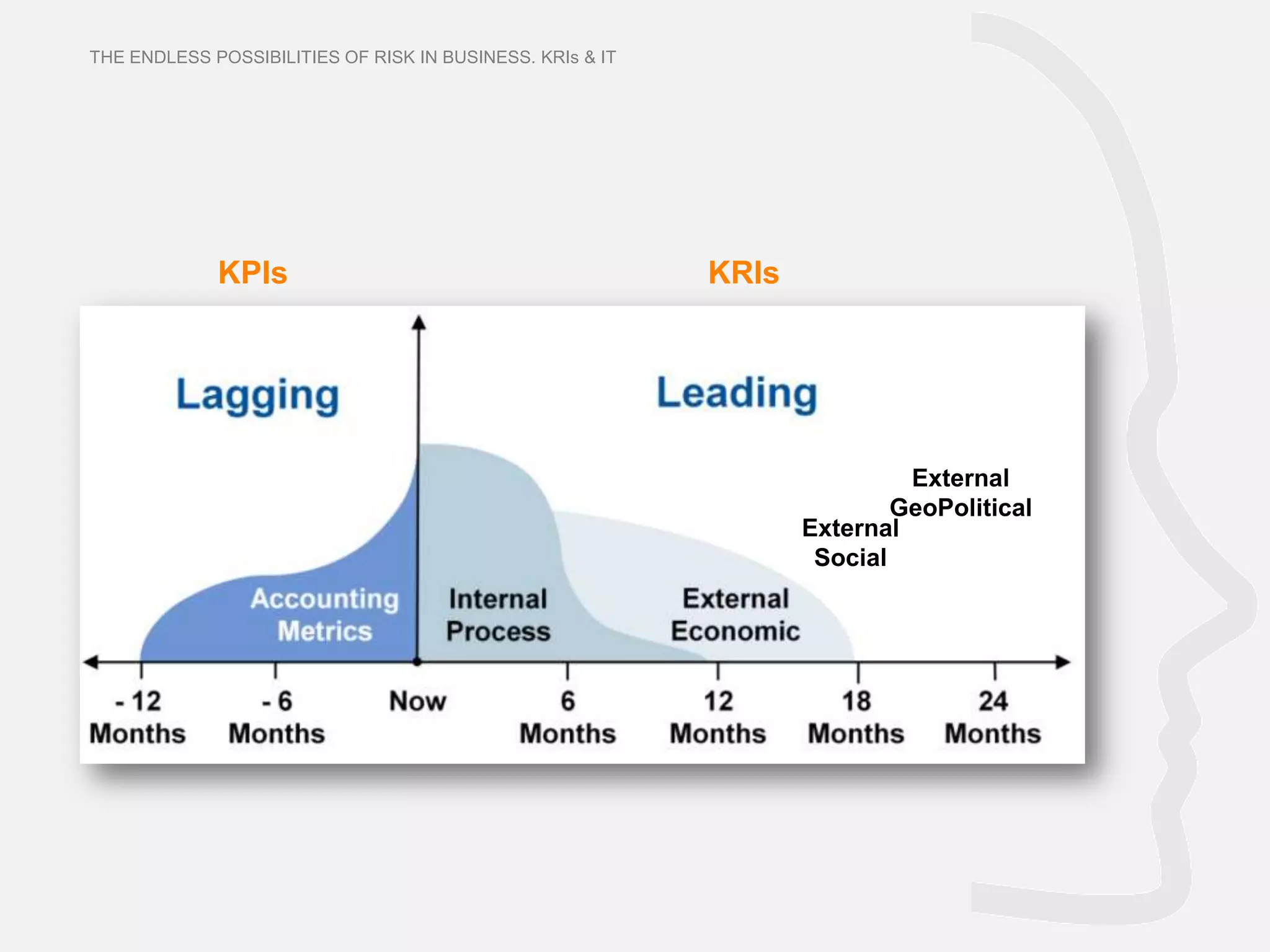

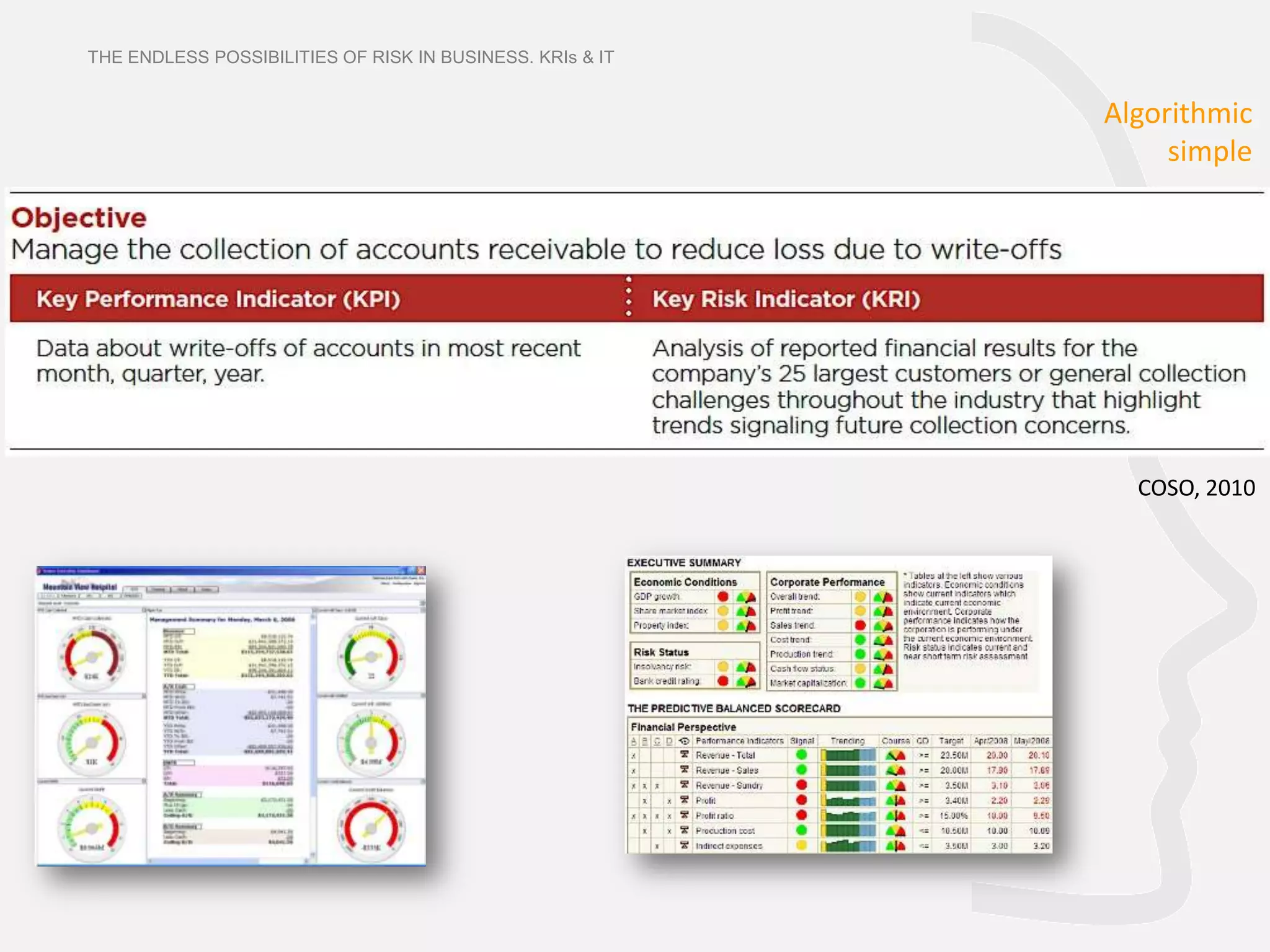

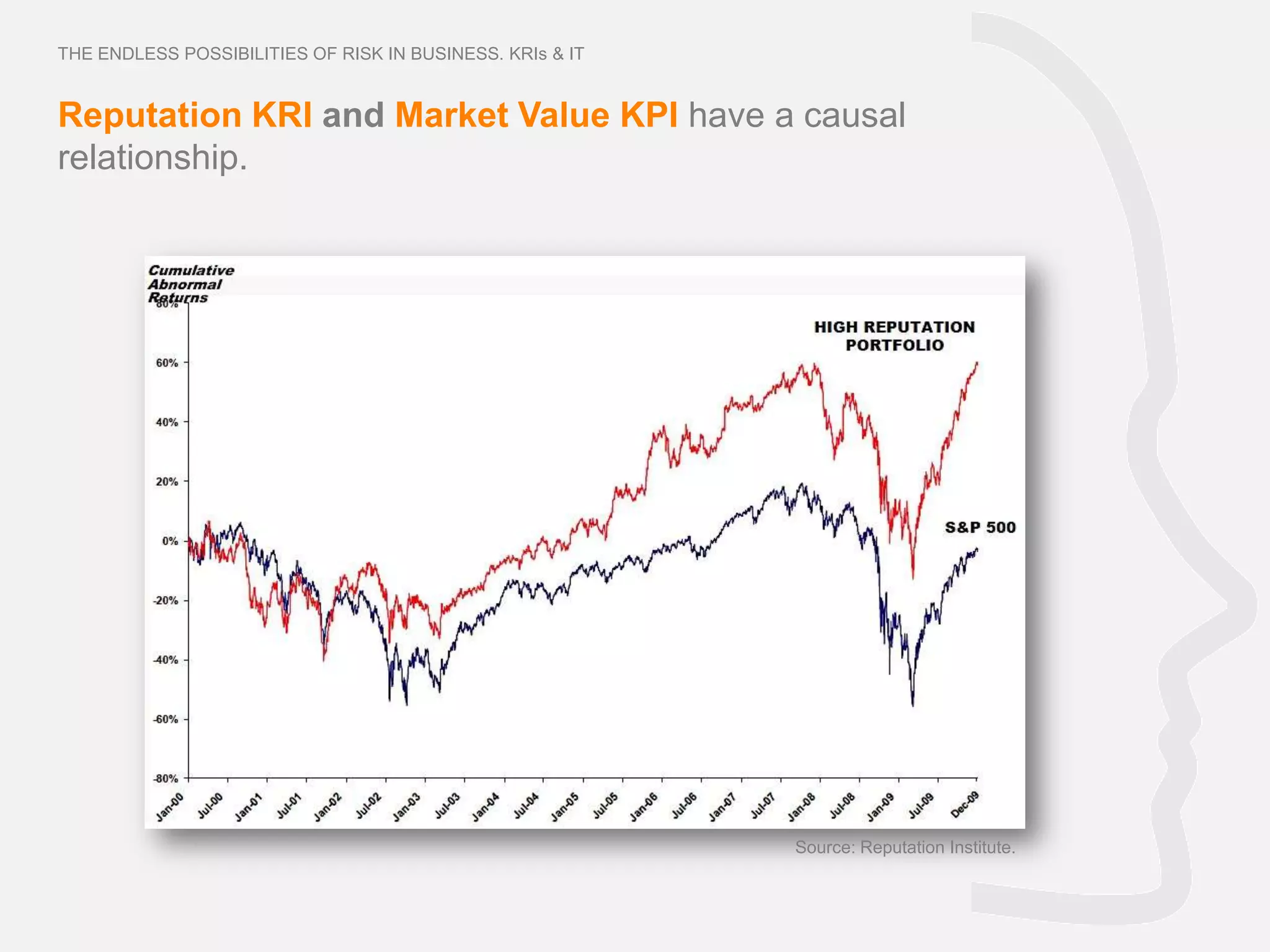

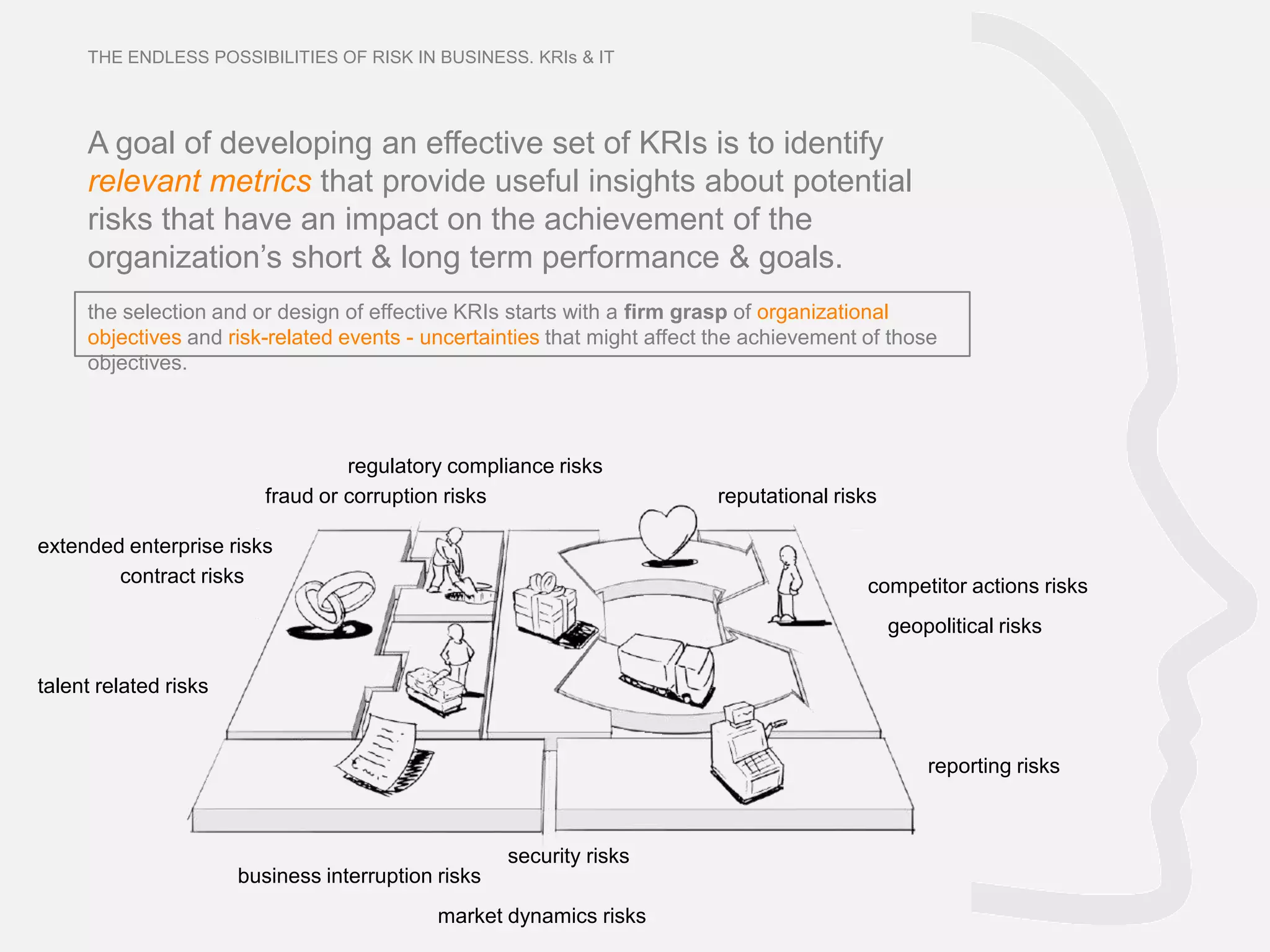

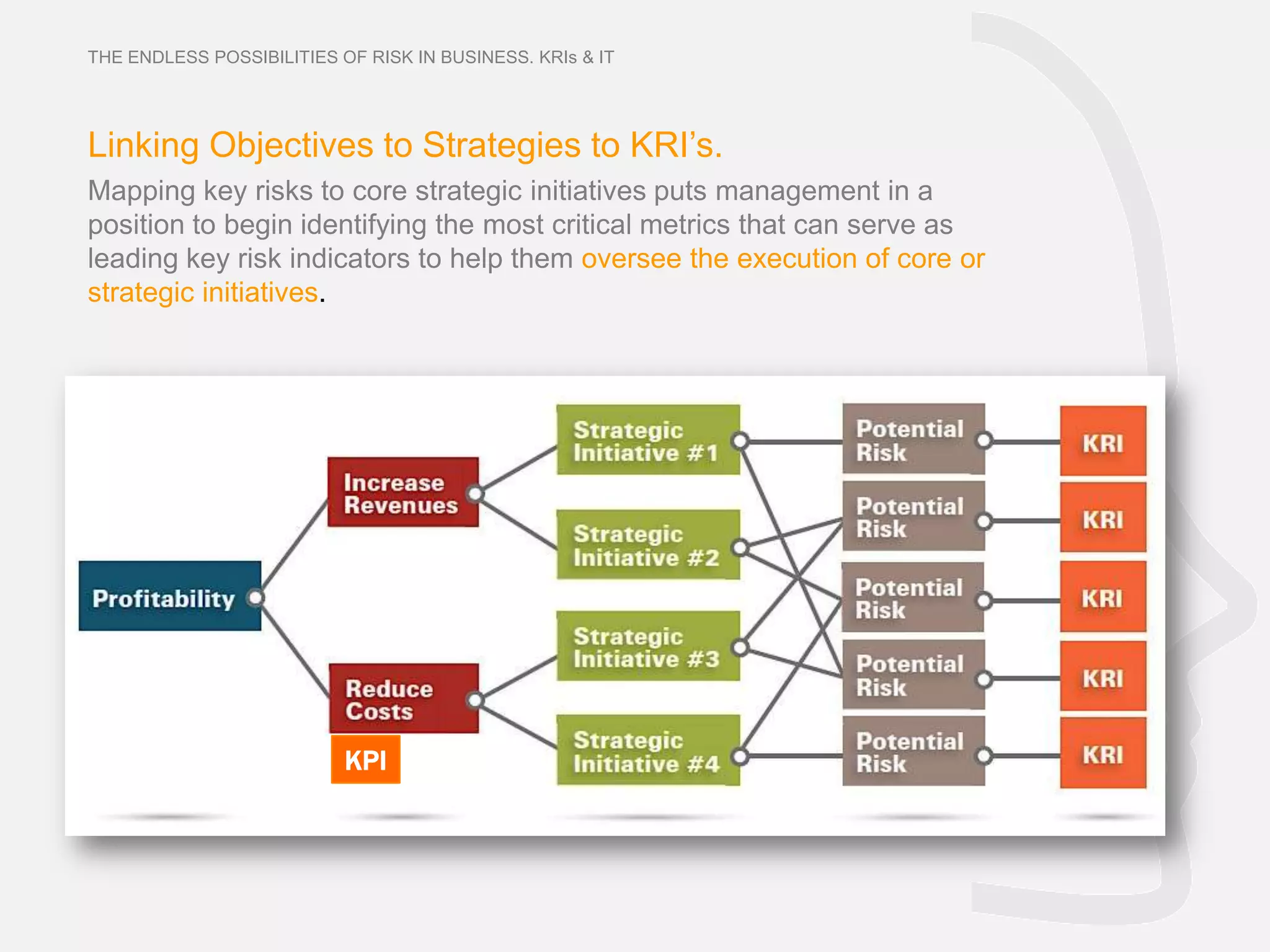

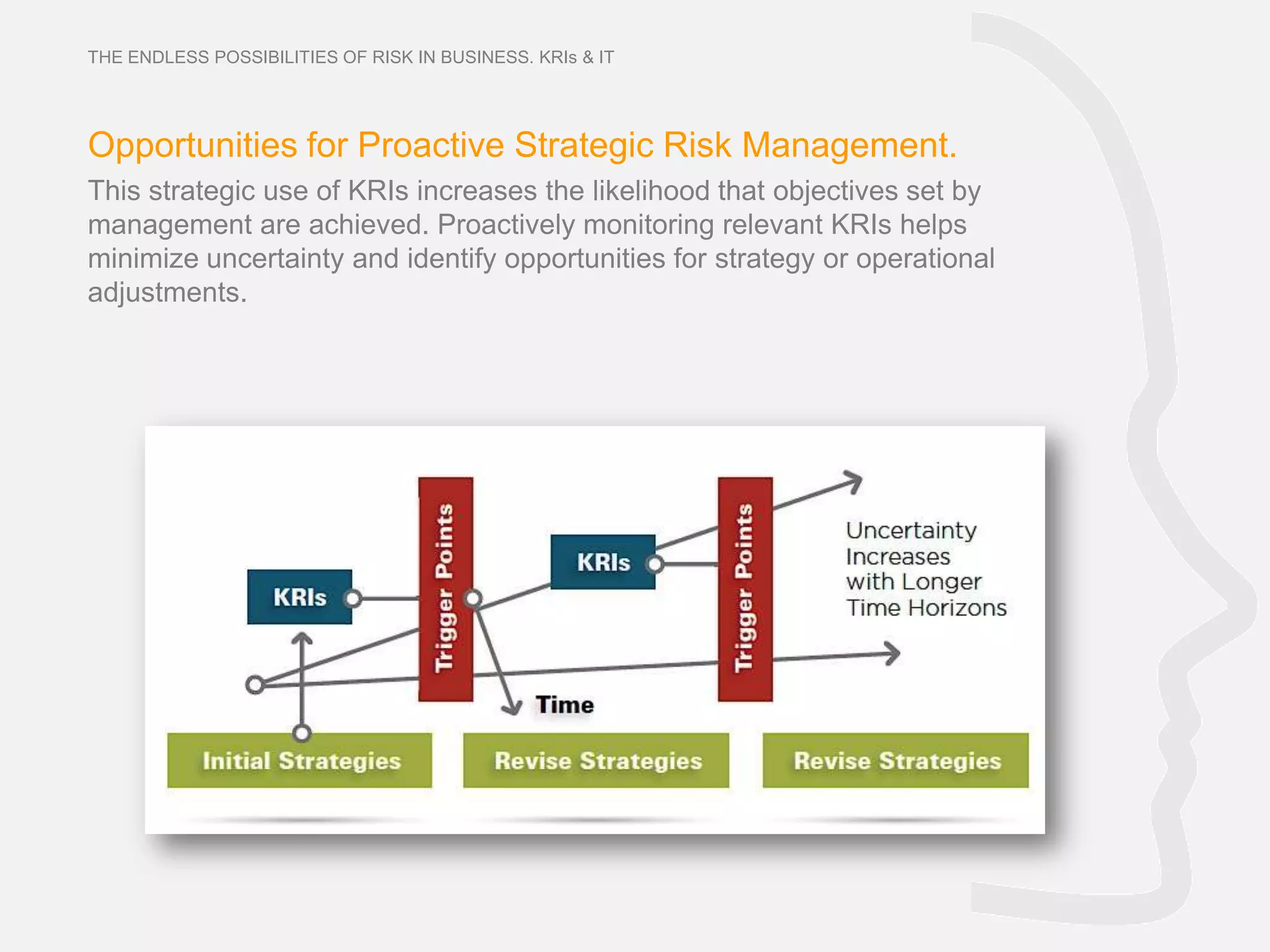

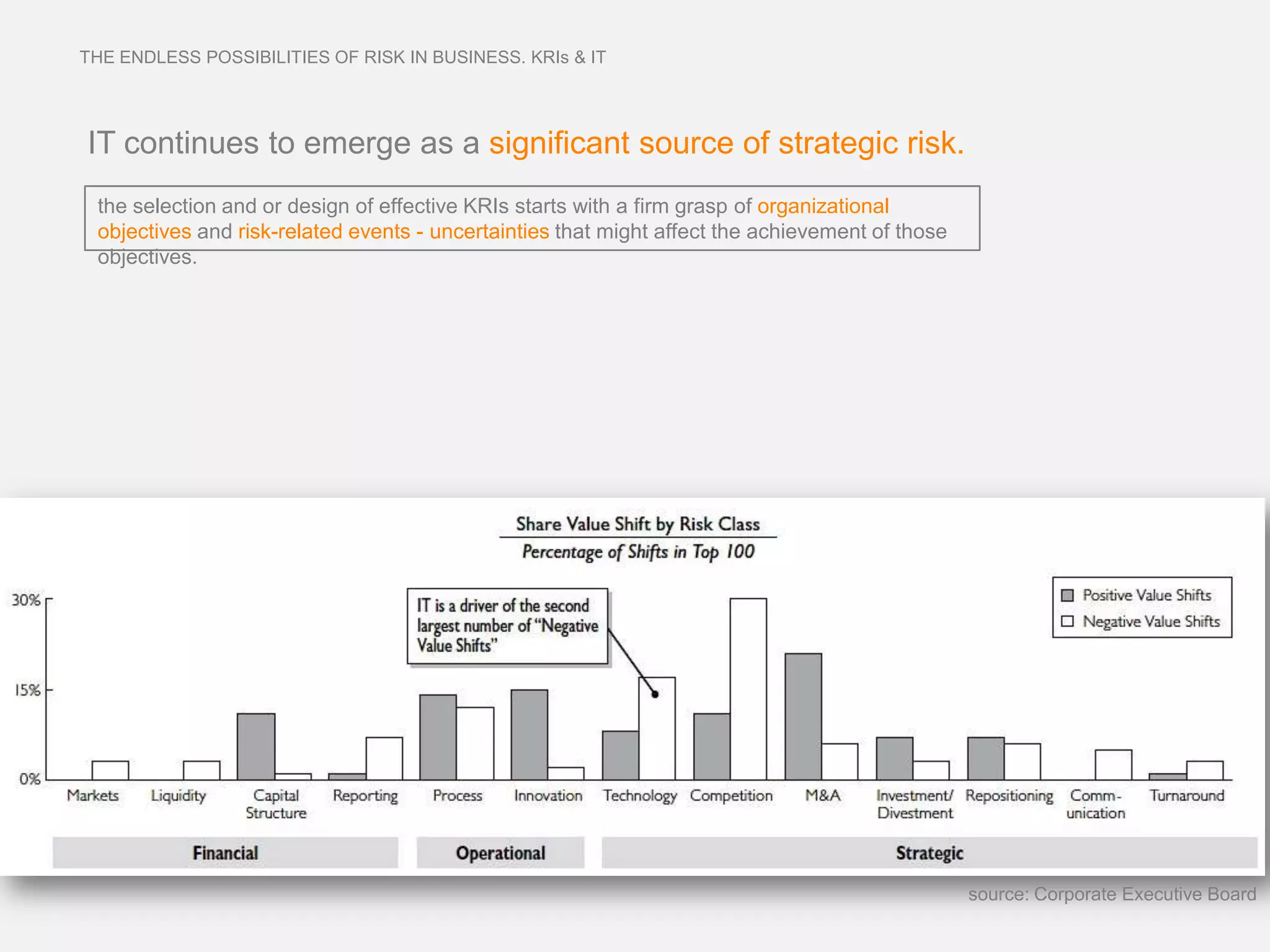

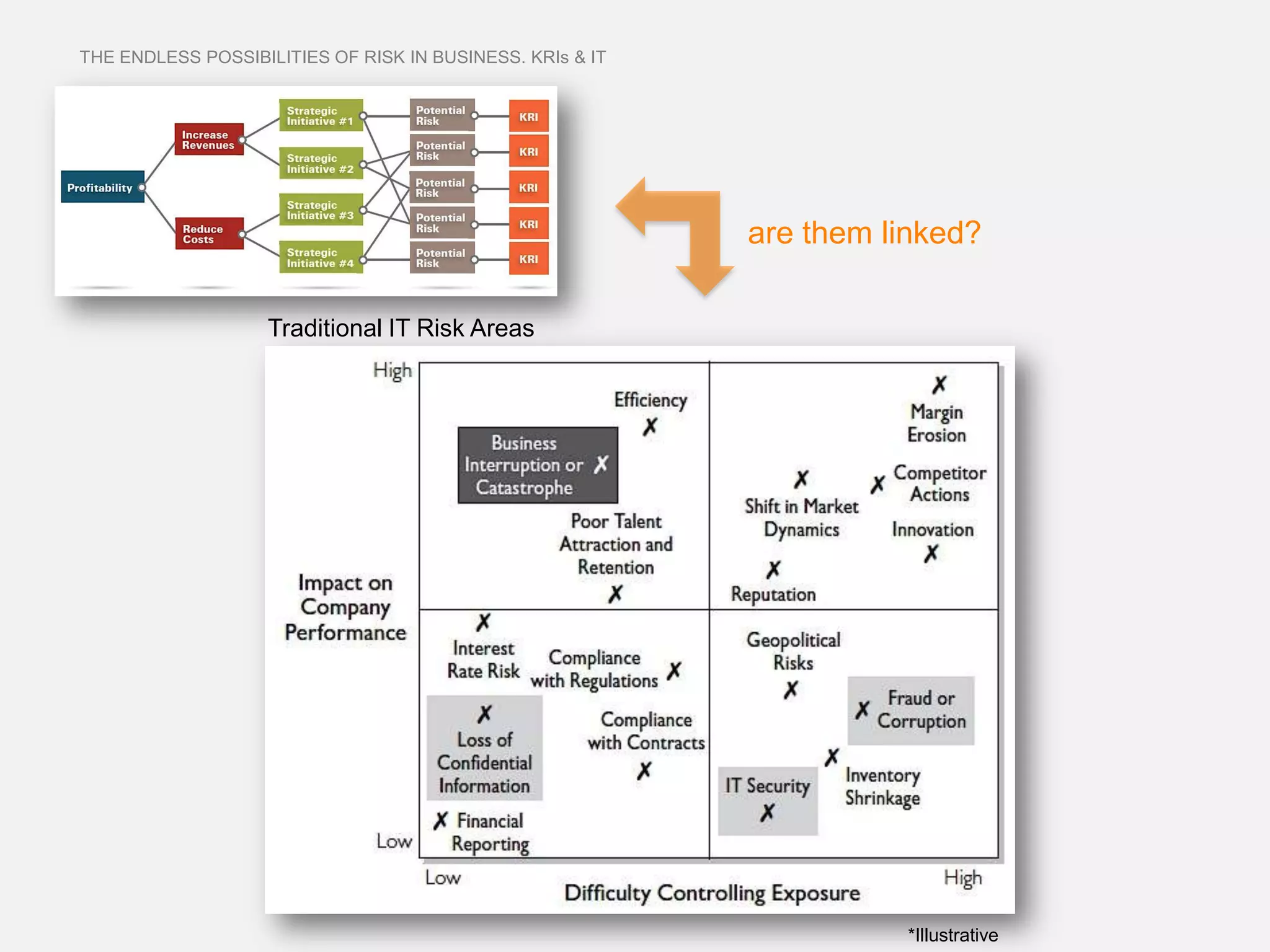

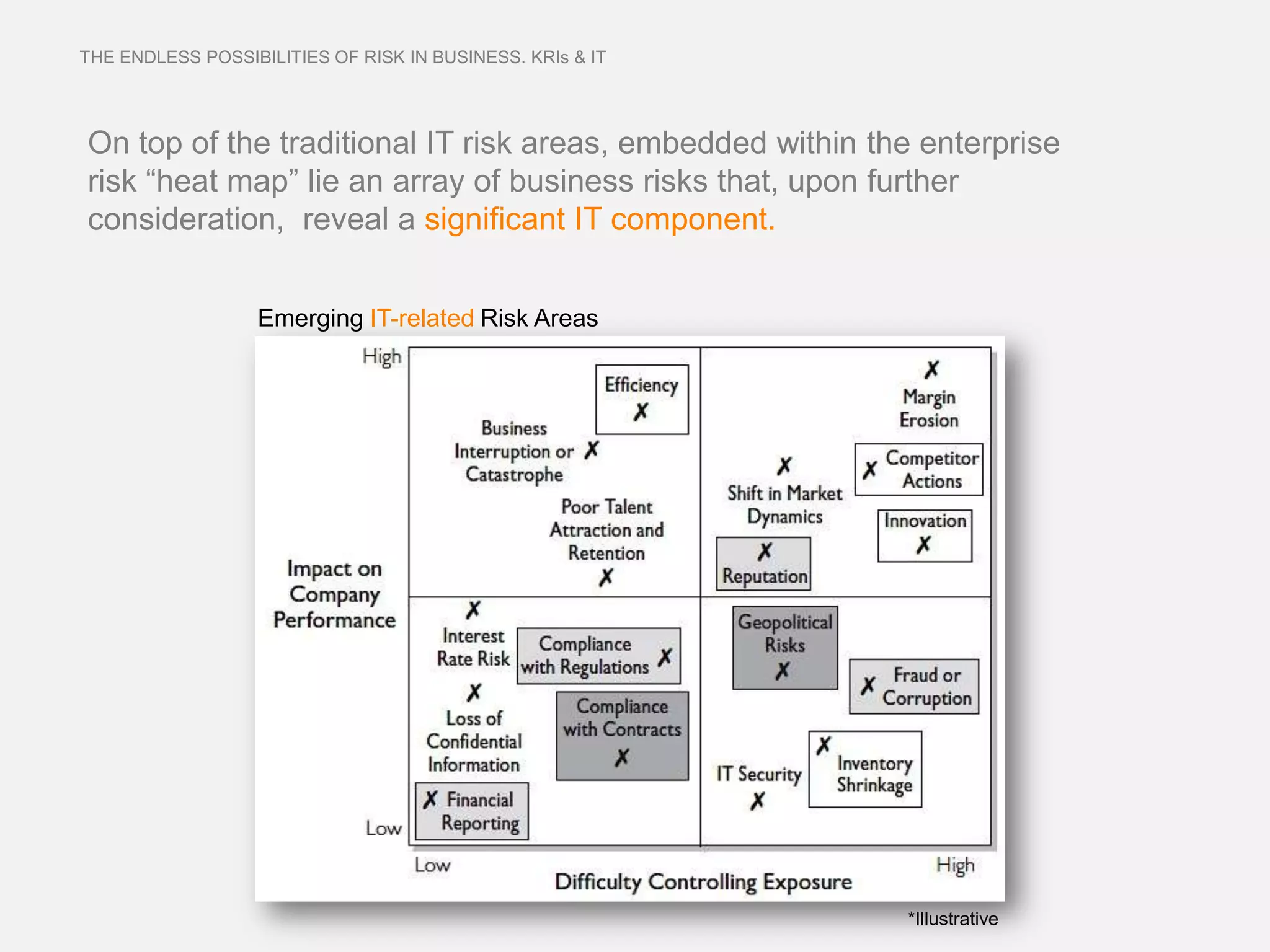

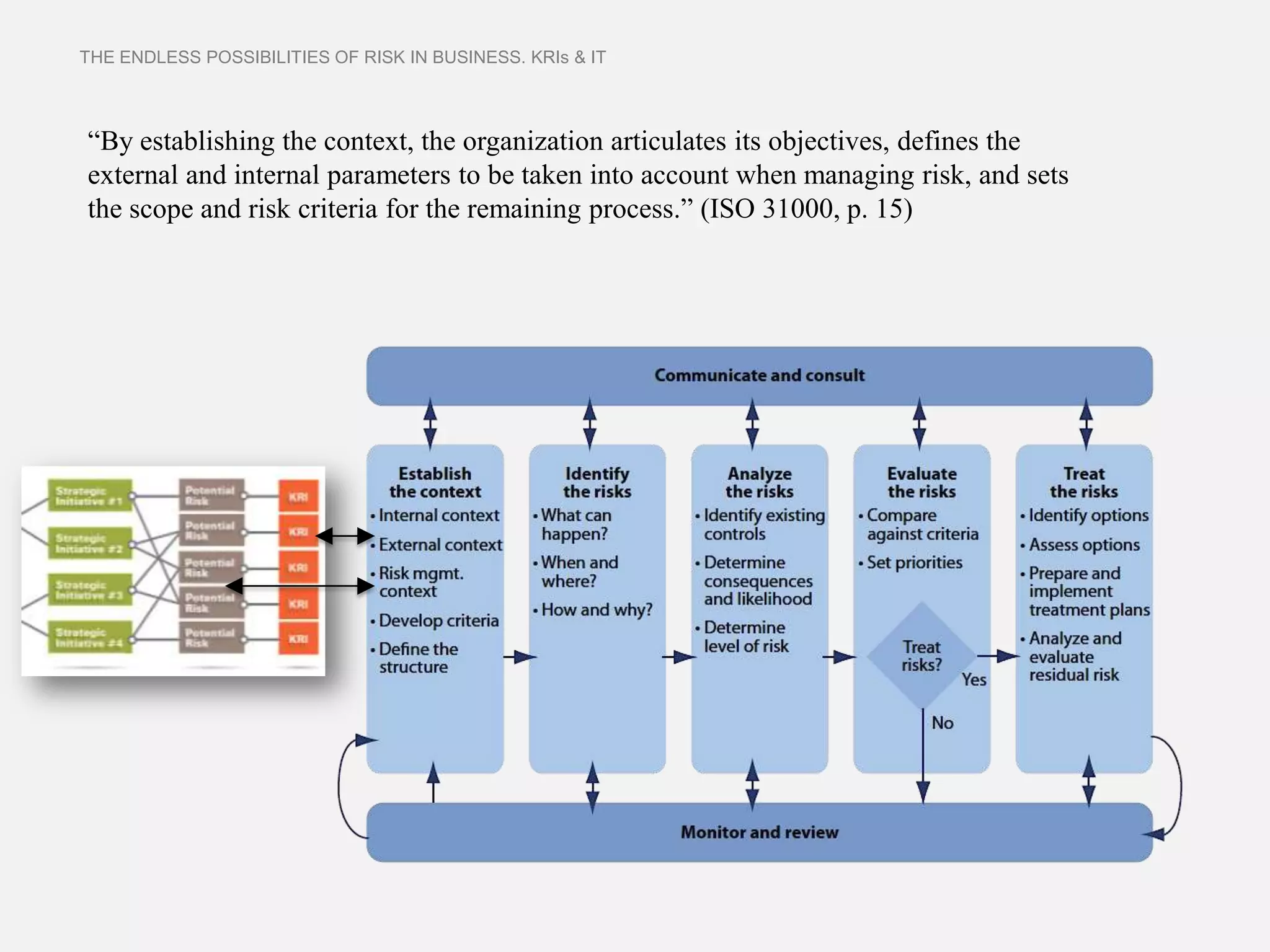

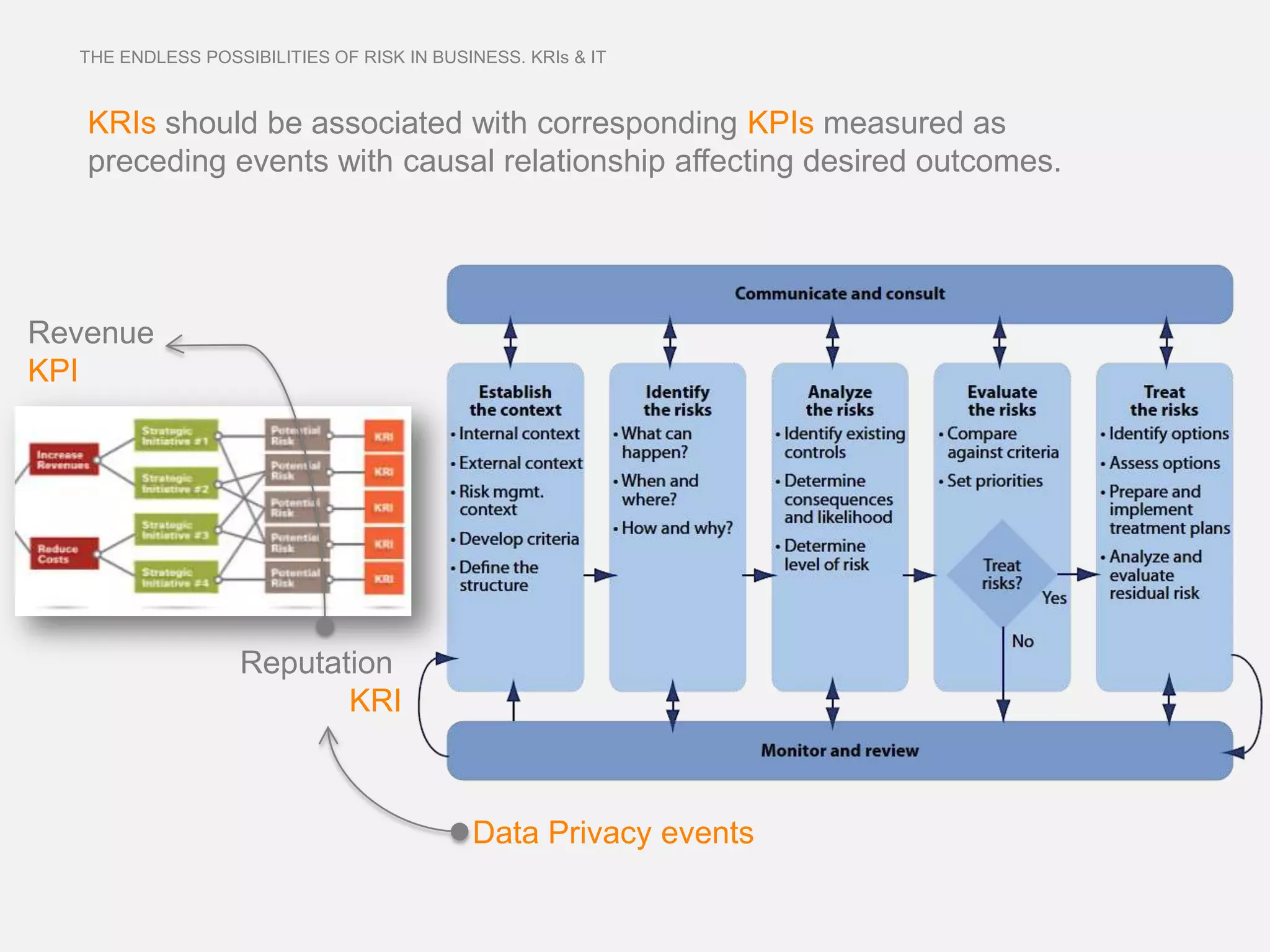

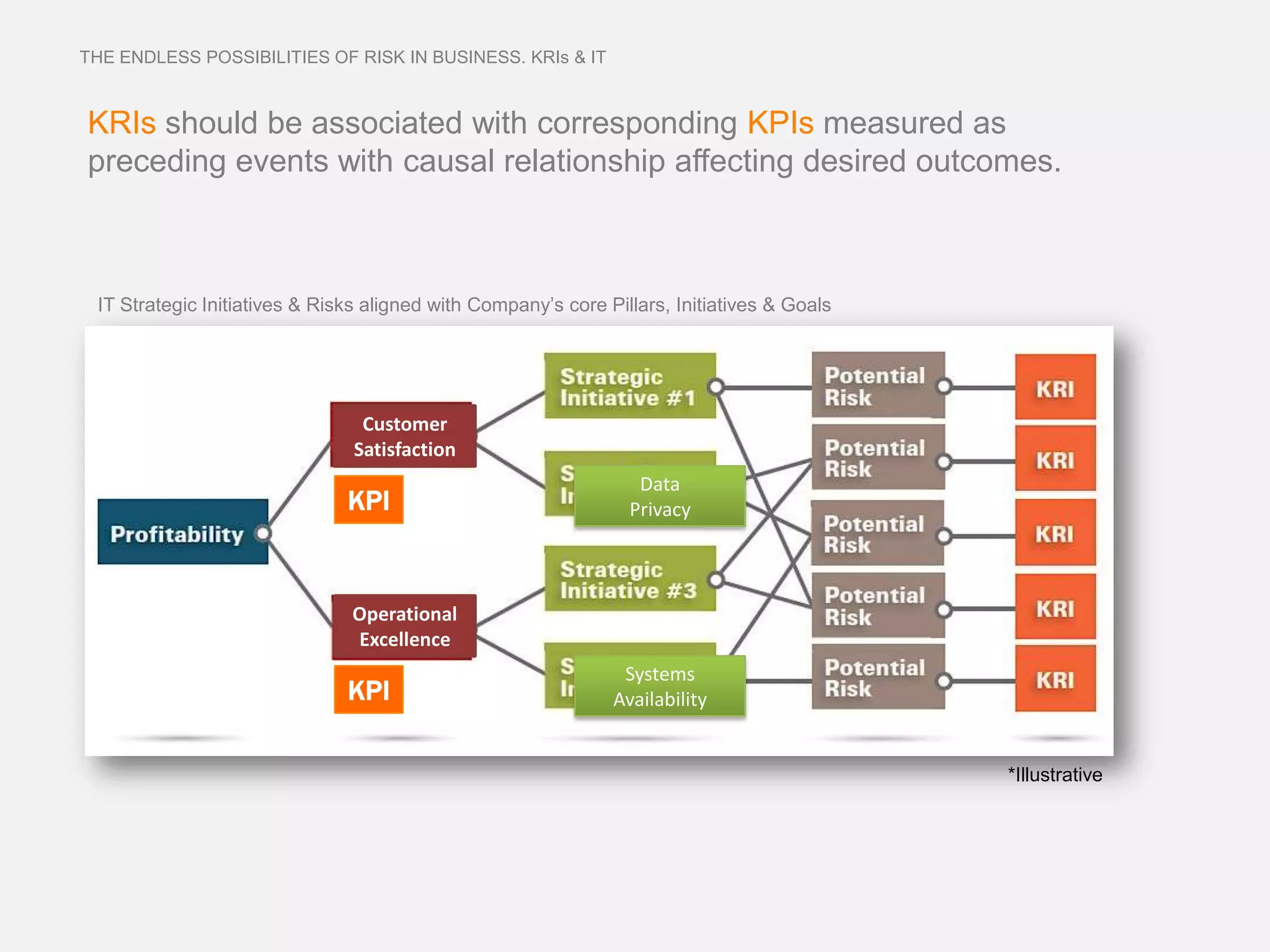

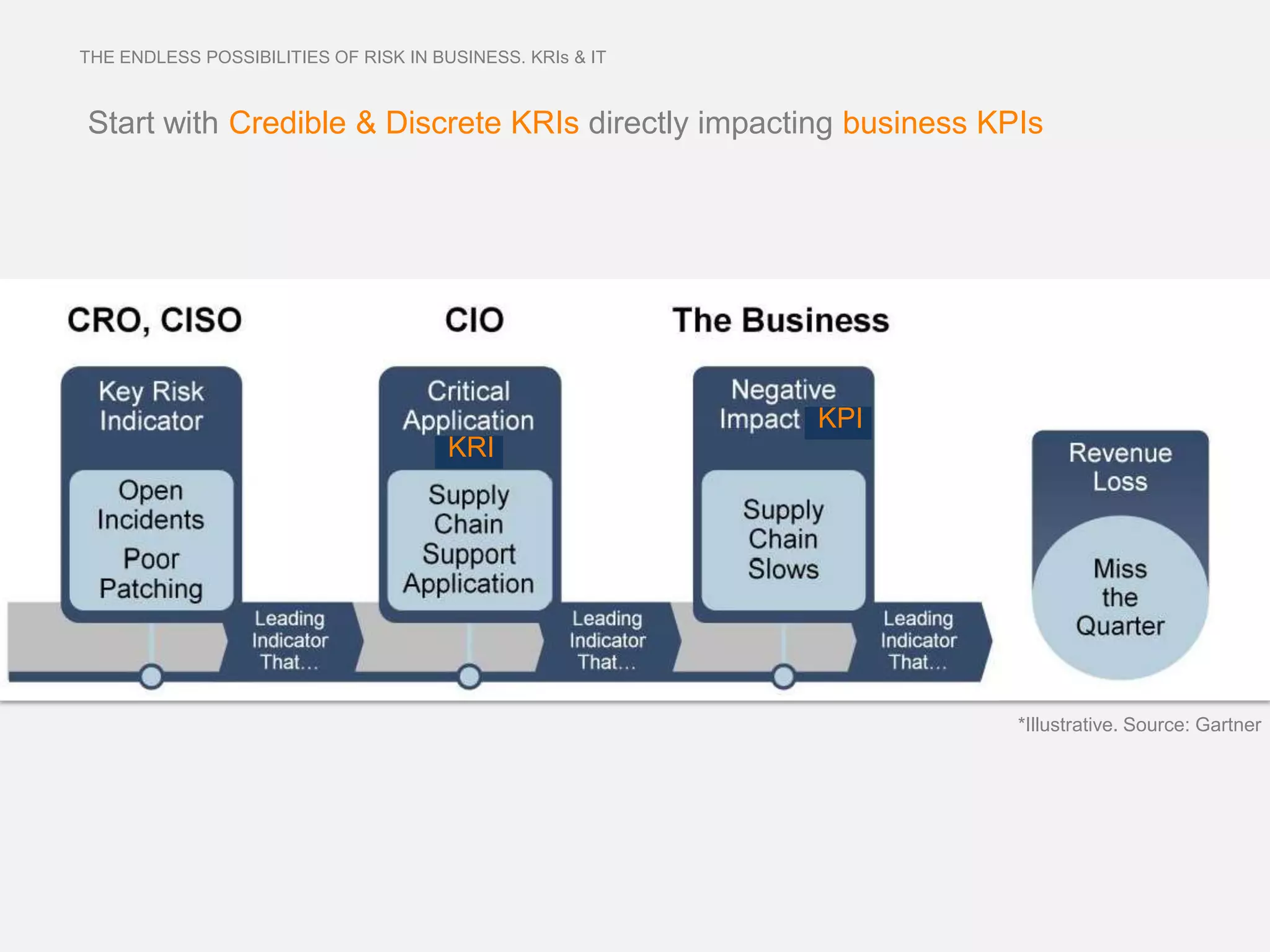

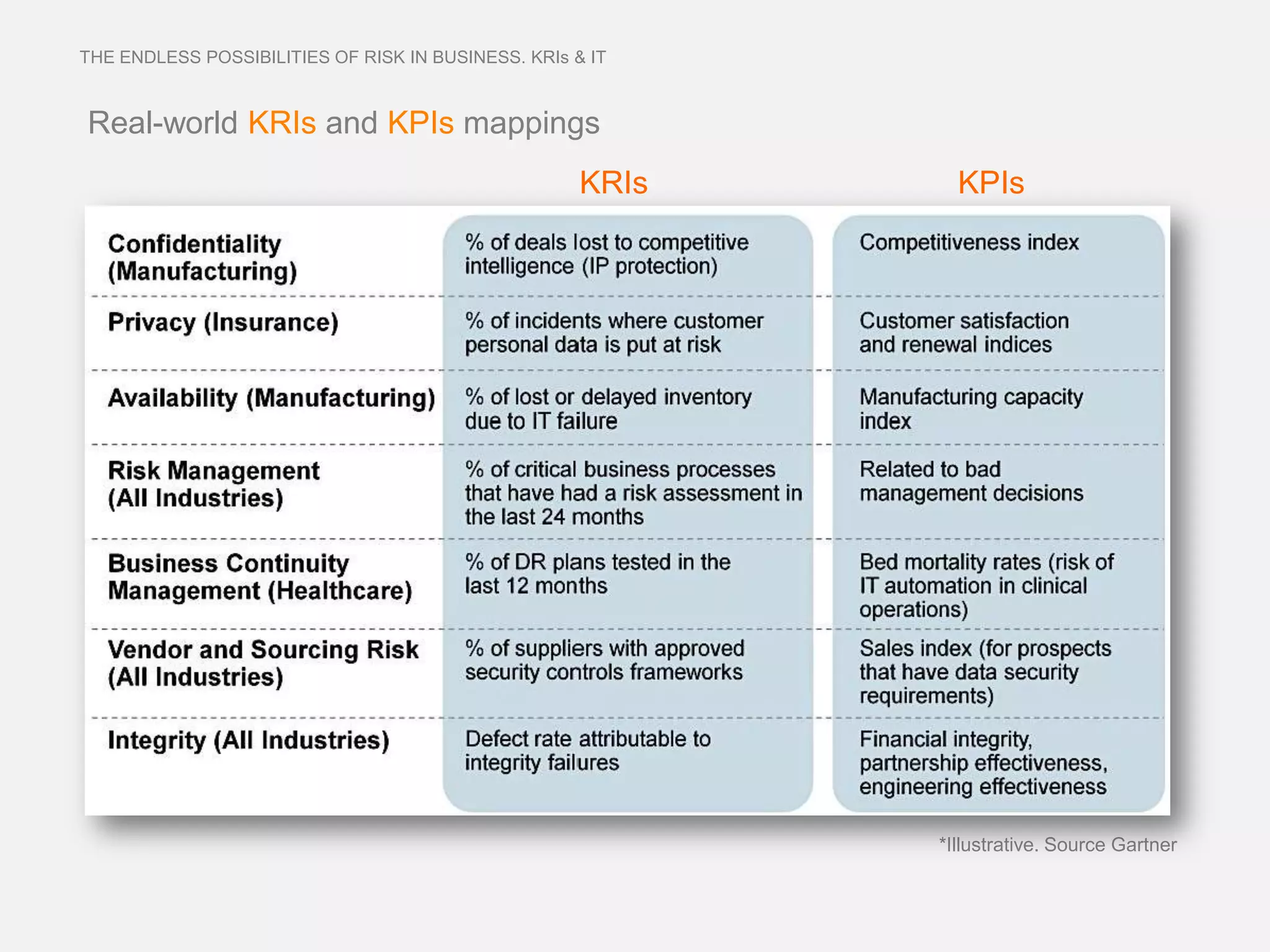

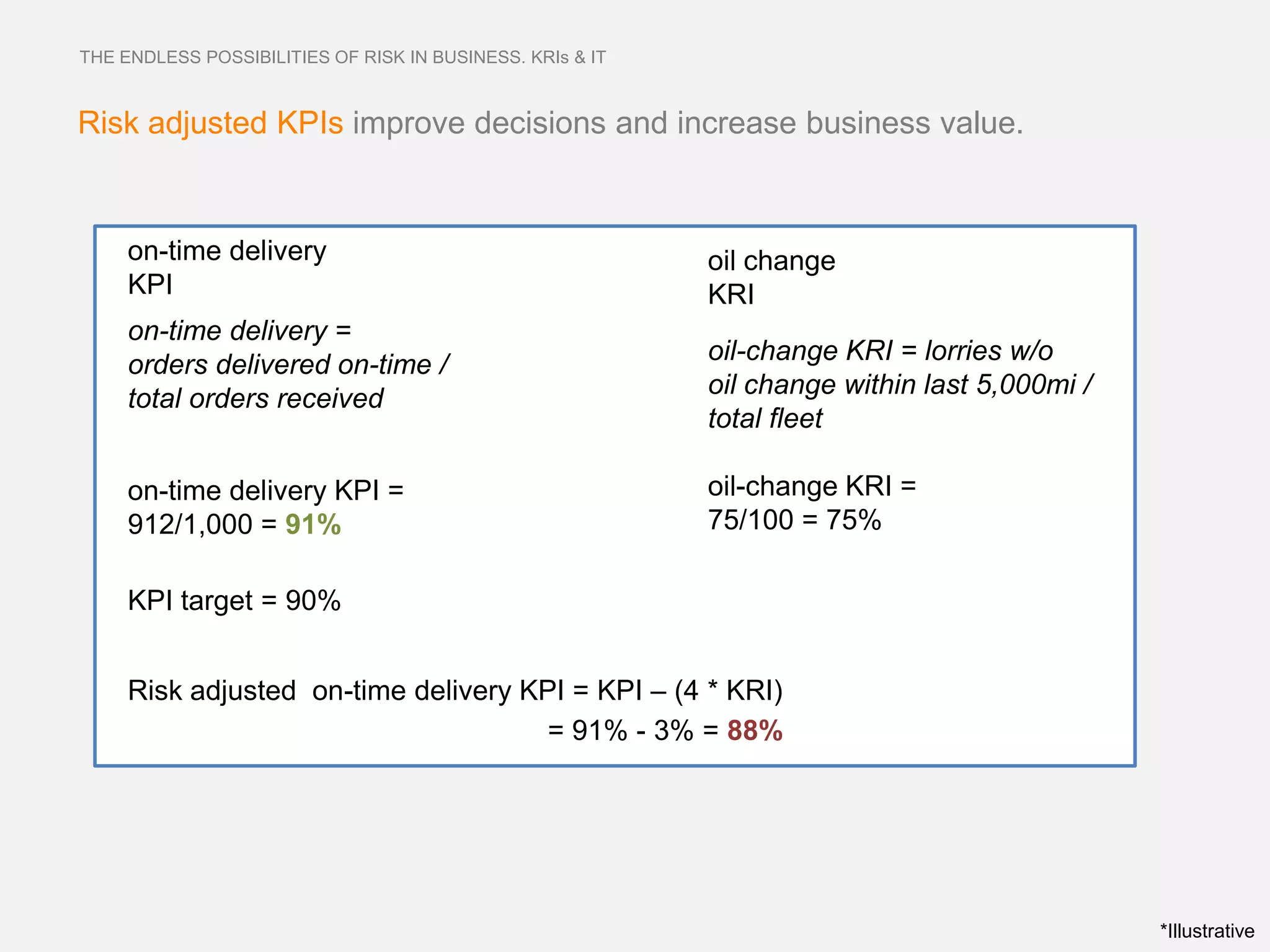

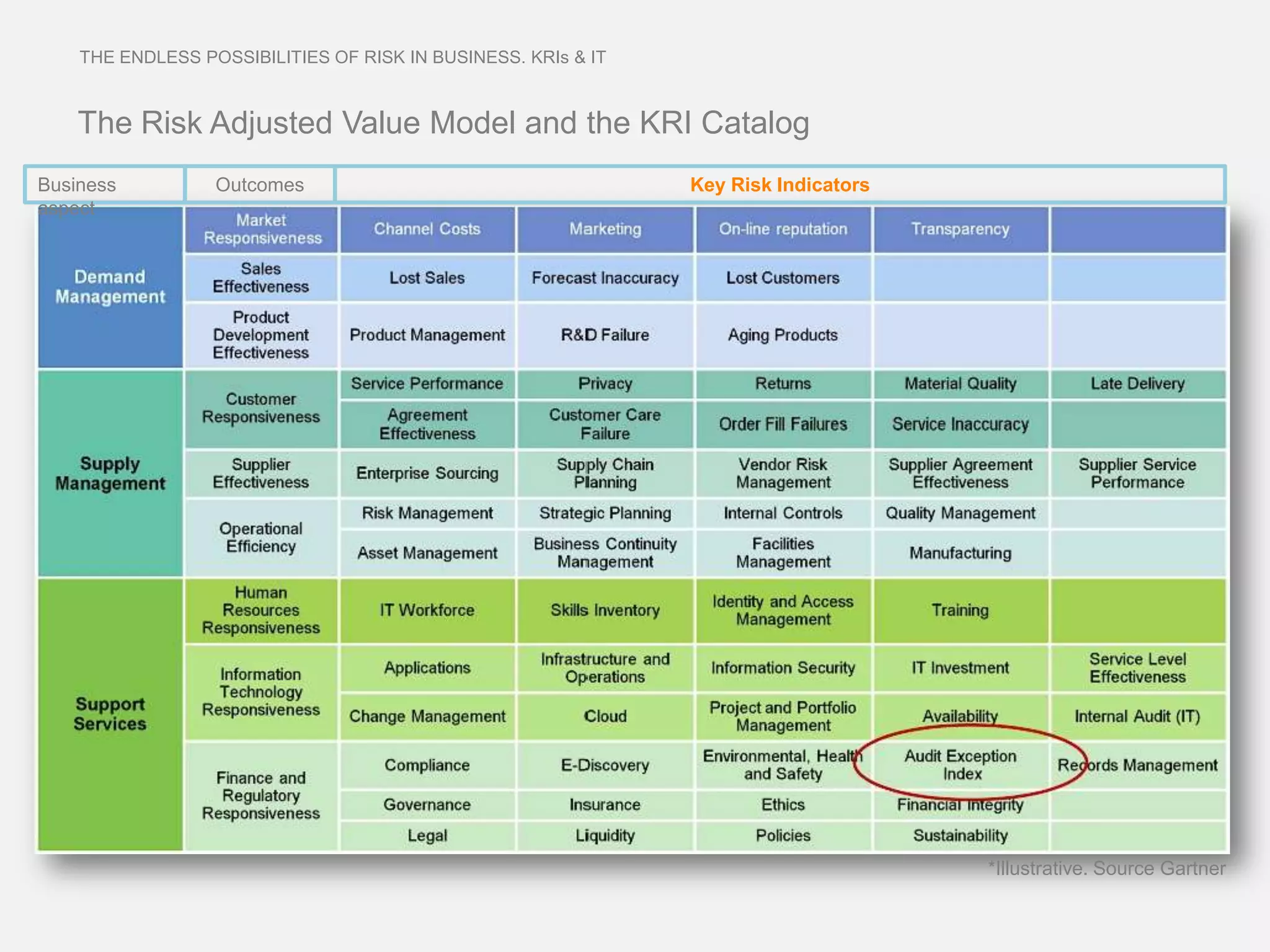

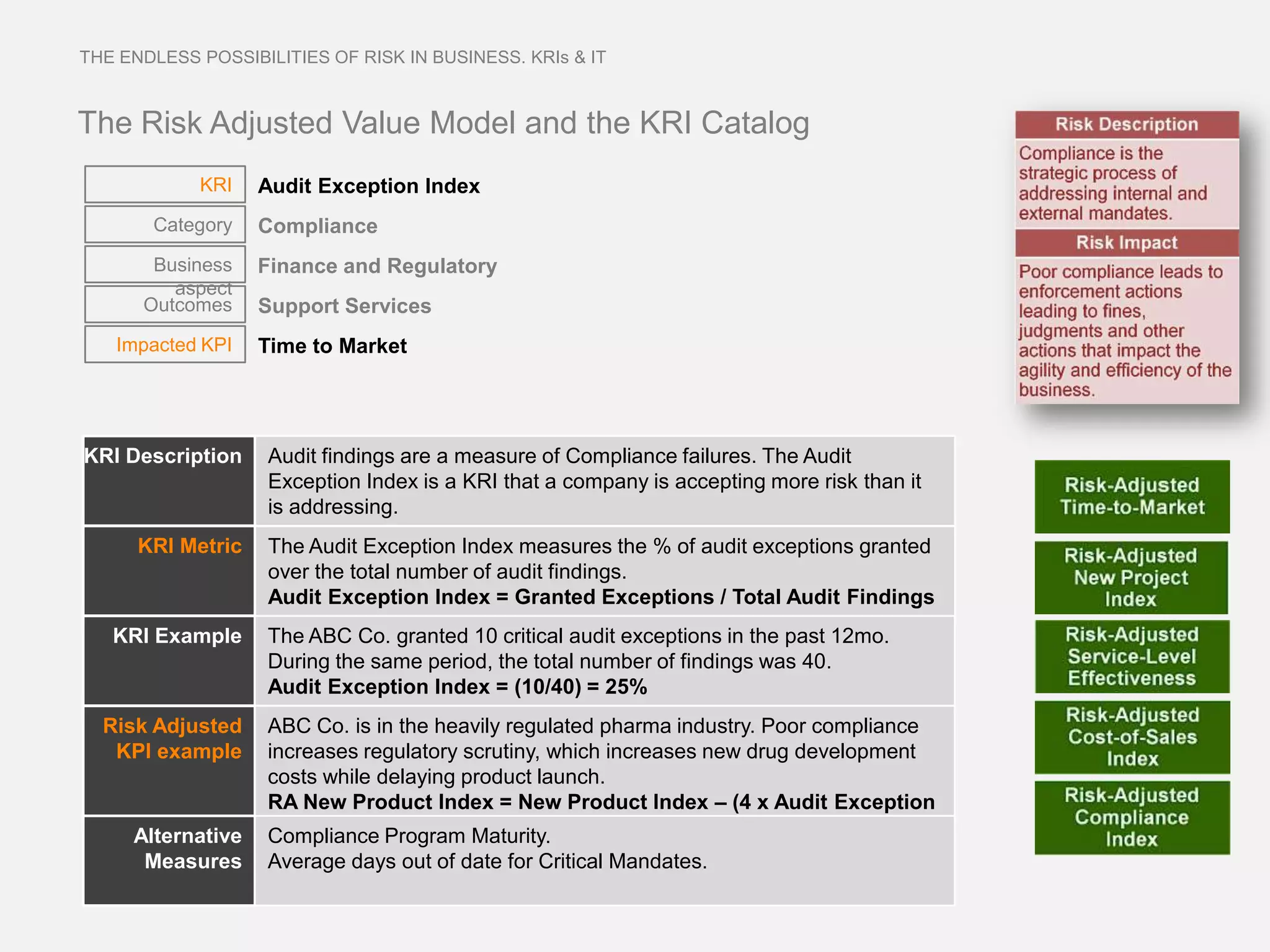

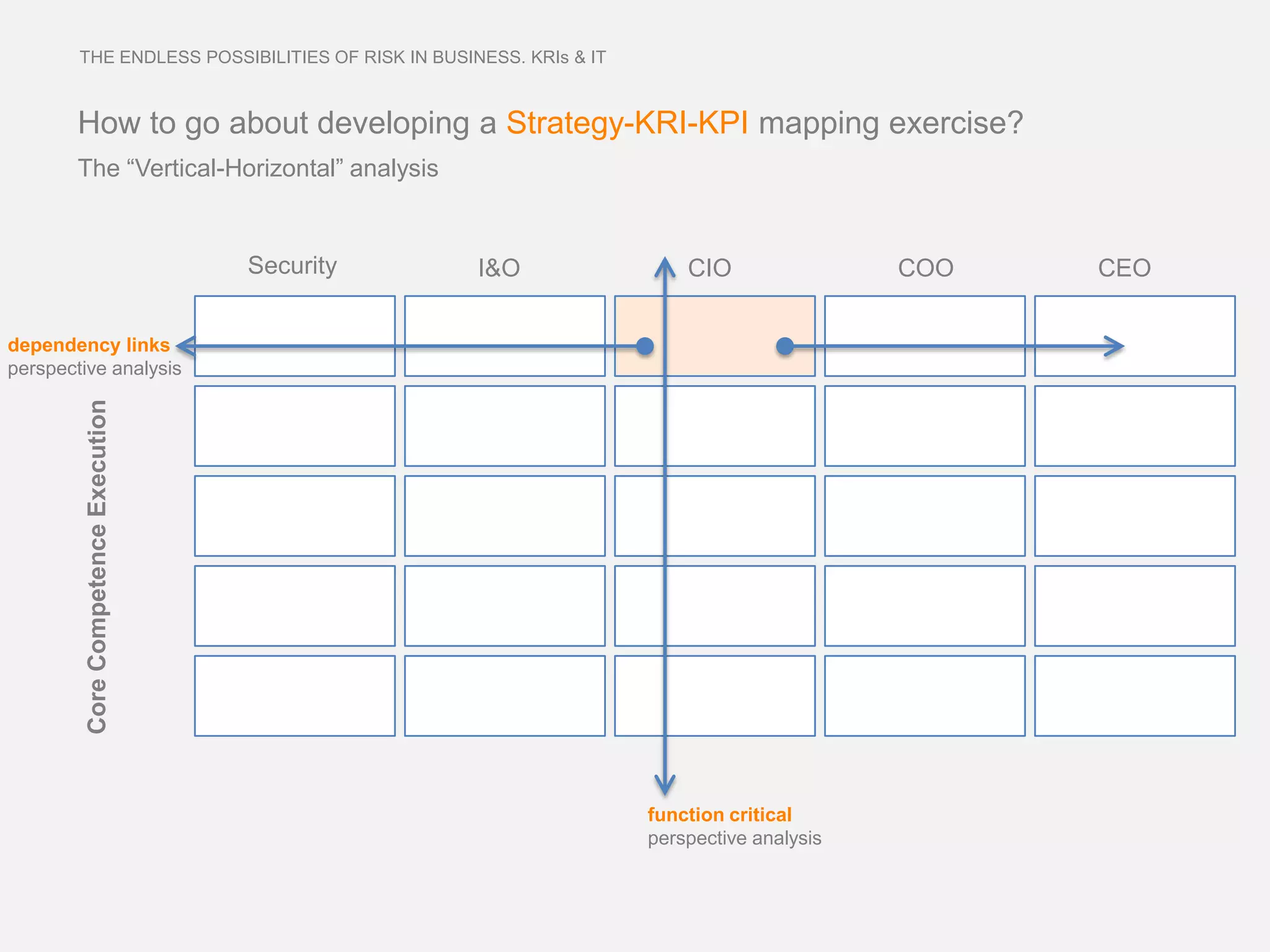

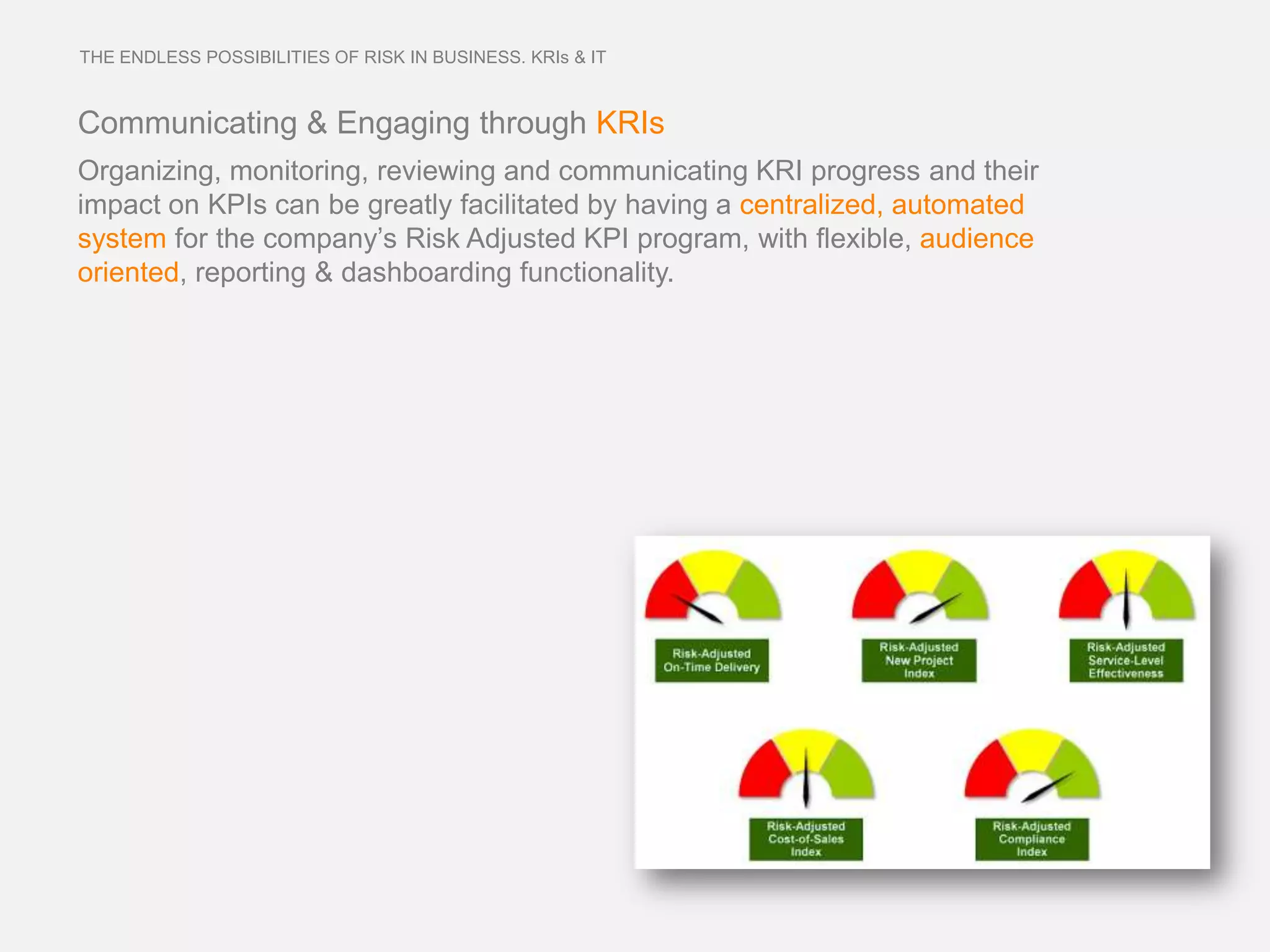

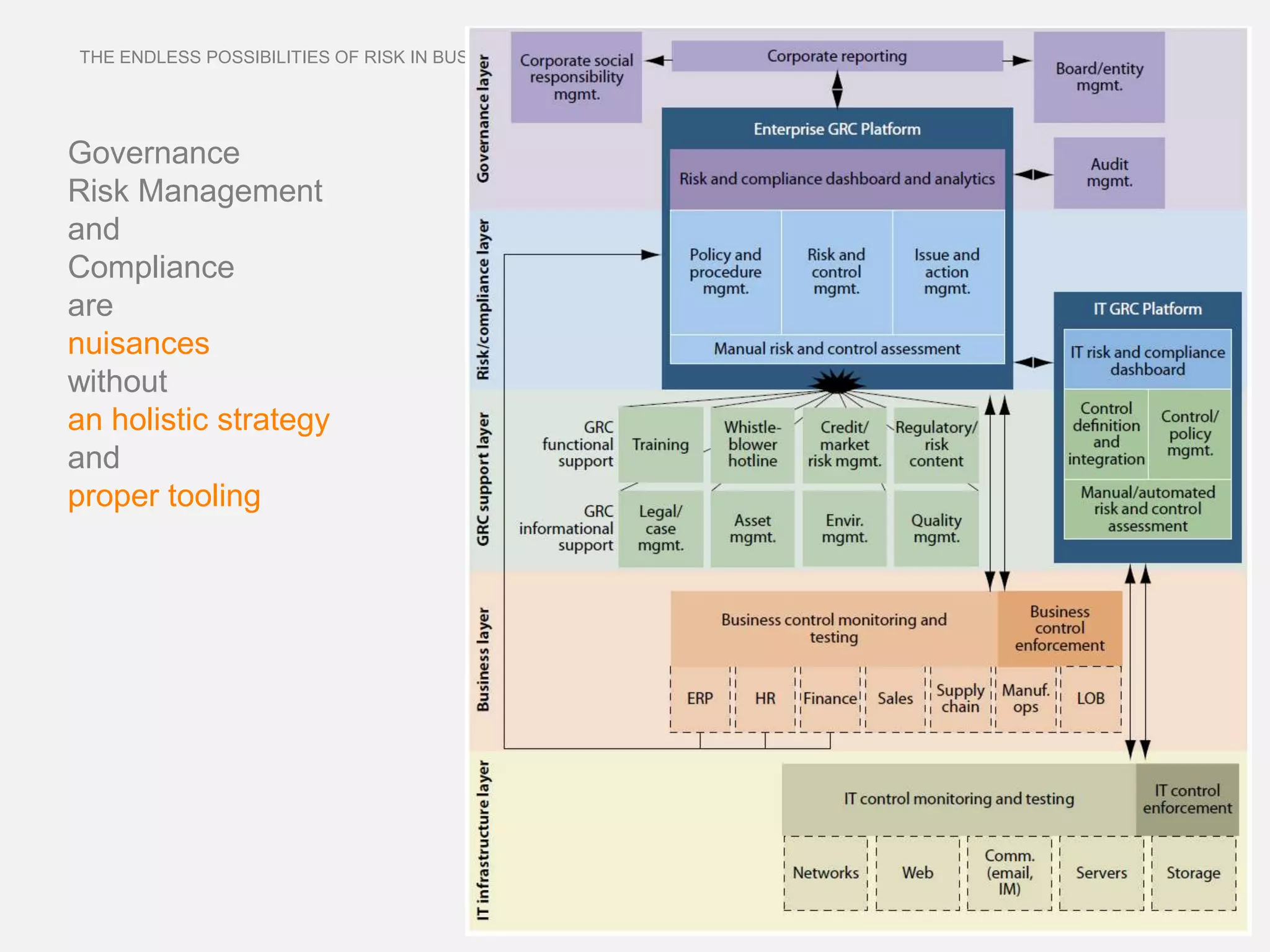

The document discusses establishing key risk indicators (KRIs) for information technology (IT). It explains that KRIs differ from key performance indicators (KPIs) in that KRIs serve as early warning signs of increased risk exposure, while KPIs provide an overview of past performance. Selecting the right KRIs for an IT organization involves understanding organizational objectives and risks that could impact achieving those objectives. Linking objectives, strategies, and KRIs allows an organization to proactively manage strategic risks and help ensure objectives are met. IT risks in particular need to be monitored through KRIs due to IT's role in enabling business strategies and operations.