NewBase 606 special 18 May 2015

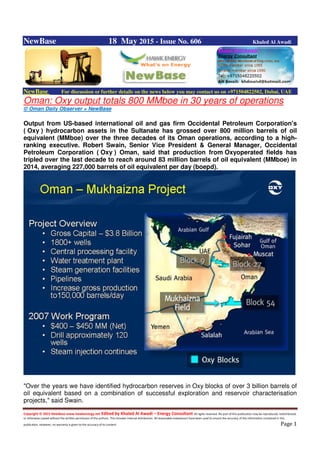

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 18 May 2015 - Issue No. 606 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oman: Oxy output totals 800 MMboe in 30 years of operations © Oman Daily Observer + NewBase Output from US-based international oil and gas firm Occidental Petroleum Corporation's ( Oxy ) hydrocarbon assets in the Sultanate has grossed over 800 million barrels of oil equivalent (MMboe) over the three decades of its Oman operations, according to a high- ranking executive. Robert Swain, Senior Vice President & General Manager, Occidental Petroleum Corporation ( Oxy ) Oman, said that production from Oxyoperated fields has tripled over the last decade to reach around 83 million barrels of oil equivalent (MMboe) in 2014, averaging 227,000 barrels of oil equivalent per day (boepd). "Over the years we have identified hydrocarbon reserves in Oxy blocks of over 3 billion barrels of oil equivalent based on a combination of successful exploration and reservoir characterisation projects," said Swain.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 "To date we have cumulatively produced more than 800 million barrels of oil equivalent," he added in a recent presentation on the company's expanding operations in the Sultanate.Oxy Oman is celebrating 30 years of successful operations in the Sultanate, having emerged as the country's largest independent oil producer over this period. The company has a substantial portfolio of hydrocarbon assets in the Sultanate: it is the operator of Block 9 (65 per cent working interest), Block 27 (65 per cent working interest), Block 53 (45 per cent working interest) and Block 62 (48 per cent working interest). A significant proportion of Oxy 's production comes from the Mukhaizna heavy oilfield (Block 53) which it operates under a 30-year Production Sharing Contract signed with the Omani government in 2005. The Mukhaizna oilfield, according to Swain, has over three billion barrels of oil in place in both heavy oil sands and fractured carbonates. Since it assumed operatorship of the field in 2005, Oxy has drilled more than 2,400 new wells, while installing extensive facilities to support its steam flood project. We are now the largest heavy oil steam flood in the Middle East, and we recently commenced exploration of both shallow and deeper zones in the block. We are testing the first wells as we speak, and look forward to the results, the Senior VP and General Manager said. Another key contributor to Oxy 's hydrocarbon production is Block 9, where output from the Safah and Wadi Latham fields currently averages around 100,000 barrels of oil equivalent per day (boepd), said Swain. Underpinning this output is a combination of over 1100 wells and continued exploration success building out from the main Safah discovery into multiple smaller fields that are connected to the existing production infrastructure, he added. In adjoining Block 27, Oxy has drilled more than 67 wells to tap the hydrocarbon potential of the Khamilah field. Discovered in 2005, the field has a reserves potential of around 200 million barrels of oil equivalent in place, with output currently averaging 10,000 boepd. In Block 62, Oxy has made headway in the development of two fields within the Discovered Non- Associated Gas (DNAG) Area. The company is moving ahead with an Extended Production Test facility targeting two key gas fields. We are drilling development wells right now while upgrading and installing a gas plant to handle that production. We will have first gas production by the end of 2015, said Swain. Also during the course of 2014, Oxy reported a total of eight new oil and gas discoveries that added an estimated 19 million barrels of oil equivalent to hydrocarbon reserves. Of this number, three oil finds were made in Block 9 and four in Block 27, while a gas and condensate discovery was made in Block 62. 3D seismic acquisition was also completed in Blocks 9 and 27 as well.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Jordan Aqaba to open LNG terminal on May 25 Jordan Times +NewBase The Aqaba Special Economic Zone Authority has announced that the Kingdom will receive the first shipment of the liquefied natural gas (LNG) via a new specialised terminal, which its investment arm, Aqaba Development Corporation (ADC), has completed. According to the corporation's Chief Executive Officer Ghassan Ghanem, the development of the facility is part of a JD1 billion- port development master plan for the years 2005-2030, which is now at its peak period. ADC's top executive said the LNG terminal, created to import liquefied gas as one alternative to the costly heavy oil used to generate electricity, is one of four energy ports, including the oil terminal, which is in the hot operation status. The third is the liquefied propane gas terminal, dedicated to receive shipments of gas used in cylinder for cooking and heating purposes. The facility is also fully operational now, after upgrades that reduced unloading time by 50 per cent. Ghanem told The Jordan Times in a recent interview at his office in Aqaba that the highest international technical and safety standards are applied in the operation of the terminal, where environment considerations have been taken into account. A state-of-the-art miscellaneous liquids terminal project is in the pipeline, with tender documents expected to be ready in two months, according to the official, who said that the port will include 30 lines to carry the liquids to tanks farms for storage. The industrial ports of Aqaba are cited as an exemplary partnership between the public and the private sector. The Jordan Industrial Ports Company PSC (JIPC) has emerged as a joint venture between Arab Potash Company (APC) and Jordan Phosphate Mines Company (JPMC). JIPC has embarked on a multi-million-dinar project to refurbish an existing industrial jetty, which is operational now, in conjunction with building a new industrial jetty. ADC chief noted that the cost of the new terminal is JD170 million, adding that the progress was at 50 per cent. A major component in the ports package, the container terminal has also received a facelift. The facility has seen expansion and upgrading, with four berths fully operational, equipment upgraded and storage areas increased, at a total cost of JD300 million.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Ghanem added that the staff members, mostly Jordanians, operating the terminal have been targeted with rehabilitation and skill-upgrading plans. New berths have been added to the passenger terminal, the CEO added, with 100 per cent progress reported in this aspect of the development, while 25 per cent of plans concerning other facilities has been completed. The New Port is the highlight of ADC's master plan for ports. The plan entails the relocation of port from the urban area to the southern tip of the region. The original land was sold to the UAE-based Al Maabar property developer, which is building the $10-billion Mrasa Zayed, a multi-use waterfront project, the largest in the history of Jordan. Ghanem said that the land value was only one reason for the relocation. Another was the need for separating the land use function, avoiding mixed use, in line with the vision for Aqaba. The city's urban part (50 per cent) is planned to be exclusively dedicated to tourism and real estate, while industrial (20 per cent) and the ports (30 per cent) components are located outside the city. The official explained that such a plan would protect the environment of Aqaba. The relocation of the port is environmentally vital because it is used for grain, which attracts birds, a major complaint by residents in the town, apart from the dust caused by unloading the commodity. In addition to these factors and the fact that the virtual life of the old facility is expired, he said, the regional developments have made it imperative to upgrade and expand the terminal. In fact, the planned capacity of 100,000 tonnes of silo storage has been doubled, a goal that was originally set to be achieved in 2025, Ghanem said, adding that 80 per cent of the project, which The Jordan Times toured, has been achieved. The Middle Port is also subject to a JD110 million makeover and ADC is currently tendering consultancy services from specialised international firms to add new berths, taking advantage of the naturally deep waters.ز

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 U.S.power sector CO2 emissions expected to increase through 2040 Source: U.S. Energy Information Administration, Annual Energy Outlook 2015 Although U.S. carbon dioxide (CO2) emissions associated with electricity generation have fallen from the 2005 level, they are projected to increase in the coming decades, based on analysis in EIA's Annual Energy Outlook 2015 (AEO2015) that reflects current laws and regulations, and therefore does not include proposed rules such as the U.S. Environmental Protection Agency's Clean Power Plan. In 2013, CO2 emissions from electricity generation accounted for 38% of the total energy-related CO2 emitted. Since 2005, the substitution of natural gas for coal as well as increases in renewable and nuclear generation helped to reduce these emissions. Increased energy efficiency in homes and business led to lower electricity demand growth, reducing the need to generate electricity. Power sector emissions in the United States are subject to federal regulation under the Clean Air Act. In June 2014, the Environmental Protection Agency (EPA) proposed the Clean Power Plan (CPP) to regulate CO2 emissions from existing power plants. The CPP specifies intensity rate targets for existing fossil fuel-fired electric generating units operating or under construction as of early 2014, with the stated aim of reducing carbon emissions in the power sector by 30% from 2005 levels by 2030. While the AEO2015 does not include EPA's proposed rule (as AEO2015 only includes existing rules and laws), it does include two regional programs in the Northeast and in California (the Regional Greenhouse Gas Initiative and Assembly Bill 32, known as RGGI and AB32, respectively) that aim to reduce greenhouse gases (GHG) from the power industry. Existing federal environmental rules that have previously been finalized, including the Mercury and Air Toxics Standard, are also included in AEO2015.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 After taking these existing environmental regulations into account, the projections for electricity generation and its resulting emissions are primarily determined by the available capacity and relative operating costs of the different technologies. Power-sector CO2 emissions are influenced by a number of factors not directly affected by environmental policies, such as macroeconomic growth levels and relative fuel prices. The AEO2015 cases with the largest differences in cumulative emissions from the Reference case are two cases that consider higher or lower macroeconomic growth. In the High Economic Growth case, electricity demand, fossil-fired generation, and resulting CO2 emissions are all higher, while the reverse is true in the Low Economic Growth case. Projected power-sector CO2 emissions increase even in the Low Economic case, and by 2040 they are 2% higher than in 2013. Cases with higher or lower world energy prices, represented by oil prices, have relatively little direct impact on power-sector emissions, as petroleum provides a small fraction of U.S. electricity generation. However, world oil and natural gas prices do affect natural gas trade and domestic natural gas prices, which in turn affect the role of natural gas in the U.S. power sector. A case that assumes significantly higher domestic oil and natural gas resource availability results in lower natural gas prices, thus increasing natural gas's share of generation and lowering power- sector CO2 emissions.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 US:The Arctic Is Hot Again Why is Shell steaming toward risk with oil at $65 /Bl? Bloomberg + NewBase Oil companies would go on to produce more than 10 billion barrels of oil from the North American Arctic. And counting. This week, with oil at $65, the Interior Department approved Royal Dutch Shell’s plan to to drill up to six exploratory wells in the Chukchi Sea, just west of the Beaufort. The industry's secret? Patience. And a strong stomach. The world is awash in oil. The Arctic is prone to weather that can affect navigation, even in the summer drilling season. Shell has already stumbled there; a botched 2012 effort, when a drilling rig ran aground, spurred investigations by the Coast Guard and Interior, which turned up major environmental and safety concerns. On Thursday, environmentalists in kayaks faced off against a Shell rig in Seattle's harbor, just a taste of the activism and PR challenge to come. Opponents warn that a spill in the ecologically sensitive region—often frozen yet unpredictable with climate change and far from help—is as unimaginable as the Deepwater Horizon was in the Gulf of Mexico in 2010. Why do it? The answer goes back to 1979. The development of enormous oil resources requires enormous amounts of money, time, and risk. There could be roughly 11 billion barrels of undiscovered economically recoverable oil in the entire Chukchi. Or maybe the answer goes back to the dawn of the industry: What oil companies do is look for oil. Even in an optimal scenario for Shell—lots of oil and no mistakes—the company is years away from production. First they'll look for the oil. Then, if they find it, they'll evaluate it to determine whether it's worth producing. If it's worth producing, they may want to cash out a bit. Shell owns 100 percent of its leases now. It might sell tracts to pay off its investment and to have partners in the hard work. By that time, who knows what oil will fetch. “The current oil price is actually somewhat irrelevant. The size of the resource is what's important,” Marvin Odum, president of Shell Oil Company, told CNBC on Thursday. The big oil companies have been thinking about the Arctic for a long time. Alaskan oil production began in the 1960s. In 1989, Shell found hydrocarbons from exploratory wells in the Chukchi Sea, the leases for which it had acquired a year earlier. After oil prices crashed, the recovery was slow, and Shell ended up returning those early leases to the U.S.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 If it finds riches and pursues them, the oil might find its way to market through a subsea pipeline. That's if Shell finds the reserves it expects in the Chukchi. And if, by the time it's ready to pump them up, they're fetching more than, what, $90 a barrel? No one can say what will make the endeavor profitable so far in the future. Spending money is the easy part. The hard part is what Shell is doing right now: moving ahead with its latest Arctic-drilling plan, seven years and $6 billion in the making, and not knowing how it will turn out. Flotilla protests Shell’s Arctic drilling plans Hundreds of activists in kayaks and small boats fanned out on a Seattle bay on Saturday to protest plans by Royal Dutch Shell to resume oil exploration in the Arctic and keep two of its drilling rigs stored in the city’s port. Environmental groups have vowed to disrupt the Anglo-Dutch oil company’s efforts to use the Seattle as a home base as it outfits the rigs to return to the Chukchi Sea off Alaska, saying drilling in the remote Arctic waters could lead to an ecological catastrophe. Demonstrators have planned days of protests, both on land and in Elliott Bay, home to the Port of Seattle, where the first of the two rigs docked on Thursday. Kayakers on Saturday paddled around the rig yelling “Shell No.” Others unfurled a large banner that read “Climate Justice.” Environmental groups contend harsh and shifting weather conditions make it impossible to drill in the Arctic, a region with a fragile environment that helps regulate the global climate because of its vast layers of sea ice. Allison Warden, 42, said she travelled from Alaska to represent her native Inupiaq tribe, which makes its home in the Arctic. She said whales central to the tribe’s culture are particularly vulnerable to oil spills. “I don’t know what our culture would be without whaling. It’s at the center of everything we do,” she said. “It’s a different relationship than just going to the grocery store. The whale feeds the entire community,” she said. Opponents of the rigs docking in Seattle, a city known for its environmental causes, include Mayor Ed Murray and the City Council. Shell was bringing in the rigs and moving ahead as planned despite the opposition and a ruling earlier this week by the city’s planning department that the port’s agreement with the company was in violation of its city permit. “The timeline now is just to make sure the rigs are ready to go,” said Curtis Smith, a Shell spokesman. The second rig is expected at the port in the coming days.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Oil Price Drop Special Coverage Oil prices rise on Midl.East fighting; OPEC output in focus Reuters+ NewBasse Oil prices rose on Monday following fighting in Iraq and Yemen, but Iranian comments that OPEC was unlikely to cut output as well as signs of strengthening U.S. production capped gains. Front- month Brent futures were up 1 percent, or 65 cents, at $67.46 a barrel by 0654 GMT. U.S. crude rose 79 cents to $60.48. Prices were supported by concerns that conflict in Iraq and Yemen could disrupt supplies after Islamic State militants said they had taken control of the Iraqi city of Ramadi in a big blow to the government. In Yemen, a Saudi-led coalition resumed air strikes against Houthi militia in Aden, a port-city on the shores of key Middle East oil routes. Despite these Middle East conflicts, analysts said oil markets remained oversupplied, and that the glut could worsen if U.S.-production picked up and output by producer-club OPEC remained strong. Oil prices appear to have outpaced the improvement in underlying fundamentals, Barclays said on Monday.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 We expect selling interest in the $65.00/67.00 area to cap WTI crude oil ($70.00/$72.00 area for Brent crude) and look for a move lower in range over the coming weeks. Our downside targets for WTI and Brent are $54.24 and $63 respectively. Iran's Deputy Oil Minister Rokneddin Javadi told Reuters on Monday that OPEC was unlikely to cut output at its next meeting in June, and that Iran hoped its crude exports would return to pre- sanctions levels of 2.5 million barrels per day (bpd) within three months once a deal to lift an oil embargo is finalised. A deal over Iran's disputed nuclear programme between Tehran and world powers could see sanctions on Iran lifted if a more permanent pact is finalised in June. Because of the sanctions, Iranian oil exports have fallen to about 1 million bpd since 2012, mainly to Asia. In the United States, Goldman Sachs said that despite an expected dip in output in the second half of this year, production would increase by 205,000 bpd in 2016. Yet most producers require higher prices. Deutsche Bank said that of major exporters only the United Arab Emirates, Qatar and Kuwait still have a balanced budget at current prices. With forward markets suggesting that the drop in prices is more permanent than temporary, a period of adjustment will therefore be necessary, it said. Brent for delivery in May 2017 is only $4 per barrel costlier than spot prices, implying an expectation that prices will not rise sharply soon.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Qatar Petroleum to restructure following oil price fall By Reuters + NewBase State-owned Qatar Petroleum will announce a restructuring plan in the coming months to adapt to the drop in oil prices, the head of its wholly owned international subsidiary said. “The restructure comes at the right time, with low oil prices a great motivation for the institution to be more capable of facing challenges in the upcoming years by getting rid of all burdens that accumulated during the previous period,” Qatar Petroleum International (QPI) Chief Executive Officer Nasser Khalil Al-Jaidah told state news agency QNA. Earlier this year, QP said it would absorb QPI into its structure, a move suggesting authorities want to consolidate the industry after the price drop. Al-Jaidah said demand for OPEC oil is likely to improve, as prices below $100 will hinder the growth of shale oil. “The coming period will witness an improvement in prices but they will not reach $100,” he said. On Friday, U.S. crude settled down 19 cents at $59.69 a barrel, after falling more than $1 during the session. Brent, the more important oil benchmark, settled up 11 cents at $66.81, down from more than $115 in June last year. Al-Jaidah said QPI’s international projects were currently being evaluated in terms of geopolitics, prices and “current challenges”, giving no further details. QPI was formed in 2007 as the foreign investment arm of the firm. Over the last few years, it has created 10 joint ventures in the United States, Britain, Italy, Singapore, Egypt and elsewhere, though it has not disclosed a figure for its total assets.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Qatar Petroleum Sees Rising OPEC Demand as Price Drop Hits Shale Bloomberg + NewBase Demand for OPEC’s crude will rise as the drop in oil prices below $100 a barrel continues to hinder shale production, Qatar Petroleum International’s Chief Executive Officer Nasser Khalil Al-Jaidah said. “The coming period will witness an improvement in prices but they will not reach $100,” he said in an interview published Saturday by the official Qatar News Agency. Current prices will hinder the expansion in shale oil, “which signals an improvement in demand for OPEC’s oil.” The Organization of Petroleum Exporting Countries decided in November not to cut its output target amid a price slump, which resulted from a global supply glut driven by sluggish demand and rising U.S. shale production. The decision roiled markets, contributing to a decline in prices of almost 50 percent last year. Brent crude closed at $66.81 on Friday, up 43 percent from its lowest settlement for the year on Jan. 13. Oil prices have stabilized since December because of higher demand from Europe and emerging markets, and lower U.S. output, Al-Jaidah said. OPEC will “stick with” its earlier decision to maintain the output ceiling when it meets next month because of the recovery in prices this year, Abdulmajeed Al-Shatti, a member of Kuwait’s Supreme Petroleum Council, said in an interview on Tuesday. Qatar Petroleum, the world’s biggest producer of liquefied natural gas, will benefit from lower oil prices as it restructures the company by “shedding added costs that have accumulated in the past,” Al-Jaidah said. Qatar Petroleum International, QP’s foreign investment arm, will be taken over by its parent, which will focus more on foreign operations and investments as most domestic production projects have been completed, he added.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 OMV hit by low oil price, security woes in Libya, Yemen Reuters + NewBase Austrian energy group OMV's first-quarter underlying operating profit fell by half to 333 million euros ($380.3 million) as oil prices dropped, beating market expectations. The average estimate in a Reuters poll of analysts for OMV's clean current cost of supplies earnings before interest and tax (clean CCS EBIT) -- which strips out special items and inventory holding gains or losses -- was 322 million euros. OMV added on Monday that its refining margins, which had benefited from low oil prices, are expected to come down due to overcapacity in European markets. Low oil prices , which slumped to about $45 per barrel at the start of the quarter, forced OMV to lower its investment plans last year and to give up on its aim of reaching output of 400,000 barrels of oil equivalent per day by 2016. It expects 2015 brent crude oil prices to average between $50 and $60 per barrel. OMV, which wants to stay cash flow neutral after dividends, said it had entered into oil price hedges between July 2015 and June 2016 for a volume of 50,000 barrels per day. OMV's first- quarter output fell to 303,000 boe/d from 318,000 in the previous quarter. OMV is expecting its output to suffer from the difficult situation in Libya and Yemen, where armed conflict has hit output. It had declared force majeure on all its blocks in Yemen last month, it said.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility gas compressor stations . Through the years, he has developed great experiences in the designing constructing of gas pipelines, gas metering regulating stations and in the engineering of supply routes. Many years were spent drafting, compiling gas transportation, operation maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 03 May 2015 K. Al Awadi

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15