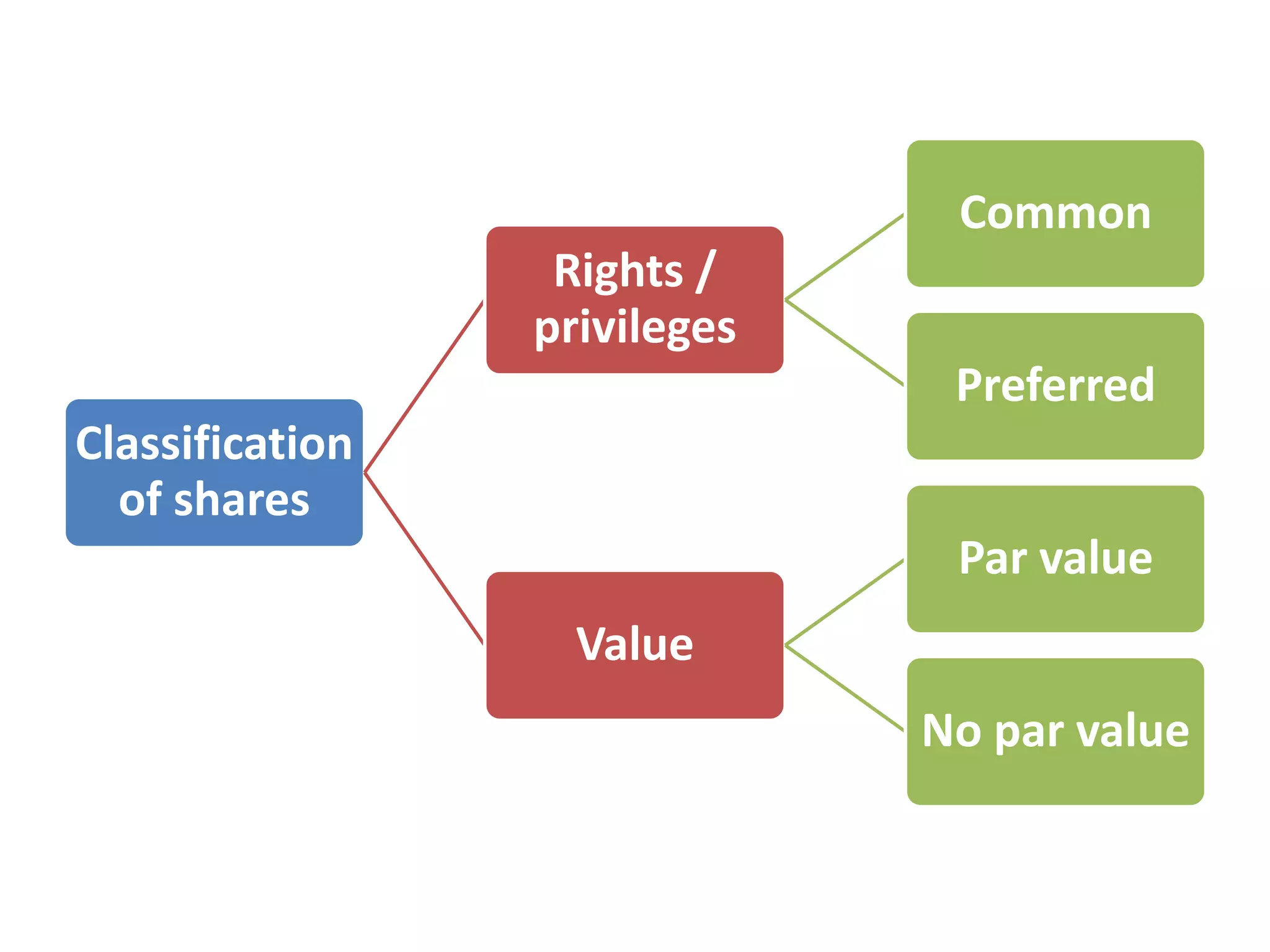

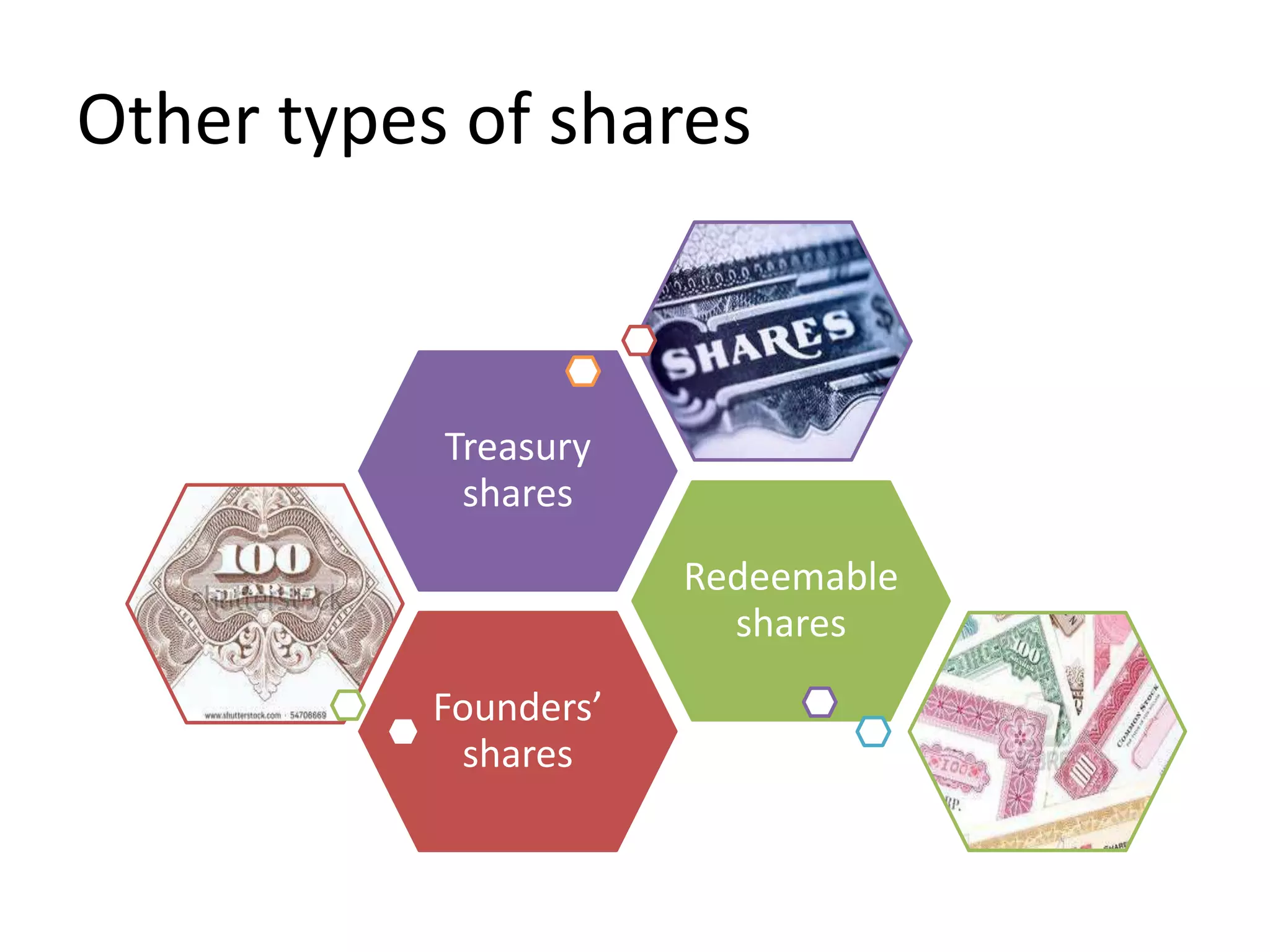

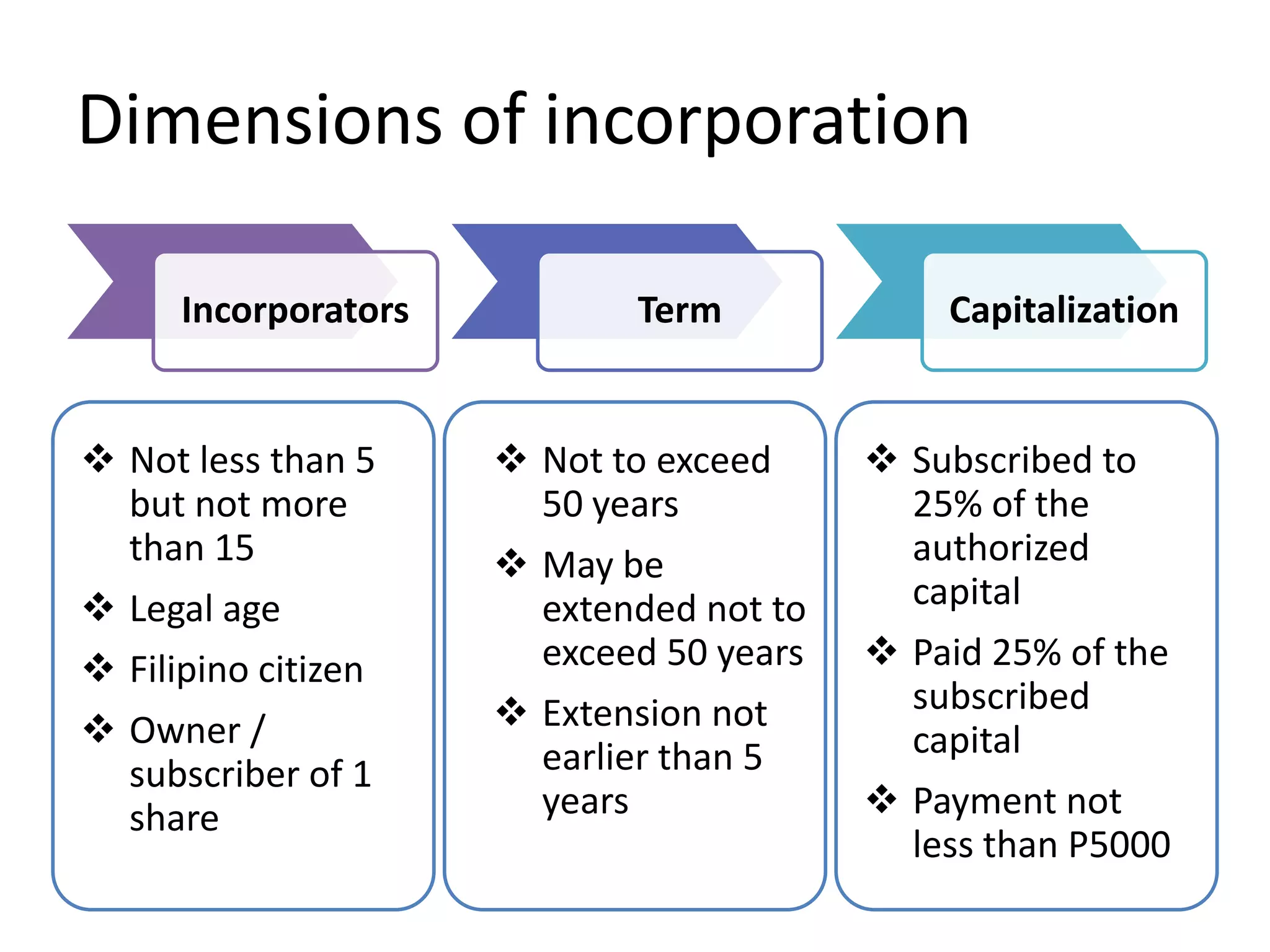

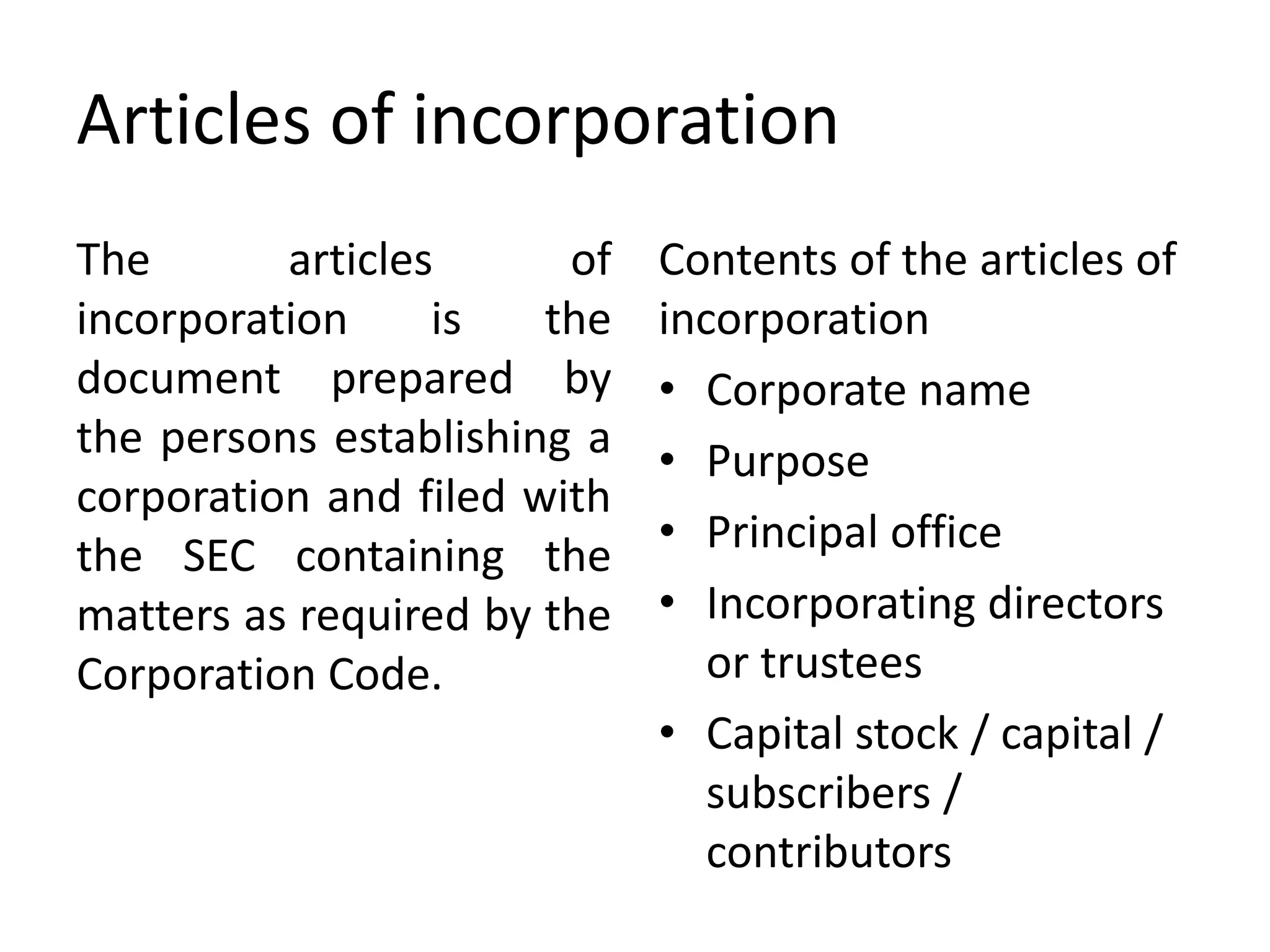

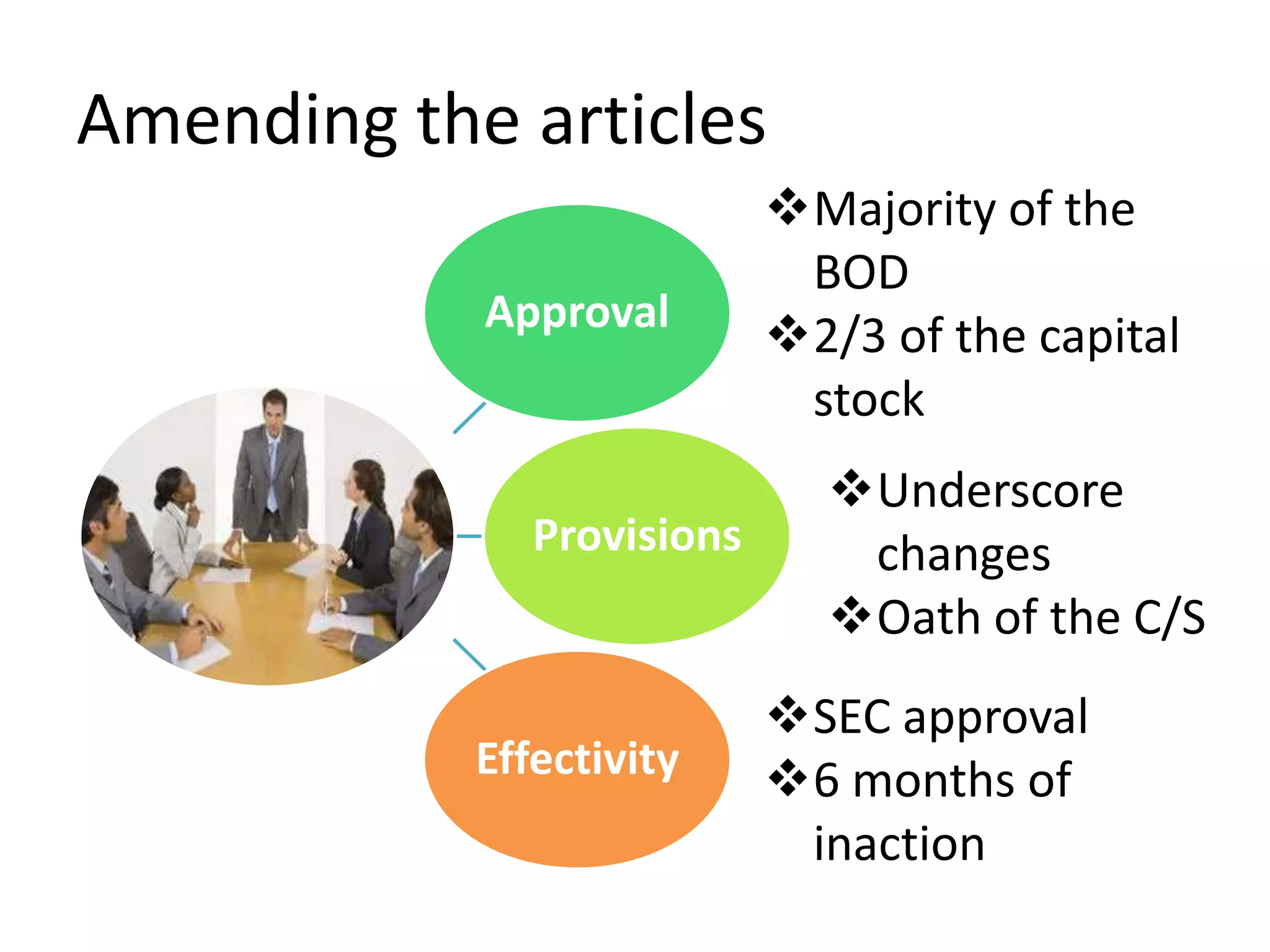

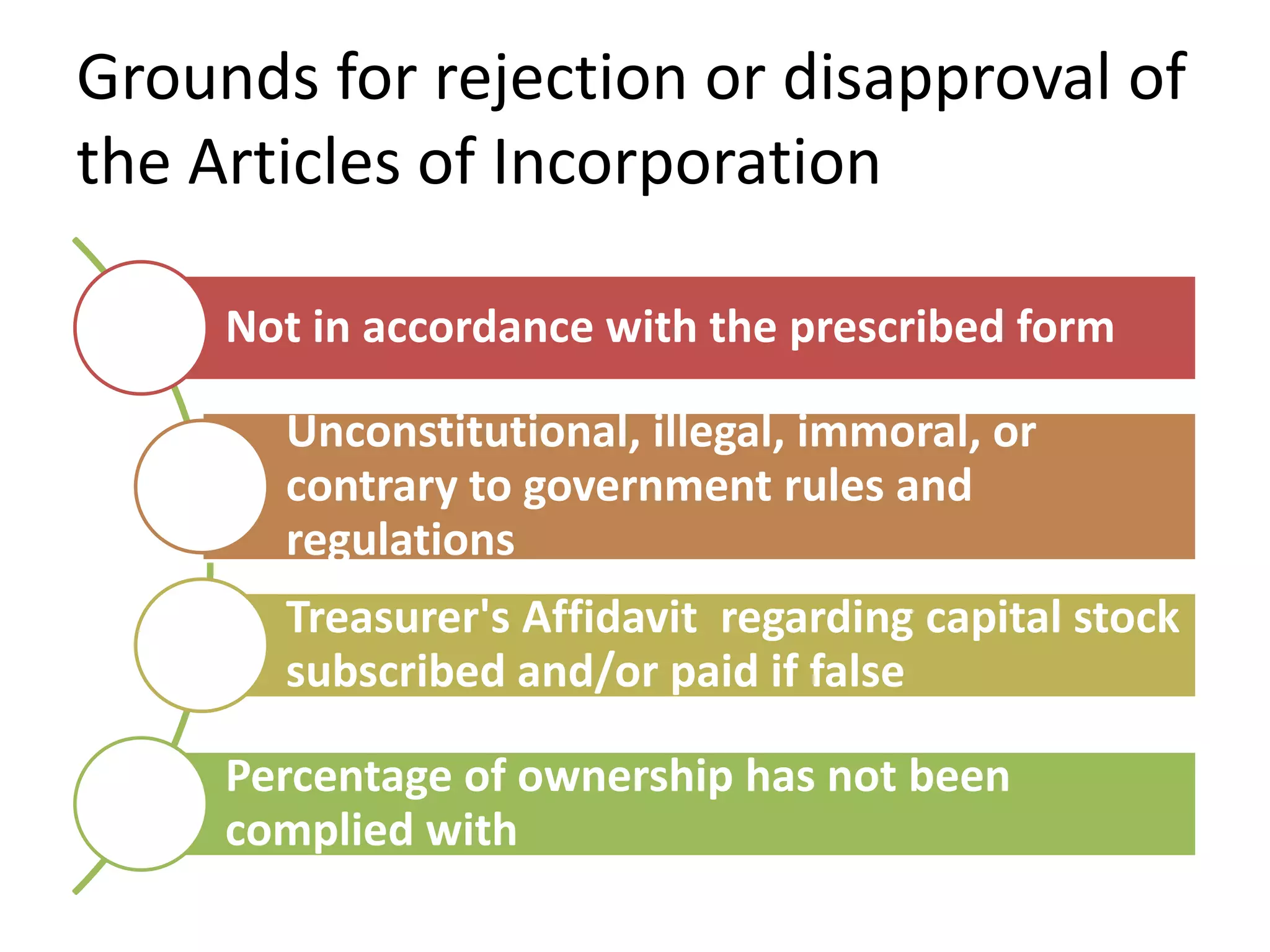

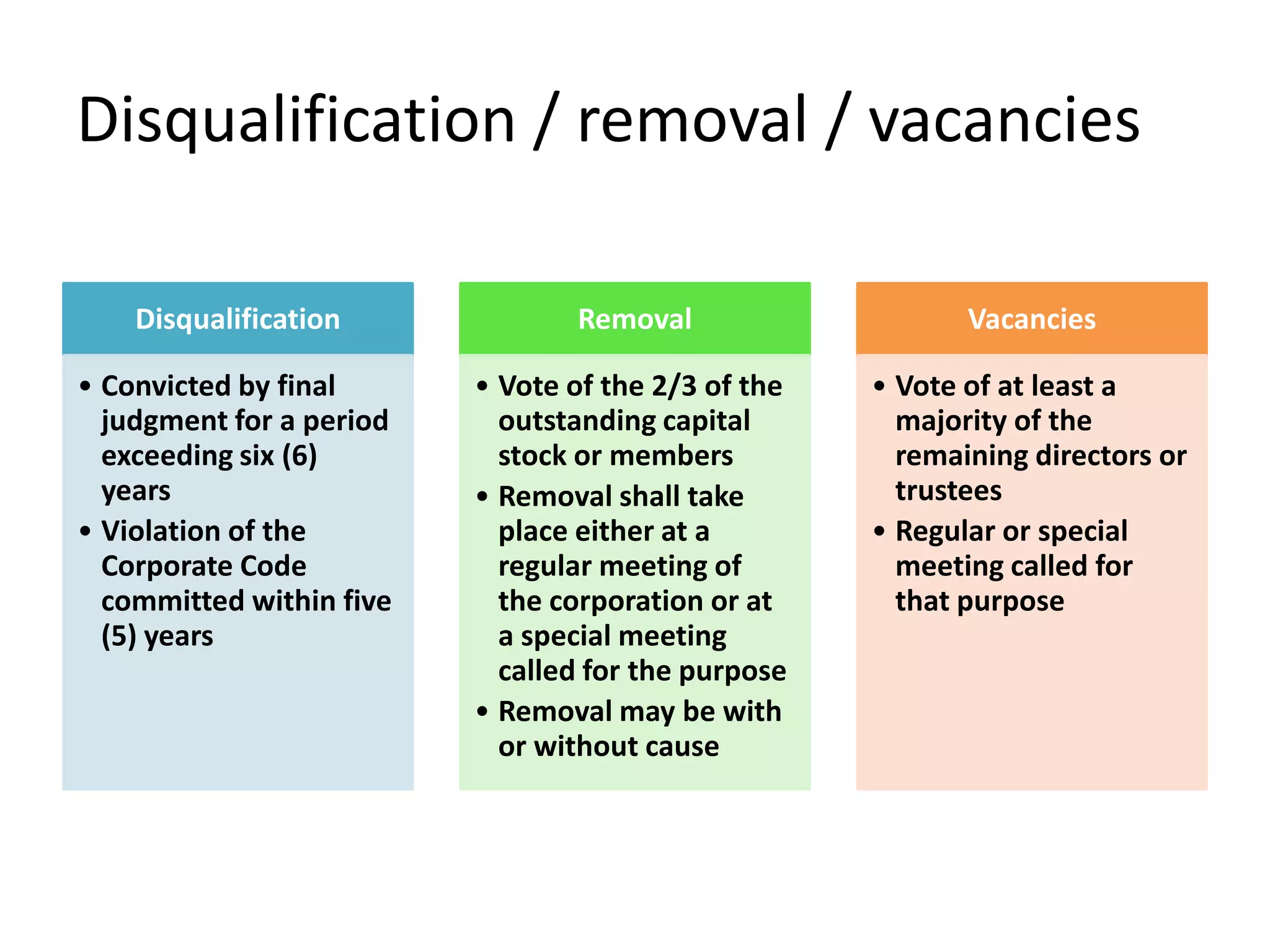

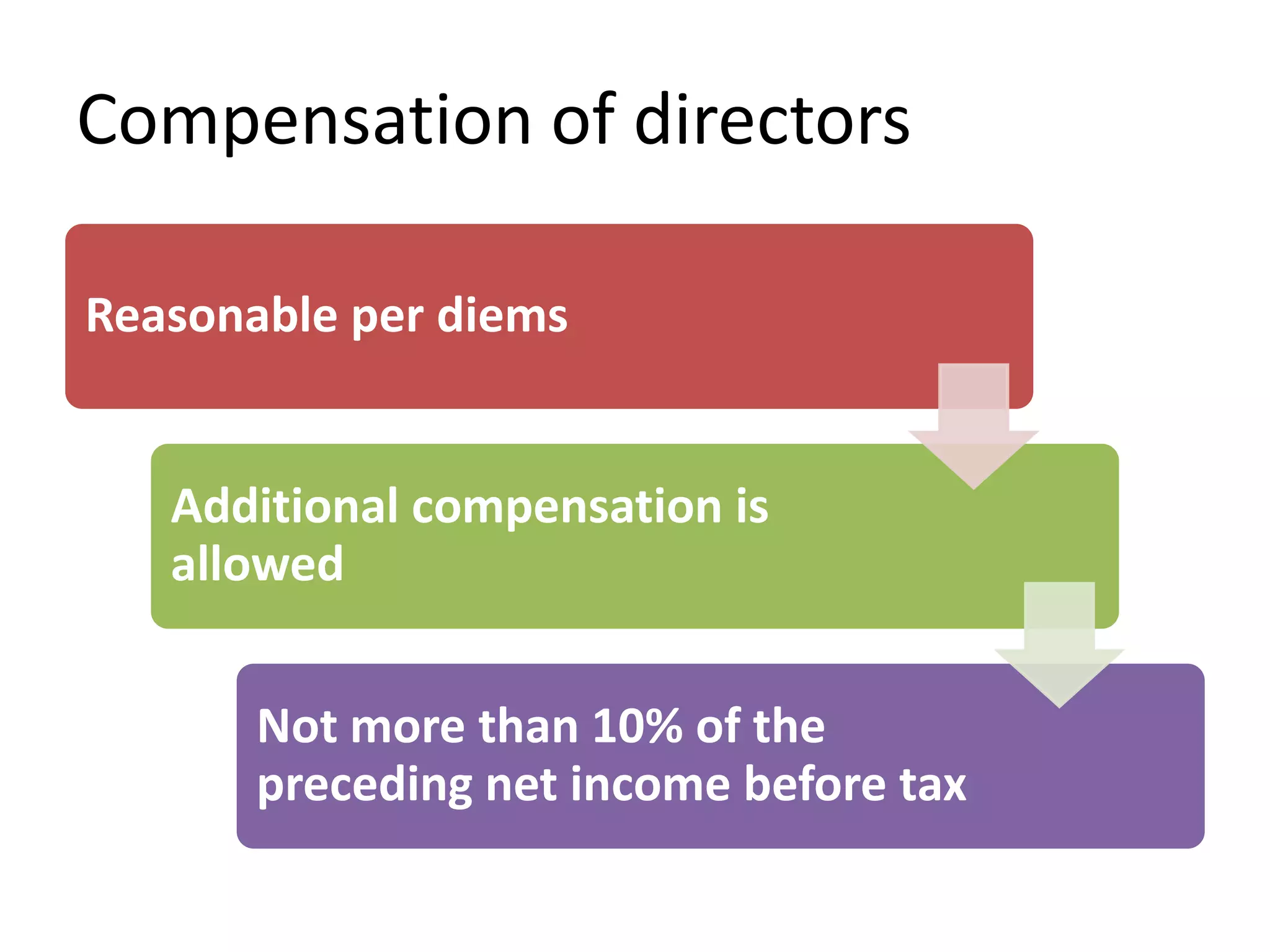

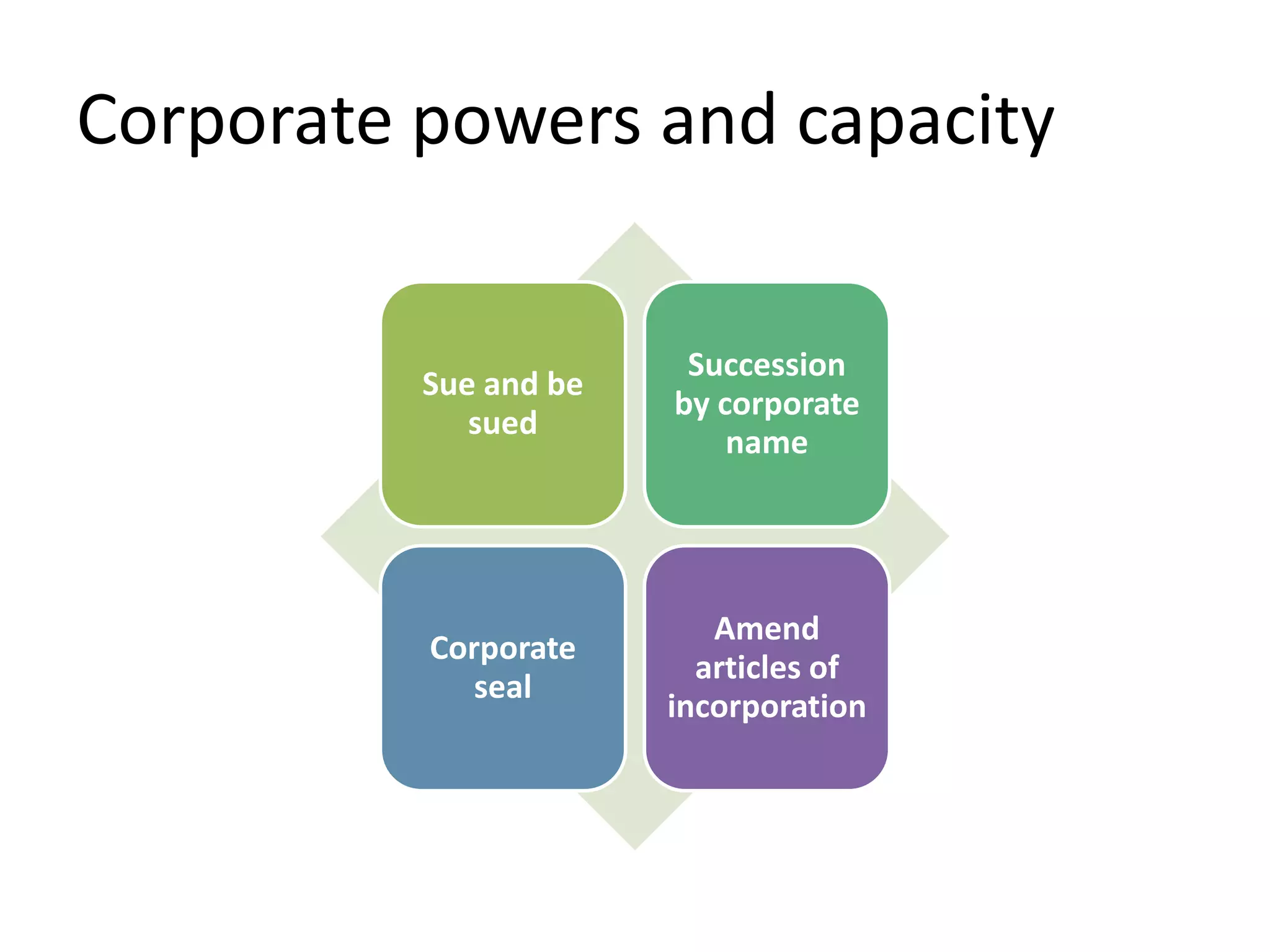

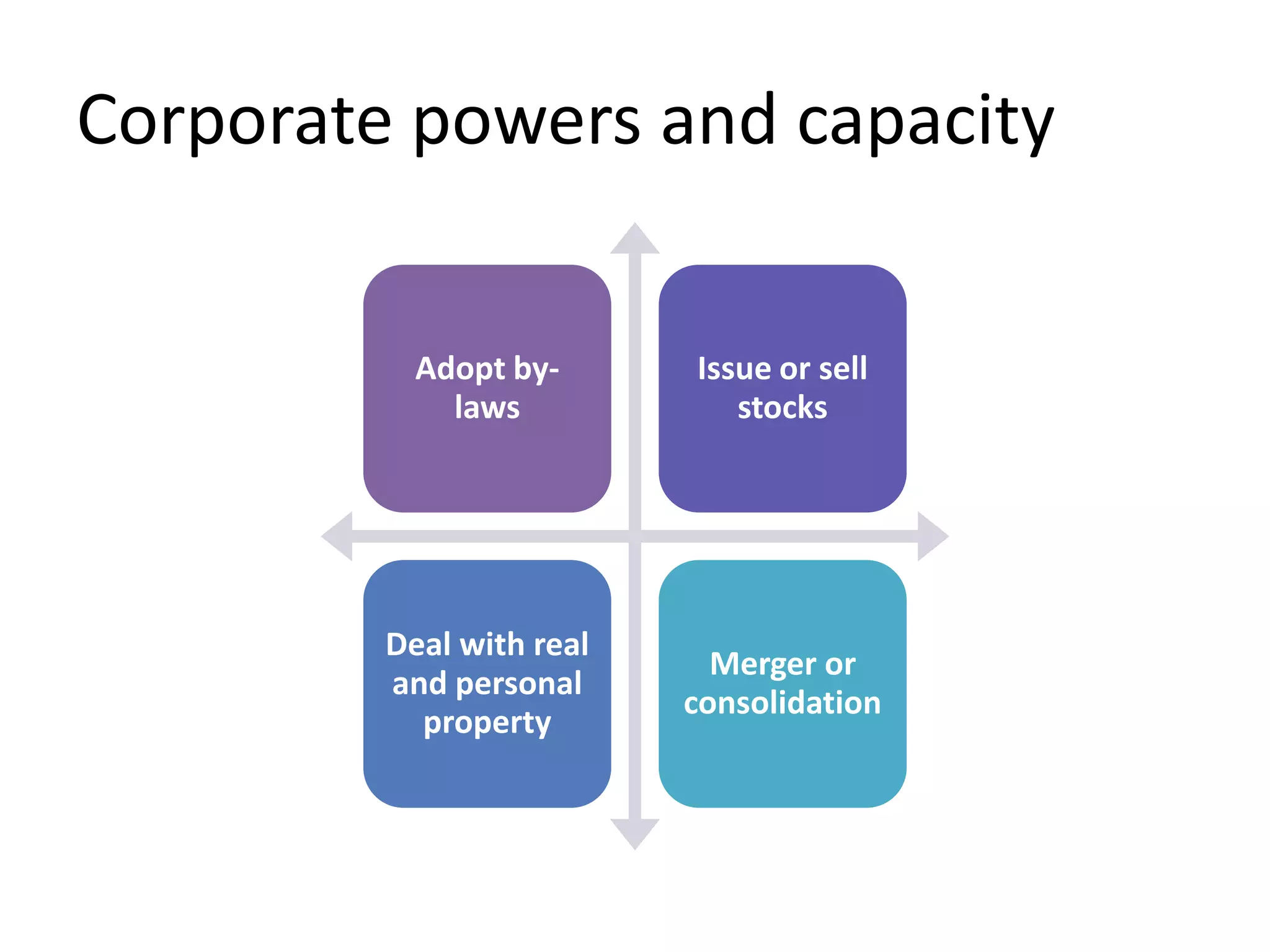

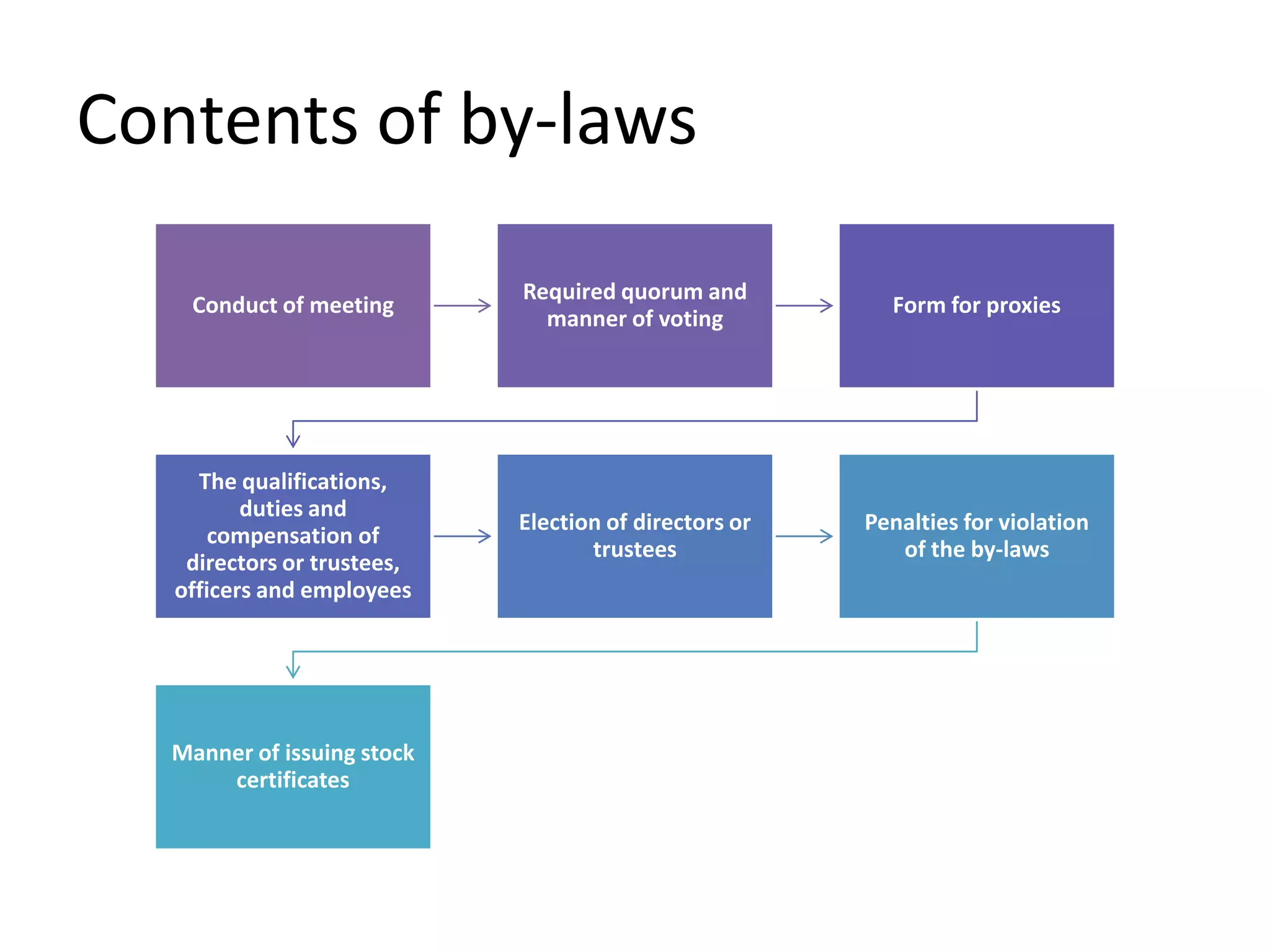

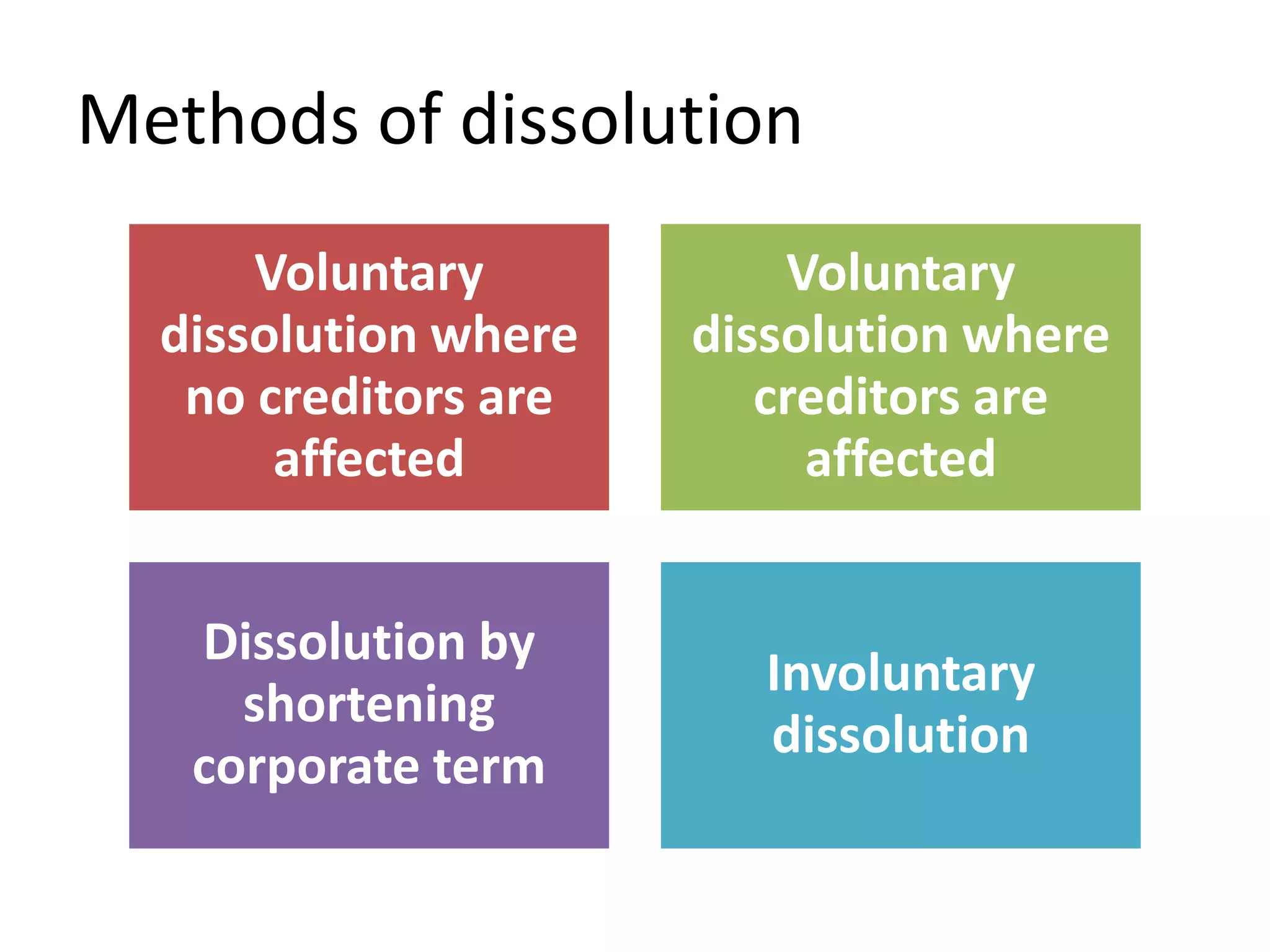

The document outlines the various forms of business organization in the Philippines, specifically focusing on corporations, including their legal framework, incorporation process, and the roles of directors and officers. It discusses different types of corporations, such as stock and non-stock corporations, and their respective powers, as well as the requirements for amending articles of incorporation and procedures for dissolution. Key components also cover shareholder rights, corporate governance, and the specifics of close and educational corporations.