New base energy news 24 november issue 1298 by khaled al awadi

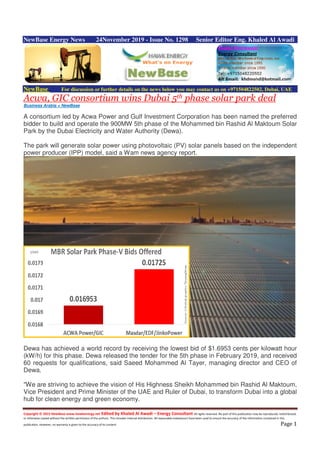

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 24November 2019 - Issue No. 1298 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Acwa, GIC consortium wins Dubai 5th phase solar park deal Business Arabia + NewBase A consortium led by Acwa Power and Gulf Investment Corporation has been named the preferred bidder to build and operate the 900MW 5th phase of the Mohammed bin Rashid Al Maktoum Solar Park by the Dubai Electricity and Water Authority (Dewa). The park will generate solar power using photovoltaic (PV) solar panels based on the independent power producer (IPP) model, said a Wam news agency report. Dewa has achieved a world record by receiving the lowest bid of $1.6953 cents per kilowatt hour (kW/h) for this phase. Dewa released the tender for the 5th phase in February 2019, and received 60 requests for qualifications, said Saeed Mohammed Al Tayer, managing director and CEO of Dewa. "We are striving to achieve the vision of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, to transform Dubai into a global hub for clean energy and green economy.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 We also support the Dubai Clean Energy Strategy 2050 to provide 75 percent of Dubai’s total power output from clean energy by 2050 and make Dubai the city with the lowest carbon footprint in the world. To achieve this, Dewa launched several leading renewable projects, including the Mohammed bin Rashid Al Maktoum Solar Park, the largest single-site solar park in the world. Using the IPP model, it will have a capacity of 5,000MW by 2030 with investments totaling Dh50 billion," said Al Tayer. "The 900MW 5th phase of the solar park using PV solar panels based on the IPP model will become operational in stages starting Q2 of 2021. The project documents, Power Purchase Agreement (PPA), and financial close agreements will be signed in due course," added Al Tayer. The projects at the Mohammed bin Rashid Al Maktoum Solar Park, the largest single-site solar park in the world, are of great interest to international developers and reaffirms investor confidence in the major projects that are supported by the Government of Dubai. Dewa has attracted huge investments to the UAE from the private sector and foreign banks, leading to increased cash flow to the economy of Dubai and the UAE. The Current total production capacity of solar projects at the solar park is 713MW. Dewa is building three other projects with a total capacity of 1,250MW. The 900MW 5th phase of the solar park will increase the production capacity to 2,863MW.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE: Abu Dhabi receives bids for planned 2GW solar scheme The National + NewBase Abu Dhabi utility firm, Emirates Water and Electricity Company (EWEC), received bids for a planned 2 gigawatt solar photovoltaic project being developed in the Al Dhafra region of the emirate. The company, a subsidiary of Abu Dhabi Power Corporation, tendered financing, construction, operation and maintenance packages for the solar plant in July, for which 24 firms pre-qualified to bid. An award is expected in the first quarter of next year, the company said. An aerial view of the 1.7GW Noor Abu Dhabi project which started commercial operations in June. Wam "A range of international energy sector experts" and international consortia submitted bids on the scheme, a company spokesman said, declining to specify a number. The project, which will be built via an independent power producer (IPP) model, will be spread across an area of 20 square kilometres and could provide electricity to 110,000 households across the UAE, according to EWEC. IPPs are typically not owned by the state but build and operate power plants for the sale of electricity to buyers, which could include a utility, the government or end users. No details were available on the number of phases over which the project will be developed or the potential commercial start date for the plant. The company spokesman said further details will be made available following the award of the contract next year. The UAE accounts for 4 per cent of global oil output, much of it from producing fields in Abu Dhabi. The emirate has begun diversifying its energy mix, adding solar and nuclear sources to its grid, as it looks to free up its hydrocarbons for the export markets.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 The planned 2GW PV project follows the start-up in June of the 1.7GW Noor Abu Dhabi plant. That project, built at a cost of Dh3.2 billion, is a joint venture between Abu Dhabi Power Corporation, Japan's Marubeni and China's Jinko Solar. EWEC was created earlier this year following a presidential decree, replacing Abu Dhabi Water and Electricity Company as part of efforts by the utility regulator, Federal Electricity and Water Authority, to consolidate power and water generation assets across the emirate. Bidders on the Dhafra solar scheme were also offered "an optional bid" for battery storage following "substantial market interest", the company said. The option would allow for an expansion of storage capacity from the existing six-hour, 108 megawatts available in the Abu Dhabi grid. The company declined to comment on battery storage capacity that would be built for the scheme.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 India Modi makes biggest privatisation push in decade to spur economy Bloomberg + NewBase India’s Prime Minister Narendra Modi is putting the flagging economy back on centre stage after announcing the biggest privatisation drive in more than a decade and making renewed attempts to ring fence the crisis-ridden shadow banking sector. The country is in the midst of a deepening slowdown amid waning consumption – the bedrock of the $2.7tn economy. And while Modi has targeted transforming India into a $5tn economy by 2025, of late, most of his attention has been focused on asserting a more muscular foreign policy and placating the Hindu majority – his main voting base – by scrapping autonomy in India’s lone Muslim-majority state of Jammu and Kashmir. On Wednesday, Indian authorities went into overdrive. The government decided to sell its entire stake in the country’s second-largest state refiner, and its biggest shipping company. It also approved a proposal to pare stakes below 51% in some companies and pushed for an introduction of a new industrial code bill. Meanwhile India’s central bank seized a troubled shadow lender to try and contain defaults from spreading in Asia’s third-largest economy. “This is Modi’s renewed attempt to instill confidence in India’s economic potential,” said Priyanka Kishore, head of India and Southeast Asia Economics at Oxford Economics, Singapore. She added it was imperative for the Modi government to announce these measures as it attempts to bridge a widening fiscal deficit following the dismal tax collections and cuts to corporate tax rates worth $20bn.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Earlier this month Moody’s Investors Service cut the country’s sovereign debt outlook to negative amid concerns over slowing growth and revenues. After winning a second consecutive term earlier this year promising rapid economic development, Modi is realising his popularity and support going forward hinges on passing tough reforms that unleash growth – and create jobs – in Asia’s third-biggest economy. The economy expanded 5% in April to June, the slowest in six years and a far cry from 8% seen just a year ago. Modi is seeking to raise a record Rs1.05tn from asset sales. He has so far has resisted big-ticket privatisation and restricted sales of its holdings to other state companies, including the Rs369.2bn ($5.14bn) sale of Hindustan Petroleum Corp to the biggest explorer Oil & Natural Gas Corp last year. Now his administration is selling the government’s entire stake in Bharat Petroleum Corp and Shipping Corp of India Ltd. “The government’s steep $15bn – 5% of its total revenues – disinvestment target in FY’ 20 may in our view need to be higher given the recent cut in the corporate tax rate and policymakers’ focus on macro stability,” said Gautam Chhaochharia, head of India research at UBS Securities India Pvt Ltd, Mumbai. The administration’s focus on getting the economy back on track comes as it plans to offer 324 companies including Tesla Incand GlaxoSmithKline Plc incentives to set up factories in a bid to capitalise from the trade war between China and the US. India has jumped 14 places to 63rd in the World Bank’s annual rankings for ease of doing business, rolled back a levy on foreign funds, injected $10bn into sick banks and relaxed foreign direct investment rules in coal mining, contract manufacturing and single-brand retail trading. The Reserve Bank of India is also poised to cut rates further after having delivered 135 basis points of rate reductions so far this year. On Wednesday, it moved to seize control of a second non-bank lender, Dewan Housing Finance Corp, stepping up efforts to contain the economic fallout from the nation’s shadow banking crisis. The year-long crisis in the shadow banking sector has snowballed to become a drag on consumption and pulled down overall growth. “While the markets will view this as positive, the move also goes to deflect the investor attention away from the government’s non-economic agenda,” said Prakash Sakpal, Economist with ING Bank NV in Singapore. “Despite massive stimulus both the RBI and government has unleashed this year, the economy continues to be stifled as will be shown by the forthcoming GDP figures.”

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 U.S Futures markets signal lower natural gas prices in 2020 Source: U.S. Energy Information Administration, based on S&P Global Platts The current outlook for U.S. natural gas prices at several key regional hubs reflects market expectations for lower prices in January and February 2020. Two factors account for generally lower prices: lower natural gas futures prices at the U.S. benchmark Henry Hub location and lower regional differentials to the Henry Hub (known in natural gas markets as the basis). The Henry Hub price is lower because of continued production increases. Note: Futures prices reflect settlements as of November 20, 2019. Natural gas basis swaps and futures contracts are generally financial instruments that reflect the difference between the futures price of natural gas at the benchmark Henry Hub in Louisiana and the forward price of natural gas at another delivery point elsewhere in the country. Large values often indicate transportation congestion on pipelines between producing regions and demand markets. Pacific Northwest: The basis price at the Sumas hub in the U.S. Pacific Northwest was relatively high in early 2019 following the October 2018 pipeline explosion in British Columbia, Canada, and the resulting lower natural gas flows to the U.S. Pacific Northwest. As pipeline flows into the region have recovered, natural gas prices in the Pacific Northwest have fallen. Trade press reports indicate that in January and February 2020, traders expect the Sumas price to average $1.25 per million British thermal units (MMBtu) higher than Henry Hub. In January and February 2019, the Sumas basis averaged $1.53/MMBtu. Chicago: For January and February 2020, trade press reports indicate that traders anticipate that the Chicago Citygate basis will be about $0.26/MMBtu higher than at the Henry Hub, similar to the 2019 difference for those same months. EIA expects that large volumes of low-cost natural gas from the Appalachia Basin will continue to flow into the Midwest. Increased deliveries of natural

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 gas to the Midwest could limit the Chicago price premium compared with the Henry Hub despite expected increases in demand for space heating in January and February. New England: New England’s Algonquin Citygate price is typically significantly higher that the Henry Hub price throughout winter because of high heating demand and high utilization and constraints on key natural gas pipelines in the region. In January and February 2019, spot prices at Algonquin Citygate were $5.30/MMBtu above Henry Hub. Trade press reports indicate that, in January and February 2020, traders expect that the Algonquin Citygate price will average $5.10/MMBtu more than the Henry Hub price. Southern California: Trade press reports indicate that traders expect lower natural gas prices for Southern California compared with last winter. In January and February 2019, the SoCal Citygate natural gas price was about $2.70/MMBtu more than at Henry Hub. In mid-November, the futures price at SoCal Citygate for January and February 2020 has been trading $1.66/MMBtu higher than the Henry Hub price. In the past year, Southern California pipeline operators have increased pipeline capacity in the region, and California regulators have allowed more flexibility in withdrawing natural gas from the Aliso Canyon storage facility that was curtailed in October 2015 because of leaks. West Texas: Continued crude oil and natural gas production in the Permian Basin in western Texas and eastern New Mexico has led to pipeline constraints as production exceeded available pipeline capacity to deliver the natural gas to markets. The recent completion of the Gulf Coast Express pipeline added 2 billion cubic feet per day (Bcf/d) of takeaway capacity in the region, partially alleviating this constraint, but natural gas production in the region has continued to increase. Trade press reports indicate that traders expect the price at the West Texas Waha hub in January and February 2020 will be $1.27/MMBtu lower than the Henry Hub, a narrower basis than the negative $1.57/MMBtu average in

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 NewBase 24 November 2019 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Crude Oil Price Forecast – Crude Oil Markets Pullback To In The Week WTI Crude Oil The West Texas Intermediate Crude Oil market pulled back slightly during the Friday session, as we continue to see the $60 level offer a bit of resistance. That being said though, the weekly candlestick is a bit of a hammer and it does suggest that there is a lot of bullish pressure underneath. With that being the case, I suspect that if we can break above the $60 level the WTI market is going to go looking towards the next resistance above, at the $62.50 level. Pullbacks at this point should be a buying opportunity, down near the 200 day EMA at the $57 level, and of course the 50 day EMA at the $56 level. Brent Brent markets have broken down a little bit on Friday, perhaps in a sign of exhaustion as we are near the 200 day EMA. At this point, it’s likely that the market may need to pullback in order to build up a bit of momentum, but what should be noted is that the weekly candlestick is a hammer, and that of course is a very bullish sign. That doesn’t mean that we break out to the upside right away, because the $65 level of course has offered resistance, but if we can break above there then we will start to chew through the “resistance zone” that extends all the way to the $67.50 level above. I like buying pullbacks, and I believe that in the short term the $60 level should be thought of as a short-term “floor.” Oil price special coverage

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.S. oil drillers cut rigs for fifth week in a row: Baker Hughes U.S. energy firms this week reduced the number of oil rigs operating for a fifth week in a row and the rig count has dropped 24% year-on-year as producers cut spending on new drilling. Drillers cut three oil rigs in the week to Nov. 22, bringing the total count down to 671, the lowest since April 2017, energy services firm Baker Hughes Co said in its closely followed report on Friday. The oil rig count, an early indicator of future output, has already declined for a record 11 months in a row as independent exploration and production companies cut spending on new drilling as shareholders seek better returns in a low energy price environment. “Nearly two-thirds of the rig count drop over the past 12 months was due to privately held companies idling their drilling rigs,” according to a report this week by energy information provider Enverus, formerly known as Drillinginfo. “During this period, a net 29% of private operators, who were drilling at the beginning of this period, have since suspended all of their U.S. drilling operations,” Everus said. Even though the rig count has declined, oil output has continued to increase in part because productivity - the amount of oil new wells produce per rig - has increased to record levels in most U.S. shale basins. ConocoPhillips unveiled a long-term plan on Tuesday to boost oil and natural gas production by about 3% per year, restrain annual spending to about $7 billion and return $50 billion to shareholders over the next decade. The largest U.S. independent crude producer, which has been divesting assets to focus on shale, said it will spend about $4 billion per year on shale, running about 20 drilling rigs across four fields, and boosting shale production from more than 400,000 barrels per day next year to around 900,000 bpd by the end of the decade. U.S. crude oil output from seven major shale formations is expected to rise about 49,000 bpd in December to a record 9.13 million bpd, the government said in its latest monthly forecast. U.S. crude futures traded near a two-month high at around $58 per barrel on Friday, putting the contract on track for a third week of gains on expectations of an extension to production cuts by the Organization of the Petroleum Exporting Countries and its allies. Looking ahead, U.S. crude futures were trading at $56 a barrel in calendar 2020 and $53 in calendar 2021. U.S. financial services firm Cowen & Co this week said 22 of the exploration and production (E&P) companies it watches reported spending estimates for 2020. Cowen said there were 16 decreases, one flat and five increases, implying a 13% year-over-year decline in 2020, which puts spending on track to decline for a second year in a row. Cowen has said the producers it watches expected to spend about $80.5 billion in 2019 versus $84.6 billion in 2018. Year-to-date, the total number of oil and gas rigs active in the United States has averaged 958. Most rigs produce both oil and gas.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase Special Coverage News Agencies News Release 24 August 2019 Satellite Studying Volcanoes Finds Giant Oilfield Methane Plume The monitoring of pollution from oil and gas fields achieved a major breakthrough after a satellite company discovered a methane leak in Central Asia equivalent to the fumes of a million cars. In a study published Friday, Montreal-based GHGSat Inc. said it was searching for emissions at mud volcanoes when it discovered the giant plume apparently deriving from unlit flaring in the Korpezhe oil and gas field in western Turkmenistan. The release, persistent in images captured from early last year through February, was the first discovery of an unknown industrial methane leak from space, GHGSat President Stephane Germain said. The company then tapped U.S., Canada and European diplomatic channels to alert the Turkmenistan field operator, Germain said in a telephone interview. They didn’t communicate with the company directly, but more recent images show the emissions had stopped by May. “This is the equivalent of taking one million passenger vehicles off the road,” Germain said. “This scientifically provides first detection” by satellite, he said.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Satellite observations of methane plumes in the Korpezhe oil and gas field of western Turkmenistan . Calls and messages to Turkmenistan’s state gas producer and energy ministry weren’t immediately answered. The find demonstrates how satellites can be used “to enable corrective action to fight climate change,” according to the research published by the American Geophysical Union’s Geophysical Research Letters journal. It comes at a time when the oil and gas industry faces mounting pressure to reduce emissions of methane, one of the most harmful greenhouse gases. Flaring is the burning of unwanted natural gas released from oil fields, converting it into carbon dioxide and avoiding the release of methane. Often, high winds and equipment malfunctions can extinguish the flames. GHGSat was capturing images scaled to 144 square kilometers (55 square miles) in Central Asia to explore and calibrate emissions detection from naturally occurring mud volcanoes to compare to land-based measurements. Their satellite couldn’t detect the small quantities from the mud volcanoes but it did pick up on three unexplained bright spots nearby. The second source appears to be from a pipeline, potentially due to a valve release, Germain said. A third smaller one, which also appears to be from an unlit flare, cropped up a few times.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Methane emissions from the oil and gas sector reached close to 80 Mt (or 2.4 billion tonnes of CO2 equivalent) in 2017. This is equal to 6% of global energy sector GHG emissions. Emissions remain high despite initial industry-led initiatives and government policies announced recently. Implementing abatement options quickly and at scale remains a real challenge. Policies will be critical to achieve the 75% emissions reduction by 2030 demonstrated in the SDS. Further innovation is needed both to increase understanding of emissions levels and to help reduce the cost of emissions mitigation strategies such as leak detection and repair Evaluating emissions trends The concentration of methane in the atmosphere is currently 2.5 times higher than pre-industrial levels. Methane has important implications for climate change, particularly in the near term. Although it has a much shorter atmospheric lifetime than CO2 – around 12 years, compared with centuries for CO2 – it absorbs much more energy while it exists in the atmosphere (one tonne of methane absorbs 84 to 87 times more energy than one tonne of CO2 for the first 20 years after being emitted to the atmosphere.) The energy sector was responsible for 130 Mt of methane emissions in 2012, (Saunois at al., 2016). Although emissions occur during coal and biofuel production and consumption, oil and gas operations are likely the largest source of emissions from the energy sector. Global oil- and gas- related methane emissions in 2017 were estimated to be 80 Mt. There is considerable uncertainty about oil and gas methane emissions levels, however, as estimates are based on sparse and sometimes conflicting data, and there is wide divergence in estimates at the global, regional and country levels. Nevertheless, enough is known to conclude that these emissions cannot be ignored and that they represent a clear risk to the environmental credentials of natural gas.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Technology performance A wide variety of technologies and measures is available to reduce methane emissions from oil and gas operations: these are generally well known and well understood. Devices such as vapour recovery units and plunger lifts can be installed, while existing devices can be replaced with lower-emitting alternatives such as instrument air systems, pneumatic pumps and electric motors. Another cost-effective mitigation option is leak detection and repair (see Innovation section below), which is critical to detect and mitigate fugitive (or accidental) methane leaks. Since methane is a valuable product, and in many cases can be sold if it is captured, the IEA estimates that around 45% of the 80 Mt of methane emissions that occur today could be avoided with measures that would have no net cost. In spite of this, methane emissions from oil and gas operations appear to remain stubbornly high. Trends are diverging strongly from those of the Sustainable Development Scenario (SDS). In the SDS, all technology options are quickly deployed across the oil and gas value chains – even if those measures cannot pay for themselves – leading to a 75% fall in emissions from current levels by 2030. Industry-led initiatives and policy actions Multiple international oil companies (IOCs) have set targets to restrict emissions or the emissions intensity of production. There are also a number of voluntary, industry-led efforts to reduce methane emissions from oil and gas operations: • The Methane Guiding Principles (MGP) established in 2017 is a multi-stakeholder collaborative platform incorporating over 20 institutions from industry, intergovernmental organisations (including the IEA), academia, and civil society. The principles aim to advance understanding and best practices for methane emissions reduction and to develop and implement methane policy and regulation. • The Oil and Gas Climate Initiative (OGCI) aims to improve methane data collection and develop and deploy cost-effective methane management technologies; it consists of thirteen major international oil and gas companies. In 2018, OGCI members announced a target to reduce the collective average methane intensity of its aggregated upstream gas and oil operations to below 0.25% by 2025 (from 0.32% today), with an ambition to ultimately achieve a level of 0.2%. • The Oil & Gas Methane Partnership (an initiative of the Climate and Clean Air Coalition) provides protocols for companies to survey and address emissions and a platform for them to demonstrate results. It consists of group of ten oil and gas companies, governments, UN Environment, World Bank, and the Environmental Defence Fund. However, there are limits to what can be achieved by voluntary action because the pool of those willing to take such action is limited, and because the actions themselves may fall short of what is desirable from a public policy perspective. Policies and regulations are therefore essential to bring emissions more into line with the SDS. Emissions reduction policies are not as ubiquitous as they should be, but some progress has been made: • Canada has introduced regulations to cut methane emissions 40-45% by 2025 from the 2012 baseline. The provinces of Alberta, British Columbia and Saskatchewan have

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 additional regulatory measures in place to address venting and flaring from upstream oil and gas operations. • The United States is in a similar position, and several states (including California, Colorado, Ohio, Pennsylvania, Utah and Wyoming) have their own regulation and standards on methane emissions that accompany or amplify obligations arising from federal rules. These vary in scope, but all require mandatory inspection of facilities at varying intervals. • Many European countries have regulations on reporting and limiting emissions levels. In Norway, for example, each oil and gas facility estimates and reports methane emissions annually using a common estimation method that relies on standard emission factors; methane emissions from venting are taxed. Recommended actions Quantitative targets set by IOCs to restrict emissions are a welcome first step to help bring this subsector closer to SDS alignment. For companies already claiming low emissions, seeking to continuously reduce emissions is as valuable as quantitative limits. Third-party verification and transparency on data and methods are also essential for credible reporting. In addition, large volumes of methane are emitted from assets not operated by IOCs. A critical near-term step will be for IOCs to apply their leakage criteria to oil and gas produced from joint ventures and non-operated assets. Along with these voluntary efforts, policies and regulations will be central to methane emissions reductions. Methane emissions reduction commitments can be an important addition to Nationally Determined Contributions in line with the Paris Agreement. Although improving data gathering and reporting is a key first step, a lack of detailed information on emissions levels should not preclude the introduction of emission abatement goals. Policies should concurrently seek to encourage operators to take advantage of abatement opportunities. Some of the key considerations and principles that could inform methane emissions reduction strategies are set out below. They are likely to be most successful if carried out in stages to help maximise effectiveness and efficiency while shifting emissions trends. Emphasise data gathering: uncertainty about current emissions levels is high, and reducing this through direct measurement is critical to improve understanding of the issue, to measure progress against goals, and to develop and refine objectives and targets. There are large data gaps that need to be addressed for multiple major gas producing and consuming regions, including Russia and the Middle East. Set an overall emissions reduction goal: these can be expressed both in broad, qualitative terms and as specific, quantitative and time-bound targets. Foster innovation: the lack of technological innovations to detect emissions and deliver reliable measurements at low cost is a key technology gap that needs to be a focus of both public support and private initiatives. Methane management can also be embedded in the oil and gas industry’s ongoing digitalisation efforts. Maximise transparency: measurement and analysis protocols (including existing datasets) could be shared within and among the industry and regulators to facilitate consistent approaches to quantification and abatement and to help spur implementation.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Ensure widespread engagement during the design of regulations: it is essential to explain why regulation is required, and then consult on how it is to be achieved, with the aim of securing support and buy-in from as broad a stakeholder group as possible. Incentivise collaboration: industry partnerships between international and national oil companies can provide a powerful impetus for the adoption of best practices in regions where policy and regulatory frameworks are less developed. Oilfield service companies, technology firms and auditing firms can also be involved. Establish enough enforcement: effective enforcement entails deciding how oversight and regulation should be carried out, determining which institution is to be charged with regulation or enforcement, providing leadership and resources for that institution, and establishing meaningful disincentives that support behavioural change, such as penalties for non-compliance. Incorporate flexibility into measurement and abatement policies: this might be done through various means, including allowing for adjustments to overall goals over time if interim milestones are either exceeded or not met. Focus on outcomes: in deciding the specific practices, standards, technologies, certification systems and quantitative limits to be introduced, it is important to bear in mind the overarching emissions reduction goal and to focus on the outcomes to be achieved. Encourage new corporate thinking on methane emissions reduction: while some companies view the minimisation of methane emissions as a central pillar of their operations, others appear to attach much less importance to it.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18