Abu Dhabi and Singapore sign energy deals

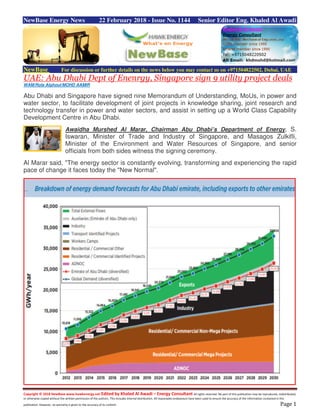

- 1. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 22 February 2018 - Issue No. 1144 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: Abu Dhabi Dept of Enenrgy, Singapore sign 9 utility project deals WAM/Rola Alghoul/MOHD AAMIR Abu Dhabi and Singapore have signed nine Memorandum of Understanding, MoUs, in power and water sector, to facilitate development of joint projects in knowledge sharing, joint research and technology transfer in power and water sectors, and assist in setting up a World Class Capability Development Centre in Abu Dhabi. Awaidha Murshed Al Marar, Chairman Abu Dhabi’s Department of Energy, S. Iswaran, Minister of Trade and Industry of Singapore, and Masagos Zulkifli, Minister of the Environment and Water Resources of Singapore, and senior officials from both sides witness the signing ceremony. Al Marar said, "The energy sector is constantly evolving, transforming and experiencing the rapid pace of change it faces today the "New Normal".

- 2. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 The interaction between digital technologies and economic forces is catalysing the fast change. In line with our Abu Dhabi Plan 2030, we are pleased to sign these MOUs to upskill and augment our sector employees to prepare them for the evolving industry landscape. This envisages creating a workforce empowered with critical technical skill development, knowledge and capacity building." Mohammed bin Jarsh Al Falasi, Under-Secretary of the Department hoped that the signing of MoUs between DoE and its sector companies and Singapore would open new vistas in power and water sector and act as catalyst in business transformation through the exchange of business innovation ideas, business models and the sharing of leading practices to foster a new generation of globally competitive power and water sector. Saeed Al Suwaidi, Managing Director Abu Dhabi Distribution Company, said that the MoUs also intend to encourage greater business collaboration as well as technology and knowledge exchange between the two countries.

- 3. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Morocco: SDX Energy's KSS-2 well in the Sebou disappoints Source: SDX Energy SDX Energy, the North Africa focused oil and gas company, has announced that the KSS- 2 well on the Sebou permit in Morocco was drilled to a total depth of 1293 meters encountering 8 net meters of high quality reservoir interval in the Gaddari and Guebbas sequences with an average porosity of 30%. However, whilst the intervals came in on prognosis, they had low gas saturation and were not deemed to be commercial. The KSS-2 well is the sixth in the Company's current nine well campaign, of which four wells have been commercial discoveries. As a result of the campaign's success to date, the result of the KSS-2 well is not expected to impact the Company's previously announced planned production increase in Morocco in 2018. Unlike the previously drilled targets, the KSS-2 prospect was on the upthrown side of the main bounding fault in the Ksiri area. This fault appears to have isolated the KSS-2 well from the source rock, resulting in low gas saturations. The next well in the campaign, the SAH-2 well, will be located on the downthrown side of the fault, drilling a similar structure to the Company's recently successful wells. The Company therefore believes that the reservoirs targeted by the SAH-2 well will have a higher probability of being commercially charged than the KSS-2 well. The KSS-2 well will now be plugged and abandoned and the drilling rig will move to the SAH-2 drilling location. Paul Welch, President and CEO of SDX, commented: 'Whilst the KSS-2 well was not a commercial success, we are viewing this one result in the context of what is already a very successful drilling campaign with four out of six discoveries to date. Using directional drilling equipment for the first time in the basin, we drilled a step out location in order to try to prove up a new concept, and potentially new volumes. Whilst KSS-2 was not successful, our belief is that this result proves that the main bounding fault provides a good seal and therefore gives us a further confidence in the forthcoming prospects. We are looking forward to drilling the final three wells in this programme and reporting on their results in due course.'

- 4. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 U.S. Oil & PetrChem Exports Go Up as Supertanker Sets Sail Bloomberg + NewBase + EIA The flood of U.S. oil exports stepped up a gear on Monday after the first fully laden supertanker sailed from an American port, alleviating a bottleneck that’s limited overseas shipments. The Louisiana Offshore Oil Port, or LOOP, the only deep water port in the U.S. able to handle the industry’s biggest tankers, said in a statement it had successfully completed the first loading of a very large crude carrier. Shipping data compiled by Bloomberg show the tanker is the Saudi Arabian-owned Shaden, now heading to the Chinese port of Rizhao. "There could not be a better time to offer this service as domestic production surpasses 10 million barrels per day in the ever-dynamic global crude oil market," said LOOP LLCPresident Tom Shaw. LOOP has been a vital piece of U.S. energy infrastructure for more than 30 years, handling oil imports from across the world as well as gathering crude pumped from deepwater deposits in the Gulf of Mexico. Since it started receiving oil in 1981, it has offloaded 10,200 tankers. The Shaden, which is owned by the National Shipping Co. of Saudi Arabia and carries the flag of the kingdom, was the first VLCC to load oil at the port rather than discharge it. Pipelines and ports have become the biggest bottleneck in U.S. oil exports, with traders at times engineering logistically complex chains combining railways, trucks, pipelines, barges, and ship-to-ship transfers to get crude out of the country. As U.S. output surpasses the record high of 10 million barrels a day set in 1970, trading houses, pipeline owners and ports are investing in new infrastructure to ship more American crude overseas. While U.S. crude has already been exported using supertankers, other ports are too shallow to allow full loadings, meaning smaller ships must shuttle multiple cargoes to the giant vessels as they wait to load offshore. LOOP, because it stands in deeper water about 18 miles off of the Louisiana coast, allows the industry’s largest tankers to load in one go.

- 5. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Using very large crude carriers will significantly cut shipping costs. The new export capacity at LOOP will allow the supertankers to deliver foreign crude into the U.S. and depart laden, known as back-hauling in the industry’s jargon, rather than returning empty. LOOP said the "shipper of record" was the trading arm of Royal Dutch Shell Plc and the oil company later confirmed it had chartered the ship Data compiled by Bloomberg had previously shown the Shaden was booked last month by Unipec, China’s biggest oil trader. a unit of the country’s refining giant China Petroleum & Chemical Corp., or Sinopec. Shell said in a statement the ship was loaded with Mars crude, a grade pumped from an offshore Gulf of Mexico field, for export. Washington lifted a 40-year ban on most oil exports in late 2015, reshaping the world’s energy map as U.S. crude was shipped to countries including Switzerland, China, Israel and even the United Arab Emirates. The de facto export ban, which only allowed a few exceptions, was imposed in the aftermath of a 1973 to 1974 oil embargo led by Saudi Arabia. Even though the country remains a net oil importer, U.S. crude exports have surged to a record high of 2.1 million barrels since the ban was lifted. China and other Asian nations have become big buyers.

- 6. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Stored Less and Shipped Abroad More Dwindling volumes at the biggest U.S. oil storage hub and the potential for bigger cargoes to sail overseas is giving American crude a premium sheen once again. The price of U.S. benchmark oil has gone above the Middle East marker for the first time in more than a year, data compiled by Bloomberg show. The shale boom that drove American crude to a discount spurred an unprecedented surge of relatively cheap shipments to Asia. That was a pain for top OPEC producers such as Saudi Arabia, which had their market share threatened as they implemented output curbs to clear a global glut. Now, a combination of new pipeline options, a rail car crunch, demand from Gulf Coast refineries and a thirst for U.S. supply from overseas means less is being hoarded. Stockpiles at Cushing, Oklahoma, have slid in all but one of the past 14 weeks as booming American production bypasses the storage hub. With the Louisiana Offshore Oil Port, or LOOP, this month loading its first very large crude carrier for export, speculation is increasing that bigger cargoes will head abroad. “Sentiment for U.S. crude has improved in part from LOOP’s very large crude carrier export capability, but fundamentally, falling Cushing stocks remains the main support for higher WTI prices,” said Den Syahril, an analyst at industry consultant FGE in Singapore. West Texas Intermediate crude was at a premium of 36 cents a barrel to Dubai oil on Monday, compared with an average discount of about $2 over 2017. It was 17 cents a barrel above the Middle East benchmark on Tuesday. The U.S. grade, of so-called light-sweet quality, had gone below Dubai in December 2016, when a historic output-cut pact involving OPEC and other producers including Russia pushed the price of medium-sour Dubai crude above WTI.

- 7. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Additional sales of U.S. Strategic Petroleum Reserve crude oil Recent legislation has directed the sale of more than 100 million barrels of oil from the U.S. Strategic Petroleum Reserve (SPR) in U.S. government fiscal years (FY) 2022 through 2027. Based on legislated sales established in multiple acts of Congress, the SPR could decline by about 40% in the coming decade while still meeting requirements for petroleum import coverage. Assuming no other legislation over this period, the SPR could decline from 695 million barrels at the start of 2017 to about 410 million barrels at the start of 2028. The largest stockpile of government-owned emergency crude oil in the world, the SPR was established to help alleviate the effects of unexpected oil supply reductions. Located in four storage sites along the Gulf of Mexico, the SPR held more than 695 million barrels of crude oil at the beginning of 2017, or about 97% of its 713.5 million barrel design capacity. Prior to FY 2017 sales, the SPR inventory level had remained nearly constant for several years. A previous Today in Energy article described the three bills enacted in 2015 and 2016 that collectively call for the sale of 149 million barrels in FY 2017 through FY 2025. Most of these sales set volumetric requirements, and revenues from those sales go to the U.S. Department of Treasury. A section of one of those bills—Section 404 of the Bipartisan Budget Act of 2015—included authorization for funding an SPR modernization program by selling up to $2 billion worth of SPR crude oil in FY 2017 through FY 2020. In that act, the sales are based on revenue targets that must be authorized by Congress. Two recent congressional acts collectively call for the sale of 107 million barrels of crude oil in FY 2022 through FY 2027:

- 8. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 The Bipartisan Budget Act of 2018, enacted in February 2018, calls for the sale of 30 million barrels over the four-year period of FY 2022 through FY 2025, 35 million barrels in FY 2026, and 35 million barrels in FY 2027. The Tax Cuts and Jobs Act of 2017, enacted in December 2017, calls for the sale of 7 million barrels over the two-year period of FY 2026 through FY 2027. One of the SPR's core missions is to hold enough oil stocks to carry out U.S. obligations under the International Energy Program (IEP), the 1974 treaty that established the International Energy Agency (IEA). Under the IEP, the United States must be able to contribute to an IEA collective action based on its share of IEA oil consumption. Based on the most recent shares, the United States must be prepared to contribute about 43% of the barrels released in an IEA coordinated response. The United States government relies on the SPR to meet this requirement. As a member of the IEA, the United States is obligated to maintain stocks of crude oil and petroleum products, both public and private, to provide at least 90 days of U.S. net import protection. As net imports of crude oil and petroleum products into the United States continue to decline, this requirement can be met with lower SPR inventory levels. The Reference case of EIA’s latest Annual Energy Outlook projects that the United States will be a net exporter of petroleum by 2029. Other cases with more domestic petroleum production show the United States reaching net petroleum exporter status even sooner. Based on November 2017 levels of net crude oil and petroleum product imports, the SPR alone holds crude oil stocks equivalent to 252 days of import protection. Private (commercial) stocks of crude oil provide an additional 452 million barrels, equivalent to another 172 days of import protection. Source: U.S. Energy Information Administration, Petroleum Supply Monthly Note: Days of import coverage reflects Strategic Petroleum Reserve level divided by net imports of crude oil and petroleum products. 2018

- 9. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Ethane exports to increase as new petrochemical plants come online Over the next two years, EIA’s Short-Term Energy Outlook (STEO) projects growth in U.S. consumption of ethane in the petrochemical industry will exceed increases in consumption of all other petroleum and liquid products—such as motor gasoline, distillate, and jet fuel—combined. EIA also projects that ethane exports will continue increasing, as ethane is exported both by pipeline to Canada and by tankers to more distant destinations. Ethane is separated from raw natural gas at natural gas processing plants along with other hydrocarbon gas liquids(HGL) such as propane, normal butane, isobutane, and natural gasoline. Ethane is mainly used as a petrochemical feedstock for the production of ethylene, which is a building block for plastics, resins, and other industrial products. As U.S. natural gas production has increased, the amount of ethane contained in raw natural gas production streams has exceeded domestic demand or the ability to export it abroad. This situation has led producers to leave some of the ethane in the natural gas stream, up to allowable limits set by natural gas pipelines and distribution systems, and to sell it as natural gas, rather than recover and market ethane as a separate product. Nonetheless, ethane is increasingly being recovered from the natural gas stream, and U.S. ethane consumption is increasing as existing ethylene crackers have expanded and new plants have begun operating. In addition, expanding pipeline networks and two new ethane export terminals have allowed U.S. ethane exports to increase.

- 10. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 In 2017, construction was completed on the first three of a series of new ethylene crackers—two early in the year and a third in late December, all on the Texas Gulf Coast. These crackers expanded the capacity to consume ethane in the United States by 210,000 barrels per day (b/d), and EIA expects ethylene plant capacity to continue to expand: six ethylene crackers, collectively capable of consuming 380,000 b/d of ethane, are planned to be completed by the end of 2019. EIA expects annual U.S. ethane consumption to grow from an estimated 1.2 million b/d in 2017 to 1.4 million b/d in 2018 and 1.6 million b/d in 2019 as these new plants and related infrastructure ramp up operations. EIA also projects continued growth in ethane exports, with average annual exports increasing from 180,000 b/d in 2017 to 290,000 b/d in 2018 and 310,000 b/d in 2019. Ethane exports by pipeline to Canada are expected to increase in early 2018 as shipments on the Utopia pipeline that crosses the U.S.-Canada border near Detroit begin to flow and as an ethylene plant in Sarnia, Ontario, expands capacity. Ethane is also exported by tanker from terminals at Marcus Hook, Pennsylvania, and Morgan’s Point, Texas, which both opened in 2016. Ethane shipments from these facilities currently supply petrochemical feedstock to countries including the United Kingdom, Norway, Sweden, India, and Brazil. By the end of 2019, ethane exports from the United States may also reach China when a new ethylene plant there begins operation.

- 11. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Offshore Oil Recovery Begins in the World's Harshest Environments By David Wethe Explorers are once again testing the waters in their search for oil, according to Transocean Ltd., the world’s biggest offshore rig contractor by market value. Drillers worldwide are forecast to boost new commitments for all types of offshore work by 140 percent this year, Jeremy Thigpen, Transocean’s Chief Executive officer told analysts and investors in a conference call on Wednesday. Thigpen said he’s excited about opportunities to drill off the coast of Norway, the U.K. and Canada. It’s all thanks to the continued climb in crude prices after a three-year crash. Brent crude, the international benchmark, touched $71.28 a barrel late last month, the highest since December 2014. Explorers who slashed budgets and canceled their riskiest drilling projects when the market crashed to focus on safe, low-cost projects in shale fields are once again venturing onto the high seas to prospect for crude. “This upward price momentum has provided some needed confidence among our customers,” Thigpen said. “Given the improvements that we’ve witnessed in harsh environment utilization and dayrates, we feel strongly this market is in the early stages of a recovery.” To read about the graveyard of hulking deep-water drilling vessels, click here The offshore rig market was one of the biggest losers during the downturn, with prices to rent the vessels falling as much as 75 percent. Global offshore spending in 2018 for all the rigs, pipes and valves needed to produce oil is expected to fall for the fourth straight year, down another 6 percent after last year’s 16 percent drop, Jud Bailey, an analyst at Wells Fargo, wrote Jan. 31 in a note to investors. “The theme for the offshore drilling market in 2018 should be ‘picking up the pieces and moving forward,”’ Bailey wrote. “Although demand prospects are clearly improving for 2018 and the worst seems to be behind the sector, we believe the damage done to the industry will take years to repair.” Transocean reported on Tuesday a loss of 24 cents a share, excluding certain items, for the final three months of last year. That was better than the 28-cent average loss from 28 analysts’ estimates compiled by Bloomberg. The shares rose 2.6 percent to $9.33 at 10:45 a.m. in New York. The improved financial condition for explorers is now emboldening rig contractors to push for better pricing. Explorers have more cash at their disposal now, as evidenced by recent shareholder-friendly measures such as dividend increases, said Roddie Mackenzie, Transocean’s vice president of marketing and contracts. “When we’re looking at the operators announcing maintaining and increasing dividends, there’s less of a desire for us to operate at that cash break even level,” Mackenzie said during the call.

- 12. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase February 22 - 2018 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices slightly fall on firmer U.S. dollar Reuters + Bloomberg + NewBase Oil prices fell on Thursday, pulled down as a firmer dollar outweighed a report of a decrease in U.S. crude inventories. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $61.12 a barrel at 0102 GMT, down 56 cents, or 0.9 percent, from their last settlement. Brent crude futures LCOc1 had dropped 50 cents, or 0.8 percent, from their last close to $64.92 per barrel. The dollar rose to a more than one-week peak against a basket of other currencies .DXY late on Wednesday, extending its recovery from last week, as minutes of the Federal Reserve’s January meeting showed policymakers confident in the need to keep raising interest rates. “The firming dollar continues to thwart investor sentiment despite the bullish inventory data,” said Stephen Innes, head of trading for Asia-Pacific at futures brokerage OANDA. Since oil trading is conducted in dollars, a rise in the greenback makes fuel imports for countries using other currencies domestically more expensive, potentially curbing demand. The firm dollar outweighed a reported fall in U.S. crude inventories. The American Petroleum Institute on Wednesday reported an unexpected drop in U.S. crude oil inventories by 907,000 barrels to 420.3 million barrels for the week to Feb. 16. Oil price special coverage

- 13. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 “Improved pipeline infrastructure to the Gulf coast and the decreased supply via TransCanada’s Keystone pipeline, sent ... inventories tumbling,” Innes said. Futures fell 0.7 percent in late trading on Wednesday. Storage in American tanks and terminals probably increased by 2.9 million barrels last week, according to a Bloomberg survey. If a government report on Thursday confirms that, it would be the fourth straight weekly gain, the longest expansion since the first quarter of 2017. An American Petroleum Institute report, said to show a 907,000-barrel decline, wasn’t enough to dispel the concerns. OPEC has “taken a lot of production off the table, but it’s just being replaced by U.S. production to a large degree,” said Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York. Cartel members recently sought to reassure investors about their resolve but “the market’s not buying it.” Oil has struggled to regain January’s highs as faltering confidence in the outlook for economic growth and a strengthening dollar reduce the appeal of commodities. The Organization of Petroleum Exporting Countries has reiterated not just its commitment to curbing an oversupply, but possibly even extending its alliance with Russia beyond this year. West Texas Intermediate for April delivery fell 45 cents to settle at $61.34 on the New York Mercantile Exchange after the API report was released. Brent for April settlement gained 17 cents to $65.42 on the London-based ICE Futures Europe exchange. The global benchmark traded at a $4.08 premium to WTI. The outlook for U.S. oil production in both 2018 and 2019 is “phenomenal,” Deputy Energy Secretary Dan Brouillette said in an interview Tuesday. The nation’s crude inventories have rebounded since late January and kept above 420 million barrels this month, according to Energy Information Administration data. The Energy Information Administration is scheduled to release its weekly inventory report Thursday, a day later than usual due to the U.S. President’s Day holiday earlier this week.

- 14. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Special Coverage News Agencies News Release February 21-2018 BP Sees Electric Future With Oil Demand Peaking in 2030s By Anna Hirtenstein "We know a lot about these new technologies," Dudley says. "They have to be economic for our shareholders." The future is electric for BP Plc, though it’s not giving up on oil just yet. The British company bumped up its forecast for electric vehicles by 80 percent to 180 million by 2035, according to an energy outlook released Tuesday. It expects a third of the miles driven in 2040 will be powered by electricity. Electric Future BP expects there will be 180 million electric vehicles on the roads by 2035 Source: BP The company forecasts the abundance of gasoline and diesel cars will ensure overall oil demand will continue to grow at about 0.5 percent per year. But that’s slower than the 0.7 percent annual increase it forecast last year. Consumption is expected to peak at 110 million barrels per day in the mid-2030s, BP’s Chief Economist Spencer Dale said. That’s earlier than the mid-2040s he predicted last year. “The suggestion that rapid growth in electric cars will cause oil demand to collapse just isn’t supported by the basic numbers -- even with really rapid growth,” Dale said. “It’s almost nothing. Oil used in the car market is essentially flat for the next 20 years.”

- 15. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Still Car Crazy BP sees oil demand from cars flat through to 2040 Source: BP BP said this year’s outlook doesn’t have a base case scenario, like in previous editions. It instead has a “evolving transitions scenario,” which has a stable pace of change. Demand from cars, the backbone of oil consumption growth in the past century, may drop after 2030 and be at about today’s level by 2040, BP said. The surge of electric cars means manufacturers may not need to put as much effort and investment in increasing the efficiency of gasoline and diesel vehicles, Dale said. “Selling more EVs will tend to have almost no effect on oil demand because now I can sell a greater number of large cars or I can do less investment in light weighting,” Dale said. Oil Peak BP forecasts oil demand to grow until the mid 2030s Source: BP The change to cleaner energy is going to be slow and BP won’t be left holding any oil assets it can’t produce from economically, Chief Executive Officer Bob Dudley said in an interview Tuesday. Cleaner burning natural gas will be an important fuel in that transition, he said.

- 16. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Gas is expected to grow faster than oil, adding about 1.6 percent per year as it increasingly becomes the fuel of choice for power producers, according to the outlook report. Coal consumption is projected to flatline. “It’s significant that BP has kicked the notion of an energy transition to the forefront of its latest outlook,” said Luke Sussams, senior researcher at Carbon Tracker Initiative, a London-based think tank. Still, its business-as-usual projection “shows the yawning gap between company expectations and the 2˚C climate target set by the world’s leaders in Paris in 2015.” BP has also raised its forecasts for renewables. It expects clean-energy technologies will make up 40 percent of the growth in energy supplies in the years ahead. The London-based company increased solar power projections by 150 percent compared with 2015 as panel costs fell faster than anticipated amid strong policy support globally. “We cannot predict where these changes will take us, but we can use this knowledge to get fit and ready to play our role in meeting the energy needs of tomorrow,” Dudley said in a statement. The oil company recently bought a stake in British solar developer Lightsource Renewable Energy Ltd. for $200 million. It’s also said to be weighing a bid for Terra Firma’s Rete Rinnovabile Srl, a solar company based in Italy. The biggest driver of oil consumption is likely to be petrochemicals. However, BP has reduced its forecast for demand from that sector by 2 million barrels a day as governments around the world are beginning to regulate the use of products such as plastic bags. Packaging makes up about 3 percent of global oil use. “We think we’re going to see increasing regulation against some types of petrochemical products, particularly single-use plastics,” Dale said. “As a result of that, we have less growth in non- combusted oils than we otherwise would have done.”

- 17. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase February 2018 K. Al Awadi

- 18. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Thank you for sharing with us your comments and thoughts on the above issue, similarly we would like to share with our daily publications on Energy news via own NewBase Energy News - call us for details khdmohd@hawkenergy.net Your Energy Consultant for the GCC area Khaled Al Awadi

- 19. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 For Your Recruitments needs and Top Talents, please seek our approved agents below