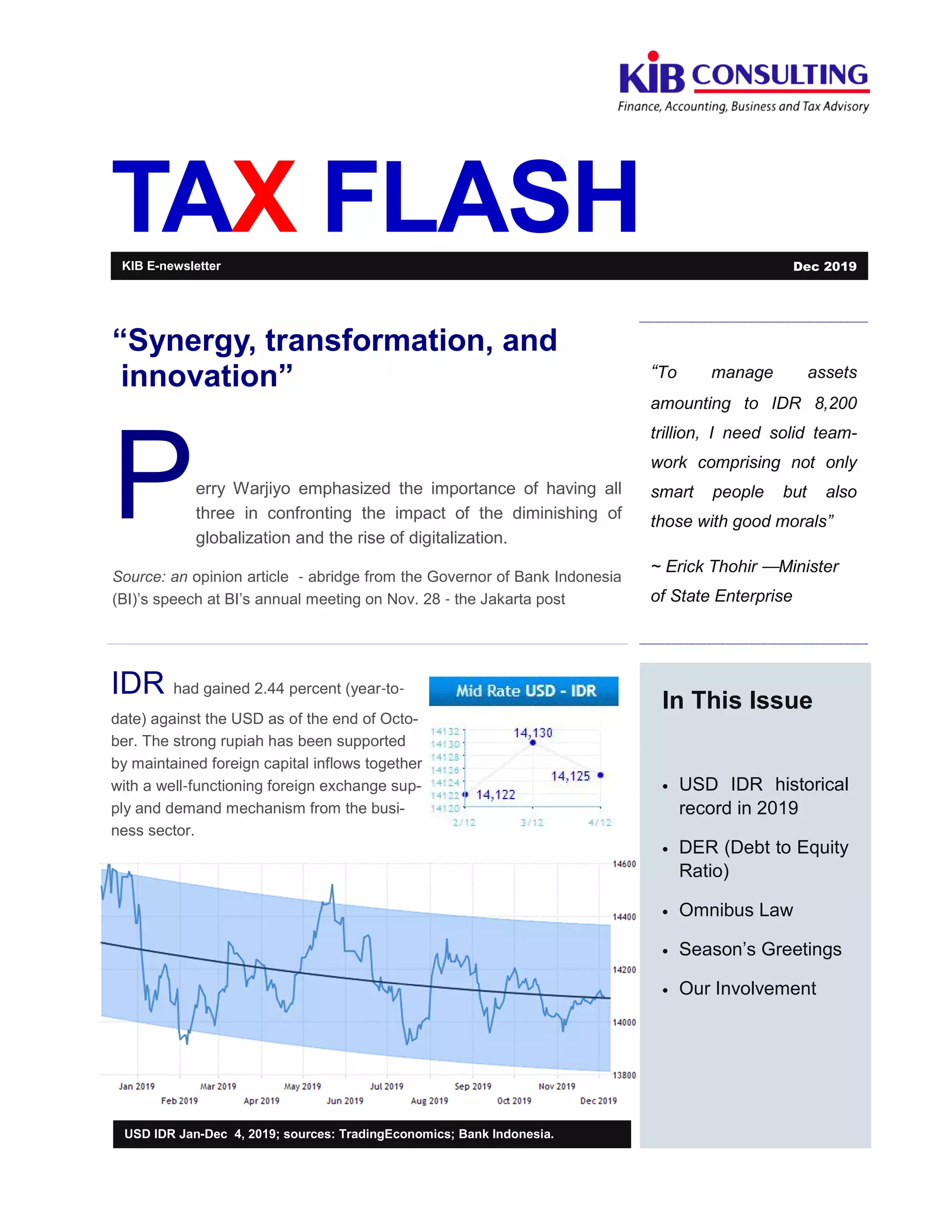

The document provides information on recent tax law developments in Indonesia, including:

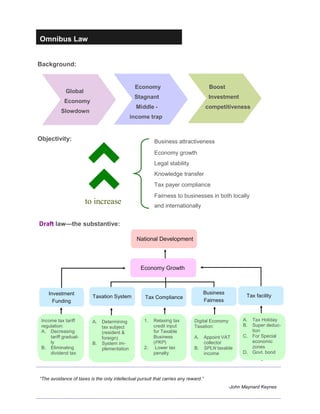

1) The government is proposing an omnibus law to reform the tax system to boost investment and economic growth. Key reforms include gradually lowering the corporate tax rate and eliminating dividend tax.

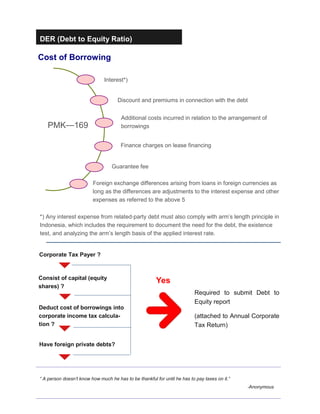

2) Current rules impose a maximum debt-to-equity ratio of 4:1 for tax purposes. Interest expenses above this ratio are not tax deductible.

3) KIB Consulting, a tax advisory firm, summarizes these tax law changes and notes its involvement in discussions with government on investment issues and the omnibus law.