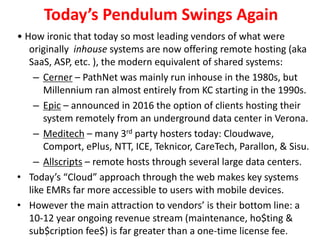

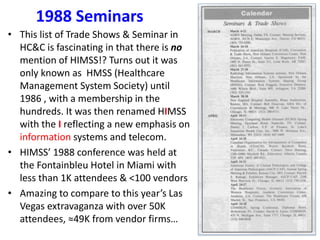

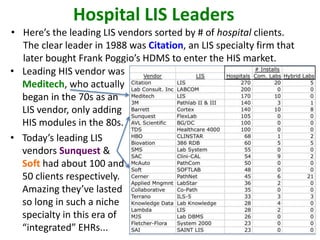

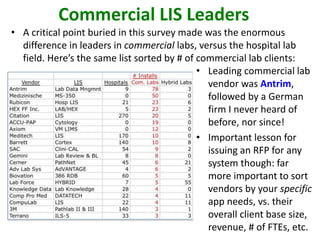

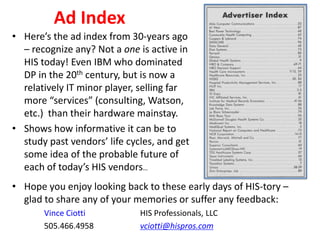

This document summarizes articles from a 1988 healthcare computing magazine, highlighting how hospital information systems have changed over the past 30 years. It notes that in the late 1970s and early 1980s, hospitals switched from shared systems to in-house systems but were beginning to return to shared systems for improved support. Today, leading vendors like Cerner, Epic and Meditech predominantly offer remote hosting from large data centers, similar to the old shared systems. The document also discusses the evolution of healthcare consulting firms and provides advice on selecting consultants that is still relevant today.