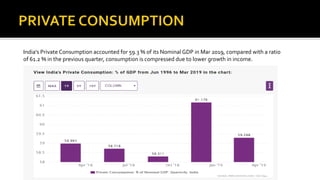

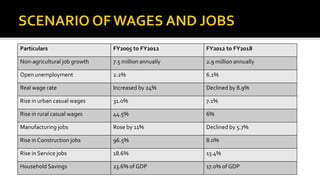

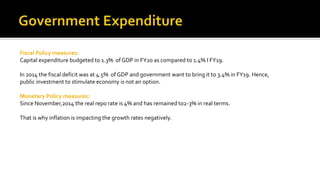

This document discusses the economic slowdown in India and reasons for it. It notes that monetary and fiscal policy measures alone cannot solve the problem and that sustained growth requires structural reforms. It then lists several warning signs for the global economy that could further impact India, such as the US-China trade war and recessions in other countries. Domestic factors like falling auto and real estate sales are also cited. Data on consumption, investment, exports and the roles of different economic sectors in India's GDP are presented. Recommendations include reducing interest rates, allowing currency depreciation, fiscal stimulus, and broader reforms.