More Related Content Similar to New base 01 march 2021 energy news issue 1411 by khaled al awadi 2021 (20) More from Khaled Al Awadi (20) 1. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 1

NewBase Energy News 01 March 2021 - Issue No. 1411 Senior Editor Eng. Khaled Al Awadi

NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

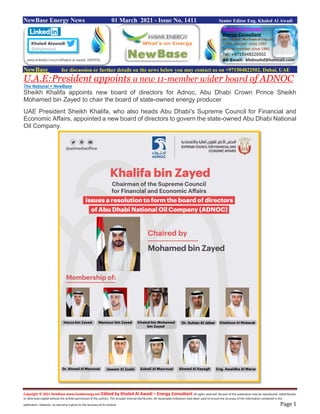

U.A.E:President appoints a new 11-member wider board of ADNOC

The National + NewBase

Sheikh Khalifa appoints new board of directors for Adnoc, Abu Dhabi Crown Prince Sheikh

Mohamed bin Zayed to chair the board of state-owned energy producer

UAE President Sheikh Khalifa, who also heads Abu Dhabi's Supreme Council for Financial and

Economic Affairs, appointed a new board of directors to govern the state-owned Abu Dhabi National

Oil Company.

2. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 2

The new board will be chaired by Sheikh Mohamed bin Zayed, Crown Prince of Abu Dhabi and

Deputy Supreme Commander of the Armed Forces, and will include the company's group chief

executive Dr Sultan Al Jaber, who has additionally been appointed managing director of Adnoc.

Dr Al Jaber, who is also the Minister for Industry and

Advanced Technology, is also part of an executive

committee of Adnoc's board which includes energy

minister Suhail Al Mazrouei, Mubadala Investment

Company chief executive Khaldoon Al Mubarak, chairman

of Abu Dhabi's Department of Finance Jassem Al Zaabi

and Minister of State, Ahmed Al Sayegh.

The executive committee will be chaired by Sheikh Khaled

bin Mohamed bin Zayed, who is a member of the Abu

Dhabi Executive Council and the chairman of the Abu

Dhabi Executive Office.

Adnoc's new board of directors includes Sheikh Hazza bin Zayed, Sheikh Mansour bin Zayed,

Sheikh Khaled bin Mohamed bin Zayed, Dr Al Jaber, Khaldoon Al Mubarak, Ahmed Mubarak Al

Mazrouei, Jassem Mohammed Al Zaabi, Suhail Al Mazrouei, Ahmed Ali Al Sayegh and Awaidha

Murshed Al Marar.

The new board of directors takes over from the Supreme Petroleum Council (SPC), which previously

governed Adnoc. The council formerly known as the SPC ratifies Adnoc's annual five-year spending

plan, discoveries of new resources and allocation of concessions to international energy companies.

The SPC was replaced in December by the Supreme Council for Financial and Economic Affairs,

with Sheikh Khalifa as the chairman and Sheikh Mohamed bin Zayed as its vice-chair. The

constitution of Adnoc's first board marks a significant milestone in the group's evolution from a

national oil firm to an integrated energy company with a growing international reach.

The new council was established to support Abu Dhabi's competitiveness and its economic and

financial sustainability.

It will set financial and economic policy and will oversee the approval of strategies for a number of state-

owned entities including Adnoc, Mubadala Investment Company, Abu Dhabi Investment Authority and

holding company ADQ. The council has the oversight over the Department of Finance but it will operate with

autonomy on a day-to-day basis.

The UAE, Opec's third-largest producer, accounts for nearly 4.2 per cent of global output of oil. Most of the

production comes from fields owned and operated by Adnoc in Abu Dhabi. The national oil company has

streamlined its operations under Dr Al Jaber, who was appointed to his existing position in 2016.

Under his leadership, Adnoc invited partnerships from international investors into its upstream concessions

and also opened up opportunities across its midstream and downstream assets to foreign capital. Last year,

the company forged a number of agreements with global asset managers across its value chain, attracting

$16.8 billion in foreign direct investment into the UAE. The Abu Dhabi firm also plans to spend $122bn over

the next five years, of which $43.5bn will be directed towards the local economy.

Adnoc pumps almost all the oil and gas in the United Arab Emirates, the third-biggest crude producer in

OPEC. Sultan Al Jaber, Adnoc’s chief executive officer, has been given the additional title of managing

director and will sit on both boards.

The decision comes after Abu Dhabi in December merged the Supreme Petroleum Council, which used to

set the government’s energy policy, with a new Supreme Council for Financial and Economic Affairs. Most

of the Adnoc board members were on the SPC.

3. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 3

Pacific Islands to enhanced renewables ambition under climate goals

Source: International Renewable Energy Agency (IRENA)

In a year of critical action on climate mitigation and adaptation, Pacific Island governments have

reinforced their commitment to energy transition action and strengthened sustainable energy goals

within updated nationally determined contributions (NDCs) ahead of COP26 in Glasgow, the United

Kingdom in November.

At a meeting of high-level policy and

intergovernmental representatives jointly

hosted by the International Renewable

Energy Agency (IRENA), the Regional

Pacific NDC Hub and the UK COP26

Presidency, ministers and government

representatives reiterated the need for

transformative pledges that significantly

reorient the world’s energy transition

pathway. Pacific nations aim to be at the

forefront of global efforts.

During the discussion, H.E Charles Obichang, Minister of Infrastructure, Palau, reaffirmed his

country’s commitment to a sustainable energy future:

'Palau is developing a new roadmap that will ultimately result in a 100 per cent fossil fuel free energy

system. The pursuit of energy security through renewable energy makes environmental, social and

economic sense for us, helping to fight climate change while creating opportunities for new

industries and new jobs. Renewables are an opportunity for us to thrive in a new era of fossil fuel

free energy production.'

Currently, 13 of the 14 Pacific Small Island Developing States (SIDS) have quantified renewable

energy targets in their NDCs, submitted under the first round of Paris Agreement climate pledges,

equating to nearly 2GW of renewables

capacity. All Pacific SIDS are engaged in a

process of NDC enhancement ahead of

COP26 under the coordination of the Regional

NDC Pacific Hub and with support of various

development partners. Fiji, Marshall Islands,

Papua New Guinea and Tonga have already

submitted enhanced contributions.

Angeline Heine, Director of Energy, Republic of

the Marshall Islands, noted that in order to meet

multiple national objectives, her country’s

strategy is organised around three pillars:

'As a front liner on climate change the Republic of the Marshall Islands is fully committed to meeting

its NDC objective of 100 per cent renewable energy by 2050. Our goal is ambitious, but our

electricity roadmap has identified three key priorities, which address the technology, human

resources, and investment components of the plan. We believe this ensures our transition is owned

and advanced by the Marshall Islands people.'

Countries are given the opportunity to submit enhanced NDCs by COP26 by revising and enhancing

mitigation and adaptation targets, finance goals, and developing concrete action plans for the

implementation, formulation, and communication of long-term emission reduction strategies in 2020.

4. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 4

Representing the UK government, H.E Ken O’Flaherty, COP26 Ambassador for Asia and the

Pacific, spoke of the opportunity for Pacific leadership both during, and in the lead up to, the climate

meeting later this year:

'The consequences of a warming planet will be catastrophic, particularly for citizens of the Pacific.

COP26 can be the moment when the world comes together to ramp up momentum towards a

climate resilient, zero-carbon economy and Pacific leadership can deliver the changes we need to

see in the world. Many Pacific states have already committed to net-zero targets in their revised

NDCs, which serve as inspiration for other countries to raise ambition.'

Francesco La Camera, Director General, IRENA, highlighted the global role Pacific Islands play in

decarbonisation:

'Pacific SIDS have become remarkable hubs of innovation on climate strategies, and a source of

inspiration for the rest of the world. Even as they are severely impacted by deadly natural disasters,

they continue to lead on climate action with steadfast resolve.

While many Pacific nations set ambitious targets in their first NDCs, there is no doubt regional

leadership shown in enhanced NDCs can inspire global efforts to drive meaningful action this year.'

Christian Gorg, Project Manager, Regional Pacific NDC Hub, said as the focus moves from ambition

to implementation of the Paris Agreement goals, countries will need well-structured programmes to

drive renewables development:

'Energy is a common mitigation strategy among regional countries, and while their carbon emissions

are insignificant their commitments are bold. The energy transformation can only be realised if

countries understand their policy context, recognise any potential legislative barriers to

development and are aware of the financing options available.'

A total of USD 5.2 billion of investment is needed by 2030 to implement what is currently targeted

under the region’s NDCs, according to IRENA data based on the first round of NDCs. IRENA is

working closely with several countries across the Pacific to enhance the renewable energy

component of new NDCs for submission ahead of COP26.

5. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 5

EU officials urge World Bank to exclude fossil-fuel investments

Reuters + NewBase

Senior officials from Europe have urged the World Bank’s management to expand its climate change

strategy to exclude investments in oil- and coal-related projects around the world, and gradually

phase out investment in natural gas projects, according to three sources familiar with the matter.

World Bank Group1 Finance to Fossil Fuels since the Paris Climate Agreement

In the six-page letter dated on Wednesday, World Bank executive directors representing major

European shareholder countries and Canada, welcomed moves by the Bank to ensure its lending

supports efforts to reduce carbon emissions.

But they urged the Bank — the biggest provider of climate finance to the developing world — to go

even further.

“We… think the bank should now go further and also exclude all coal- and oil-related investments,

and further outline a policy on gradually phasing out gas power generation to only invest in gas in

exceptional circumstances’’, the European officials wrote in the letter, excerpts of which were seen

by Reuters.

6. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 6

The officials took note of the World Bank’s $620 million investment in a multi-billion dollar liquified

natural gas project in Mozambique approved by the Bank’s board in January, but did not call for its

cancellation, one of the sources said.

The World Bank confirmed receipt of the letter but did not disclose all its contents. It noted that the

World Bank and its sister organisations had provided $83 billion for climate action over the past five

years.

“Many of the initiatives called for in the letter from our shareholders are already planned or in

discussion for our draft Climate Change Action Plan for 2021-2025, which management is working

to finalise in the coming month’’, the Bank said in an emailed statement. The Bank’s first climate

action plan began in fiscal year 2016.

The United States, the largest shareholder in the World Bank, this month rejoined the 2015 Paris

climate accord, and has vowed to move multilateral institutions and US public lending institutions

toward “climate-aligned investments and away from high-carbon investments.”

World Bank President David Malpass told finance officials from the Group of 20 economies on

Friday that the Bank would make record investments in climate change mitigation and adaptation

for a second consecutive year in 2021. “Inequality, poverty, and climate change will be the defining

issues of our age’’, Malpass told the officials.

‘‘It is time to think big and act big in finding solutions’’, He said it was also launching new reviews to

integrate climate into all its country diagnostics and strategies, a step initiated before the letter from

the European officials, said one of the sources.

World Bank Group Fossil Fuel Project Finance Since the Paris Climate Agreement1

:

By Bank Division2

(million US$)

7. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 7

India’s Biggest Oil Retailers Are Focusing on Rural Revival

Bloomberg

Villagers fill their tractor at a Hindustan Petroleum Corp. station in rural Uttar Pradesh. The

agricultural sector is the second-biggest consumer of diesel after transportation. Photographer:

Sanjit Das/Bloomberg

If there’s one part of India’s economy that’s been relatively unscathed by the devastating impact of

Covid-19 it’s the vast rural hinterlands. And the country’s biggest fuel retailers are sitting up and

taking notice.

Stay-at-home orders first imposed from March last year had a disproportionate impact on India’s

teeming cities, but in small towns and villages people mostly went about their business with fewer

restrictions. A bumper agricultural crop and a splurge in government spending to pull the economy

out of a slump is also expected to put more money into the hands of rural farmers and laborers.

The increasing economic importance of India’s hinterlands is influencing business expansion plans

and accelerating a trend of more service stations being opened in the countryside. Bharat Petroleum

Corp. and Hindustan Petroleum Corp. -- two of the three biggest fuel retailers -- both said they

planned to raise the proportion of outlets they have in rural areas this year.

Rural Push

Indian fuel retailers looking to countryside for growth

“While the first-level cities are getting saturated, demand is coming up in rural areas,” Hindustan

Petroleum Chairman Mukesh Kumar Surana said. The new outlets Hindustan is looking to open

8. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 8

would “have a reasonable component of second-rung cities and rural areas without any doubt,” he

said.

India is pinning its hopes on the agricultural sector to help the economy recover after its worst

recession since the 1950s. Rural India was a bright spot in local automaker Mahindra & Mahindra

Ltd.’s latest financial results amid strong demand for tractors and farm equipment. The rural sector

continues to outperform urban India, Ambuja Cements Ltd. Chief Executive Officer Neeraj Akhoury

said on a conference call with analysts last month.

A farmer uses a tractor to plough a flooded paddy field in Haryana in June 2020.

India’s economy pulled itself out of recession last quarter amid a steady drop in virus cases and as

agriculture continued to perform well. Gross domestic product rose 0.4% year-on-year in the final

three months of 2020, according to data released Friday, after contracting 7.3% in the previous

quarter.

HPC and BPC, together with Indian Oil Corp., account for more than 90% of Indian fuel sales. The

share of rural service stations in the world’s third-biggest oil importer rose to 26.8% in January from

24.8% a year earlier, oil ministry data show, and the rate of increase looks set to accelerate this

year.

Diesel is the most widely used petroleum product in India, accounting for around 40% of total fuel

use. The agricultural sector is the second-biggest consumer of diesel after transportation.

Bharat Petroleum, the second-biggest fuel retailer, opened 2,212 outlets in the past year, with two-

thirds of these in rural areas, the oil ministry data show.

“We weren’t having a presence in the rural segment the way our competition had and that impacted

us in Covid times,” said N. Vijayagopal, finance director at Bharat Petroleum. “So, we are now

targeting an expansion drive of retail in places where we are under-represented -- the rural side.”

9. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 9

From U.S. domination to energy transition, two years that changed oil

Reuters - By Jessica Resnick-Ault

Former U.S. Secretary of State Mike Pompeo took the stage at the world’s largest energy

conference in 2019 to declare an age of U.S. dominance after a decade of rapid shale development

made the United States the world’s top oil and gas producer.

Two years later, the oil industry is recovering from the worst recession it has ever experienced after

measures to contain coronavirus stopped billions of people from traveling and wiped out one-fifth of

worldwide demand for fuel. The U.S. fossil fuel industry is still reeling after tens of thousands of jobs

were lost.

The pandemic has also accelerated the energy transition, interrupting a steady rise in fuel

consumption that may have otherwise continued for several more years unabated. Oil demand may

never recover from that hit. This year, the CERAWeek conference in Houston is entirely virtual and

numerous panels are dedicated to the transition to the low-carbon economy of the future, hydrogen

technologies and climate change.

Microsoft Corp co-founder Bill Gates, U.S. climate envoy John Kerry, and speakers from Amazon

and renewable fuels giant Iberdrola are among the headline speakers.

“The tone is different: There’s one theme that permeates the entire conference and that is energy

transition,” said CERAWeek Founder Dan Yergin, vice chair of IHSMarkit.

Last year’s conference was one of the first major global events to be canceled as the pandemic

started to rage and quickly made it unfeasible to gather thousands of people from 85 countries at

the conference venues.

Since that time, many of the world’s major oil companies have set ambitious goals to shift new

investments to technologies that will reduce carbon emissions to slow global warming. U.K.-based

BP Plc has largely jettisoned its oil exploration team; U.S. auto giant General Motors Co announced

plans to stop making gasoline and diesel-powered vehicles in 15 years.

To be sure, the 2021 program includes oil leaders who typically appear at CERAWeek. They include

Mohammed Barkindo, secretary general of the Organization of the Petroleum Exporting Countries

(OPEC), and the chief executives of Exxon Mobil, Total, Chevron and Occidental Petroleum.

10. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 10

But they will participate in panels focusing on the energy transition. Barkindo will discuss what kind

of a recovery oil and gas will have as future demand is challenged.

BP’s Looney will join Andy Jassy, who is set to become Amazon.com Inc’s CEO later this year, on

a panel about reinventing energy. Occidental CEO Vicki Hollub and Ahmed Al Jaber, United Arab

Emirates minister of state, are slated to tackle cutting carbon emissions.

Oil companies have come under

increasing pressure from

shareholders, governments and

activists to show how they are

changing their businesses from fossil

fuels toward renewables, and to

accelerate that transition.

“This year’s program reflects the reality

of the transition toward a net zero

future,” said Julien Perez, vice

president of strategy and policy for the

Oil and Gas Climate Initiative, a

consortium of major oil companies.

Yergin said Gates will discuss the difficulty in reducing emissions to slow temperature rise around

the world. He is expected to focus on the technologies that are missing, but required, from the

energy transition.

“You’ll often go to conferences where people say, ‘Hey, let’s get companies to report their emissions

and somehow magically make the emissions go away, or we’ll just divest the stocks,’” Gates told

Reuters in an interview earlier this month.

The reality, Gates said, is

much tougher. Many

heavy industries that use

oil and gas are hard to

shift away from those

fuels, and that is where

new technologies are

needed. Steel, for

instance, still relies on

furnaces fired by

metallurgical coal.

“If you’re a steel

company, you’re going to

report a very big

(emissions) number.

People still need basic

shelter, and it’s unlikely we’ll stop building buildings.”

While the shared goal of carbon neutrality has now become widely accepted, finding the best way

to reach that goal is much more difficult, Yergin said.

“Previous energy transitions unfolded over centuries. This is meant to unfold over less than three

decades - that’s a really heavy lift,” he said.

11. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 11

Pakistan enters LNG supply deal with Qatar Petroleum

Gulf News + NewBase

Qatar Petroleum has entered into a new long-term Sale and Purchase Agreement (SPA) with

Pakistan State Oil Company Limited (PSO) for the supply of up to 3 million tons per annum (MTPA)

of liquefied natural gas (LNG) to Pakistan.

Under the 10-year agreement, LNG deliveries

to Pakistan’s world-class receiving terminals will

commence in 2022 and continue until the end of

2031.

The SPA was signed in Islamabad by Saad

Sherida Al-Kaabi, the Minister of State for

Energy Affairs, the President and CEO of Qatar

Petroleum, and Syed Taha, the Managing

Director & CEO of PSO in a special ceremony

held under the patronage and with attendance

of Imran Khan, the Prime Minister of Pakistan,

senior Pakistani government officials and

Sheikh Saoud bin Abdulrahman Al Thani,

Qatar’s Ambassador to Pakistan.

Al-Kaabi said: “We are delighted to enter into this new long-term agreement with Pakistan State Oil

Company Limited and to continue our contributions towards meeting Pakistan’s increasing energy

demand.

“This agreement further extends Qatar’s long standing LNG supply relationship with Pakistan and

highlights our commitment to meeting Pakistan’s LNG requirements. We are confident that the

exceptional reliability of our LNG supplies will provide PSO with the required flexibility and supply

security to fuel Pakistan’s impressive growth.”

“With a well-established gas market and distribution system, Pakistan is a strategically important

market for Qatar LNG. We are encouraged by Pakistan’s exceptional growth and excellent

economic potential as well as by the prospect of it being one of the world’s fastest growing LNG

markets.

I would like to take this opportunity to thank His Excellency Prime Minister Imran Khan for his support

and for his patronage of this special event. I also would like to thank Pakistan’s energy officials as

well as PSO’s management for all their efforts and for the professional and transparent negotiations

leading to today’s important agreement,” Al-Kaabi concluded.

Pakistan currently has two operational LNG receiving terminals, namely the Engro LNG Receiving

Terminal and Pakistan GasPort LNG Receiving Terminal, both of which utilize Floating Storage and

Regasification Units moored in Port Qasim. There are a number of additional terminals currently

under consideration by various private sector players in the country.

This is the second such agreement signed between Qatari and Pakistani entities since 2016, when

Qatargas signed a long-term agreement to supply PSO with 3.75 MTPA of LNG. The agreement

raises the total of long-term LNG supplies from Qatar to Pakistan to 6.75 MTPA. – TradeArabia

News Service

12. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 12

NewBase March 01-2021 Khaled Al Awadi

NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

Oil prices climb after progress on huge U.S. stimulus bill

Reuters + NewBase

Oil prices rose more than $1 on today – Monday 01/03/2021 on optimism in the global economy

thanks to progress in a huge U.S. stimulus package and on hopes for improving oil demand as

vaccines are rolled out.

Brent crude futures for May rose $1.24, or 1.92%, to $65.66 per barrel by 9.04 GMT. The April

contract expired on Friday. U.S. West Texas Intermediate (WTI) crude futures jumped $1.19,

or 1.93%, to $62.69 a barrel.

Oil price special

coverage

13. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 13

“Oil prices are recovering this morning in line with most risk assets on the back of the U.S. stimulus

bill passing the House and as central banks continue to sabre rattle to ward off market-implied

financial tightening,” Stephen Innes, chief global markets strategist at Axi, wrote in a note on

Monday.

U.S. House of Representatives passed a $1.9 trillion coronavirus relief package early Saturday.

Democrats who control the chamber approved the sweeping measure by a mostly party-line vote of

219 to 212 and sent it to the Senate, where Democrats planned a legislative maneuver to allow

them to pass it without the support of Republicans.

More positive news on the coronavirus vaccination front and signs of an improving Asian economy

also boosted prices.

A U.S. Centers for Disease Control and Prevention advisory panel voted unanimously on Sunday

to recommend Johnson & Johnson’s COVID-19 shot for widespread use, and U.S. officials said

initial shipments would start on Sunday.

J&J expects to ship more than 20 million doses by the end of March and 100 million by midyear,

enough to vaccinate nearly a third of Americans.

Over in Japan, a private survey showed factory activity expanding at the fastest pace in over two

years in February, adding to signs of a rebound in Asian growth.

On the flip side, investors are betting that this week’s meeting of the Organization of the Petroleum

Exporting Countries (OPEC) and allies, a group known as OPEC+, will result in more supply

returning to the market.

“More supply needs to come onto the market to ensure OPEC+ meets incremental demand and

keeps internal discipline ducks in a row,” Innes added.

U.S. drillers add rigs for seventh month in a row, pace slows - Baker Hughes

U.S. energy firms this week added oil and natural gas rigs for a seventh month in a row for the first

time since May 2018, but the rate of growth in February slowed even as oil prices rose to their

highest since 2019.

The oil and gas rig count, an early indicator of future output, rose five to 402 in the week to Feb. 26,

its highest since May, energy services firm Baker Hughes Co said in its closely followed report on

Friday.

14. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 14

But with just 18 additions, the pace of increase slowed in February, compared with 33 in January

and 31 in December, partly due to a rare deep freeze in Texas last week and also oil companies’

continuing commitment to capital discipline.

That count is still 388 rigs, or 49%, below this time last year. The total count, however, has soared

since hitting a record low of 244 in August, according to Baker Hughes data going back to 1940.

U.S. oil rigs rose four to 309 this week, their highest since May, while gas rigs rose one to 92.

All of the oil rig additions this week were in the Permian Basin in West Texas, prompting some

analysts to question how producers were able to start drilling again so quickly after last week’s deep

freeze.

“All I heard last week was how the Permian Basin was frozen in,” said Bob Yawger, director of

energy futures at Mizuho in New York. “Now, I am being led to believe ... that crews have already

returned to the frozen tundra and started drilling new holes.”

In February, oil rigs rose for a sixth straight month, gaining 10, their smallest monthly build since

September as their growth slowed from a rise of 28 in January and 26 in December.

After falling to record lows below zero in April 2020 due to coronavirus demand destruction, U.S.

crude futures have climbed over $63 a barrel this week and hit their highest settle since 2019. [O/R]

Most energy firms said they plan to keep spending flat in 2021 with 2020 levels as they focus on

boosting cash flow and reducing debt rather than increasing output.

U.S. financial services firm Cowen & Co said the 45 independent exploration and production (E&P)

companies it tracks plan to keep spending flat in 2021 versus 2020. That follows capex reductions

of roughly 49% in 2020 and 12% in 2019.

15. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 15

NewBase Special Coverage

The Energy world – March 01- -2021

OPEC+ Faces Calls to Cool Oil Market Frenzy With Extra Barrels

Bloomberg - Grant Smith Javier Blas , and Salma El Wardany + Platts + NewBase

From trading houses in Geneva to Wall Street banks, much of the oil world agrees that global

markets could use some more barrels. The big question is whether OPEC+ will provide enough of

them.

A crude glut that piled up during the pandemic is vanishing fast. Global inventories are plunging at

the steepest rate in two decades, according to Morgan Stanley. Prices have rallied to pre-virus

levels, while U.S. production has taken a hit from freezing storms. Talk swirls of market supercycles,

and even the return of $100 oil.

With the need for more supply evident, traders expect the OPEC+ coalition, led by Saudi Arabia

and Russia, will agree to increase production when it meets on March 4, reversing some of the

output cuts made last year.

But it’s unclear if the group will act vigorously enough. Wary of the virus’s persisting threat to

demand, Saudi Energy Minister Prince Abdulaziz bin Salman has urged fellow producers to remain

“extremely cautious.”

16. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 16

If the alliance agrees an output hike that falls short of requirements, however, it could trigger a

further price surge -- and the group would be forced to deal with its unwelcome consequences.

“There’s a real risk they’re going to over-tighten the market,” said Bill Farren-Price, a director at

research firm Enverus and veteran observer of the cartel. “It’s already super-tight, and if OPEC just

focuses on keeping prices up, that’s going to eventually provoke supplies from their rivals.”

The Organization of Petroleum Exporting Countries and its allies rescued the global oil industry from

an unprecedented slump last year by slashing production when the coronavirus crisis pummeled

demand. The strategy has revived international benchmark Brent crude to $67 a barrel, shoring up

revenues for the producers’ battered economies.

The 23-nation coalition continues to idle just over 7 million barrels of daily output -- about 7% of

global supply -- and on Thursday will decide whether to revive a 500,000-barrel tranche in April. In

addition, the Saudis will confirm whether an extra 1 million barrels they’ve recently taken offline will

return as scheduled.

Demand Recovery

Global oil markets are signaling that they could comfortably absorb the full complement of 1.5 million

barrels.

Demand in China, the world’s biggest oil importer, is back above pre-virus levels as its containment

of the disease allows much of normal life and economic activity to resume. India, another key

customer, warns that high prices are jeopardizing the global economic recovery. Propelled by cold

weather, fuel use in Japan, the fourth-largest oil consumer, posted in January its first year-on-year

increase since mid-2019.

In the U.S., stockpiles of crude oil and refined products are back near levels last seen a year ago.

Though demand for aviation fuels remains depressed, purchases of products that cater to working

and consuming at home -- like diesel for trucks and plastics -- have boomed.

OPEC’s own data show it can go ahead with this year’s scheduled production increases and still

manage to deplete world oil inventories, whittling them down to their five-year average -- the group’s

desired target -- by August.

17. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 17

Futures markets testify that supplies are tightening sharply.

Near-term Brent contracts are commanding a sizable premium over later months known as

backwardation, with the six-month spread standing at $3.22 a barrel. That reflects “a sustained,

strong short-term deficit” of about 2 million to 3 million barrels a day, according to Giovanni Serio,

global head of market analysis at Vitol Group, the world’s biggest oil trader.

Bullish Calls

The shift to a tightening market has sparked a wave of bullish projections.

Goldman Sachs Group Inc. sees Brent hitting $75 a barrel in the third quarter as a new commodities

supercycle beckons, while trading giant Trafigura Group says it’s “very bullish” on the months

ahead. Socar Trading SA, a unit of Azerbaijan’s state oil company, predicts $80 could be reached

this summer and triple digits within two years.

“The fear is that in 12 months there will be a shortage” even if OPEC+ revives output, said Socar

Chief Trading Officer Hayal Ahmadzada. “It will drive the price very high, very fast.”

It’s still unclear what exactly OPEC+ will decide.

Russian Deputy Prime Minister Alexander Novak has signaled that the country once again wants to

proceed with an increase, noting on Feb. 14 that “the market is balanced” already. Saudi Arabia

sounds more reserved, urging its counterparts to recall the “scars” of last year’s collapse.

Prices are still far below the levels most OPEC nations need to cover government spending, and

the International Energy Agency -- a leading forecaster -- anticipates a market setback in the

second quarter as a seasonal lull briefly causes inventories to accumulate again.

18. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 18

If Riyadh wants to limit the overall size of the group’s increase, it has a powerful bargaining chip:

the pace it chooses to return the extra 1-million barrel cutback that’s supposed to expire at the end

of next month.

But for some in the market, the kingdom should instead be opening the taps wide. Keeping prices

high will only rekindle investment by U.S. shale drillers, they contend, and bring a flood of new

supply that cancels out OPEC’s hard work.

Even the full 1.5 million barrels isn’t sufficient to satisfy demand, says Jan Stuart, global energy

economist at Cornerstone Macro LLC.

HIGHLIGHTS:

OPEC+ compliance up to 101% with new quotas

OPEC Jan output 25.70 mil b/d, up 270,000 b/d

Non-OPEC allies add 170,000 b/d on Russian surge

Saudi output 9.11 mil b/d; Russia pumps 9.25 mil b/d

OPEC and its allies boosted their crude oil production for the seventh straight month in

January, according to the latest S&P Global Platts survey, as the coalition continued to unwind

its pandemic-prompted output cuts and take advantage of rebounding global demand.

OPEC's 13 members pumped 25.70 million b/d in the month, up 270,000 b/d from December,

while their nine non-OPEC partners, led by Russia, produced 12.91 million b/d, a rise of

170,000 b/d, the survey found.

The volumes bring the alliance's total output rise close to 2 million b/d since May, when it first

started record cuts to pilot the oil market out of its coronavirus nosedive.

19. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 19

January's boost was mainly attributed to ramp-ups by heavyweights Russia, Saudi Arabia, the

UAE and Kuwait, along with a rebound in Iran and Venezuela, two of the three members

exempt from quotas.

Under a deal agreed in early December, quotas were eased by almost 500,000 b/d in January,

which helped lift the group's collective compliance to 101% from 98.5% in December.

Looking ahead, February and March should see total OPEC+ production go down, with price

hawk Saudi Arabia having announced it would unilaterally cut its own output by an additional

1 million b/d in both months, more than offsetting the 75,000 b/d monthly rise granted to Russia

and Kazakhstan. All other members are set to hold their volumes steady.

A key OPEC+ monitoring committee on Feb. 3 reaffirmed the plan, saying it was

encouraged by the rollout of coronavirus vaccines in bolstering the global economic recovery,

which pushed crude prices to one-year highs of over $60/b on Feb. 8. The full coalition will

meet March 4 to decide on April quotas.

Barrels return

Russia posted the largest increase among the group in January, raising output by 170,000 b/d

to 9.25 million b/d, the Platts survey found.

20. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 20

Despite being a co-chair of the monitoring committee, which is tasked with assessing member

compliance, Russia continues to be the worst quota violator, according to OPEC+ data seen

by Platts. It pumped 130,000 b/d above its January cap.

However, Russian crude exports are poised to dip in February as it directs more of its oil to

domestic refineries to address soaring gasoline prices ahead of its driving season, along with

tepid European demand for its crude.

Saudi Arabia, OPEC's largest producer and de facto leader, boosted its output by 100,000 b/d

in January to pump 9.11 million b/d, just 10,000 b/d below its new quota.

Exports from the kingdom fell last month, but domestic consumption rose as the 400,000 b/d

Jazan refinery started test runs, among other factors, according to survey panelists.

Saudi Arabia's extra cut for February and March has tightened the availability of medium sour

crudes, prompting many refiners to scramble for other supplies.

Fellow Gulf producers UAE and Kuwait also posted monthly increases of 40,000 b/d and

20,000 b/d, respectively, the survey found, largely in line with their January allocation.

Reclaiming market share

Iran and Venezuela -- both of which are exempt from the cuts due to US sanctions targeting

their crude exports – added 180,000 b/d to the market in January.

Iranian crude production rose sharply by 100,000 b/d to 2.14 million b/d, its highest since

November 2019, according to the survey.

Iranian crude exports have started to climb in recent months as the country pins its hopes on

improving relations with the US under the Joe Biden administration.

Iran's government has targeted 2.3 million b/d of exports if the sanctions are lifted and has

recently ordered its domestic oil operators to begin increasing production, largely from the

South Azadegan and West Karun fields. Pre-sanctions production capacity was 4 million b/d.

Similarly, Venezuela produced a seven-month high of 500,000 b/d, up 80,000 b/d from

December.

The increase mainly came from state-owned PDVSA's joint ventures in the country's Orinoco

Belt, which contains some of the world's largest reserves.

PDVSA has undertaken a well maintenance plan to repair some of its oil infrastructure, which

has deteriorated due to a lack of investment, exacerbated by US sanctions.

Libya, the third country exempted from OPEC+ quotas, produced 1.14 million b/d in January,

according to the survey, a fall of 40,000 b/d, marking its first month-on-month production fall

since May.

The decline was due to pipeline maintenance that affected the Waha oil fields, and some

exports were also disrupted briefly by strikes at some of Libya's key eastern terminals.

21. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 21

Iraq, Nigeria stay compliant

Iraq produced 3.82 million b/d of crude in January, a fall of 30,000 b/d from the previous month,

as southern exports dipped slightly.

That puts Iraq comfortably below its OPEC+ production quota of 3.857 million b/d, which is

effective through March.

The country's energy ministry has pledged to remain "resolute" to its OPEC+ commitments

but it has struggled to comply in recent months due to fiscal and political pressures.

Nigeria maintained its recently strong compliance, mainly due to more involuntary outages.

Nigeria produced 1.47 million b/d last month, a 40,000 b/d rise from December, but below its

January quota.

A pipeline closure affected Forcados exports, but this was offset by the return of Qua Iboe

output mid-month. Platts figures are compiled by surveying oil industry officials, traders and

analysts, as well as reviewing proprietary shipping, satellite and inventory data.

22. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 22

NewBase Energy News 01 March 2021 - Issue No. 1411 call on +971504822502, UAE

The Editor:” Khaled Al Awadi” Your partner in Energy Services

NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE.

For additional free subscriptions, please email us.

About: Khaled Malallah Al Awadi,

23. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 23

Energy Consultant

MS & BS Mechanical Engineering (HON), USA

Emarat member since 1990

ASME member since 1995

Hawk Energy member 2010

www.linkedin.com/in/khaled-al-awadi-38b995b

Mobile: +971504822502

khdmohd@hawkenergy.net or khdmohd@hotmail.com

Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas

sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S.

Universities. Currently working as Technical Affairs Specialist for Emirates General

Petroleum Corp. “Emarat “with external voluntary Energy consultation for the GCC

area via Hawk Energy Service, as the UAE operations base. Khaled is the Founder

of NewBase Energy news articles issues, an international consultant, advisor,

ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste

management, waste-to-energy, renewable energy, environment protection and

sustainable development. His geographical areas of focus include Middle East,

Africa and Asia. Khaled has successfully accomplished a wide range of projects in

the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities &

gas compressor stations. Executed projects in the designing & constructing of gas

pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted &

finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements.

Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass

energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous

conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-

in-Chief of NewBase Energy News and is a professional environmental writer with more than 1400 popular

articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste

management and environmental sustainability in different parts of the world. Khaled has become a reference

for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC

leading satellite Channels. Khaled can be reached at any time, see contact details above.

NewBase: For discussion or further details on the news above you may contact us on +971504822502, Dubai, UAE

NewBase 2021 K. Al Awadi

24. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 24

25. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 25

26. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 26

For Your Recruitments needs and Top Talents, please seek our approved agents below