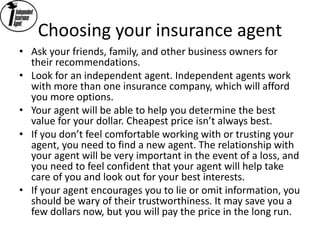

This document provides an overview of small business insurance. It discusses the importance of obtaining insurance to transfer risk from the business to an insurance company. Common types of insurance are described, including general liability, property, commercial auto, umbrella liability, workers' compensation, professional liability, and employment practices liability. The document emphasizes choosing an independent insurance agent to help determine the appropriate types and amounts of coverage needed based on the business needs. It also provides definitions and examples to help business owners understand their insurance options.