New base 19 april 2017 energy news issue 1020 by khaled al awadi

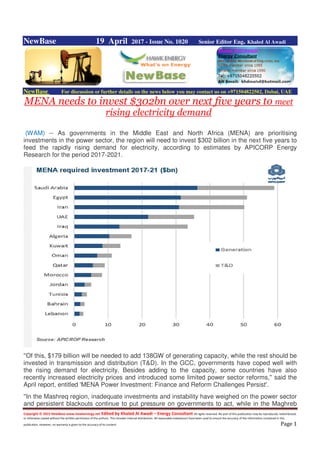

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 19 April 2017 - Issue No. 1020 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE MENA needs to invest $302bn over next five years to meet rising electricity demand (WAM) -- As governments in the Middle East and North Africa (MENA) are prioritising investments in the power sector, the region will need to invest $302 billion in the next five years to feed the rapidly rising demand for electricity, according to estimates by APICORP Energy Research for the period 2017-2021. ''Of this, $179 billion will be needed to add 138GW of generating capacity, while the rest should be invested in transmission and distribution (T&D). In the GCC, governments have coped well with the rising demand for electricity. Besides adding to the capacity, some countries have also recently increased electricity prices and introduced some limited power sector reforms,'' said the April report, entitled 'MENA Power Investment: Finance and Reform Challenges Persist'. ''In the Mashreq region, inadequate investments and instability have weighed on the power sector and persistent blackouts continue to put pressure on governments to act, while in the Maghreb

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 region renewable-energy projects are at the forefront of long-term government plans to diversify power-generation capacity and reduce fuel import bills. But investment in the power sector will continue to be a challenge due to finance constraints and tight government budgets,'' the report mentioned. The monthly analysis stated that electricity demand in the MENA region has been growing rapidly, driven by population growth and urbanisation, rising income levels, industrialisation, and low electricity prices. Looking ahead, it noted, these factors will continue to place greater demand on the electricity- generation capacities. MENA economic growth has slowed compared with the historical highs, but the International Monetary Fund still expects an increase of 3.2 percent in 2017, rising to 3.6 percent in 2021. The region’s population is also expected to grow at an average rate of 2 percent per year in that period. To meet the rising demand, MENA power capacity will need to expand by an average of 7.4 percent each year between 2017 and 2021, which corresponds to an additional capacity of 138GW. This would require $179 billion of investment in the generation capacity and a further $123billion for T&D. ''Governments have been accelerating their investment plans and our estimates show that 97GW of capacity additions are already in the execution stage,'' it added. ''The GCC represents 43 percent, or 157GW, of current MENA power generating capacity. Despite this large capacity, the GCC will require $81 billion for the addition of 62GW of generating capacity and another $50 billion for T&D over the next five years. However, declining oil revenues and large budget deficits mean that GCC governments can no longer continue to support the provision of cheap power. Subsidy reforms announced in late 2015 are part of a programme that aims to liberalise domestic energy prices over the medium term. "The region is also placing greater emphasis on renewable energy. The UAE recently announced a nationwide power strategy which aims to have 50 percent clean energy by 2050. Solar power features heavily in its plans and is expected to account for 25 percent of the generation mix once a $13.7 billion (5GW) solar park is fully commissioned in 2030. Saudi Arabia also recently unveiled its latest renewable-energy initiatives. The programme will aim to develop 10GW of solar and wind energy by 2023," the report stated. According to the report, the UAE needs to invest at least $35 billion to meet the 17GW capacity addition needed over the medium term. ''The UAE is pushing strongly to diversify its energy sources in the power mix; we estimate that 10.4GW of capacity additions are already in execution. Much of the power is generated using natural gas, but Abu Dhabi’s Barakah nuclear-power plant will see four reactors come online between 2017 and 2020, contributing 5.6GW in total," the report read.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE not keen on Adnoc IPO like Aramco, energy minister says Adnoc is the 12th largest global producer of oil…..by: Gulf News - Siddesh Suresh Mayenkar, Senior Reporter The United Arab Emirates has not seen a need for or discussed the listing of state-run Abu Dhabi National Oil Company (Adnoc) — similar to Saudi Aramco’s scheduled initial public offering (IPO) — the country’s energy minister Suhail Mohammad Al Mazroui said on Tuesday. When asked if the government would consider offering shares of Adnoc, Al Mazroui said: “Our situation in the UAE is different. Since the beginning we have foreign investors, and they are our partners and shareholders, when it comes to operating companies. I don’t think we have discussed or seen a need to IPO Adnoc.” Al Mazroui’s comments came following Saudi Arabia’s announcement to offer shares of its crown jewel Saudi Aramco, which is said to be valued at $2 trillion. Optimisation: Al Mazroui said they would continue to integrate Adnoc’s subsidiaries for efficiency. “There is going to be a continuous engagement to cut costs and optimise. We would continue doing that,” he said at a conference in Dubai. “Adnoc is looking at several opportunities of optimising cost. Are they looking at more opportunities to merge, I can say yes. Have they reached that recommendation to come, we will have to wait and see,” he added. Adnoc is the 12th largest producer of oil globally. It currently produces about three million barrels of oil per day and targets 3.5 mbopd by 2018 depending on market conditions. “As a responsible player, we need to have that buffer to ensure that we don’t have shocks. Those buffers were very helpful to avoid surges in the market that was hurting the economy. The last thing we want is a bust followed by a boom,” he added. Additionally, the energy minister is happy with compliance on the last year’s deal to cut output. “We are happy with the performance of the commitment. We still have gave two months to evaluate and decide. I hope that we would get together to form a single opinion,” Al Mazroui said. Opec is scheduled to meet on May 25 to discuss whether to extend output cuts of 1.2 million barrels per day for another six months.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi Arabia, Russia to launch joint projects worth $3bn,in 2017 Most promising areas of cooperation include energy, geological exploration, mining, petrochemicals and investment cooperation By Business Arabia Russian Federation Council chairperson Valentina Matvienko pictured with King Salman bin Abdulaziz Al Saud of Saudi Arabia. Image: Russian Federation Council Press Office/TASS Russia and Saudi Arabia will launch joint projects worth $3bn by the end of the year, according to the speaker of Russia’s Federation Council Valentina Matviyenko. Russian news agency TASS reported that Matviyenko made the comments during a meeting with members of the Russian-Saudi Business Council on Monday. “Although Saudi Arabia ranks second among the Arab states in terms of trade with Russia, the volume of mutual trade turnover in the past year has significantly decreased," said Matviyenko during the meeting. "This does not correspond to the potential that our countries have, we are interested in expanding economic ties," the speaker added. Matviyenko said the proposed areas of cooperation include energy, geological exploration, mining, petrochemicals, tanker construction, investment cooperation, and the training of personnel. She also underlined the opportunities for business development and investment offered to its partners, referring to existing partnership between the Russian Direct Investment Fund and the Sovereign Fund of Saudi Arabia. "The parliament adopted the laws improving the investment and business climate," she said. "Thanks to them, projects totaling about $600 million have been implemented and projects worth $3 billion should be launched by the end of this year," she said. The Federation Council is upper chamber of the Russian parliament

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Morocco: Sound Energy mobilisation of rig to Sidi Moktar Source: Sound Energy Sound Energy, the African and European focused upstream gas company, has announced the mobilisation of a rig to the Company's Sidi Moktar asset, onshore Morocco. The Sidi Moktar licences cover 2,700 sq kms in the Essaouira basin, central Morocco and contain an existing gas discovery in the Lower Liassic ('Kechoula') and significant deeper potential. Sidi Moktar is close to existing infrastructure, including the large scale Moroccan state owned OCP Phosphate plant. Two wells have already been drilled at Kechoula by previous operators and have been estimated to have an unrisked mid case original gas in place ('GOIP') of 293 Bscf (gross). As previously announced by the Company, the Sidi Moktar licences are also estimated, similar to the Company's Eastern Morocco positions, to have significant pre-Jurassic exploration potential from the TAGI and Paleozoic in excess of 1 Tcf unrisked GOIP (gross). The Company notes the quantitive assesment prepared by a previous operator in 1998 which referred to exploration potential of the Sidi Moktar licences of up to 9 Tcf unrisked GOIP (gross) in the TAGI and Paleozoic. The Company will require the reprocessing of existing 2D seismic, acquisition of new 2D seismic and drilling results before forming its own volume estimates for the exploration potential of the Sidi Moktar licences. The Company announces that the SAIPEM rig used to drill the Company's most recent Tendrara well (TE-8) has now been mobilised to Sidi Moktar. The rig will, upon arrival in May 2017, execute the re-entering and testing of the two existing wells on the Kechoula discovery which, subject to initial well results, may include a sidetrack and an extended well test thereafter. Given the Company's strong financial position, the Company also announces that it has decided not to proceed with the previously announced proposed farm out of Sidi Moktar, and to instead retain its 75% operated position in the Sidi Moktar licences. Once the workovers, and any sidetrack and extended well test are complete, the Company intends to renew the Sidi Moktar licences (which currently expire on 28 August 2017) thereby starting a new eight year period. The first activity following the renewal of the Sidi Moktar licences will be 2D seismic reprocessing and the acquisition of new 2D seismic, scheduled for 2018, after which the deeper pre-salt horizons can be drilled.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Egypt: SDX Energy reports gas discovery at the first target depth in its SD-1X well onshore Egypt Source: SDX Energy SDX Energy has announced that drilling on the carried SD-1X well at its South Disouq concession, where it holds a 55% equity interest and is operator in the Nile Delta area of Egypt has reached its first target depth. The SD-1X well is targeting gas in the upper Abu-Madi section, and oil from the deeper Abu Roash and AEB horizon. To date the well has been drilled to a total depth of 7,777 ft. reaching its first target depth in the Abu Madi. The Company is pleased to announce that during drilling, conventional natural gas bearing horizons were encountered in the Abu Madi. The well encountered 65 ft. of net pay section with an average porosity of 25%. The results are in line with pre-drill estimates. Additional evaluation work is currently underway to provide an accurate recoverable volume estimate which will be the subject of a subsequent release. Drilling will now continue to the deeper Abu Roash and AEB sections, targeting oil. SDX will provide further updates on the drilling campaign in due course. Paul Welch, President and CEO of SDX, commented: 'It is clearly very encouraging to have made a gas discovery at the first of SD-1X’s target intervals. The 3D seismic data acquired and interpreted over the South Disouq concession has provided a very accurate view of the subsurface as the target interval has come in on prognosis. This provides us with additional encouragement for the deeper horizons where we are targeting oil. Any production testing of the Abu Madi or one of the deeper horizons will be undertaken after drilling operations have been completed and the rig has moved off location.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Senegal/Gambia: African Petroleum to farm out Senegal and Gambia licences …Source: African Petroleum African Petroleum, an independent oil and gas exploration company operating high impact exploration licences offshore West Africa, has signed non-binding heads of terms and a binding exclusivity agreement with a well funded, listed oil and gas company with a strong track record in off-shore deep-water drilling. The Heads of Terms and Exclusivity Agreement provide a framework for the incoming third party to secure a 70% operated interest in the Company’s SOSP production sharing contract ('PSC') in Senegal and the A1 and A4 licences in The Gambia. The Exclusivity Agreement grants the incoming third party an initial eight week period of exclusivity over the Company’s SOSP PSC in Senegal and the A1 and A4 licences in The Gambia. This period of exclusivity may be further extended under certain conditions. During the period of exclusivity the Company and the incoming party will work together to finalise negotiations with the respective governments in order to amend the work commitment in Senegal and to enter the next phase of the licences in The Gambia, complete due diligence, and agree and execute farm-in documentation. The Heads of Terms sets out the broad commercial terms under which the incoming party intends to, subject to certain conditions, farm-in to the Company’s SOSP PSC in Senegal and the A1 and A4 licences in The Gambia. The terms propose that the incoming party will pay up to US$8.5 million to the Company, fund 100% of at least two deep water offshore wells at a gross cost of up to US$35 million per well, fund 100% of a 3D seismic acquisition, fund 100% of pre-stack depth migration ('PSDM') processing/reprocessing, and potentially fund 100% and 85% respectively of a further two wells at a gross cost of up to US$35 million per well.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 The broad commercial terms outlined in the Heads of Terms are summarised as follows: SOSP (Senegal): The incoming party proposes to farm-in to the SOSP PSC for a 70% operated interest in return for: 1. reimbursing 100% of certain licence feecosts; 2. paying 100% of acquiring 3D seismic and PSDM processing; and 3. paying 100% of the first exploration well. A1 (TheGambia): The incoming party proposes to farm-in to the A1 licence for a 70% operated interest in return for: 1. reimbursing 100% of certain licence fee costs; 2. paying 100% of PSDM reprocessing; 3. paying 100% of the first exploration well;and 4. paying 85% of the second exploration well. A4 (TheGambia): The incoming party to be granted a 15 month option to farm-in to the A4 licence for a 70% operated interest in return for paying 100% of the annual licence fees for the licence during the option period. Should the incoming party exercise its option then it will pay 100% of the first exploration well in order to earn its 70% operated interest. Commenting on this announcement, African Petroleum’s Chief Executive Officer Jens Pace said: 'This is a significant development for the Company with a well funded credible partner with strong deep-water drilling experience. Whilst final farm-in agreements are subject to completion and the successful outcome of negotiations with the governments in Senegal and The Gambia, we are confident that the proposed partner’s reputation, strong balance sheet and appetite to explore the potential of these exciting licences with the drill-bit, will greatly increase our ability to conclude the discussions with an outcome that benefits all parties. Our objective is to ensure that African Petroleum’s shareholders retain significant exposure to several firm and contingent wells, at no cash cost to the Company, in one of the most exciting hydrocarbon basins in the world.'

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 China crude oil imports more coming from non-OPEC countries Source: U.S. EIA, based on data from China General Administration of Customs and Bloomberg L.P China is the world’s largest net importer of crude oil, and in recent years, China’s crude oil imports have increasingly come from countries outside the Organization of the Petroleum Exporting Countries (OPEC). While OPEC countries still made up most (57%) of China’s 7.6 million barrels per day (b/d) of crude oil imports in 2016, crude oil from non-OPEC countries made up 65% of the growth in China’s imports between 2012 and 2016. Leading non-OPEC suppliers included Russia (14% of total imports), Oman (9%), and Brazil (5%). On an average annual basis, China’s crude oil imports increased by 2.2 million b/d between 2012 and 2016, and the non-OPEC countries’ share increased from 34% to 43% over the period. Market shares for China’s top three non-OPEC suppliers (Russia, Oman, and Brazil), all increased over these years. While still comparatively small as a share of China’s crude oil imports, imports from Brazil reached a record high of 0.6 million b/d in December 2016, and imports from the United Kingdom reached a high of 0.2 million b/d in February 2017. Growth in China’s total crude oil imports in 2016 reflected both lower domestic crude oil production and continued demand growth. After increasing steadily between 2012 and 2015, China’s crude oil production declined significantly in 2016. Total liquids supply in China averaged 4.9 million b/d in 2016, a year-over-year decline of 0.3 million b/d, the largest drop for any non-OPEC country in 2016. U.S. crude oil production fell by more than 0.5 million b/d in 2016, but total liquids declined by less than 0.3 million b/d because other liquids production increased by less than 0.3 million b/d.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Much of Chinese production growth from 2012 through 2015 was driven by more expensive drilling and production techniques, such as enhanced oil recovery (EOR) in older fields. As oil prices declined during 2016, investments in developing new reserves also fell and were not high enough to offset the natural production declines of older fields. China’s demand growth has remained the world’s largest in every year since 2009, increasing 0.4 million b/d in 2016. As China increased its imports to address a growing gap between its domestic production and demand, it surpassed the United States as the world’s largest net importer of total petroleum (crude oil and petroleum products) in 2014. The United States imports more crude oil and exports more crude oil and petroleum products than China. Other factors contributed to an increase in Chinese crude oil imports. For example, in July 2015, the Chinese government began allowing independent refiners (those not owned by the government) to import crude oil. The independent refiners previously had restrictions on the amount of crude oil they could import and relied on domestic supply and fuel oil as primary feedstocks. Another factor is the Chinese government’s filling of new Strategic Petroleum Reserve sites. EIA’s latest Short-Term Energy Outlook (STEO) forecasts a 0.3 million b/d increase in China’s total liquid fuels demand in both 2017 and 2018. Absent any domestic production increases, China’s crude oil imports are expected to continue increasing. More information about China’s crude oil imports and various market forces that may suggest continued growth in non-OPEC crude oil imports are available in EIA’s This Week in Petroleum.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 UK: Angus Energy receives planning approval for second production well at its Lidsey oil Source: Angus Energy Angus Energy has announced that West Sussex County Council have now approved details under the provision of the planning consent for the proposed drilling of the second well, the new Lidsey-X2 onshore production well at the Lidsey oil field (PL241) near Bognor Regis in the south of the United Kingdom. Angus Energy has planning consent for the development and operation of a three wellhead and beam pump oil production facility plus ancillary works at its Lidsey oil field. As permitted by the site planning consent, the first well has already been drilled at the site (Lidsey-X1) and the tophole/cellar completed and installed to enable a second well to be drilled (Lidsey-X2). This second well has not yet been drilled and is planned to be drilled to a depth of approx. 1,000 metres and will target the upper crest of the Great Oolite reservoir that has until being temporarily suspended in February 2016 produced oil from the Lidsey-X1 well which was first discovered in 1987. Lidsey-X2 will also assess the Kimmeridge formation which is located above the Great Oolite reservoir. Under the provisions of the site planning consent, Condition 8 requires prior approval by West Sussex County Council of details of the drilling rig and equipment and the period of their use to drill additional wells. West Sussex County Council have now approved details under the provision of the extant planning consent for the proposed drilling of the second well together with their approval for a new site security fence and new site administration facilities comprising offices, toilets and mess facilities. There is no change to the Company’s earlier guidance with regards to operations at its Brockham oil field.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Alaska: BP Kills Alaska Well After Capping Oil, Natural Gas Leaks by Jessica Summers and Alex Nussbaum A BP Plc well on Alaska’s North Slope is no longer leaking crude oil or natural gas, a spokeswoman said Monday. Environmentalists, describing the well as “out of control,” called on the state to investigate. The crude spray was discovered Friday morning, and capped early Sunday. A second leak that was emitting gas at a reduced rate was closed off overnight on Sunday, spokeswoman Dawn Patience said in an email. The well was originally completed in 1976 and was currently producing the equivalent of about 500 barrels of oil a day, she said. The leak came as the remote North Slope, once home to America’s biggest oilfields, has seen signs of a resurgence with producers working to boost output from aging wells and extend their reach to new supplies. Output there rose to 565,000 barrels a day in March, its highest level since December 2013. That’s still down by almost three-quarters from the peak of more than 2 million barrels in the late 1980s. “The well is no longer leaking any gas or oil,” Patience wrote. “Overnight, the Unified Command achieved source control and killed the well. ” In 2010, a BP well became the site of the worst offshore oil spill in U.S. history. The deadly Deepwater Horizon accident in the Gulf of Mexico forced BP to sell billions of dollars in assets and set aside more than $50 billion to pay for damages.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 While it’s not uncommon for natural gas to escape from North Slope wells, an emergency of Friday’s magnitude is rare, said Lois Epstein, Arctic Program Director for The Wilderness Society, an environmental group in Anchorage. Something Wrong “Whenever you have an out-of-control well like this, that means something very serious went wrong,” Epstein said in a telephone interview. “This really needs to be thoroughly investigated to find out what went wrong and whether there’s a danger of it happening again.” The North Slope is also home to vast underground reserves of natural gas, but the lack of a gas pipeline out of the region has kept companies from bringing any of it to market. The gas, which comes up along with oil, is typically pumped back underground to squeeze more crude oil out of the reservoirs. The volume of the North Slope leak hasn’t been determined and the cause of the release is unknown, the state’s Department of Environmental Conservation has said. There have been no injuries and no reports of harm to wildlife. The nearest local community, Nuiqsut, located about 50 miles west, has been notified. “It’s tough to determine collateral impacts at this point, but some incident-related slowdown at Prudhoe Bay seems at least a reasonable risk to consider,” Tudor Pickering Holt & Co., a Houston-based energy investment bank, wrote in a Monday note. ‘Jacked Up’ Emergency crews responding on April 14 discovered the well had “jacked up,” or risen, by three to four feet after the incident, the state said in its latest report. That movement broke a well pressure gauge and temporarily delayed efforts to close off the well, the state said. By Sunday night, the well had settled about 11 inches. Based on aerial pictures, the release appeared to be contained to the gravel pad surrounding the well head and never reached the surrounding tundra, BP said in an earlier statement. The well has been shut in since Friday. BP did not immediately respond to questions about how much oil the well typically produces. Candice Bressler, a state spokeswoman, referred production questions to the company. Alyeska Pipeline Service Co.’s Trans-Alaska Pipeline System, which runs from Prudhoe Bay south to Valdez, isn’t affected by this incident and is operating normally, Michelle Egan, a company spokeswoman, said by telephone Sunday. Alyeska is a joint partnership led by the North Slope’s top producers, BP Plc, Exxon Mobil Corp. and ConocoPhillips. Alaskan North Slope crude was valued at $1.80 a barrel over U.S. benchmark West Texas Intermediate on Monday, according to data compiled by Bloomberg. It has averaged a $1.16 premium to WTI this year.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase 19 April 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices dip on bloated US market, mixed Saudi signals Reuters + NewBase Oil prices dipped on Wednesday as bloated U.S. supplies weighed on markets while a fall in Saudi crude exports was offset by rising production in the country. Brent crude futures, the international benchmark for oil, were at $54.84 per barrel at 0059 GMT, down 5 cents from their last close. U.S. West Texas Intermediate (WTI) crude futures were down 4 cents at $52.37 a barrel. Data fro the American Petroleum Institute (API) on Tuesday showed that U.S. markets remained bloated. Although crude inventories fell by 840,000 barrels in the week to April 14 to 531.6 million barrels, still close to record highs, gasoline stocks rose by 1.4 million barrels as refinery crude oil runs increased by 334,000 bpd, the API said. Official U.S. oil data is expected to be published later on Wednesday by the Energy Information Administration (EIA). Outside the United States, a fall in Saudi output as part of its planned production cuts for the first half of this year lent the market some support. The Organization of the Petroleum Exporting Countries (OPEC), of which Saudi Arabia is the de- facto leader, together with other producers like Russia have agreed to cut output by almost 1.8 million barrels per day (bpd) during the first half of the year to rein in a global fuel supply overhang and prop up prices. Oil price special coverage

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Saudi crude exports fell to 6.96 million bpd in February, from 7.7 million bpd in January, according to the Joint Organisations Data Initiative (Jodi). However, Saudi production rose to 10 million bpd in February, up from 9.75 million bpd the previous month, the Jodi data showed, as domestic refiners processed more crude oil. This means that the Saudi oil may still make its way into a glutted global market as significant proportions of its refined fuel products are exported. U.S. Oil Rig Count Climbs U.S. crude production will likely rise in the months ahead as explorers added rigs for a 13th week, capping the longest stretch of gains since 2011. Rigs targeting crude rose by 11 to 683 this week, the highest level since April 2015, according to Baker Hughes Inc. data released Thursday. The number of wells drilled has more than doubled since tumbling to 316 in May.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Citi Sees Oil Surging $10 as OPEC Combats Roaring U.S. Shale by Serene Cheong Citigroup Inc. joined Goldman Sachs Group Inc. in backing commodities, saying it’s the season to have faith in raw materials and oil will probably rally to the mid-$60s by the end of the year. While U.S. shale output may come “roaring back” amid higher crude prices, production curbs by OPEC and its allies should help offset that increase over the next six to nine months, Citi analysts including Ed Morse and Seth Kleinman wrote in an April 17 report. The producers need to extend their deal to cut supplies through the end of the year amid concerns that Russia is lagging behind on its pledged reductions, the bank said. While the historic agreement between producers that went into effect Jan. 1 “induced a euphoric and unsustainable surge” in bullish bets by investors, that also set the stage for an inevitable sell- off as record fourth-quarter OPEC output and oil stored at sea moved to onshore sites, according to Citigroup. Goldman Sachs has also made similar comments, saying ample inventories that have undermined the output cuts are set to shrink and calling for more patience from the market. “With a continuation of the OPEC and non-OPEC producer deal in the second half of 2017 and the expected associated inventory draw-down, we expect oil prices to move above $60 a barrel by the second half of the year,” the analysts wrote in the note. Still, increased supplies from producers in the fourth quarter of 2016 is now “a dark cloud hanging over the market,” and a failure to extend the output agreement would send prices “precipitously lower,” they said.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 The bank expects U.S. West Texas Intermediate oil to average $62 a barrel and global benchmark Brent crude to average $65 a barrel in the fourth quarter. WTI was trading 30 cents lower at $52.35 a barrel on the New York Mercantile Exchange at 10:34 a.m. London time on Tuesday. Brent on the ICE Futures Europe exchange was down 35 cents at $55.01 a barrel. Supply Surge The production-cut agreement spurred a change in market structure that meant traders had less incentive to store oil at sea, prompting the flow of supplies floating on ships to onshore sites. That set the stage for boosting U.S. inventories to a record in the first quarter of 2017, the bank said. This gain and a surge in output by the Organization of Petroleum Exporting Countries in the fourth quarter had an effect that would “ultimately obstruct and for a period of time reverse the very rebalancing they were trying to accelerate,” the analysts said. The bank expects U.S. liquids output to grow year-over-year at 1 million barrels per day or more by December. The drop in oil prices during March led declines across commodities, according to Citigroup. It estimates commodity assets under management grew about $45 billion in the first two months of the year but gave up $35 billion during the selloff in raw materials in March. Investment inflows should increase in the second quarter, the bank predicted. “Do commodities need a bit of a prayer to rebound in ‘17? Probably not,” the analysts wrote. “Commodities stumbled through the first quarter following what was clearly the healthiest year for the sector since the decade began. In retrospect part of the sell-off toward the end of the last quarter was too much froth in critical subsectors like oil, copper and iron ore. But signs of better performance are increasingly clear, despite major risks.”

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Big Oil’s Rejection of Silicon Valley Is Finally Coming to End by David Wethe The nodding donkey was invented nearly a century ago, and it’s still hard at work in the oil patch, virtually unchanged, pumping oil out of the ground. There’s been a recent innovation, though: Algorithms adjust the extraction flow based on computer monitoring hundreds of feet below. Finally. “Onshore North America used to be a market where state-of-the-art technology went to be humiliated,” said Tom Curran, an energy analyst at FBR Capital Markets & Co. “You’ve had a clear shift occur where onshore North America for the first time in recent history has become a technology play.” The worst crude-market crash in a generation propelled energy companies into the digital world. They had already pretty much tested their physical limits with brute strength, ramping up injections of sand to tease more oil out of subterranean pockets and drilling wells longer and longer. Now they’re using DNA sequencing to track crude molecules and mapping buried streams with imaging software. Robots are fitting pipes together. Roughnecks consult mobile apps for drilling-direction advice. Oilfield services providers find themselves in a new arms race, led by giant Schlumberger Ltd., which recently opened an office on Sand Hill Road in the heart of Silicon Valley. Real Revolution It’s a real revolution, because many if not most explorers and drillers were stubbornly slow to look to software for help. They’ve historically been a conservative bunch. And during the good times of $100-a-barrel oil, profits were flowing so fast there wasn’t any incentive to experiment. The price plummeting to $50 since 2014 opened a lot of minds, starting a seismic shift to improve efficiency with data crunching and predictive analytics to get more out of rocks at less cost. “The promise of oil and gas in the future is to actually start using the data that we have, and then acquire more of it and use more of it,” said Ashok Belani, executive vice president of technology at Schlumberger. “Data in the oil and gas industry has never been organized in the way that a company like Google or Amazon would do it.” And for all the recent progress, “we are in inning one of nine.” There’s room for improvement in the business of exploration and extraction, particularly in the shale fields that are the most abundant sources left onshore. Recovery rates run about 8 percent. Getting to the targets requires fracturing oil-soaked rock with injections of water, sand and chemicals. That works about half the time. Microbes in Rocks So several companies, including Norway’s Statoil ASA and Houston-based Anadarko Petroleum Corp., have hired Biota Technology to help them identify the most bankable parcels. By comparing microbes in rock samples to those from oil produced in the area, Biota can map out choice draining spots and, according to founder Ajay Kshatriya, boost a well’s output by millions of dollars. “It’s a whole new data source for an industry that’s never looked at this before,” said Kshatriya, an engineer who used to work in biotech. “New technology innovation is now existential. It’s not a nice-to-have to create a couple more points of profit margin. It’s, ‘If we don’t get more economic, our field is out of the money. So we need that technology to remain competitive.’ ”

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 EOG Resources Inc., an Enron Corp. castoff that is now the second largest independent U.S. oil explorer, has embraced big data analysis to such a degree that Wolfe Research analyst Paul Sankey called it “the best oil company we have ever covered.” The Houston-based company has, among other things, invented proprietary iPhone apps that field crews use to calculate how hard to frack particular stretches of crude-soaked rocks. Autonomous Operations The industry is years away from fully embracing autonomous operations, said Binu Mathew, who was recruited seven months ago from Oracle Corp. to be the global head of digital for General Electric Co.’s oil and gas unit and works out of GE’s San Ramon, California, research center. The company is planning to roll out a new software suite in the third quarter that will pull in data from wells connected to the cloud. There’s a lot of promise. A truly digital oilfield could lead to a 20 percent cut in primary preventative maintenance costs and a 2.5 percent boost to production volumes, according to GE estimates. With oil production in the U.S. is at 10 million barrels a day, that could mean a 231,000 barrel-a-day boost. As it is, only 3 to 5 percent of all oil and gas assets -- including wells themselves and all the various equipment used to drill and frack and maintain production -- are connected digitally, according to GE. And of data collected, 97 percent is never used. That seems to be on track to change fast. Over the next three to five years, 50 percent of oil and gas companies surveyed by Accenture Plc, a said they plan to boost spending on digital technologies. Investments are expected to focus increasingly on big data and mobile devices for roustabouts. Disrupted Industry As Mathew sees it, the oil industry is on its way to being disrupted, to use the Silicon Valley vernacular, in the way the auto industry has been. Self-driving cars are being tested around the country and could be on the market within a decade, and even the vehicles most Americans drive today are as dependent on processors as bolts and gears to function. A $10 million oil well should have the same round-the-clock connectivity and self-help diagnostic capabilities as a $30,000 Chevrolet. To get to that point, energy companies “have to agree to work differently,” said Schlumberger’s Belani. Schumberger planted its flag when it opened its Technology Innovation Center in 2015 less than a mile west of Stanford University. Oil-industry veterans and newly minted tech geeks work together in the two-story building that dutifully uphold Silicon Valley traditions, with a ping-pong table, bean- bag chairs, catered lunches and yoga classes. “It’s really trying to bring that oilfield expertise and insert it into the mix of a Silicon Valley, digital- technology way of working," said Jan Smits, an engineer who is Schlumberger’s head of software technology. “That’s where the magic happens.”

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase Special Coverage News Agencies News Release 19 April 2017 For Oil's Future, Peer Through the Hedges By Liam Denning In oil, like life, the secret to happiness is to lower your expectations. That isn't just a piece of homespun, nihilist wisdom. It's what's happening beneath the surface of the oil market. Hedging is how exploration and production companies manage their market risk. Locking in a price for future output -- by, for example, selling oil futures -- provides certainty on cash flow. This not only helps management sleep at night. More importantly -- in an industry as profligate as this one -- it helps their bankers and shareholders rest easier, too; maybe even dream a little. So data on hedging by producers provides some insight on where their head is at. And, fortunately enough, Matt Hagerty and Peter Pulikkan of Bloomberg Intelligence have just released a detailed survey of 37 E&P companies pumping an estimated 4.2 million barrels a day. Their data show E&P companies getting by with less these days. First, a little history. The chart below shows the net short position of swap dealers in Nymex crude oil futures and options. This is a proxy for hedging activity by E&P companies (which generally use swaps dealers to establish their hedging positions). The lower the number, the more oil sold short, or hedged. I've marked some periods to show what oil prices and rig counts were like at those times: A Short History E&P firms boosted hedging activity during the shale-oil boom from 2011 through 2014; pulled back in the crash; and are back to hedging again

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 There are three phases there: 1. 2007 to 2008: Peak-oil supply thinking, implying prices were only going up, was all the rage. Meanwhile, fracking was focused on natural gas. So industry hedging of oil was minimal. 2. 2009 to 2014: Oil prices crash and rebound while gas prices crash and don't. E&P companies switch their focus to fracking for oil, so the oil-rig count soars and so does hedging to help finance fracking. 3. Late 2014 to present: Oil prices crash and so does drilling. OPEC-led efforts to support prices stabilize the market, leading E&P companies to resume drilling, and hedging to help fund it. The real plot twist there concerns price. During the first shale wave that crested and broke in 2014, the 12-months forward oil "strip" (or average price) was bobbing around at $100 a barrel, a very attractive level at which to sell future production. Since early 2016, as E&P firms have resumed drilling and hedging again, the strip has been more like $50 to $55. I wrote here about how $50 seemed to have become a threshold for E&P companies either cranking up or turning down, due in part to productivity gains made under pressure. Bloomberg Intelligence's hedging survey strengthens the point. Out of their 37 companies, 32 have hedged some of their anticipated oil production for 2017. Overall, 43 percent of that output is hedged at an average price of $50 and change a barrel. In the Permian shale basin, the engine of U.S. production growth, a dozen E&P companies in the survey have hedged an even higher share of this year's expected output at even lower prices: 64 percent at a weighted average of $49.43 a barrel. One or two bigger producers, such as Concho Resources Inc., actually skew that average higher; the median price is less than $47 a barrel. More For Less Permian-focused E&P companies have hedged a lot of their expected oil production for 2017 -- and at less than $50 a barrel, on average It isn't as if these companies like getting less than $50 a barrel, or are making a prediction on prices. It is just that, for the purposes of funding their businesses -- including growth plans -- it is a price they can live with.

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 This is why, in a slew of reports released this week by OPEC, the Energy Information Administration and the International Energy Agency, estimates of U.S. oil production growth for 2017 were all revised higher. This, along with OPEC members maxing out production ahead of their cuts and (something to watch) softer demand than expected, mean the oil market has proven slow to tighten. All of which leaves OPEC and its partners in a bind as they head towards next month's meeting. Even the strongest in their ranks, such as Saudi Arabia, can only stomach $50 a barrel for so long (while basket cases such as Venezuela face catastrophe). It is pretty much a given that the cuts will be extended at the meeting in order to drain more oil from the glut of inventories built up in the last few years. Yet this raises a thorny problem. As of now, only 21 of the 37 companies in the Bloomberg Intelligence survey have hedged any of their anticipated oil production for 2018, and these hedges cover less than 10 percent of it. The Permian set have hedged more, but still only 22 percent. The current futures strip for 2018 is $54 and change, around where futures prices for the rest of the decade have stabilized since early 2016 even as near-month prices have bobbed up and down. While futures prices are not predictions, the stability of those longer-term futures suggest that U.S. shale producers' costs, as reflected in their hedging programs, are expected to be price setters in the oil market in the next few years. Fixed Horizon While front-month oil futures have whipped around, stability for longer-term ones has shifted from a level around $85 to around $50-$55 a barrel In other words, if shale producers can live with oil at $50 or thereabouts, then others will have to adapt themselves to that level. Moreover, if OPEC "succeeds" in pushing up price expectations with extended supply cuts, Permian producers will thank them in the only way they know how. Namely, by laying on more hedges for 2018, using the cash to produce more oil -- and thereby pulling those prices back down. That said, the current market is close to that level: Average Nymex prices so far this year and current futures prices add up to an implied average for 2017 of $53.43 a barrel.

- 23. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase April 2017 K. Al Awadi