New base 1053 special 20 july 2017 energy news ilovepdf-compressed

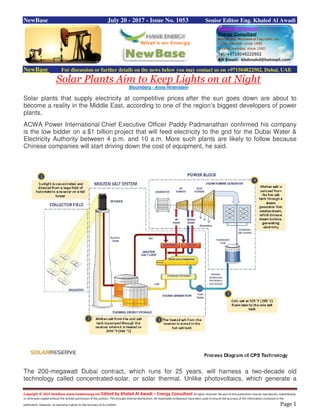

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase July 20 - 2017 - Issue No. 1053 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Solar Plants Aim to Keep Lights on at Night Bloomberg - Anna Hirtenstein Solar plants that supply electricity at competitive prices after the sun goes down are about to become a reality in the Middle East, according to one of the region’s biggest developers of power plants. ACWA Power International Chief Executive Officer Paddy Padmanathan confirmed his company is the low bidder on a $1 billion project that will feed electricity to the grid for the Dubai Water & Electricity Authority between 4 p.m. and 10 a.m. More such plants are likely to follow because Chinese companies will start driving down the cost of equipment, he said. The 200-megawatt Dubai contract, which runs for 25 years, will harness a two-decade old technology called concentrated-solar, or solar thermal. Unlike photovoltaics, which generate a

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 charge directly from the sun’s power, thermal plants use mirrors to concentrate heat on water, turning it to steam to drive a turbine. The heat can be stored in molten salt to be used later. The technology to date has slipped behind PV on cost but is quickly becoming more competitive, the executive said. “I expect concentrated-solar power, within 18 months, to be head to head with combined-cycle gas, if not more competitive,” Padmanathan said in an interview in London. “The focus has been on PV and batteries, but there’s a limit on how long they can hold a charge for. We’re proving that CSP can work through the night.” Since it can retain heat, the plant can keep working after dark. The sun’s energy in some cases can heat molten salt to 490 degrees Celsius (914 degrees Fahrenheit), which allows operators to predict when electricity will flow. Uncertain Outlook While solar thermal plants are becoming cheaper, PV costs are falling too, raising questions whether the Dubai project really will be as attractive as ACWA expects, said Jenny Chase, head of solar analysis at Bloomberg New Energy Finance. “This plant in Dubai is for delivery by 2021,” Chase said. “By then, we’re expecting solar PV and batteries to be in the same order of magnitude for cost and will be a lot more flexible than a solar thermal plant. Also, a lot of these projects are operating below what they’re meant to, such as the entire Spanish fleet and some in India as well.” There are 319 gigawatts of photovoltaic panels installed worldwide, compared to about 5 gigawatts of solar thermal, according to BNEF data. The mass deployment has driven down costs of solar panel equipment by about 70 percent since 2010, with the latest record set in Abu Dhabi at 2.45 cents per kilowatt-hour. In comparison, solar thermal was around 15 to 18 cents per kilowatt-hour until recently. China hosts 80 percent of the world’s PV solar manufacturing industry. The nation’s expertise at mass production is credited with making solar panels more affordable, although companies are now reviving work on thermal technology. More Suppliers “There are currently just two suppliers in solar CSP,” Padmanathan said. “The others have gone bankrupt. I know of at least five Chinese companies that are starting to enter the market.” ACWA, which is based in Riyadh, Saudi Arabia, bid 9.45 cents per kilowatt-hour, almost cutting in half the cost of concentrated-solar power. Each of the bidders were also asked to submit an alternative tender. The offtaker will choose between the bid and the alternative bid, so the price may be even lower. ACWA has also built similar projects in Morocco’s Noor solar complex and South Africa’s desert. One in each nation are operating, with two more in Morocco and one in South Africa currently under development. ACWA is also seeking to build two more projects in Morocco in the Midelt area, which will have a joint capacity of 350 megawatts. “I’m also hoping to build one in Saudi,” Padmanathan said. “Right now they’re tendering for solar PV and wind, but I think they’ll want a CSP project as well, especially when they see how cost competitive it can be.”

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Kuwait's Ethylene 2 Plant resumes production KUWAIT, 18th July, 2017 (WAM) Kuwait's Ethylene 2 Plant Tuesday resumed operation following a brief shutdown for technical considerations last week, the EQUATE Group announced today. "Operations at our EU2 have resumed normally in record time following repairs. Both the Ethylene Glycol and Polyethylene plants in Kuwait have returned to the usual production levels as they were impacted by the temporary shutdown of EU2," the Kuwait News Agency, KUNA, quoted EQUATE Group’s President and CEO Mohammad Husain as saying. The EU2 has a production capacity of 850,000 metric tons annually and is owned by The Kuwait Olefins Company, TKOC, part of the EQUATE Group. The dedication and efforts of EQUATE Group’s employees were lauded by Husain as operations resumed two weeks ahead of the planned schedule in absolute conformity with safety standards. The EQUATE Group is a global producer of petrochemicals and the world’s second largest producer of Ethylene Glycol (EG).The Group has industrial complexes in Kuwait, North America and Europe that annually produce over 5 million tons of Ethylene, EG, Polyethylene (PE) and Polyethylene Terephthalate (PET).

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi Aramco WorleyParsons awarded contract for Marjan field Source: WorleyParsons WorleyParsons has been awarded the project management and front end engineering and design (FEED) services for the offshore oil and gas facilities portion and the onshore upstream and downstream pipelines portion of Saudi Aramco’s Marjan Oil Field Development Program. Under the agreement, WorleyParsons will provide project management and FEED services. The services will be executed from WorleyParsons’ office in Al-Khobar in the Kingdom of Saudi Arabia with support from other WorleyParsons offices. WorleyParsons awarded FEED contract for Saudi Aramco's Marjan field 'We are pleased to build on our relationship with Saudi Aramco through this significant contract' said Andrew Wood, Chief Executive Officer of WorleyParsons.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Saudi Aramco considers Zuluf oilfield expansion REUTERS/Ali Jarekji State oil firm Saudi Aramco is considering building new facilities to add production of Arabian Heavy crude from the Zuluf offshore oilfield, industry sources said. The central processing plant is expected to have two units, known as trains, with a total capacity of 600,000 barrels per day (bpd) to process Arabian Heavy crude supplied by electrical submersible pumps (ESP). "ESPs are required in this Zuluf increment because the Arabian Heavy reserves have a lower reservoir pressure than the Arabian Medium reserves," said Sadad al-Husseini, a former executive vice president at Saudi Aramco. He said the artificial lift and pressure maintenance would achieve optimum production rates and economics, while also ensuring effective reservoir management. Zuluf was one of the largest offshore oilfields in the world and held extensive proven Arabian Medium and Arabian Heavy reserves, said Husseini, who is now an energy analyst. The gas and condensate will be sent to the new Tanajib gas plant, which is part of the new Marjan programme. Saudi Aramco declined to comment on the report. Saudi Aramco is expected to invite companies to bid for front-end engineering and design later this month with an award seen in September. Like the Marjan increment, it will take until 2021 for the project to be completed, one of the sources said. Industry sources estimate Zuluf's production capacity is between 550,000-600,000 barrels per day. Aramco has an oil production capacity of 12 million bpd. Saudi Aramco's CEO Amin Nasser said this month the firm planned to invest more than $300 billion in the coming decade "to reinforce its pre-eminent position in oil, maintain its spare oil production capacity and pursue a large exploration and production programme centered on conventional and unconventional gas resources." Saudi officials have said the firm's investment plans aim to compensate for any declining fields elsewhere rather than adding to total capacity. Saudi Aramco has recently launched studies to expand its offshore oilfields Berri and Marjan. Besides Zuluf, sources expect to increase oil output from other offshore fields, such as Safaniya. Saudi Aramco has previously estimated that the five offshore oil fields Safaniya, Marjan, Zuluf, Berri and Abu Safah, a field it shares with Bahrain, accounted for more than 20 percent of the kingdom's daily production.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Egypt sets sights on doubling natural gas output by 2020 Egypt has been seeking to speed up gas production from recently discovered fields, with an eye to halting imports by 2019 ….Reuters + ( images by NewBase) Three recently discovered major gas fields are expected to raise Egypt’s natural gas output by 50 per cent in 2018 and 100 per cent in 2020, the petroleum ministry said. The fields of Zohr, North Alexandria and Nooros are among the most important projects that will increase natural gas production ... and will contribute to (Egypt’s) natural gas self-sufficiency by the end of 2018,” Petroleum Minister Tarek El Molla said in a statement, which set out the production forecasts. Egypt’s natural gas production rose to about 5.1 billion cubic feet per day in 2017 from 4.4 billion cubic feet in 2016 with the start of production from the first phase of BP’s North Alexandria project. Egypt has been seeking to speed up gas production from recently discovered fields, with an eye to halting imports by 2019. Once an energy exporter, it has become an importer after domestic output failed to keep pace with rising demand. The three large projects, which include the mammoth Zohr Mediterranean gasfield discovered by Italy’s Eni last year, are expected to collectively bring 4.6 billion cubic feet of gas per day online by the start of 2019. Eni began production at Nooros, its Nile Delta offshore field, in September 2015. Egypt is in talks with its liquefied natural gas (LNG) suppliers to defer contracted shipments this year and aims to cut back on purchases in 2018, as surging domestic gas production pushes back demand for costly imports.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Tanzania: Wentworth Resources update on its Mnazi Bay asset Source: Wentworth Resources Wentworth Resources reports that, further to the Operational Update in June 2017 including an update on the Company's Mnazi Bay asset in Tanzania, it is pleased to report that further payments have been received from Tanzania Petroleum Development Corporation ('TPDC') and Tanzania Electric Supply Company Limited ('TANESCO') totalling $1.2 million net to Wentworth, bringing the total cash received for invoiced gas sales to $7.9 million in 2017. Since 31 March 2017, receivables from TPDC have remained consistent at four months and receivables from TANESCO have improved from thirteen months to eight months. The Mnazi Bay Partners continue to work closely with the Government of Tanzania to settle the remaining outstanding invoices. As expected, daily production volumes during the rainy months of April and May were impacted by the use of hydroelectric power. However, since the end of the rainy season, gas demand has increased with June volumes averaging 45 MMscf/d bringing the average for Q2 to 31 MMscf/d. Furthermore, the Company has experienced a temporary increase in volumes since the start of Q3 due to maintenance work elsewhere in the pipeline system with July month-to-date averaging 71 MMscf/d. We maintain our guidance for 2017 averaging between 40 - 50 MMscf/d. In relation to the recent legislative changes in Tanzania and the introduction of three new bills relating to the mining and oil & gas sectors, the Company has undertaken a review of these new laws to determine their implications on the Company's Tanzania operations. Based on our current understanding of this new legislation and given the existing terms and conditions of our relevant agreements we do not anticipate any material impact on our existing operations. The Company will report Q2 results on 10 August 2017 and will be holding a conference call for analysts and shareholders that day. Geoff Bury, Managing Director, commented: 'We are pleased to have received further payments from TPDC and TANESCO which demonstrates their commitment to settle invoices as soon as practicable. The payments received year to date have enabled the Company to meet its obligations and we continue, along with our Operator, Maurel et Prom, to work with the Government to resolve the payment delays and clear all arrears. It is very encouraging to see production volumes increase post the end of the rainy season and we remain confident in achieving our production guidance for the year.'

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 UK: Independent Oil and Gas submits Field Development Plan for the Blythe and Elgood fields in the Southern North Sea.. Source: Independent Oil and Gas Independent Oil and Gas has announced that it has submitted the Field Development Plan ('FDP') to the UK Oil and Gas Authority ('OGA') for the Blythe Hub, which comprises the Blythe and Elgood fields. This follows on from IOG's submission of a draft FDP for only the Blythe field in December 2016. The Blythe and Elgood gas fields are 100% owned and operated by IOG and located in the UK Southern North Sea close to existing infrastructure and other IOG-owned licences. Blythe contains independently verified 2P reserves of 34.3 billion cubic feet ('BCF') (6.1 million barrels of oil equivalent, ('MMBoe') and Elgood 22 BCF of 2C resources (4.3 MMBoe). A new Competent Persons Report ('CPR') currently being completed for the Blythe Hub will soon provide up-to-date independently verified estimates of the reserves and resources. Neither Blythe nor Elgood requires further appraisal and on FDP approval the Elgood resources would be upgraded to 2P. The Blythe Hub is expected to provide the first gas for IOG via the recommissioned Thames Pipeline and therefore the first revenues to the Company from its current portfolio of assets. IOG is in the process of completing the 100% acquisition of the pipeline which is intended to be tested and recommissioned. There are significant synergies with the 100%-owned Vulcan Satellites Hub, containing independently verified 2C resources of 321 BCF (55.45 MMBoe), which is also intended to be exported via the Thames Pipeline. IOG is also 100% owner of the Harvey discovery, which lies between the Blythe and Vulcan Satellites Hubs. Harvey needs further appraisal and is currently estimated to have P50 recoverable resources of 113 BCF (19.5 MMBoe). Mark Routh, CEO and Interim Chairman of IOG commented: 'We are very pleased to have delivered the Blythe Hub FDP for approval to the OGA, thanks to the team's extensive development work. This is a major step forward from the single-field draft submission in December 2016. The Blythe Hub is of great strategic value to IOG alongside the larger Vulcan Satellites Hub. Commercial negotiations continue to be progressed upon the basis of deferrals of a substantial proportion of contractor costs as well as prepayments from potential gas offtakers to help meet the funding requirements. This aligns all our partners to ensure an efficient project and help create value for all stakeholders. We look forward to providing further updates in due course.'

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 India Approves Creation of State Oil Giant in $4.6 Billion Deal By Debjit Chakraborty India approved the sale of a $4.6 billion stake in state-run refiner Hindustan Petroleum Corp. to the country’s biggest oil and gas explorer, according to a person with knowledge of the decision. The move fulfills a plan, first outlined in February, to create an Indian oil giant through consolidation and mergers, forming a company comparable with international rivals that could weather crude-price volatility. Bringing HPCL into its fold will make Oil & Natural Gas Corp. the nation’s No. 3 refiner after Indian Oil Corp. and Reliance Industries Ltd. "This deal will make both ONGC and HPCL stronger as the benefits of synergy are huge," ONGC Chairman Dinesh Kumar Sarraf said in a phone interview on Wednesday. "It will add value to shareholders of both companies." The cabinet backed the plan to sell the government’s 51.1 percent holding in HPCL to ONGC, the person told reporters, asking not to be identified because the information isn’t public. The stake is valued at about 299 billion rupees ($4.6 billion), based on Wednesday’s closing stock price. That’s more than 40 percent of the 725 billion-rupee target in India’s asset disposal plan for the fiscal year to March 2018. Prime Minister Narendra Modi’s administration received 462.47 billion rupees from divestmentslast fiscal year, exceeding its goal. The HPCL stake sale is unlikely to trigger an open-offer rule as the government’s holding is being transferred to another state-run firm. Under India’s takeover code, if a company acquires more than 25 percent of another listed entity, it has to make an open offer to buy at least 26 percent more. Spending Plans ONGC is running low on funds as it has raised spending amid a decline in costs for exploration services and equipment. The acquisition may threatensome of its near-term investments including a plan to revive a long-delayed project aimed at cutting the nation’s energy imports. Why India is creating an oil and gas giant - a QuickTake explainer Apart from a proposed $4.5 billion investment in its oil and gas blocks this financial year, ONGC plans to spend a further $1.2 billion to acquireGujarat State Petroleum Corp.’s stake in a block off India’s east coast. The company had surplus cash of 130.14 billion rupees as of March 31, down from 246.9 billion rupees a year earlier, according to an exchange filing. "We have chalked out a funding plan and that would include a portion of debt as well," Sarraf said, without giving details. He also said that the deal won’t affect any other ONGC investments.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 GCC on track to add 1.5 mbpd refining capacity by 2021 Apicorp Energy Research ( images by NewBase) GCC is leading the greenfield projects and refinery expansion drive in the Middle East with 1.5 million barrels per day (mbpd) of new refining capacity expected online by 2021, a report said. The new capacity will be dominated by the two major additions in Saudi Arabia and Kuwait, as well as clean fuel projects in the region, added the July edition of Apicorp Energy Research. They will adhere to stringent European requirements for cleaner fuels, and will thus provide GCC refineries with a competitive edge in a tough market. At the same time, these refinery additions are changing global trade flows, with the region exporting more refined products, particularly to Europe. As global capacity rises and fuel standards improve, competition will become more intense meaning a more uncertain outlook awaits the region’s refineries. The GCC refining sector has seen tremendous growth over the past few years, mainly driven by significant government investments during a period of high oil prices. Governments have prioritised the expansion of the downstream sector for several reasons. First, the region has witnessed rapidly rising demand for gasoline and diesel in the transportation sector, as well as diesel and fuel oil in the power sectors of Saudi Arabia and Kuwait. Second, governments are seeking to diversify away from crude exports towards more specialised refined products. Third, they are also committing to create more value in their economies by integrating the crude, refining and petrochemical industries.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Refinery additions have shifted trade flows Of the recent 1.2 mbpd of additional capacity, diesel represents over half, while gasoline and jet fuel output stood at around 350,000 bpd and 140,000 bpd. These additions have had a measurable impact on trade flows, particularly in the diesel market. Prior to the recent ramp ups, Kuwait and Bahrain had been the only two net diesel exporters in the region. As for gasoline, refineries in GCC countries were built to meet domestic demand. As a result, Saudi Arabia has become a net exporter of diesel, with cargos competing in the European market. Thanks to the GCC region's geographical position between Europe and Asia, its refineries have turned into competitors to their Asian counterparts, especially in the overcrowded diesel segment. For example, Saudi Arabia had historically been a net importer until 2014; however, by 2016, the country had evolved into a net exporter of over 300,000 bpd. This surge in diesel exports is attributed to the mainly diesel- oriented refineries that were recently built and geared towards increasing production in anticipation of rising demand in Asia, particularly China. As for gasoline, Saudi Arabia became a marginal net exporter of gasoline in 2016 after historically having been a net importer. In 2016, the kingdom exported 5,000 b/d, coming from an average net import level of 55,000 bpd and 60,000 bpd in 2015 and 2014. Second wave of expansion in the GCC region Despite the oil price collapse since mid-2014, the region is still seeing significant investments in its refining sector. The

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 main additions that came online in the past 12 months were condensate splitters in Qatar and Iran, which are geared towards producing gasoline and naphtha. In 2016, the Ras Laffan 2 condensate splitter added approximately 150,000 b/d of capacity. This will reduce the country’s condensate exports from 500,000 bpd to 350,000 bpd, allowing the country to refine domestically before exporting. The splitter will mainly produce naphtha (60,000 bpd) and jet fuel (53,000 bpd), with the remaining being small amounts of gasoline and LPG. In the period 2017-21, the region will continue its expansion plans with the 600,000 bpd Al Zour refinery in Kuwait and the 400,000 bpd Jazan project in Saudi Arabia being the major additions. The Jazan refinery is expected to commence operation in 2018-19 while the Al Zour refinery is expected towards the end of the decade. The rest of the additions will come from the Duqm refinery and the Sohar expansion in Oman. The 230,000 bpd Duqm refinery -a joint venture between Oman Oil Company and Abu Dhabi's International Petroleum Investment Company (now merged with Mubadala) -is likely to come online in 2020. In addition, Bahrain's plans to expand the Sitra Refinery, which aim to add 100,000 bpd to the existing 260,000 bpd, are ongoing. In total, the GCC countries are expected add 1.5 mbpd of refining capacity between 2017-21, although the recent shutdown of the 200,000 bpd Shuaiba refinery in Kuwait means that net additions in the medium term will be 1.3 mbpd. Uncertain longer-term outlook The surge in refining capacity in the past decade was mainly a response to rising domestic demand but also an effort to diversify away from crude exports and integrate the crude, refining, and petrochemical industries. It is also having an impact on trade flows. The year 2016 marked a milestone for the GCC region as it became a net exporter of all refined products, although a marginal exporter of gasoline. On the other hand, diesel exports are expected to lead the way, having reached over 500,000 bpd in 2016, up from 310,000 bpd in 2015.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 The slowdown in economic activity and the limited price reforms that were introduced in early 2016 have already impacted demand growth in the region, with diesel demand in Saudi Arabia hit particularly hard. Further price reform will likely have a more significant impact on domestic demand, possibly freeing up more refined products for exports. In the medium term, there are plans to further increase refining capacity, but the outlook beyond 2021 is less certain. The Al-Zour project in Kuwait as well as the Sitra expansion programme faced financing challenges which caused delay for several years, before finally reaching financial closure. On the other hand, tough competition in the products market and weakening demand is putting further pressure on the refining industry. The recently commissioned projects, as well as the ones expected online in the next five years, are in the process of turning the region into a leading hub for exports of refined products. As elsewhere, the new refineries in the Middle East have been configured mainly to produce diesel to cater for the anticipated increase of diesel demand from Asia, particularly from China. However, China’s economic rebalancing away from manufacturing towards consumer goods and services has changed demand patterns within the country: diesel demand, related to heavy industry and transport of goods, is flat-lining, while gasoline demand related to personal transportation continues to grow. This has turned China into a net exporter of diesel. With US exports of distillates surging to record levels, Russia upgrading its refineries to produce more distillates, and Indian refineries ramping up their production, the competition in the products market, particularly in the diesel segment, has become more intense. However, GCC export-oriented refineries might stand to benefit from the recent International Maritime Organisation rules which would alter demand patterns as fuel oil is replaced by diesel in 2020.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase 20 July 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil steady after drop in US fuel stocks, but markets remain bloated Reuters + NewBase Oil prices held steady on Thursday, hanging on to gains made the previous session when falling U.S. crude stocks lifted the market, as analysts offered mixed supply outlooks for the commodity ahead of a key OPEC meeting next week. Crude oil prices are still capped below the key $50-per-barrel mark on concerns about high supplies from the Organization of the Petroleum Exporting Countries (OPEC) despite its pledge to cut output along with non-OPEC producers. Brent crude futures, the international benchmark for oil prices, were at $49.66 per barrel at 0512 GMT, just 2 cents down from their last settlement. U.S. West Texas Intermediate (WTI) crude futures were at $47.10 per barrel, 2 cents below their last close. Prices jumped more than 1.5 percent in the previous sessions for both crudes on a report showing U.S. crude and fuel stocks fell in the United States last week. U.S. crude inventories fell by 4.7 million barrels in the week to July 14, according to data from the Energy Information Administration, against analyst expectations for a decrease of 3.2 million barrels. Oil price special coverage

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 "Over the past 15 weeks, U.S. oil inventories have fallen ... 13 times, and in most cases, the falls were more pronounced than expected," said Fawad Razaqzada, market analyst at futures brokerage Forex.com. "Yet, U.S. crude oil inventories still remain near the upper half of the average for this time of the year," he added. The ongoing high U.S. inventories - crude stocks are now just over 490 million barrels - as well as high output from OPEC are preventing prices from rising much further, traders said. OPEC and non-OPEC producers are due to meet in St. Petersburg, Russia, next Monday to discuss the current situation in oil markets. OPEC, along with Russia and other non-member producers, has pledged to cut production by 1.8 million barrels per day (bpd) between January this year and March 2018. A lack of compliance by some, though, and exemptions for Nigeria and Libya have undermined that OPEC-led effort, preventing prices from rising by much. Analysts, however, pointed to rising political risk factors, including potential U.S. sanctions on Venezuela and tensions in the Middle East and North Africa, that could impact oil prices. Crude Oil Price Forecast July 20, 2017, Technical Analysis WTI Crude Oil The WTI Crude Oil market initially went sideways during the session on Wednesday, but as the Crude Oil Inventories number came out, it showed that demand had picked up for crude oil, so obviously drunk price higher. It looks as if the market is struggling near the $47 level though, so it’ll be very interesting to see how this turns out. At the first signs of exhaustion, I would be a seller as we are getting a bit stretch, but if we can break above the $47 level, it’s likely that the market will go looking for the $48 level. Either way, expect volatility but it looks as if the buyers are starting to flexor muscles a bit. Brent Brent markets of course did the same thing, slicing towards the $49.50 level. I think there is a massive amount of resistance near the $50 handle, and a break above there would be a major sign of strength. However, the market should continue to go much higher. I think that the $50 level is going to be very difficult to overcome, as it is a large, round, psychologically significant number, and of course previous support and resistance on the longer-term charts. Alternately, if we break down below the $49 level, the market should continue to go much lower, perhaps reaching towards the $48 level. I expect a lot of volatility, but it looks as if the markets are trying to rebalance themselves a bit, and that perhaps supply is starting to dwindle down a bit. However, longer-term it can only go for so long, as there is a plethora of American wells that are almost completed. In other words, if oil continues to rise in value, those wells will be utilized.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Three Years Into Cheap Oil, Gulf Is Still Depending on a Rebound Bloomberg - Ahmed Feteha Energy-rich Gulf Arab nations have scrambled to adjust to the slump in oil prices since 2014. Three years on, their economies are mired in weak growth and largely just as dependent on crude as they ever were. The six members of the Gulf Cooperation Council have curtailed subsidies and introduced new taxes to bolster non-oil revenue and reduce ballooning budget deficits. Much of the savings, however, have been due to spending cuts and the pace of reforms has slowed across the region, said Monica Malik, chief economist at Abu Dhabi Commercial Bank. Overall progress in economic diversification has been limited, she said. Absent a rebound in oil prices, analysts say it’s unlikely that these nations can repair their finances without deeper spending cuts that could further hurt growth. The standoff between a Saudi-led bloc and Qatar is also undermining investor confidence at a time when the GCC is seeking foreign funds. Five charts illustrate oil’s dominance and the challenges facing the region. First-quarter budget data from Saudi Arabia and Oman showed an improvement in their budget deficits alongside higher oil revenue, after the price of Brent crude rose to as high as $57.10 per

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 barrel in January. It has since retreated under $50, well below what the two nations need to balance their budgets. Saudi Arabia, OPEC’s biggest producer, increased non-oil revenue in 2016 and introduced taxes on tobacco products and soda drinks in June this year. The government, however, reversed a decision to cut the bonuses and some allowances of state employees. A second round of subsidy cuts will also likely be delayed to later in 2017 or early next year, according to people with knowledge of the matter. Risk Perception The average cost of protecting government bonds of Saudi Arabia, the U.A.E., Kuwait and Qatar was at a three-year low about six weeks ago, when the Qatar dispute erupted. It has since jumped by about 40 percent to 94 basis points, according to data compiled by Bloomberg. “The Qatar situation has an added an element on the political and economic risk side, so it is not surprising to see risk perceptions going up,” said David Butter, associate fellow at Chatham House in London. “Most countries in the GCC are still in relatively solid financial positions,” he said, but there are “underlying issues” around the long-term sustainability.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Growth Suffers Austerity measures and oil-output cuts are weighing on economic growth in the region. The Saudi economy contracted in the first three months of this year for the first time since 2009. The International Monetary Fund expects average growth in the GCC to slow to 0.9 percent this year, compared with 5 percent during the last oil boom between 2000 and 2013. “We’re going to see poor levels of growth across the GCC on lower oil production, although they’ve been helped in the first quarter by the relatively higher prices,” Butter said. Vulnerable Pair Bahrain and Oman have the lowest credit ratings of the GCC nations, with less oil to sell, thinner fiscal buffers and in Bahrain’s case, more debt. That picture is unlikely to change unless crude prices rise dramatically. Bahrain needs $101.1 a barrel for its budget to break even, the highest among Middle East and North African net oil exporters, according to the IMF.

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Oman’s budget deficit soared to about 21 percent of GDP last year, the highest in the GCC. Official data shows little progress made on fiscal consolidation in the first four months of this year. Blessing in Disguise? Yet for Qatar, the world’s biggest exporter of liquefied natural gas, the economy’s reliance on hydrocarbons is proving to be a blessing in disguise. Revenue from LNG and oil exports has remained intact through the diplomatic row. And while Standard Chartered Plc economists expect Qatar’s non-oil economy to slow this year as a result of the crisis, they still see overall gross domestic product expanding 2.5 percent -- little changed from 2016.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase Special Coverage News Agencies News Release 20 July 2017 Saudi Arabia and the oil cuts countries needs or problems By Liam Denning ( title revised by NewBase ) The felines in this case are the countries making up the Vienna Group, which agreed to cut oil production to support prices. This strategy hasn't been terribly successful thus far, despite most of the 24 countries involved delivering on their promises, more or less. Brent crude oil is now roughly where it was before the agreement was announced in November and 10 percent below where it was when the cuts were extended in late May. The pain of those low prices led one of the cats to call it quits on Tuesday. Ecuador, which is implementing an austerity plan and struggling to clear a $1.1 billion backlog of unpaid pensions, said it can't continue to forgo the revenue lost from cutting a nominal 26,000 barrels a day as part of the agreement. At current prices, that's worth about $465 million a year. Now, as Ecuador's oil minister said when announcing this, “What Ecuador does or doesn’t do has no major impact on OPEC output.” That is true in strict mathematical terms. Bit Part Ecuador accounts for just 1 percent of the Vienna Group's agreed output cuts

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 Saudi Arabia's own oil minister, Khalid Al-Falih, has been relying more on the power of rhetoric, with a central banker-like promise to do "whatever it takes" to clear the glut of excess barrels weighing on prices. It is telling that, not long after Ecuador announced it was cutting loose, a report surfaced that Saudi Arabia was considering a unilateral reduction in exports of a further 1 million barrels a day. This would help offset this year's surge in Nigerian and Libyan production, two sick cats exempted from the original agreement but now being called upon to do their part, too. Yet this is exactly the situation Saudi Arabia wanted to avoid. The whole point of getting other countries to join with OPEC's cuts -- Russia, in particular -- was to reassert the cartel's powers of persuasion in the futures market and make sure Saudi Arabia didn't have to act as cutter of last resort (it could, after all, use the money to help ease the pains of its rather ambitious reform program.) Besides Libya and Nigeria, Iraq is another concern. Producing 4.4 million barrels a day, the country's compliance with its agreed cuts has slipped from more than 80 percent in April to less than 30 percent. Meanwhile, tensions are high within OPEC's core, the Gulf monarchies engaged in a tense face-off with Qatar. Ecuador may be a kitten in the grand scheme of things. But its departure, and the (perhaps coincidental) signal that Saudi Arabia might shoulder even more of the burden encourages moral hazard in a group that hardly needs encouraging. This column does not necessarily reflect the opinion of NewBase and its owners.

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

- 23. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase July 2017 K. Al Awadi

- 24. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24