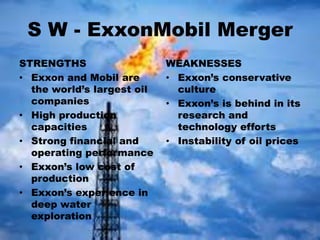

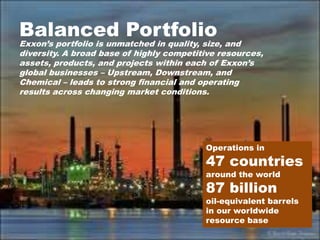

The document provides an overview of ExxonMobil, including its history from the Standard Oil Company through the 1999 merger of Exxon and Mobil. It discusses ExxonMobil's mission, operations in upstream, downstream and chemical businesses, competitors like Shell and Chevron, and controversies like the Exxon Valdez oil spill. The summary analyzes the reasons for and risks of the Exxon-Mobil merger, and describes how ExxonMobil has grown to be the world's largest publicly traded international oil and gas company today through balanced operations, disciplined investing, high-impact technologies, and global integration.