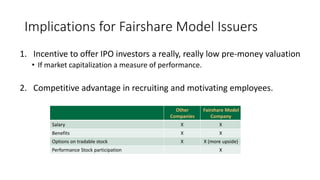

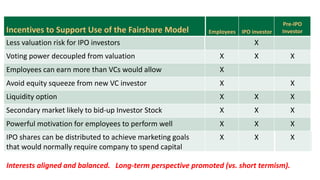

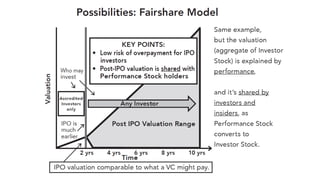

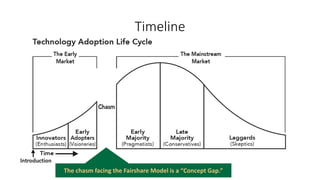

The document outlines the Fairshare model, which aims to create a performance-based capital structure for venture-stage initial public offerings (IPOs) to allow average investors to participate on favorable terms. It examines previous attempts at implementing this model, the evolution of the regulatory environment, and the challenges faced, while also promoting a book that further explores the concepts of the Fairshare model. Key goals include reducing valuation risks for IPO investors and providing companies with an alternative to traditional venture capital funding.

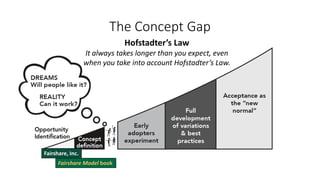

![A 2:3 Paradigm for Venture-Stage Investors

Two Fundamental Risks

1. Failure risk

• Hard to control

2. Valuation risk

• Controllable

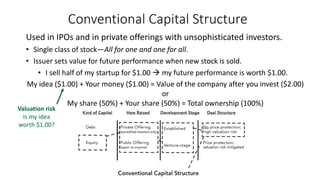

Three Equity Capital Structures

1. Conventional

2. Modified Conventional

3. Fairshare Model

* Fraud = [Failure Risk + Valuation Risk] X False and/or Inadequate Disclosure

*](https://image.slidesharecdn.com/fairsharemodelsjogrenglobalbigdataconf8-190824005614/85/Fairshare-Model-presentation-Global-Big-Data-conf-8-21-19-16-320.jpg)

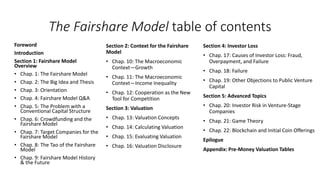

![“An important work.”

—Ken Wilcox, Chairman Emeritus, Silicon Valley Bank

“Why not reimagine the relationship between investors and

company employees to be one that is fairer and benefits both?”

—Po-Chi Wu, Senior Partner, Futurelab Consulting

“It’s time to reassess the alignment of interests in early-stage

companies. How do you get everyday people to share in the

benefits of capitalism? How do you avoid insane valuations of

companies going public? I may be time to look at the ideas set

out in The Fairshare Model.”

—Sara Hanks, Managing Partner, CrowdCheck Law

“I highly recommend [The Fairshare Model] for entrepreneurs,

practitioners, academics and investors who are committed to

the common good for all.”

—Gregory Wendt, Stakeholders Capital

Advance Praise](https://image.slidesharecdn.com/fairsharemodelsjogrenglobalbigdataconf8-190824005614/85/Fairshare-Model-presentation-Global-Big-Data-conf-8-21-19-34-320.jpg)