NewBase May 19-2022 Energy News issue - 1514 by Khaled Al Awadi.pdf

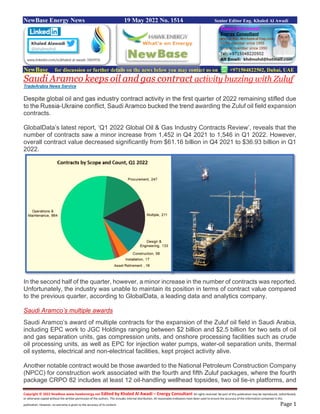

- 1. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 19 May 2022 No. 1514 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Saudi Aramco keeps oil and gas contract activity buzzing with Zuluf TradeArabia News Service Despite global oil and gas industry contract activity in the first quarter of 2022 remaining stifled due to the Russia-Ukraine conflict, Saudi Aramco bucked the trend awarding the Zuluf oil field expansion contracts. GlobalData’s latest report, ‘Q1 2022 Global Oil & Gas Industry Contracts Review’, reveals that the number of contracts saw a minor increase from 1,452 in Q4 2021 to 1,546 in Q1 2022. However, overall contract value decreased significantly from $61.16 billion in Q4 2021 to $36.93 billion in Q1 2022. In the second half of the quarter, however, a minor increase in the number of contracts was reported. Unfortunately, the industry was unable to maintain its position in terms of contract value compared to the previous quarter, according to GlobalData, a leading data and analytics company. Saudi Aramco’s multiple awards Saudi Aramco’s award of multiple contracts for the expansion of the Zuluf oil field in Saudi Arabia, including EPC work to JGC Holdings ranging between $2 billion and $2.5 billion for two sets of oil and gas separation units, gas compression units, and onshore processing facilities such as crude oil processing units, as well as EPC for injection water pumps, water-oil separation units, thermal oil systems, electrical and non-electrical facilities, kept project activity alive. Another notable contract would be those awarded to the National Petroleum Construction Company (NPCC) for construction work associated with the fourth and fifth Zuluf packages, where the fourth package CRPO 82 includes at least 12 oil-handling wellhead topsides, two oil tie-in platforms, and

- 2. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 one electrical distribution platform, and the fifth package CRPO 83 includes up to 12 additional oil- handling wellhead topsides, two oil tie-in platforms, as well as infield pipelines and cables. Pritam Kad, Oil & Gas Analyst at GlobalData, comments: “Contracts in the oil and gas industry could only float due to the sheer uncertainties surrounding it, including the ongoing Russia-Ukraine crisis, rising prices, and project cost escalation.” In terms of single scopes, operation and maintenance (O&M) represented 56% of the total contracts in Q4 2021, followed by procurement with 16%, and contracts with multiple scopes, such as construction, design and engineering, installation, procurement, and O&M accounted for 14%.- Zuluf oil field expansion details The aging offshore infrastructure at the Zuluf oil field is being replaced with modern electrified platforms to extend the operational life of the field. A single well observation platform and three oil production deck manifolds along with associated subsea pipelines are being installed as part of the expansion. New onshore central processing facilities to be built as part of the Arab Heavy (AH) Crude Oil Increment 600 MBCD initiative of the Zuluf field development program will include a new gas and oil separation plant (GOSP), gas compression facilities, a new water injection plant, and associated pipelines. The onshore central processing facility will process 600,000 barrels of Arabian Heavy crude from the Zuluf field. The stabilized crude oil from the processing facility will be sent to the Ju'aymah crude oil terminal, while the separated gas and condensate will be sent to the Tanajib gas plant through new downstream pipelines. Infrastructure at the Zuluf oil field The Zuluf oil field is developed with more than 270 producing wells and four offshore GOSPs capable of processing a total of 800,000 barrels of Arab Medium crude oil a day. Originally built in 1983, the GOSP-3 was closed in 1995 due to low demand for Arabian Medium crude oil. Saudi Aramco, however, decided to restart the plant in 2016, as a result of which the GOSP-3 was repaired and brought on stream in 2017. The plant has the capacity to process 250,000 barrels of oil and 100 million metric standard cubic feet (Mmscf) of gas a day. A five-story residential platform with a total area of 3,750m² was also renovated as part of the GOSP-3 renovation project.

- 3. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi PIF-backed EV maker Lucid to produce 150,000 cars a year at its Saudi factory .. The National - Alkesh Sharma + NewBase Lucid Group, which is backed by Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), said its new factory in the kingdom will have a production capacity of 155,000 units a year. Its new facility is expected to address growing demand for electric vehicles by increasing Lucid’s global production capacity to 500,000 EVs per year in the coming years, the company said. The US-listed EV maker on Wednesday hosted a ceremonial signing event to mark the February agreements with various entities including the Ministry of Investment of Saudi Arabia, the Saudi Industrial Development Fund (SIDF), the Economic City at King Abdullah Economic City and Gulf International Bank. The agreements are estimated to provide financing and incentives worth $3.4 billion to Lucid over the next 15 years to build and operate a manufacturing facility in the kingdom, the EV maker said. “This signing ceremony marks yet another step forward in the realisation of Lucid’s mission to inspire the adoption of sustainable energy, and I am delighted this brand-new manufacturing facility will come to fruition here in Saudi Arabia,” said Peter Rawlinson, Lucid’s chief executive and chief technology officer. Lucid plans a phased global expansion with Saudi Arabia – the Arab world’s largest economy. “I am truly delighted to partner with PIF, our signing partners, and the government of Saudi Arabia in advancing our shared vision of global sustainability,” Mr Rawlinson said. Saudi Arabia, the Arab world's biggest economy, is in the midst of an economic diversification drive under its Vision 2030 agenda. A key area of focus is to support the sustainable development goals of all economic

- 4. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 sectors, with the country aiming to achieve net-zero carbon emissions by 2060 through a circular carbon economy approach. A part of this strategy is the transition to greener means of transportation. The rapid growth of the kingdom's EV market even led Saudi to reach a top-50 spot for the first time in New York-based consultancy AlixPartners' latest Automotive Electrification Index, which was released last month. Last month, Lucid also signed an agreement with the kingdom's government for the sale of 100,000 cars that will support Riyadh's sustainability drive. The deal with the kingdom's Ministry of Finance — which will include the flagship Lucid Air and other future models — covers a 10-year period and includes an initial commitment to purchase 50,000 vehicles, plus an option for up to 50,000 additional cars over the same period. "With today’s signing ceremony, we are taking a major step towards Saudi Arabia's goal of diversifying its economy by creating a new manufacturing hub to spearhead the future of mobility for the Middle East region,” Minister of Investment Khalid Al Falih said. “This project demonstrates the confidence investors have in Saudi Arabia's competitiveness, its ability to create opportunity and serve global demand for a highly complex product such as electric vehicles.” At its Saudi plant, AMP-2, Lucid plans to establish operations initially for re-assembly of Lucid Air vehicle kits that are pre-manufactured at the company’s US AMP-1 facility in Casa Grande, Arizona, and, over time, for production of complete vehicles. It expects construction of the plant to “commence shortly”. Vehicles will be initially scheduled for the Saudi Arabian market, but Lucid plans to export finished vehicles to other global markets as well. Bandar Alkhorayef, the Minister of Industry and Mineral Resources and chairman of SIDF, said the automotive industry in the kingdom is one of the important sectors supported by the national industrial strategy. "We look forward to working with Lucid and other leading companies, while continuing to build our global expertise,” he said. Global sales of EVs more than doubled to 6.6 million in 2021, according to the International Energy Agency. Almost a million EVs a month will be added to the global fleet in the second half of 2022, BloombergNEF estimates showed. “PIF partners with leading global innovators, like Lucid, to shape the economies of the future and drive the economic transformation of Saudi Arabia in line with Saudi Vision 2030,” Turqi Al Nowaiser, PIF’s deputy governor and head of international investments division, said.

- 5. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Europe fills gas storage at record rate as Asia's buyers step aside REUTERS/Christian Charisius Europe's gas inventories are rebuilding after winter at the fastest rate on record as the region's buyers outbid competitors from Asia to acquire as much gas as possible at any price. Stocks in the European Union and United Kingdom (EU28) have risen by 151 terawatt-hours (TWh) since the start of April and 159 TWh from their post-winter low on March 19. Storage is filling even faster than during the lockdowns in the first wave of the pandemic in 2020, according to data from Gas Infrastructure Europe ("Aggregated gas storage inventory", GIE, May 17). The storage deficit that emerged in the second quarter of 2021 and persisted through the winter has been eliminated (https://tmsnrt.rs/37VE1r6). Stocks are now at 450 TWh, almost exactly in line with the prior 10-year average and 21 TWh above the pre-pandemic five-year average for 2015-2019. Europe's gas buyers have proved willing to pay much more for deliveries in the short term than their counterparts in Asia. Futures contracts for deliveries in July 2022 to Northwest Europe are trading at almost $100 per megawatt-hour compared with just $68 for deliveries to Northeast Asia.

- 6. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 ASIA GAS STOCKS Asia's LNG buyers have been less active than normal and inventories in the region have been allowed to fall compared with the seasonal average. China does not publish gas inventory levels, but LNG imports have been significantly below prior-year levels every month so far in 2022, according to customs data. LNG imports declined to 17.3 million tonnes in the first three months of the year compared with the 19.7 million in the same period in 2021, the first decline for at least seven years. China's increasing coronavirus outbreaks and lockdowns have severely disrupted industrial activity and household spending, which is likely to have reduced gas consumption. But most gas consumption comes from residential and commercial heating rather than power generation so the downturn likely reflects a decision to allow stocks to fall rather than pay exceptionally high prices. Japan's gas inventories have also been allowed to decline as utilities decline to pay record prices in competition with Europe. Stocks fell to 1.49 million tonnes at the end of February, the latest data available, the second lowest for the time of year since 2015. Japan imported significantly less LNG in both January and February this year than in 2021, data from the Ministry of Economy, Trade and Industry show.

- 7. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 To some extent, Asia's importers have stepped aside as Europe races to fill storage as quickly possible in case pipeline supplies from Russia are interrupted by the war with Ukraine and sanctions. But it likely means Asia's buyers will have to accelerate purchases later in the year, keeping prices elevated, even if Europe's own storage remains on track to become full over the next few months.

- 8. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 EU to map out €210 Billion escape route from Russian fossil fuels Reuters The European Commission will on Wednesday unveil a 210 billion euro plan for how Europe can end its reliance on Russian fossil fuels by 2027, and use the pivot away from Moscow to quicken its shift to green energy. The invasion of Ukraine by Russia, Europe's top gas supplier, has prompted the European Union to rethink its energy policies amid sharpened concerns of supply shocks. Russia supplies 40% of the bloc's gas and 27% of its imported oil, and EU countries are struggling to agree sanctions on the latter. To wean countries off those fuels, Brussels will propose a three-pronged plan:- 1- a switch to import more non-Russian gas, 2- a faster rollout of renewable energy, and 3- more effort to save energy, . The draft measures, which could change before they are published, include a mix of EU laws, non- binding schemes, and recommendations national governments could take up. Taken together, Brussels expects them to require 210 billion euros in extra investments - which the EU plans to support by freeing up more money for the energy transition from its COVID-19 recovery fund, and which would ultimately reduce the billions of euros Europe spends on fossil fuel imports each year. The plans outline a short-term dash for non-Russian gas supplies, highlighting the potential to increase imports of liquefied natural gas from countries including Egypt, Israel and Nigeria, plus infrastructure needed to pivot away from Russia.

- 9. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Europe's gas demand is expected to drop by about a third by 2030 under the bloc's targets to fight climate change, and the proposals are expected to outline aims to produce 10 million tonnes of renewable hydrogen by 2030 and import another 10 million tonnes - which could be used to replace gas in industry, to avoid locking in years of emissions. The Commission is considering proposing higher targets to expand renewable energy and energy efficiency - with a 45% share of renewable energy by 2030, replacing its current 40% proposal. A 13% cut in EU energy consumption by 2030, against expected use, is also under discussion to replace a current 9% proposal. Other parts of the package include an upgraded law offering one-year simplified permits for some wind and solar projects, to slash the years-long permitting deadlines that hold up projects. New EU schemes to jumpstart a large-scale rollout of solar energy would also attempt to cut gas- fuelled power and heating in homes, offices and factories, by requiring countries to install solar energy in all new public buildings from 2025, according to another draft.

- 10. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 US: bp and Linde plan major CCS project to decarbonization Source: bp Key Points:- Project to include carbon capture and storage (CCS) and low carbon hydrogen production With potential start-up by 2026, project aims to store up to 15 million metric tons of CO2 per year in multiple sites – the equivalent of removing approx. 3 million cars from the road Engaging with additional emitters to decarbonize Texas Gulf Coast. bp and Linde, a leading global industrial gases and engineering company, have announced plans to advance a major carbon capture and storage (CCS) project in Texas that will enable low carbon hydrogen production at Linde’s existing facilities. The development will also support the storage of carbon dioxide (CO2) captured from other industrial facilities – paving the way for large-scale decarbonization of the Texas Gulf Coast industrial corridor. Upon completion, the project will capture and store CO2 from Linde’s hydrogen production facilities in the greater Houston area – and potentially from its other Texas facilities – to produce low carbon hydrogen for the region. The low carbon hydrogen will be sold to customers along Linde’s hydrogen pipeline network under long-term contracts to enable production of low carbon chemicals and fuels. bp and Linde plan major CCS project to advance decarbonization efforts across Texas Gulf Coast As part of the project, bp will appraise, develop and permit the geological storage sites for permanent sequestration of the CO2. bp’s trading & shipping business aims to bring custom low

- 11. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 carbon solutions to the project, including renewable power and certified natural gas, along with commodity trading and price risk management expertise. Linde will use its proprietary technology and operational expertise to capture and compress the CO2 from its hydrogen production facilities for the project. Together with its extensive infrastructure of hydrogen production facilities and its storage cavern connected through its pipeline network across the Texas Gulf Coast, this project will enable Linde to supply cost-effective, reliable low carbon hydrogen and, together with bp, provide carbon capture and storage solutions. Dave Lawler, chairman and president of bp America, said: 'The energy expertise in Texas and strong supply chains have been generations in the making. This new low carbon energy project will help us leverage those strengths for the next chapter of the energy transition. In particular, it can help decarbonize hard-to-abate industries for the greatest potential impact on emissions while protecting jobs. bp is proud to support this project as we continue delivering on our own strategy and net zero ambition.' The project will be a further important step in the development of bp’s low carbon business. bp is evaluating large-scale CCS and hydrogen projects for industrial clusters in the US and already is in action on Teesside, the industrial heart of the United Kingdom. 'Linde is committed to lowering absolute carbon emissions 35% by 2035 and reaching climate neutrality by 2050. Capturing the CO2 from our hydrogen production plants in the Houston area will be a significant step towards achieving these goals,' added Dan Yankowski, president, Linde Gases North America. 'We are excited to bring Linde’s leading technology portfolio and infrastructure to support this project and make low carbon hydrogen available to our customers in the Gulf Coast. More broadly, Linde is well positioned to enable similar projects, be it in the Gulf Coast where we operate two hydrogen pipelines and a hydrogen storage cavern or elsewhere in the US.' The overall development, expected to be operational as early as 2026, will also enable capture and storage of CO2 from other large industrial facilities in the region and could ultimately store up to 15 million metric tons per year across multiple onshore geologic storage sites – the equivalent of taking approximately 3 million cars off the road each year.

- 12. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase May 19 -2022 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil prices recoup early losses on China hopes, global supply fears Reuters + NewBase Oil prices rose on Thursday, recovering from early losses, on hopes that planned easing of restrictions in Shanghai could improve fuel demand while lingering concerns over tight global supplies outweighed fears of slower economic growth. Brent crude futures for July were up $1.53, or 1.4%, at $110.64 a barrel at 0447 GMT, after falling by more than $1 earlier in the session. U.S. West Texas Intermediate (WTI) crude futures for June rose 93 cents, or 0.8%, to $110.52 a barrel, recovering from an early loss of more than $2. WTI for July was up $1.57, or 1.5%, at $108.50 a barrel. Both benchmark prices fell about 2.5% on Wednesday. Oil price special coverage

- 13. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 "A slump in Wall Street soured sentiment in early trade as it underlined concerns over weakening consumption and fuel demand," said Satoru Yoshida, a commodity analyst with Rakuten Securities. Asian shares on Thursday tracked a steep Wall Street selloff as investors fretted over rising global inflation, China's zero-COVID policy and the Ukraine war. "Still, oil markets are keeping a bullish trend as a pending import ban by the European Union on Russian crude is expected to further tighten global supply," Yoshida said. The European Commission unveiled on Wednesday a 210 billion euro ($220 billion) plan for Europe to end its reliance on Russian fossil fuels by 2027, and to use the pivot away from Moscow to quicken its transition to green energy. read more Also, U.S. crude inventories (USOILC=ECI) fell last week, an unexpected drawdown, as refiners ramped up output in response to tight product inventories and near-record exports that have forced U.S. diesel and gasoline prices to record levels. Capacity use on both the East Coast and Gulf Coast was above 95%, putting those refineries close to their highest possible running rates. In China, investors are closely watching plans in the country's most populous city, Shanghai, to ease restrictions from June 1, which could lead to a rebound in oil demand at the world's top crude importer. Stephen Innes from SPI Asset Management said news that Shanghai planned to gradually resume inter-district public transport from May 22 was positive for risk and supporting oil prices. ($1 = 0.9537 euros). Stronger U.S. dollar contributes to higher crude oil prices in international markets… Source: U.S. Energy Information Administration, The price of Brent crude oil, the world benchmark, has increased in 2022, partly as a result of Russia’s full-scale invasion of Ukraine. In addition, a strong U.S. dollar means that countries that use currencies other than the U.S. dollar pay more as crude oil prices increase. Since June 1, 2021, the Brent crude oil price has increased by 59% in U.S. dollars and by 86% in euros.

- 14. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 The U.S. dollar index measures the value of the U.S. dollar against six currencies: the euro, yen, British pound, Canadian dollar, Swiss franc, and Swedish krona. When the U.S. dollar index increases, it means the U.S. dollar is gaining value against those currencies. Conversely, it also means those other currencies are losing value against the U.S. dollar. Crude oil is generally priced in U.S. dollars, so purchases in other currencies are not only affected by the dollar price of crude oil but also by the exchange rate to the dollar. The price of crude oil and the value of the dollar generally move in opposite directions so these factors offset each other. Recently, however, the price of Brent crude oil and the value of the U.S. dollar have both increased. Recent increases in short-term U.S. treasury yields may be contributing to higher demand for U.S. government bonds, which increases demand for U.S. dollars and, therefore, the value of the U.S. dollar against other currencies. Source: Graph by the U.S. EIA, based on data from Intercontinental Exchange as compiled by Bloomberg L.P. The value of the U.S. dollar also increases when it is considered a safer investment compared with other currencies. Recent global events, including Russia’s full-scale invasion of Ukraine and concerns caused by COVID-19 mobility restrictions in China, may also be increasing demand for the U.S. dollar.

- 15. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase Special Coverage The Energy world –May -01 -2022 CLEAN ENERGY Ammonia co-firing in power plants could be worth $100bn in 2050, says Woodmac Energy Voice + NewBase While hydrogen can be used in many sectors, its derivative, ammonia, has emerged as a key tool to provide flexible power generation and integrate variable renewables. Analysis by energy research company Wood Mackenzie shows that a 10% ammonia co-firing in global coal plants would translate to 200 million tonnes (Mt) of ammonia demand, a potential market of $100 billion by 2050. Power generation in Germany. Ammonia could help decarbonise thermal power generation. While hydrogen can be used in many sectors, its derivative, ammonia, has emerged as a key tool to provide flexible power generation and integrate variable renewables. Analysis by energy research company Wood Mackenzie shows that a 10% ammonia co-firing in global coal plants would translate to 200 million tonnes (Mt) of ammonia demand, a potential market of $100 billion by 2050. Thermal generation is the largest source of power and heat in the world today. In 2021, the share of thermal generation was 70% in Asia Pacific, and 50% in Europe and Americas combined. Amid rising power demand and a strong focus on decarbonisation globally, there is an urgent need to replace thermal power generation plants with renewables and battery storage or pair with new

- 16. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 technologies such as carbon capture, utilisation and storage (CCUS) to abate emissions. A quick replacement of these thermal power plants will be costly as the thermal fleets in several countries still have many years of useful life, said Wood Mackenzie. With commodity prices at record highs, and expected to remain elevated for some time, priorities have shifted. Security and diversity of supply are front of mind for policymakers. Any progress in reducing reliance on single fuels or single suppliers is becoming important. The ability to co-fire ammonia or low-carbon hydrogen in thermal generation is an increasingly attractive proposition, even if costs may be higher. Speaking at the APPEA conference in Brisbane today, Prakash Sharma, Vice President of Multi- Commodity Research at Wood Mackenzie said: “The possibility to burn low-carbon hydrogen and ammonia in thermal power plants provides countries with an additional tool for decarbonising the power generation sector. This strategy allows for optimisation of power plants, while maintaining grid resiliency and lower carbon intensity of power generation. “Just a 10% use of ammonia co-firing in coal plants could result in a 50% growth from today to 200 Mt of ammonia demand by 2050, and this is a $100 billion market opportunity. Additionally, co-firing will deliver a 10% reduction in carbon emissions, a strategic benefit in markets with physical limitations to build renewables and CCUS capacity.” While the costs of renewables and electrolysers will continue to decline, resulting in lower costs of production for green hydrogen, the hydrogen value chain, particularly the midstream, is complex as

- 17. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 it considers processing, storage, shipping, and reconversion for different carriers of hydrogen and different transportation methods. Hydrogen needs to be competitive at the point of delivery or end use, not at the point of production. Sharma said: “When looking at power generation, ammonia is one available option to be used directly either by itself or by co-firing with no reconversion cost needed. Our analysis shows on average the delivered cost of low-carbon ammonia to Japan is expected to fall 60% from $1,250 per tonne (t) currently to under $500/t by 2050.” Wood Mackenzie considered both blue and green hydrogen production in Australia, Canada, Chile and the Middle East for delivery to Japan. Ammonia was assumed as the preferred carrier method across all four trade routes as the end-use application for the case study is ammonia co-firing in power plants, and there would be no requirement for reconverting ammonia back to hydrogen. Japan’s power utilities are taking a lead in co-firing ammonia in both coal- and gas-fired power plants. Initial tests have shown encouraging results, and commercial operations are scheduled to start around 2025. South Korea also recently expanded plans to co-fire hydrogen and ammonia in thermal power plants. Although ammonia co-firing is currently uncompetitive, even with a carbon price, the prospect of rapidly falling costs combined with supportive policies will lower the levelised cost of electricity (LCOE) to $90 per megawatt-hour by 2050, reckons Wood Mackenzie. As ammonia delivered costs to Japan could fall to $500/t or lower in the long term, ammonia combustion in thermal power plants would become a feasible decarbonisation strategy and comparable to CCUS-paired plants. To support this shift, Wood Mackeznie estimates carbon pricing requirements would need to be $40-$120/t of carbon dioxide equivalent in 2050 for 20% and 60% co-firing shares, respectively. Sharma said: “While liquid hydrogen offers the lowest cost to reconversion and highest purity, infrastructure and capability is in its infancy. Ammonia, on the other hand, can leverage existing infrastructure and can be used directly in power generation and as a shipping fuel.

- 18. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 “Reaching net zero emissions requires rapid electrification of energy systems through support from hydrogen, ammonia and other green technologies. The entire hydrogen value chain, as well as the end-use application, should therefore be considered when choosing the most suitable hydrogen carrier and supplier into key markets.” JERA Planning to Shift Coal Power Fleet to 100% Ammonia Japanese firm JERA, a joint venture between TEPCO and Chubu Electric, on Oct. 13 issued a roadmap to achieve zero carbon emissions by 2050. The move is notable for the company whose business includes a sizable global liquefied natural gas (LNG) portfolio of five upstream projects, 20 fleet carriers, an LNG tank capacity that is equivalent to 30% of Japan’s tank capacity, and 11 LNG terminals in Japan. It also owns 27 thermal power stations in Japan, which have a total capacity of 70 GW, and another 30 power projects, including renewables, in more than 10 countries, which amount to about 9 GW. Under its roadmap, JERA plans to shutter its entire 2.2 GW supercritical coal power generation fleet in Japan by 2030, and then gradually increase the ratio of mixed combustion of fossil fuels to ammonia and hydrogen at ultrasupercritical plants. 1. JERA’s 4.1-GW Hekinan Thermal Power Station is one of the world’s biggest coal plants. The plant houses five units. Units 1, 2, and 3 are 700-MW units that opened between 1991 and 1993, and Units 4 and 5, 1 GW each, opened in 2001 and 2002. Courtesy: JERA Co-Firing Planned at a 4.1-GW Coal Plant That effort will begin within the next decade with projects to demonstrate ammonia co-firing at the 4.1-GW Hekinan Thermal Power Station in Aichi Prefecture (Figure 1), and a hydrogen co-firing demonstration at another power plant. Over the next decade, JERA also plans to promote offshore wind power projects and further improve the efficiency of LNG thermal power generation. In the first half of the 2030s, the company wants to achieve a 20% ammonia co-firing rate at all its coal plants, and it is seeking to shift to 100% ammonia by the 2040s. It notes, however, that its zero-carbon business strategy will depend heavily on “advances in decarbonization technology, economic rationality, and consistency with government policy.” To that end, JERA is developing the decarbonization technologies it plans to use. Its ammonia plans stem from a collaboration with Japanese giants IHI Corp. and Marubeni Corp., along with Australian

- 19. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 natural gas and LNG producer Woodside Energy. The companies launched a feasibility study with Japan’s New Energy and Industrial Technology Development Organization (NEDO) this March. Slated to wrap up in February 2021, the study will essentially involve a technical analysis to inform JERA’s demonstration for direct use of ammonia as a fuel source in pulverized coal boilers, as well as evaluate the economics of equipment costs, operational costs, and the costs of producing and transporting ammonia. Interest in Ammonia Is Growing Ammonia—a compound of nitrogen and hydrogen—“can efficiently transport and store hydrogen at low cost and in addition to its role as an energy carrier, it can be directly used as fuel in thermal power generation,” the companies explained. According to the Ammonia Energy Association (AEA), interest in exploring the gas as a decarbonizing fuel has soared of late because it does not emit carbon dioxide when it is burned. To date, the 2004-established industry coalition has 76 members. Its power generating members include AES, Arizona Public Service, ENGIE, ITM Power, Nebraska Public Power District, Origin Energy, Shell, Total, and Tri-State Generation and Transmission. IHI, JERA, and Marubeni, notably, are board members on Japan’s Green Ammonia Consortium, and their emphasis on ammonia is backed by Japan’s International Resource Strategy, which the Ministry of Economy Trade and Industry (METI) issued in March. The strategy explicitly calls for demonstration projects to promote ammonia as a fuel. Japan, notably, also announced on Oct. 28 it will seek to be carbon neutral by 2050, a shift that will require a fundamental revision of its policy on coal plants. But as the AEA noted, much progress has already been achieved in Japan, led mainly by IHI, which is already developing a broad portfolio of ammonia fuel technologies, including a solid oxide fuel cell, gas turbine, industrial boilers, and co-fired thermal power boilers. Ammonia-coal co-firing has also already been demonstrated, first by Chugoku Electric in July 2017 at its 156-MW Mizushima Thermal Power Station Unit 2 with a fuel mix composed of 0.6% to 0.8% ammonia, and then by IHI in March 2018 at a “large-capacity combustion facility” in Aioi City, with a fuel mix composed of 20% ammonia. As Bunro Shiozawa, a senior associate at Sumitomo Chemical Co., wrote in an AEA blog post this October, IHI’s demonstration, which involved a coal-ammonia burner that can be attached to an existing coal plant, confirmed that at 20% ammonia co-firing carbon emissions decreased 20%, and while nitrogen oxide could be largely reduced, the boiler’s heat rate did not change significantly. Under the study with NEDO, four companies plan to survey the full ammonia-coal lifecycle from ammonia production to power generation (Figure 3). IHI plans to evaluate the thermal efficiency of ammonia co-firing using a numerical analysis, but the company will also study ammonia storage and supply facilities, as well as ammonia co-firing burners. 3. A March 2020–launched feasibility study being conducted by three major Japanese coal generators and an Australian gas producer, in collaboration with Japan’s New Energy and Industrial Technology Development Organization, will evaluate all aspects of ammonia-coal co-firing from production to power generation. Courtesy: JERA JERA’s role in the feasibility study involves identifying and resolving challenges related to the application of ammonia co-firing in commercial coal plants. It will also study specifications on

- 20. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 ammonia storage, vaporizers, and evaluate necessary costs and capital investments. Marubeni will look into methods to tamp down the carbon footprint of ammonia, and to improve its transportation efficiency, including by using larger-sized vessels to reduce costs. Finally, Woodside will study challenges related to realizing large-scale ammonia production plants and assess ways to reduce production costs. Other notable industry initiatives to explore ammonia power associated with the Green Ammonia Consortium include Mitsubishi Power’s agreements with Indonesia’s Bandung Institute of Technology in May to “probe new fuel technologies using ammonia and hydrogen to reduce greenhouse gas emissions, and to enhance technologies for diagnosing the operation of Indonesia’s power plants through use of artificial intelligence (AI) and big data analysis.” 3. Japan’s Green Ammonia Consortium envisions a multi-pronged strategy for the production and use of carbon-free ammonia fuel. As Shigeru Muraki, representative director of the consortium, explained in March 2020, taking into account all cost components, transmission and distribution of hydrogen as ammonia is likely the cheapest mechanism for imports to Japan from Australia. Source: The Green Ammonia Consortium

- 21. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase Energy News 20 May 2022 - Issue No. 1514 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 22. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22

- 23. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23

- 24. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24