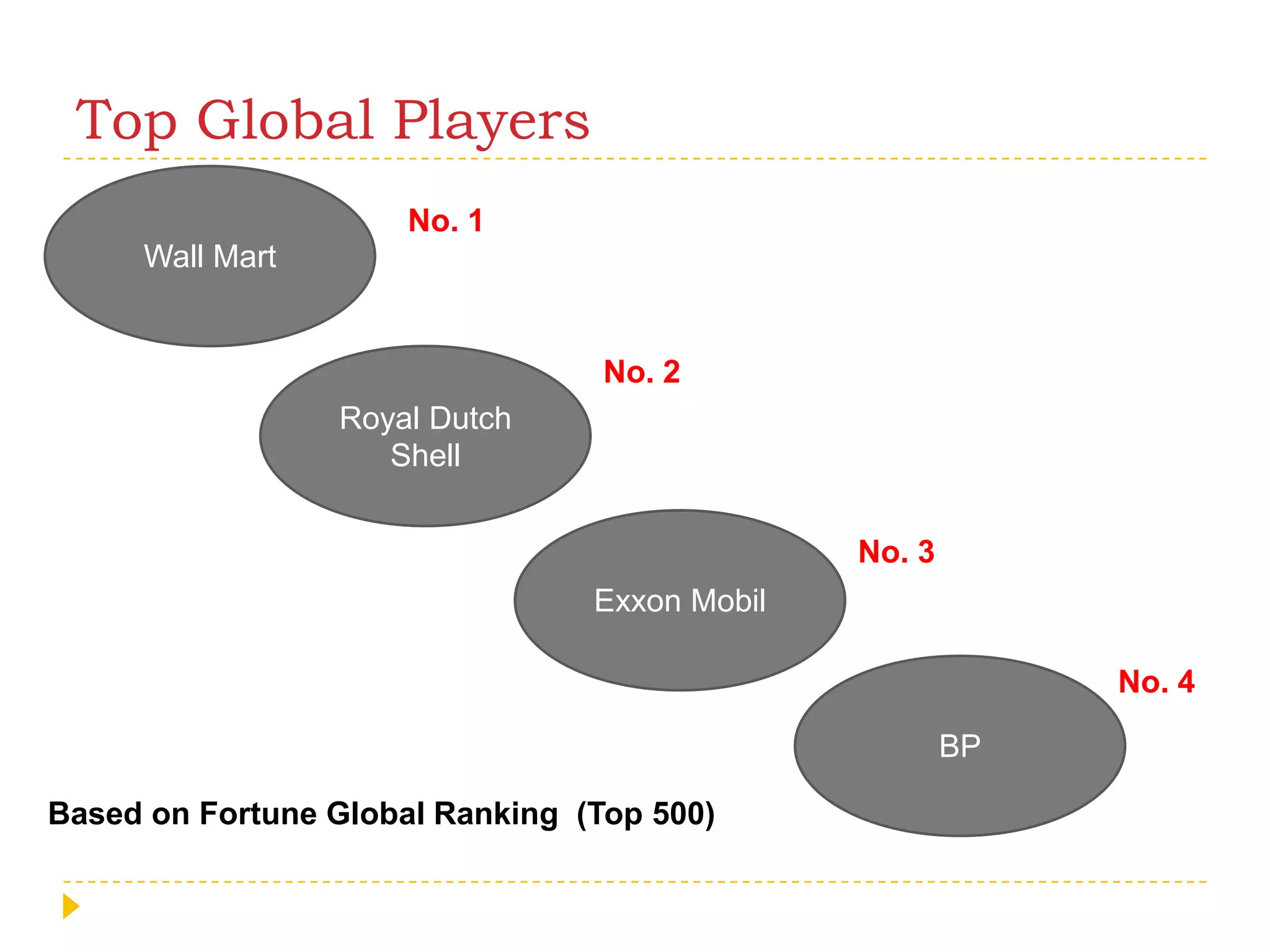

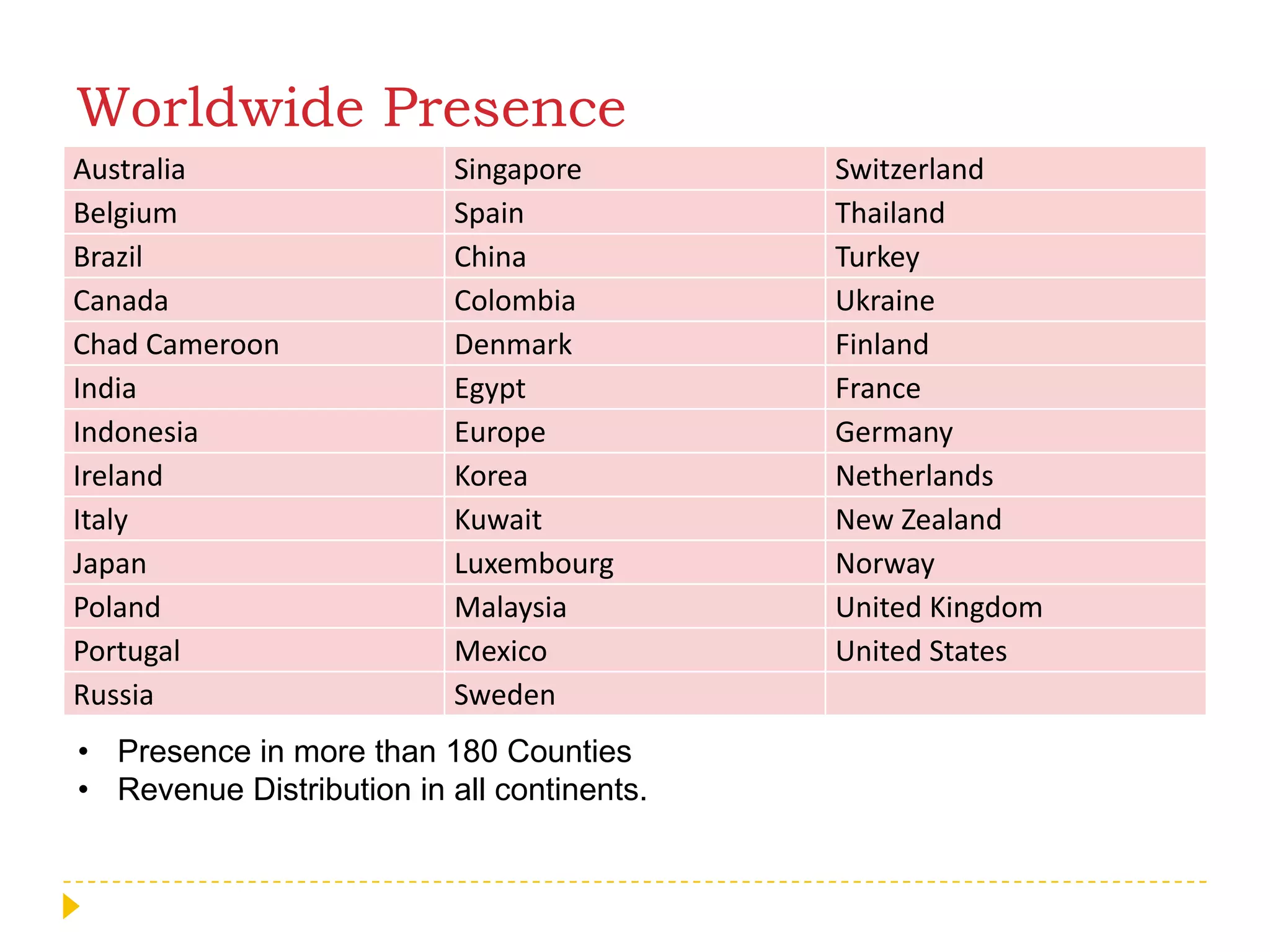

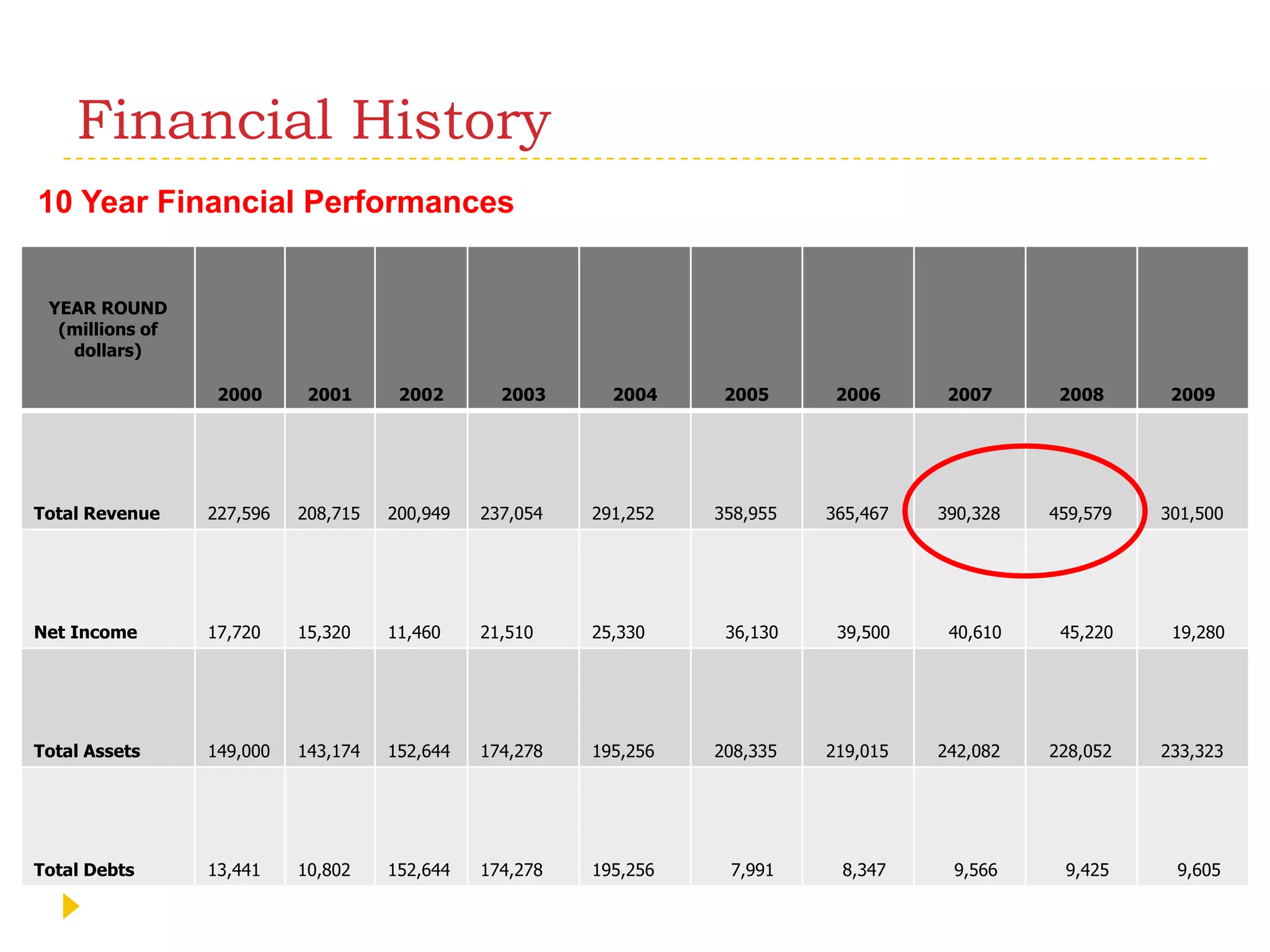

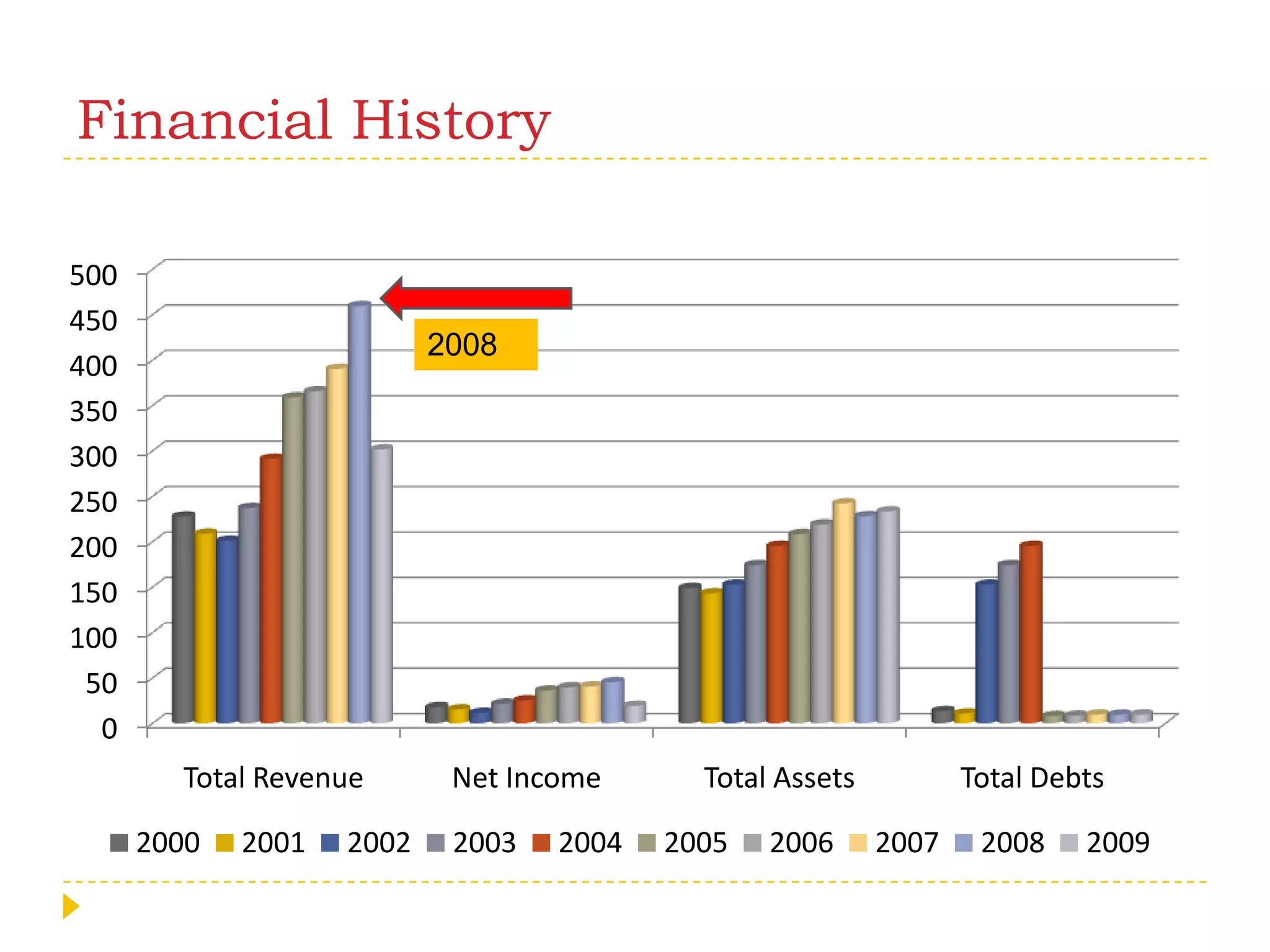

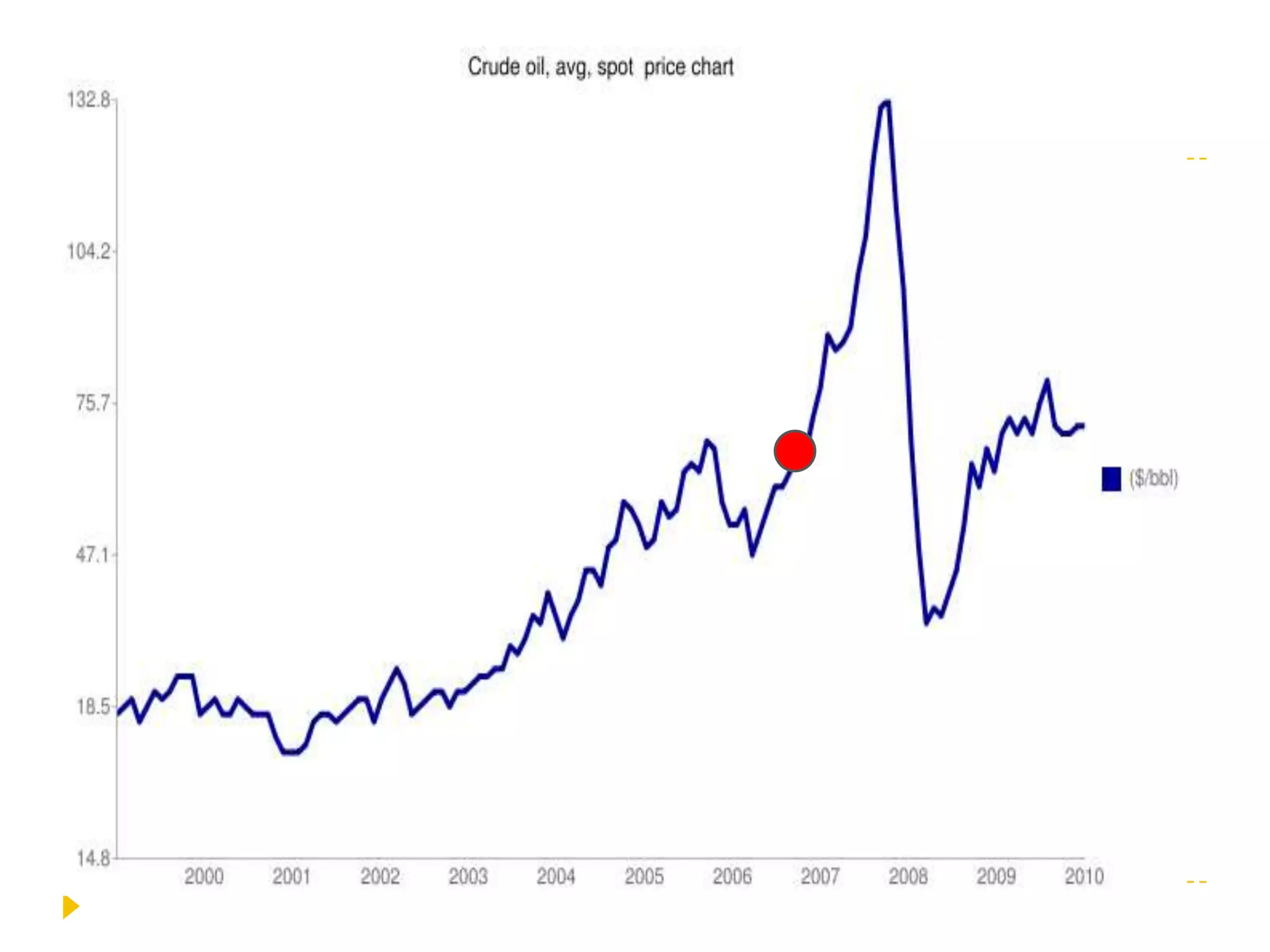

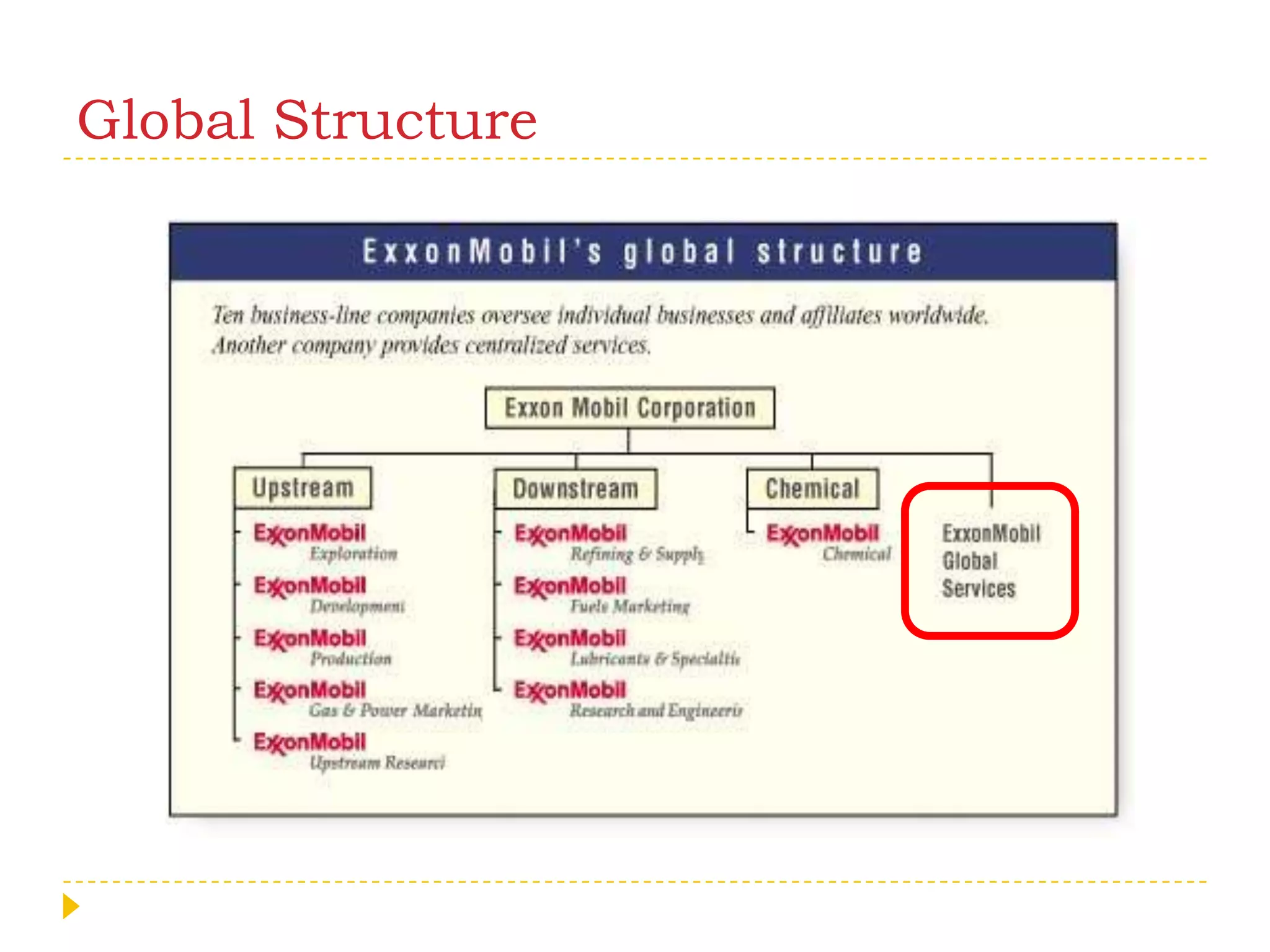

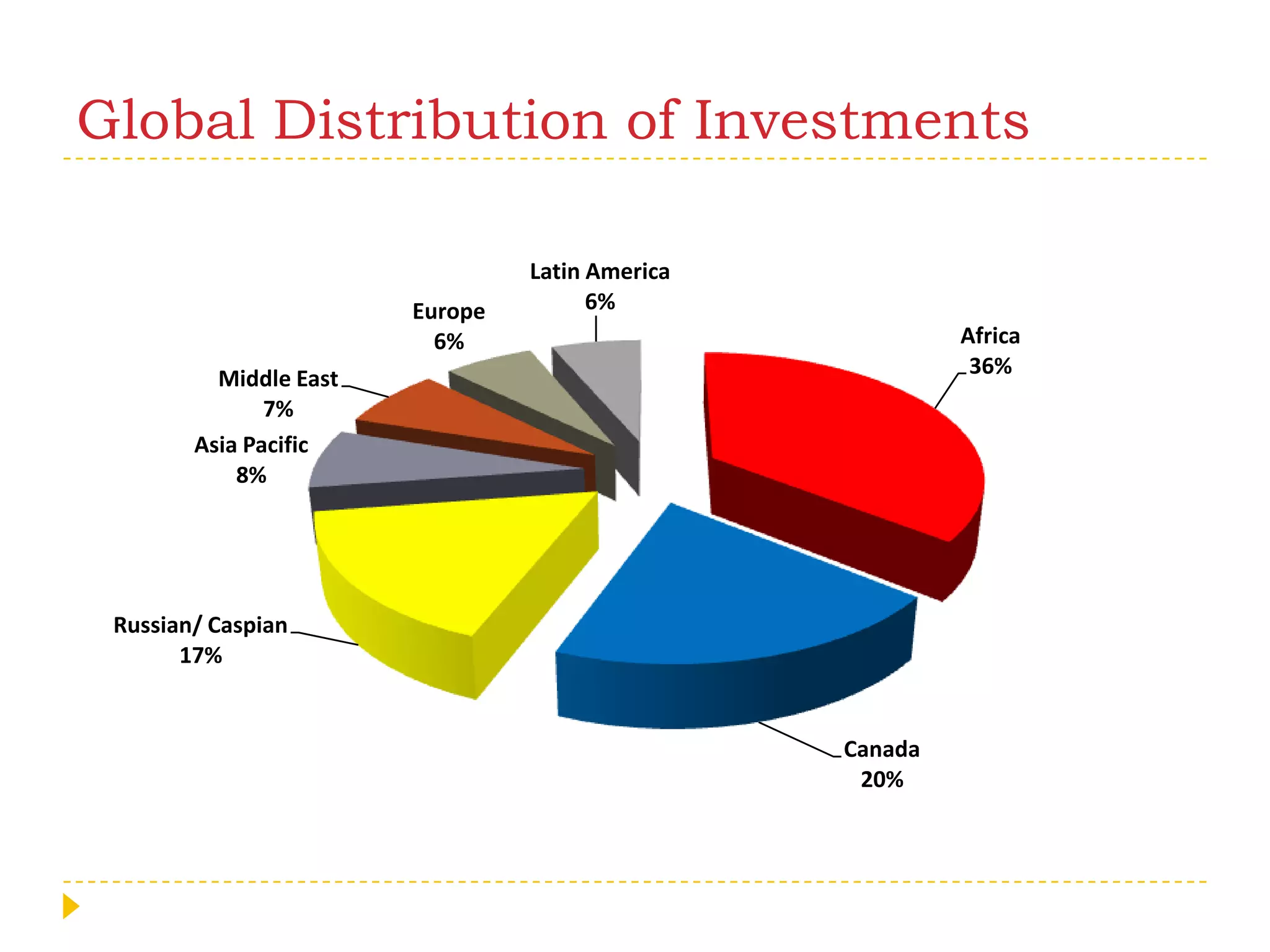

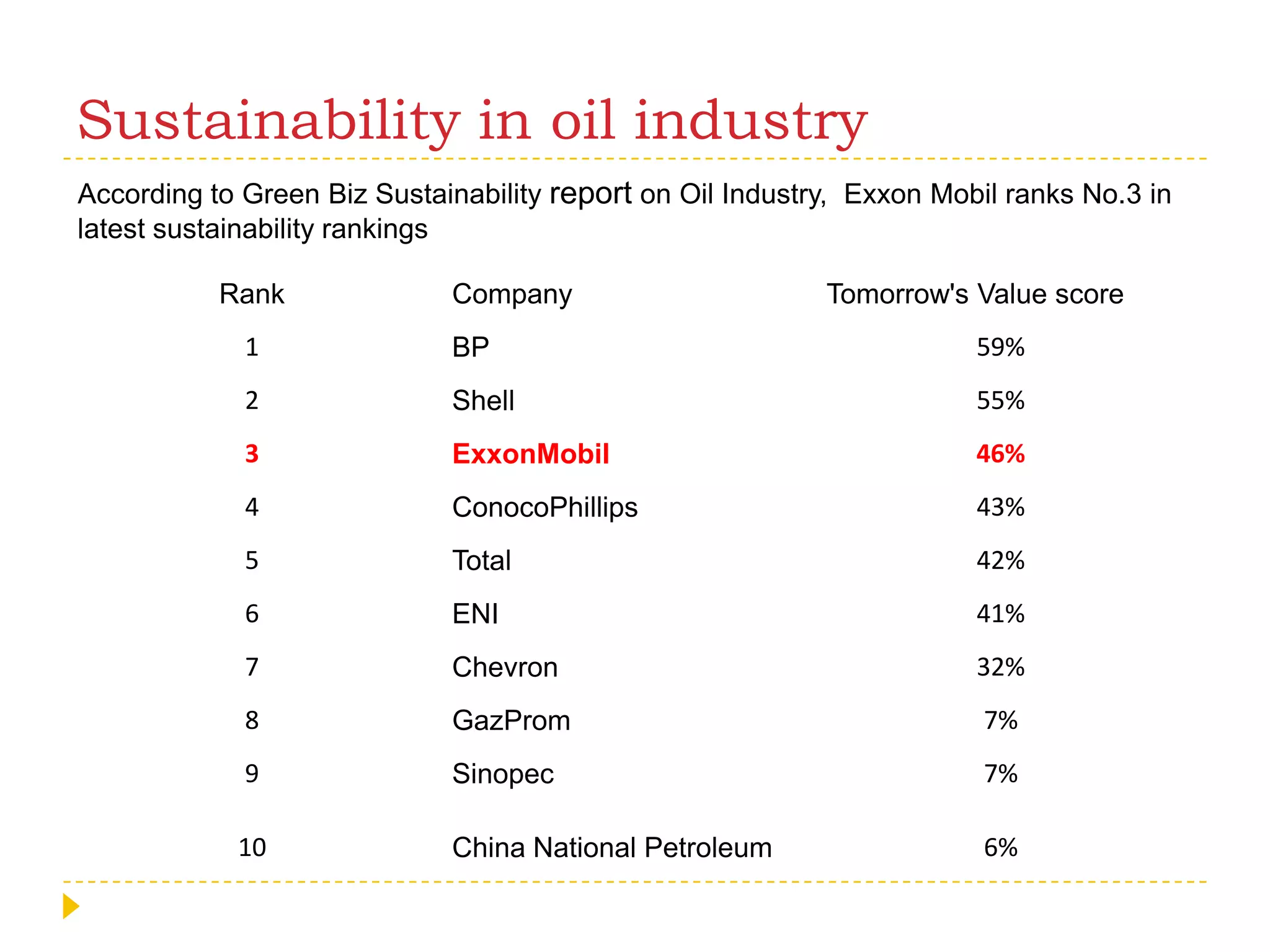

Exxon Mobil is an American multinational oil and gas corporation headquartered in Texas. It is one of the largest publicly traded international oil and gas companies in the world, consistently ranking among the top three largest companies by revenue. Exxon Mobil has operations in over 50 countries and refineries in 21 countries with a combined daily refining capacity of over 6 million barrels. The company focuses on environmental performance, workplace safety, corporate governance, transparency, and community development as key commitment areas of its global operations.