Oz Metals 20150510

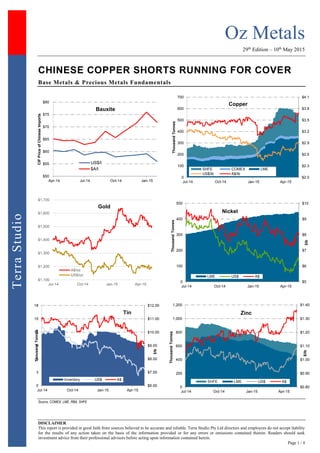

- 1. Oz Metals 29th Edition – 10th May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 1 / 4 TerraStudio CHINESE COPPER SHORTS RUNNING FOR COVER Base Metals & Precious Metals Fundamentals Source: COMEX, LME, RBA, SHFE $50 $55 $60 $65 $70 $75 $80 Apr-14 Jul-14 Oct-14 Jan-15 CIFPriceofChineseImports Bauxite US$/t $A/t $2.0 $2.3 $2.6 $2.9 $3.2 $3.5 $3.8 $4.1 0 100 200 300 400 500 600 700 Jul-14 Oct-14 Jan-15 Apr-15 ThousandTonnes Copper SHFE COMEX LME US$/lb A$/lb $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 Jul-14 Oct-14 Jan-15 Apr-15 Gold A$/oz US$/oz $5 $6 $7 $8 $9 $10 0 100 200 300 400 500 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Nickel LME US$ A$ $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 0 3 6 9 12 15 18 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Tin Inventory US$ A$ $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 0 200 400 600 800 1,000 1,200 Jul-14 Oct-14 Jan-15 Apr-15 $/lb ThousandTonnes Zinc SHFE LME US$ A$

- 2. Oz Metals 29th Edition – 10th May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 2 / 4 TerraStudio Markets & Majors Thomson Reuters - Arrivals of anode, refined copper, copper alloys and semi-finished copper products in China stood at 430,000 tonnes in April, the highest monthly imports since April 2014 and up 4.9% from 410,000 tonnes in March, according to data from the Chinese General Administration of Customs. SMM - Chinese analysts expect the peak demand season for copper market which came later this year to continue through the end of May, proffering impetus to copper prices in the second quarter. The Shanghai Futures Exchange (SHFE) reported continuous declines in copper inventories lately, and many futures analysts considered the inventory falls partly a reflection of growing copper consumption. The rise in global copper prices is forcing Chinese hedge funds that were responsible for causing a shortage of the metal to rethink their strategy, Metal Bulletin wrote, citing market participants. Mining Journal - Glencore has reported a 9% year-on-year decrease in copper production in the March quarter, saying the 350,700-tonne total was affected by grade reductions at two mines and a maintenance shutdown at Collahuasi in Chile. Thomson Reuters – Volumes in the global spot gold market have fallen to their lowest in a year, with shrinking liquidity and a slowdown in interbank trade making customers reluctant to transact on a large scale. Tighter regulation and credit constraints resulting from 2008-2009 financial crisis saw several banks withdraw from the commodity sector to ease cost pressures and boost efficiency against a background of lower raw material prices. Lower prices and a stronger dollar helped lift US imports of gold, silver and platinum jewellery by as much as 15% in the first quarter of 2015, according to Thomson Reuters GFMS calculations. Thomson Reuters - A fall in China's demand for physical zinc metal to its weakest in two years has raised concerns that a six-week rally in London forwards prices has overshot fundamentals and could unwind. London Metal Exchange zinc has surged 15% from mid-March, an 18-month high, supported by worries about falling mine supply and steady galvanising demand from China, the world's biggest user. SMM - Rare earth prices are expected to rise significantly in 2015, driven by robust demand growth in new energy vehicle and other new markets, such as rare earth functional ceramics and PVC. Funding, Mergers & Acquisitions Following the approval of the proposed demerger of South32 by BHP Billiton Group's shareholders, the mining giant's board resolved to approve the in-specie distribution of South32 shares to shareholders in BHP Billiton. BHP Billiton is offering shareholders 1 South32 share for every BHP Billiton share held. Evolution Mining is subscribing for up to 105.9 million new shares, representing a 19.9% shareholding, in Phoenix Gold for a total investment of A$9.0 million. Guangdong Rising Assets Management Co. Ltd.'s has decided to increase its all-cash takeover offer for PanAust by 8% to A$1.85 per share. The independent directors of PanAust have unanimously recommended shareholders to accept the offer in the absence of a better proposal. Venturex Resources has inked an agreement with Forge Resources Swan Pty Ltd, as managers of the Balla Balla joint venture, to sell non-core exploration tenement E47/924 for A$400,000 in cash. E47/924 is within the Salt Creek copper-zinc tenement package in Western Australia. TNG inked a nonbinding memorandum of understanding with a leading manufacturer of Vanadium Redox-Flow Batteries, or VRB, for the supply of vanadium from its wholly owned Mount Peake project in the Northern Territory, Australia, and to examine the feasibility of installing a VRB unit on site to help power the operation. Valence Industries entered into a binding heads of agreement for US$75 million in debt finance facilities for its planned expansion programs. Bauxite Sector Source: Bloomberg, SNL Metals & Mining, Terra Studio Zinc & Poly-metallic Sector Source: SNL Metals & Mining Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABX Australian Bauxite 0.30 ▼ (5%) (2%) 42 4 38 BAU Bauxite Resources 0.076 ▼ (7%) (22%) 18 24 (6) CAY Canyon Resources 0.040 — 0% (20%) 5 1 4 MLM Metallica Minerals 0.054 ▼ (18%) (2%) 9 2 7 MMI Metro Mining 0.085 ▼ (1%) 215% 25 5 20 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AQR Aeon Metals 0.085 — 0% (15%) 26 3 38 ARD Argent Minerals 0.023 ▼ (12%) (36%) 4 0 3 DGR DGR Global 0.032 ▼ (3%) 0% 13 23 15 HRR Heron Resources 0.13 ▼ (4%) 0% 45 26 19 IBG Ironbark Zinc 0.115 ▼ (4%) 44% 51 3 48 IPT Impact Minerals 0.021 ▲ 24% (13%) 12 1 10 IVR Investigator Resources 0.010 ▼ (17%) (38%) 5 3 (0) MRP MacPhersons Resources 0.095 ▼ (1%) (24%) 30 4 25 PNX Phoenix Copper 0.014 ▼ (18%) (53%) 5 2 4 RDM Red Metal 0.038 ▼ (5%) (53%) 7 3 2 RVR Red River Resources 0.16 ▼ (3%) 45% 28 3 24 RXL Rox Resources 0.030 ▲ 7% 7% 26 2 23 TZN Terramin Australia 0.125 ▲ 14% 14% 189 0 189 VAR Variscan Mines 0.012 — 0% (51%) 4 1 4 VXR Venturex Resources 0.005 — 0% 0% 8 1 6

- 3. Oz Metals 29th Edition – 10th May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 3 / 4 TerraStudio Nickel Sector Source: SNL Metals & Mining Copper Producers Source: SNL Metals & Mining Copper Developers & Explorers Source: SNL Metals & Mining Tin Sector Source: SNL Metals & Mining Gold Producers Source: SNL Metals & Mining Gold Developers & Explorers Source: SNL Metals & Mining Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) IGO Independence Group 6.00 ▲ 2% 35% 1,406 57 1,314 MBN Mirabella Nickel 0.125 ▼ (11%) 331% 116 22 218 MCR Mincor Resources 0.63 ▲ 5% 8% 119 26 100 PAN Panoramic Resources 0.53 ▼ (4%) 25% 169 64 110 WSA Western Areas 3.80 ▲ 1% 1% 884 231 833 AVQ Axiom Mining 0.265 ▼ (4%) 18% 64 1 NA CZI Cassini Resources 0.07 ▼ (7%) (43%) 8 1 6 DKM Duketon Mining 0.19 ▲ 3% (29%) 14 6 8 LEG Legend Mining 0.007 — 0% 0% 14 7 7 MAT Matsa Resources 0.250 ▲ 39% 47% 36 2 36 MLM Metallica Minerals 0.054 ▼ (18%) (2%) 9 2 6 PIO Pioneer Resources 0.017 ▼ (6%) 31% 12 3 9 POS Poseidon Nickel 0.14 — 0% 13% 92 8 109 SEG Segue Resources 0.004 ▼ (20%) (20%) 8 0 7 SGQ St George Mining 0.065 — 0% 3% 7 1 6 SIR Sirius Resources 2.82 ▼ (3%) 10% 963 210 718 TLM Talisman Mining 0.14 ▼ (10%) (10%) 18 6 4 WIN Winward Resources 0.14 ▼ (13%) (13%) 15 8 11 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABY Aditya Birla Minerals 0.22 ▲ 13% 13% 69 137 (35) HGO Hillgrove Resources 0.35 ▲ 1% (23%) 51 9 61 KBL KBL Mining 0.030 ▲ 36% 0% 15 7 38 MWE Mawson West 0.042 ▼ (11%) (20%) 17 27 68 OZL OZ Minerals 4.66 ▼ (1%) 34% 1,414 219 1,196 PNA PanAust 1.73 ▼ (1%) 22% 1,121 94 1,339 SFR Sandfire Resources 5.28 ▲ 5% 16% 826 58 910 SRQ Straits Resources 0.007 ▼ (13%) 40% 9 13 165 TGS Tiger Resources 0.078 ▲ 24% (40%) 89 80 295 985 CST Mining 0.016 ▼ (2%) 120% 429 172 250 1208 MMG 0.52 ▼ (5%) 33% 2,745 318 14,445 3993 China Molybdenum 1.19 ▼ (6%) 62% 13,336 1,901 13,895 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AOH Altona Mining 0.105 — 0% (56%) 56 48 9 ARE Argonaut Resources 0.007 — 0% (56%) 3 1 2 AVB Avanco Resources 0.079 — 0% 4% 131 16 111 AVI Avalon Minerals 0.033 ▲ 6% 65% 6 3 4 AZS Azure Minerals 0.014 — 0% (42%) 14 2 13 CDU CuDeco (suspended) 1.20 S (39%) 332 16 398 CVV Caravel Minerals 0.010 ▼ (9%) 25% 7 0 7 ENR Encounter Resources 0.15 ▲ 11% 15% 20 2 18 ERM Emmerson Resources 0.032 ▼ (6%) 3% 12 3 9 FND Finders Resources 0.15 ▼ (3%) 0% 99 28 99 GCR Golden Cross Resources 0.059 ▼ (2%) (16%) 6 1 5 GPR Geopacific Resources 0.049 ▲ 29% (6%) 19 3 15 HAV Havilah Resources 0.29 ▲ 12% 107% 45 3 43 HCH Hot Chili 0.12 ▲ 4% (25%) 42 5 48 HMX Hammer Metals 0.080 ▲ 7% (2%) 8 1 8 IAU Intrepid Mines 0.14 ▲ 8% 4% 52 69 27 KDR Kidman Resources 0.071 ▲ 3% 6% 8 1 8 KGL KGL Resources 0.15 — 0% (33%) 21 8 12 MEP Minotaur Exploration 0.08 ▼ (1%) (46%) 14 4 8 MNC Metminco 0.004 ▼ (11%) (50%) 8 1 7 MTH Mithril Resources 0.007 ▲ 17% 0% 3 1 2 PEX Peel Mining 0.074 ▼ (12%) 7% 10 2 8 RDM Red Metal 0.038 ▼ (5%) (53%) 7 3 2 RER Regal Resources 0.045 ▲ 13% (2%) 10 1 7 RTG RTG Mining 0.636 ▲ 5% 5% 85 11 82 RXM Rex Minerals 0.115 ▲ 5% 5% 25 13 18 SMD Syndicated Metals 0.022 ▼ (4%) (31%) 6 1 5 SRI Sipa Resources 0.080 ▼ (4%) 116% 50 2 49 SUH Southern Hemisphere 0.012 ▲ 9% (72%) 3 1 2 THX Thundelarra Resources 0.100 ▲ 5% (9%) 32 6 NA XAM Xanadu Mines 0.093 ▼ (11%) (7%) 35 6 34 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) CSD Consolidated Tin Mines 0.053 ▼ (2%) 29% 15 3 14 ELT Elementos 0.006 ▼ (14%) (25%) 5 1 3 KAS Kasbah Resources 0.038 ▲ 12% (30%) 17 3 11 MLX Metals X 1.50 — 0% 91% 624 123 501 MOO Monto Minerals 0.004 — 0% 100% 5 1 5 SRZ Stellar Resources 0.032 — 0% 10% 10 3 7 VMS Venture Minerals 0.030 ▲ 50% (3%) 9 4 5 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AGD Austral Gold 0.16 — 0% 23% 77 6 68 ALK Alkane Resources 0.29 ▲ 9% 32% 120 16 101 AMI Aurelia Metals 0.25 ▼ (2%) 4% 97 22 198 BDR Beadell Resources 0.22 ▲ 2% (2%) 176 13 281 BOK Black Oak Minerals 0.37 ▼ (1%) 37% 16 3 28 DRM Doray Minerals 0.45 ▼ (3%) (6%) 108 16 107 EVN Evolution Mining 1.13 ▲ 15% 75% 810 32 919 IGO Independence Group 6.00 ▲ 2% 35% 1,406 57 1,314 KCN Kingsgate Consolidated 0.74 ▲ 1% 11% 164 54 248 KRM Kingsrose Mining 0.28 ▼ (8%) 10% 100 7 111 LSA Lachlan Star 0.024 — 0% 20% 4 2 22 MIZ Minera Gold 0.002 — 0% (33%) 6 0 11 MLX Metals X 1.50 — 0% 91% 624 57 517 MML Medusa Mining 1.01 ▲ 11% 55% 209 17 202 MOY Millennium Minerals 0.028 ▼ (7%) (24%) 6 2 42 NCM Newcrest Mining 13.75 ▼ (5%) 26% 10,540 141 14,957 NGF Norton Gold Fields 0.23 — 0% 84% 214 19 342 NST Northern Star Resources 2.09 ▼ (3%) 40% 1,238 82 1,210 OGC OceanaGold Corp. 2.63 ▲ 5% 25% 797 65 854 PGI PanTerra Gold 0.160 ▼ (14%) (11%) 14 3 75 PRU Perseus Mining 0.40 ▲ 8% 52% 208 37 174 RMS Ramelius Resources 0.130 ▼ (4%) 155% 61 12 44 RRL Regis Resources 1.22 ▼ (3%) (37%) 607 7 617 RSG Resolute Mining 0.35 ▲ 8% 32% 224 19 255 SAR Saracen Mineral Holdings 0.47 ▲ 3% 82% 369 36 349 SBM St Barbara 0.54 ▲ 15% 410% 265 79 588 SLR Silver Lake Resources 0.18 ▲ 3% (8%) 91 24 97 TBR Tribune Resources 3.45 — 0% 30% 173 11 NA TRY Troy Resources 0.41 — 0% (12%) 87 43 127 UML Unity Mining 0.017 ▲ 42% 143% 19 7 7 Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AYC A1 Consolidated 0.032 ▲ 14% (20%) 9 0 8 ABU ABM Resources 0.25 ▼ (6%) (15%) 84 23 73 AWV Anova Metals 0.040 ▼ (7%) 48% 12 2 11 AZM Azumah Resources 0.024 — 0% 20% 9 3 8 BLK Blackham Resources 0.15 ▲ 4% 184% 26 0 NA BSR Bassari Resources 0.011 ▼ (8%) (8%) 14 0 15 CHN Chalice Gold Mines 0.12 ▼ (4%) 10% 33 41 (10) CHZ Chesser Resources 0.032 ▼ (3%) (11%) 7 8 2 DCN Dacian Gold 0.42 — 0% 50% 40 7 33 EXG Excelsior Gold 0.085 ▼ (6%) 39% 42 1 41 FML Focus Minerals 0.007 — 0% (7%) 59 80 50 GCY Gascoyne Resources 0.089 ▲ 11% 25% 16 1 15 GMR Golden Rim Resources 0.008 — 0% 60% 12 1 11 GOR Gold Road Resources 0.36 ▲ 3% 47% 214 19 193 GRY Gryphon Minerals 0.065 — 0% 2% 26 20 2 KGD Kula Gold 0.041 ▲ 3% (7%) 11 1 8 MSR Manas Resources 0.016 ▲ 14% 14% 8 1 8 MUX Mungana Goldmines 0.145 ▼ (3%) 16% 35 2 40 OGX Orinoco Gold 0.072 ▲ 3% 24% 11 1 12 PNR Pacific Niugini 0.066 ▼ (6%) 32% 26 11 25 PXG Phoenix Gold 0.088 — 0% (10%) 37 7 32 RED Red 5 0.079 ▼ (21%) (14%) 60 13 42 RNI Resource & Investment 0.037 ▼ (18%) (51%) 19 0 35 RNS Renaissance Minerals 0.050 ▲ 25% (23%) 20 3 16 SAU Southern Gold 0.012 ▼ (8%) 50% 6 1 8 SIH Sihayo Gold 0.014 — 0% 75% 16 0 11 TAM Tanami Gold 0.029 ▼ (9%) 107% 34 1 43 WAF West African Resources 0.082 ▲ 17% (18%) 22 5 22 WPG WPG Resources 0.029 ▼ (15%) (24%) 8 2 5

- 4. Oz Metals 29th Edition – 10th May 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 4 / 4 TerraStudio Specialty Metals Sector Source: SNL Metals & Mining For further information, please contact: J-François Bertincourt +61 406 998 779 jf@terrastudio.biz Code Company Name Close Price Week Δ YTD Δ 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AJM Altura Mining (Li-Ta) 0.015 ▲ 36% (75%) 7 1 7 ALK Alkane Resources (RE) 0.29 ▲ 9% 32% 120 16 101 ARU Arafura Resources (RE) 0.055 ▼ (2%) 15% 24 16 6 CNQ Carbine Tungsten (WO3) 0.15 ▲ 4% 12% 45 1 45 GXY Galaxy Resources (Li) 0.033 — 0% 32% 35 3 128 KNL Kibaran Resources (C) 0.19 ▲ 3% 27% 29 1 27 LMB Lamboo Resources (C) 0.085 — 0% (51%) 13 1 12 LML Lincoln Minerals (C) 0.043 ▼ (4%) (27%) 12 1 10 LYC Lynas Corp. (RE) 0.045 ▲ 2% (34%) 152 44 589 NMT Neometals (Li) 0.082 ▼ (9%) 116% 41 9 39 ORE Orocobre (Li) 2.70 ▲ 7% (3%) 409 66 411 PEK Peak Resources (RE) 0.088 ▲ 5% 22% 29 5 31 PLS Pilbara Minerals (Li-Ta) 0.050 ▼ (2%) 19% 31 1 30 SBU Siburan Resources (WO3) 0.045 ▼ (2%) (12%) 11 2 9 SFX Sheffield Resources (MS) 0.73 ▼ (1%) (1%) 98 6 93 SHE Stonehenge Metals (WO3) 0.033 ▼ (11%) 725% 28 1 27 SYR Syrah Resources (C) 4.02 ▲ 3% 26% 664 15 648 TLG Talga Resources (C) 0.44 ▲ 10% 83% 61 7 58 TNG TNG (WO3) 0.16 — 0% 94% 99 4 92 TON Triton Minerals (C) 0.40 ▲ 5% 114% 132 1 131 VML Vital Metals (WO3) 0.040 — 0% 38% 12 1 15 VXL Valence Industries (C) 0.28 ▼ (22%) (49%) 43 3 35 WLF Wolf Minerals (WO3) 0.35 ▼ (9%) 30% 283 43 279 YRR Yellow Rock Resources (V2O5) 0.010 ▼ (9%) 11% 8 3 4