This document summarizes key aspects of arbitrage pricing theory (APT) and multifactor models of risk and return from the textbook "Investments" by Bodie, Kane, and Marcus:

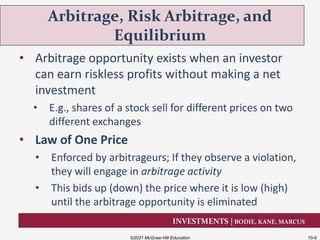

1) APT generalizes the security market line of the CAPM to provide richer insight into the risk-return relationship by allowing for multiple systematic risk factors rather than a single market factor.

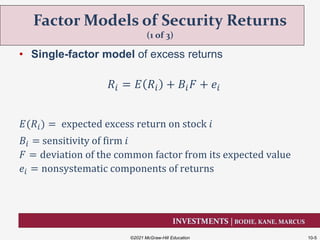

2) Multifactor models posit that security returns respond not just to overall market movements but also to specific systematic risk factors like GDP, interest rates, and inflation.

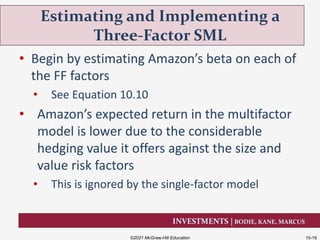

3) The Fama-French three-factor model explains returns based on sensitivities to market, firm size, and book-to-market factors