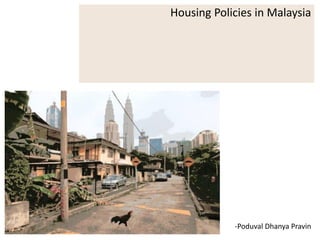

Housing Policies in Malaysia

- 1. Housing Policies in Malaysia -Poduval Dhanya Pravin

- 2. Structure • Introduction • National Housing Policy • Housing Delivery System • Initiatives Undertaken • Skim Perumahan Rakyat 1Malaysia (PR1MA) • Rumah Mesra Rakyat 1 Malaysia (RMR1M) RMR1M • Rumah Mesra Rakyat Plus • Skim Rumah Pertamaku (SRP) / My First Home Scheme • Skim Perumahan Mampu Milik Swasta (MyHome) • Perumahan Penjawat Awam 1Malaysia (PPA1M) • Housing loan scheme (SPP) • Projek Perumahan Rakyat (PPR) • District housing program (PPR for rent) • Malaysia transit 1 house (RT1M) • First home deposit financing scheme (MyDeposit) • Rumah Mampu Milik Wilayah Persekutuan (RUMAWIP) • Rumah Selangorku • Rumah Idaman Rakyat (RIR) • References

- 3. Introduction Housing is decisively rooted in the economic social, and political sphere of any country that it impossible to be explored in isolation from the broader scope of governance and policy. Besides being a remarkably valuable asset, it carries multidimensional significance; It plays an eminent role in accelerating economic growth and it carries social prominence as a spatial locus of personal and familial life (Abd Aziz, Hanif, & Singaravello, 2011; Keivani & Werna, 2001) Rapid urbanization combined with population growth has incited a surge in housing prices in many urban areas, mainly in developing countries including Malaysia. This has been supported by the evolution of nuclear families as against extended families brought about by economic development. Furthermore, increase migration, changing pattern of economic status of the population, change in expectation, and dilapidation of the existing stock has resulted in severe shortage of affordable housing. The programs discussed further in this presentation are measures undertaken to curb the housing shortage in all the social domains. 1 RM = 16.96 INR Malaysia India Population 3.12 crores (2016) 132.42 crores (2016) Area 330,803 km² 3.287 million km² Housing Shortage 1 Million Units 18.78 Million Units HH size 4.3 4.7

- 4. National Housing Policy • Thrust 1 Provision of Adequate Housing Based on the Specific needs of Target Groups • Thrust 2 Improving the Quality and Productivity of Housing development • Thrust 3 Increasing the Effectiveness of Implementation and ensuring Compliance of the Housing Service Delivery system • Thrust 4 Improving the Capability of the People to Own and Rent Houses • Thrust 5 Sustainability of the Housing Sector • Thrust 6 Enhancing the Level of Social Amenities, Basic Services and Liveable Environment A National Housing Policy (NHP) is needed to provide the direction and basis for the planning and development of the housing sector by all relevant ministries, departments and agencies at the federal, state and local levels as well as the private sector. Thrust Need For the Policy Issues & Challenges of Policy • Quality of the houses built; • Abandoned housing projects; • Affordability and accessibility of the people to own or rent houses; • Demand exceeding supply for low-cost and medium- cost houses; • Construction of Affordable Public Housing (APH) at non-strategic locations • Distribution of APH. Goal of the Policy To provide adequate, comfortable, quality and affordable housing to enhance the sustainability of the quality of life of the people. Objectives • Providing adequate and quality housing with comprehensive facilities and a conducive environment; • Enhancing the capability and accessibility of the people to own or rent houses. • Setting future direction to ensure the sustainability of the housing sector.

- 5. Stage Period Major Housing Characteristic Colonial Period Before 1957 • Government as a main player in housing provision • Housing for the government servant • Resettlement to protect from communist • Housing provision for low income people in urban Early stage of Independence 1957-1970 • Emphasized housing for low income people in urban • Public sector focused on low cost housing • Private sector started to involve in medium and high cost housing • Enhancement of basic infrastructure New Economic Policy 1970-1990 • Private sector played role in the development of low, medium and high cost housing • Housing for low income group being focus and national agenda Implementation of Human Settlement Concept National Development Plan 1991- 2000 • The government created many new laws and guidelines to ensure quality housing. • Housing law and policies that emphasis on sustainable development. • To ensure all people regardless of their income to live in a decent house. • Public and private sector responsibilities to provide housing Vision Development Plan 2001-2010 • Government as a key player in provision of low cost housing provision and private sector for medium and high cost housing. • Emphasis on sustainable urban development and adequate housing for all income groups. • Housing development will be integrated with other type of development, such as industry and commerce. National Housing Policy

- 6. Housing Delivery System Structure of Housing Provision State Federal Government National Housing Department Housing Stock Hosing for Rent / Sale PR1MA, SPNB & Other Agencies Housing Stock Affordable House for Sale State Government State Government Agencies Housing Stock Affordable House for Sale Financing : Federal Government Land: State Land Acquisition Construction : Private Contractors Market Private Housing Housing Developers & State Linked / Companies Housing Stock Affordable House for Sale Housing Stock Affordable House for Sale Financing : Private Finance Institutions / Banks Land: State / Private Land Construction : Private Contractors

- 7. Initiatives Undertaken Skim Perumahan Rakyat… Rumah Mesra Rakyat 1 Malaysia Rumah Mesra Rakyat Plus Perumahan Penjawat Awam… Projek Perumahan Rakyat Skim Rumah Pertamaku Housing loan scheme First home deposit financing scheme Projek Perumahan Rakyat for Rent Malaysia transit 1 house Rumah Selangorku Rumah Mampu Milik Wilayah Persekutuan Skim Perumahan Mampu Milik Swasta Rumah Idaman Rakyat

- 8. Skim Perumahan Rakyat 1Malaysia (PR1MA) • REGISTRATION Create an account at the website, complete registration and upload all required documents. • LAUNCH NOTIFICATION There will be notification of the launch of PR1MA developments in your preferred locations also will be advertised in the media. • LAUNCH NOTIFICATION Application for developments that are opened for application. • BALLOTING An open and transparent "balloting" process will be conducted for applicants who have fulfilled all the requirements. • UNIT SELECTION Invitation for a Unit Selection session to choose your preferred unit based on availability. • FINANCING PR1MA HOPE Home Assistance Programme is a scheme which offers financial solutions and easy access to home ownership. • SALE & PURCHASING AGREEMENT Sale & Purchase Agreement (SPA) will be signed between the developer, i.e., PR1MA and you as the Purchaser of the Property Program Name Skim Perumahan Rakyat 1Malaysia (PR1MA) Known as Malaysia People’s Housing Objective Build Affordable housing units in urban areas for middle income Malaysians. Target Group All citizens of Malaysia Target Income Group RM 2500 – RM 10000 Eligibility Criteria • Malaysian Citizen • Above 21 years old • House hold income between RM 2500 – RM 10000 • Own not more than 1 property (single or jointly) Selection Method Ballot System Price Range RM 100000 – RM 400000 Constraints • Resale is forbidden before 10 years • Not allowed to rent out Agency Perbadanan Pr1ma Malaysia (Federal Government) Process of Application

- 9. Skim Perumahan Rakyat 1Malaysia (PR1MA) • TYPE OF RESIDENCE: Apartment • NUMBER OF UNITS: 650 • PROPOSED PROJECT SITE AREA: 5.46 Acres • LAND STATUS: Freehold • UNIT SIZE: •Type A: 859 sqft (3 bedrooms, 2 bathrooms) •Type B: 1,107 sqft (4 bedrooms, 2 bathrooms) • LOCATION & EASY ACCESS • North - South Expressway • Jalan Putra Mahkota • LEKAS Highway • PRICE RANGE: RM288,000 * End Financing Scheme • The key features of this scheme include stepped-up financing, waiver of stamp duty on Sales & Purchase Agreement (SPA) and Loan Agreement Rent to Own Scheme • If your loan was rejected by our panel banks, you may be considered for the Rent-To-Own. Care by PR1MA • With Care by PR1MA, you can enjoy better insurance coverage for home ownership. Case Exploration

- 10. Rumah Mesra Rakyat 1 Malaysia (RMR1M) • REGISTRATION Create an account at the website, complete registration and upload all required documents. • APPLICATION Apply for developments that are opened for application. This would take a period of 3 months Process of Application Construction / Modification Period • Not later than 18 months from the date of surrender of the vacant site / date of agreement • Modification may be made after a defective repair period expires within 1 year after the key deliveries are made. Program Name Rumah Mesra Rakyat 1 Malaysia Objective Provide low income land owner such as farmer and fisherman to own a comfortable home. Target Group Low income land owner Target Income Group RM 750 – RM 3000 Eligibility Criteria • Malaysian Citizen • Age between 18 to 60 • House hold income between RM 750 – RM 3000 • Does not own a house • Owns a land size not lesser than 2800 sq ft. Selection Method Screening Process Price Range RM 45000 – RM 65000 Agency Syarikat Perumahan Negara (SPNB), Federal Government

- 11. Rumah Mesra Rakyat Plus • Cash • Through bank lending / any financial institution RMRPlus is a new business model that takes the basic concept of RMR1M but is dedicated to those who have their own land but does not meet the minimum criteria of the RMR1M application. The RMRPlus program is an alternative program that targets those who are not eligible to receive subsidies under the 1Malaysia People Friendly Homes Program (RMR1M) because they exceed the program's minimum requirements. Finance SystemObjective Eligibility Criteria • Malaysian • Aged 18 years old and above • The condition of the land is subject to design and financing Key Features • One Stop House (1) Level • 3 Rooms & 2 Bathrooms • Site preparation, kitchen cabinet Cupboard fixtures, Safety system, Fence • Converting roof specification Agency Syarikat Perumahan Negara (SPNB), Federal Government

- 12. Program Name Private Affordable Ownership Housing Scheme Objective A scheme by Malaysian government to encourage more affordable homes development by private sectors Target Group All Malaysian citizens Target Income Group RM 3000 – RM 6000 Eligibility Criteria • Malaysian Citizen • Above 18 years old • House hold income between RM 3000 – RM 6000 • First time buyer Selection Method Screening Process Constraints Resale is forbidden before 10 years Price Range RM 50000 – RM 170000 Agency Ministry of Urban Wellbeing, Housing & Local Government Skim Perumahan Mampu Milik Swasta The MyHome scheme was announced by YAB Prime Minister of Malaysia, YAB Dato 'Sri Mohd Najib bin Tun Abdul Razak when presenting the Supply Bill 2014 at the Dewan Rakyat on 25 October 2013. This scheme is one of the government's measures to encourage the private sector to build more many affordable homes. The MyHome scheme offers incentives up to RM30,000 per unit which benefits both home buyers and private developers. In 2015, the government has provided a budget of RM300 million for the construction of 10,000 units of affordable housing nationwide. Eligibility Criteria - Developer • A legitimate company is incorporated and incorporated under the Law of Malaysia • Licensed housing project approved by the Housing Development License and Advertising & Sales Permit (APDL) • The project is implemented on private land owned • Market Price / House sale under My Home Scheme is not more than RM300,000.00 • Private housing projects that do not receive any incentives from the Government. Housing Projects implemented by the Federal / State Government such as PPA1M, PR1MA, RUMAWIP, State Affordable Homes and so on are not eligible.

- 13. Skim Perumahan Mampu Milik Swasta Eligibility Criteria - Project • Strategic project location selection. • Viability and feasibility of the project ( feasibility ). • Meeting the demand and needs of the home at the location requested. • Have a strong financial capability. Market Price / Sales (RM) Actual Purchase Price (RM) Minimum Area (sqft) HH Monthly Income (RM) MyHome1 80,000-120,000 50,000-90,000 800 3,000-4,000 MyHome1 Kuala Lumpur 80,000-150,000 50,000-120,000 800 3,000-4,000 MyHome1 Sabah & Sarawak 90,000-120,000 60,000-90,000 800 3,000-4,000 Market Price / Sales (RM) Actual Purchase Price (RM) Minimum Area (sqft) HH Monthly Income (RM) MyHome2 120,001-200,000 90,001-170,000 850 4,001- 6,000 MyHome2 Kuala Lumpur 150,001-300,000 120,001-270,000 850 4,001- 6,000 MyHome2 Sabah & Sarawak 120,001-200,000 90,001-220,000 850 4,001- 6,000 My Home 1 My Home 2

- 14. Skim Rumah Pertamaku (SRP) • Residential properties located in Malaysia • Minimum property value of RM100,000 • Maximum property value of RM500,000 • Owner occupied (buyers are required to reside in the property) The Scheme allows young adults to obtain 100% financing from participating financial institutions, enabling them to own their 1st home without the need to pay a 10% down payment. Eligible PropertiesObjective Eligibility Criteria • Must be a Malaysian citizen • First time home-buyer • Individuals up to age 40 years • Employees in private sectors, including statutory bodies that do not offer government staff housing loan/financing facility • Single borrower gross income not exceeding RM5,000/month and joint borrowers gross income not exceeding RM10,000/month (based on gross maximum income of RM5,000/month per borrower) • Repayment of total financing obligation must not be more than 60% of the net monthly income or maximum financing limit of the participating bank, whichever is lower • Financing tenure not exceeding 35 years, subject to borrower’s age not exceeding 65 years at the end of financing tenure. • Amortising facility only • Instalments payable via monthly salary deduction or standing instruction • Compulsory Fire insurance Financial Requirements • Application can be made at any branch of the participating banks. • The maximum financing tenure is 35 years, subject to borrower’s age not exceeding 65 years at the end of financing tenor and to underwriting policies of the participating banks. Application Procedure

- 15. HOUSING LOAN SCHEME (SPP) Eligibility • Applicants and spouse are Malaysian citizens • Aged 21 to 70 years old • Not a Government employee or pensioner (including spouse) • Applicants and spouses have no home yet • Total gross household income ranging from RM1,000.00 to RM3,000.00 per month • Own land or land belonging to immediate family members SPP was created to provide lending facilities to low-income earners who still do not own their own homes. This scheme is one cost of building houses so that they have the least resources to own their homes. Objective The Housing Loan Scheme (SPP) is managed through a trust fund account known as the Housing Loan Trust Fund for the Low-Income Group. This fund was approved on 17 December 1975 under the Financial Procedure Act 1957 (amendment 1972) and came into force in 1976 Construction Terms • Low cost house - floor area 700 - 1,000 square feet, at least 3 bedrooms and 2 bathrooms, living room and kitchen. • It is given the option to use the plans provided by the National Housing Department (NRD) ONLY. • Applicants can NOT use their own plan • Obtain approval of Building Plan by the Local Authority (PBT) if required • Appointment of contractors is managed by the borrower and the contractor: - • Local contractors by state constituency; • Have a Company Registration or a valid CIDB Registration Certificate; • Having sufficient financial resources • Have specialization in construction related fields Terms of Loan • Maximum Loan Limit RM60,000.00 (excluding insurance coverage) • Maximum loan repayment period of 35 years or up to age 70. • Service charge of 2% on the loan. • Need to take insurance coverage provided by the Insurance Panel, the National Housing Department on a built house

- 16. DISTRICT HOUSING PROGRAM (PPR For Ownership) Features & Facility • Large area in the city: The type of multilevel house between 5 to 18 floors • Suburban area: Type of terrace house • Area: Not less than 700 square feet • Buildings - 3 Bedrooms, 1 Living Room, 1 Kitchen Room, 2 Bathrooms • Basic facilities: • Community Hall / Public Hall • Surau / Prayer Room • Dining Stall / Commercial Space • Kindergarten • OKU facilities • Playground / Free Area • Garbage House The Program is a Government program for relocation of squatter and meeting the needs of the dwelling for the lower income group. The Government is implementing the Owned PPR which aims to enable lower-income groups to have their own homes. Owned PPR houses sold at RM35,000 per unit in Peninsular Malaysia and RM40,500 per unit in Sabah and Sarawak. Program Name DISTRICT HOUSING PROGRAM Objective Improve standard and cost of living of LIG Target Group All Malaysian citizens Target Income Group Under RM2500 Eligibility Criteria • Malaysian Citizen • Above 18 years old • House hold income below RM 2500 • First time buyer • Applicant with family (Priority) Selection Method Screening Process Constraints Not allowed to rent out Price Range RM 30000 – RM 40500 Agency Ministry of Urban Wellbeing, Housing & Local Government

- 17. DISTRICT HOUSING PROGRAM (PPR For Rent) The rented PPR program was introduced in February 2002 aimed at being rented out to target groups (low income and squatter) at RM124.00 per month. Objective Features & Facility • Large area in the city: The type of multilevel house between 5 to 18 floors • Suburban area: Type of terrace house • Area: Not less than 700 square feet • Buildings - 3 Bedrooms, 1 Living Room, 1 Kitchen Room, 2 Bathrooms • Basic facilities: • Community Hall / Public Hall • Surau / Prayer Room • Dining Stall / Commercial Space • Kindergarten • OKU facilities • Playground / Free Area • Garbage House Eligibility Criteria • Malaysian • Aged 18 years old and above • Household income below RM3000 per month • The petitioner has no home yet • Under the additional terms set by the State Government • The program is a Government program for relocation of squatter and meeting the needs of the dwelling for the lower income group. The National Housing Department under the Ministry of Urban Wellbeing, Housing and Local Government is the leading implementing agency for PPR projects throughout Malaysia. • All houses constructed under both the Owned PPR and Rented PPR program will use the specification of design and design of low-cost housing set out in the National Housing Standard for Low Cost Housing (CIS2). Locations DEVELOPMENT TYPE 1 PPR Simpang, Perdana Apartment 2 PPR Sungai Putat, Melaka Apartment 3 PPR Hiliran, Kuala Terengganu, Terengganu. Apartment

- 18. MALAYSIA TRANSIT 1 HOUSE (RT1M) The 1Malaysia Transit Home Program (RT1M) aims to provide temporary housing facilities to married couples aged between 18 and 30 years old. This program is concentrated in big cities to reduce the burden of low qualified low-income young couples. Target Group All Malaysian citizen with a hh income less than RM5000 living in a transit area and does not have his own house. Objective Rent & Rental Period • The house is rented at a rate of RM250.00 per month for an initial rental period of two years. • The tenant will be given six months prior to the expiry of the contract period for the purpose of emptying the house. Features & Facility • The area of the unit is between 700 and 850 square feet, 2 or 3 bedrooms,2 bathrooms, Living room, Kitchen and equipped with fan and lamp • Facilities at RT1M include Multipurpose hall, Nursery room, Shops / booths, Management Office, Parking lot, Motorcycle parking lot, Area fence and Security Current Locations Currently, 2 blocks (L and M Blocks) at PPR Pinggiran Bukit Jalil with 632 units of houses are used as a pilot project for this program. The program will be extended to major cities throughout Malaysia. Eligibility Criteria • Applicants and spouse are Malaysian citizens • Applicants have been married • The applicant is between 18 and 30 years old • The applicant does not have his / her own home in the transit area / country of residence • The applicant works in the transit area / country • Household income of RM5,000 and below • There is no criminal record

- 19. In line with the objective of the National Housing Policy to enhance the capabilities and accessibility of homeowners. The Government has announced an allocation of RM200 million as a contribution to the deposit payment for the purchase of the first house by one household. The My Deposit Scheme application was officially opened on 6 April 2016. This scheme is one of the Government's initiatives to encourage home ownership by Malaysians. Through My Deposit, new first home owners are able to get a one-off contribution of 10% on the sale price or a maximum of RM30,000 (whichever is lower). This amount does not need to be paid back as it is a contribution from the government. FIRST HOME DEPOSIT FINANCING SCHEME The First Home Deposit Financing Scheme (My Deposit) is a special product introduced by the Government to help the middle class have the first home. The Government has announced an allocation of RM200 million as a contribution to the deposit payment for the purchase of the first house by one household. Eligibility - Projects • Licensed new housing project licensed from licensed housing developers only • House purchase price of RM500,000 and below • Approval of purchases for private housing projects that are not subsidized / incentives / Government funds • Housing projects by Federal and State Governments such as PPA1M, PR1MA, RUMAWIP, PPR, My Home and Affordable Houses are not allowed Objective Constraint It has been stipulated that the properties bought via the My Deposit scheme cannot be sold for 10 years, effective from Sale & Purchase Agreement date. • Malaysian • Aged 21 and up • Purchase of first home for one household. Households refer to husband or wife only. The spouse or spouse who owns the home for one household is NOT ALLOWED. • Household income ranges from RM3,000 to RM15,000 Eligibility Criteria Agency The My Deposit Scheme was launched by the Government through the Ministry of Urban Wellbeing, Housing and Local Government (KPKT)

- 20. Rumah Idaman Rakyat (RIR) The My Home scheme was announced by YAB Prime Minister of Malaysia, when presenting the Supply Bill 2014 at the House of Commons on 25 October 2013. This code is one of the government's measures to encourage the private sector to build more many affordable homes. Features Program Name Rumah Idman Rakyat Objective Provide affordable houses to MIG Target Group All Malaysian Citizen Target Income Group Monthly HH income< RM 10000 Eligibility Criteria • Malaysian Citizen • Age : 21 years and above • Priority given to first time buyers, disabled persons (OKU) and single mothers Selection Method Screening Process Price Range Under 350000 Constraints Resale is forbidden for 5 years Not allowed to rent out Agency Syarikat Perumahan Negara (SPNB), Federal Government • SELLING PRICE House ≤ RM350, 000 • MIXED HOUSING Lot Bungalow / Units Unit, Home Terrace / Shop, Apartment : 5 ≤ 7 units • LAND OWNERSHIP State or Federal Government of the State statutory body or Agency Federation • FINANCING Financing by bank • MORATORIUM ≤ 5 years • CAPITAL CYCLE Infrastructure and earthworks allocation RM83 million. • BUSINESS PARTNER Cooperation between RIR and business partners such as bank institutions (Maybank / CIMB etc.), Mydin Store and KFC to jointly develop selected residential areas with SPNB

- 21. Rumah Mampu Milik Wilayah PersekutuanThe State Government has introduced a new housing concept, Affordable Homes, which provides more comfort in terms of size, design and community. Now Low Cost Houses, Medium Low Cost Houses, Medium Cost Houses and Affordable Houses are known as Selangorku Houses. Program Name Rumah Selangorku Objective Provide affordable houses to MIG within the region of Selangor Target Group All Malaysian Citizen Target Income Group RM 3000 – RM 10000 Eligibility Criteria • Malaysian Citizen • Age : 18 years and above • Residing in Selangor • Does not own a property in Selangor Selection Method Screening Process Price Range Under 350000 Constraints • Resale is forbidden for 5 years • Not allowed to rent out Agency Lembaga Perumahan dan Hartanah Selangor (LPHS) Rumah Selangorku Program Name Rumah Mampu Milik Wilayah Persekutuan Objective Provide affordable houses to MIG who stay and work in Waliyah Persekutuan Target Group Waliyah Persekutuan Citizen Target Income Group Under RM150000 Eligibility Criteria • Malaysian Citizen • Age : 21 years and above • Stay and work in Waliyah Persekutuan • Income less than RM15000 • First house in Waliyah Persekutuan Selection Method Ballot Price Range Under 350000 Constraints • Resale is forbidden for 5 years • Not allowed to rent out Agency Ministry of Federal Territories (KWP)

- 22. References National Housing Policy, Malaysia Malaysia Affordable Housing Revisited- Diwa Samad Malaysian Housing Policies – Pospects and obstaclesof National Vision 2020 – Andrew C Ezeanya http://www.spnbmesra.com.my/ https://www.spnbidaman.com.my/rumah-idaman-rakyat/ https://sprn.kpkt.gov.my/sites/default/files/SPP_760.pdf https://www.ppa1m.gov.my/application/survey http://haven.pr1ma.my/?l=en