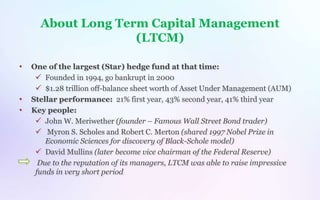

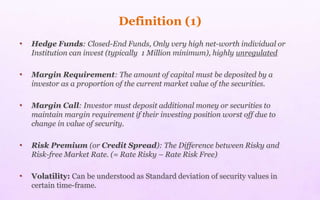

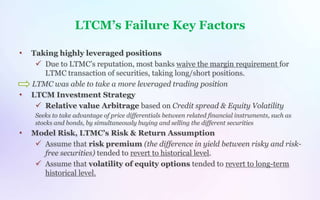

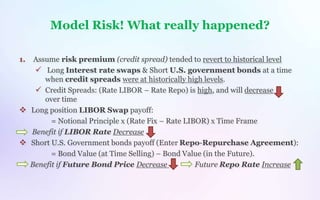

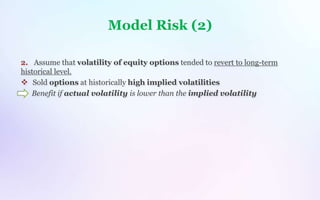

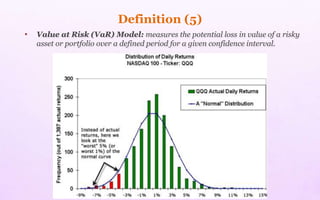

Long Term Capital Management (LTCM) was a large hedge fund that collapsed in 1998 due to significant losses from its investment strategies. LTCM took on extremely high leverage based on models that assumed risk premiums and volatility levels would revert to historical averages. However, the Russian financial crisis and other events caused unprecedented increases in risk premiums and volatility. This led to major losses that overwhelmed LTCM's capital. The Federal Reserve orchestrated a bailout to rescue LTCM's major investors and prevent broader financial fallout. The LTCM collapse demonstrated the dangers of relying on assumptions in models without proper stress testing or margin requirements regardless of reputation.