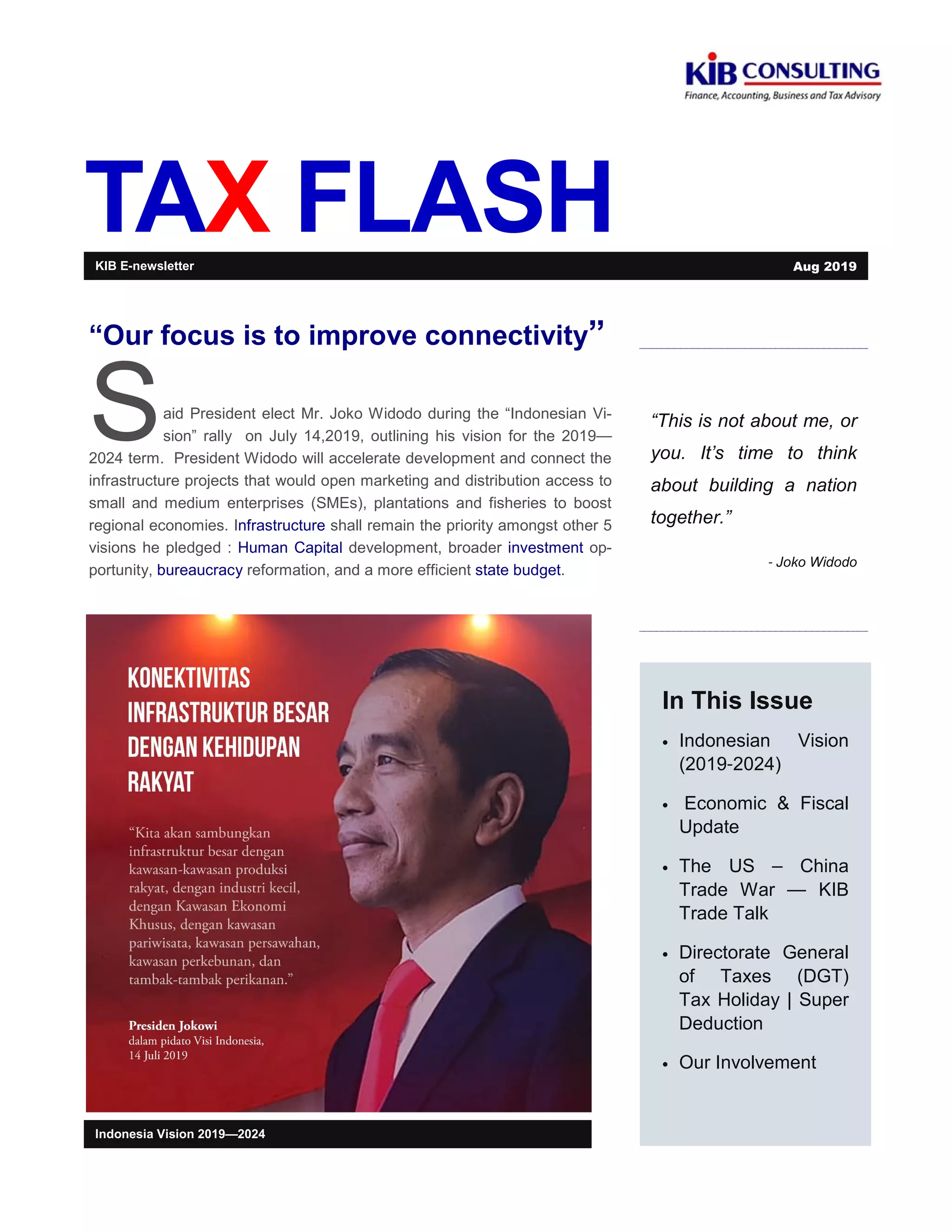

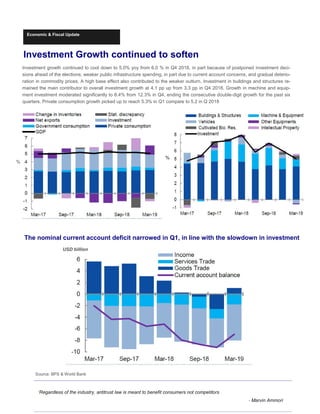

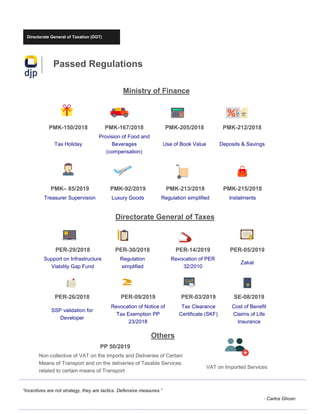

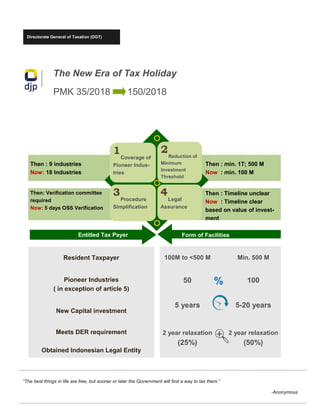

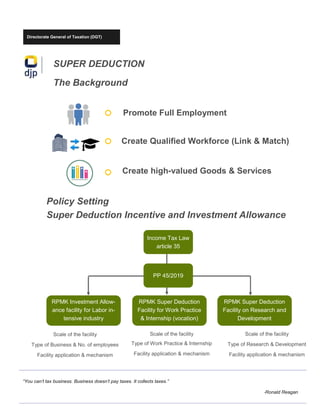

- The document discusses Indonesia's economic and fiscal updates under President Joko Widodo's 2019-2024 vision of improving connectivity and infrastructure. Key points include GDP growth slowing to a 2-year low of 5.05% in Q2 2019 due to weaker investment. Exports fell while imports declined faster, helping GDP. The US-China trade war has boosted Vietnam's economy but widened Indonesia's trade deficit. Solutions proposed include improving competitiveness, workforce skills, and commodity value-addition. The DGT outlines new tax regulations like tax holidays and super deductions to promote investment and employment.