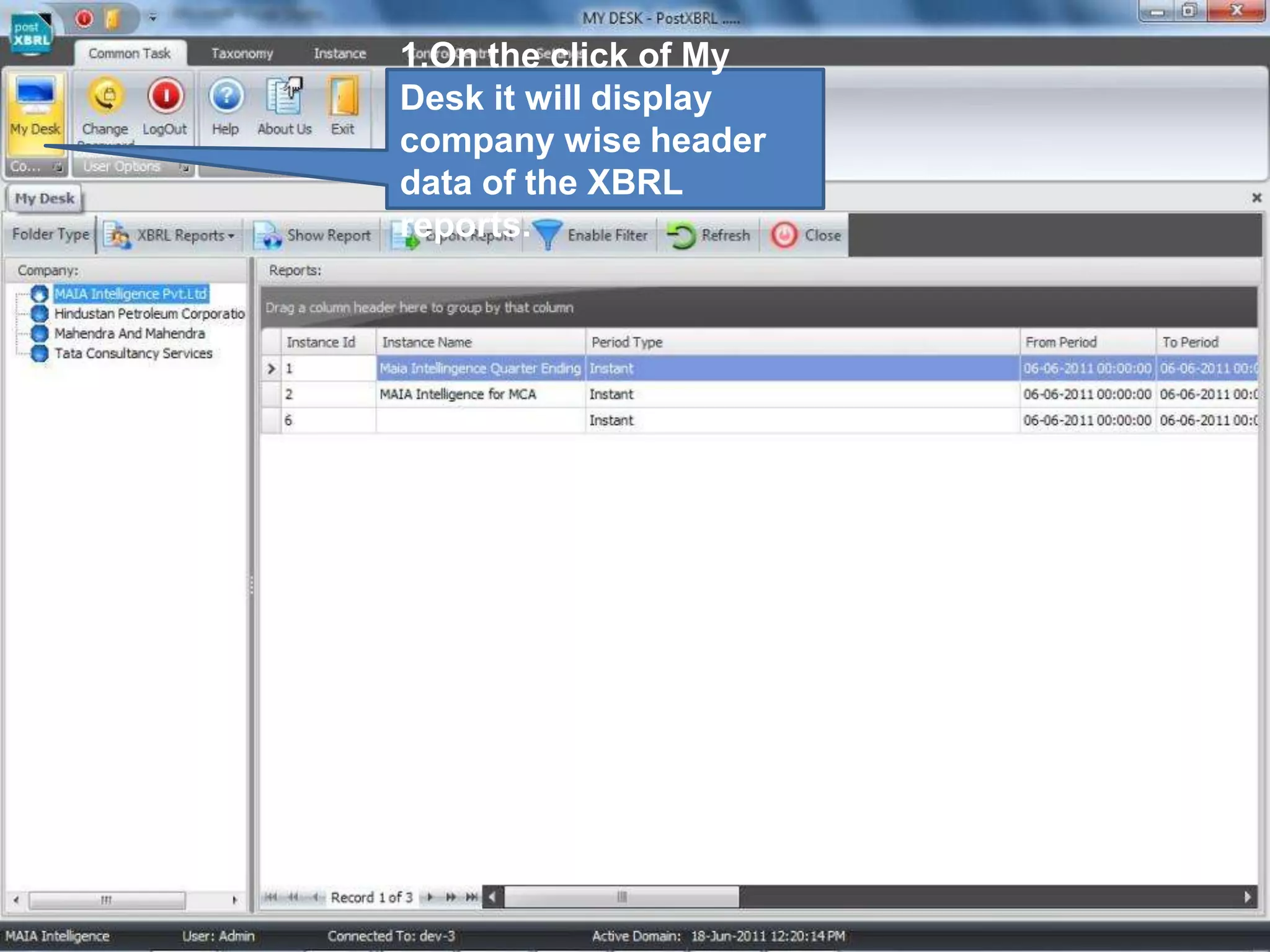

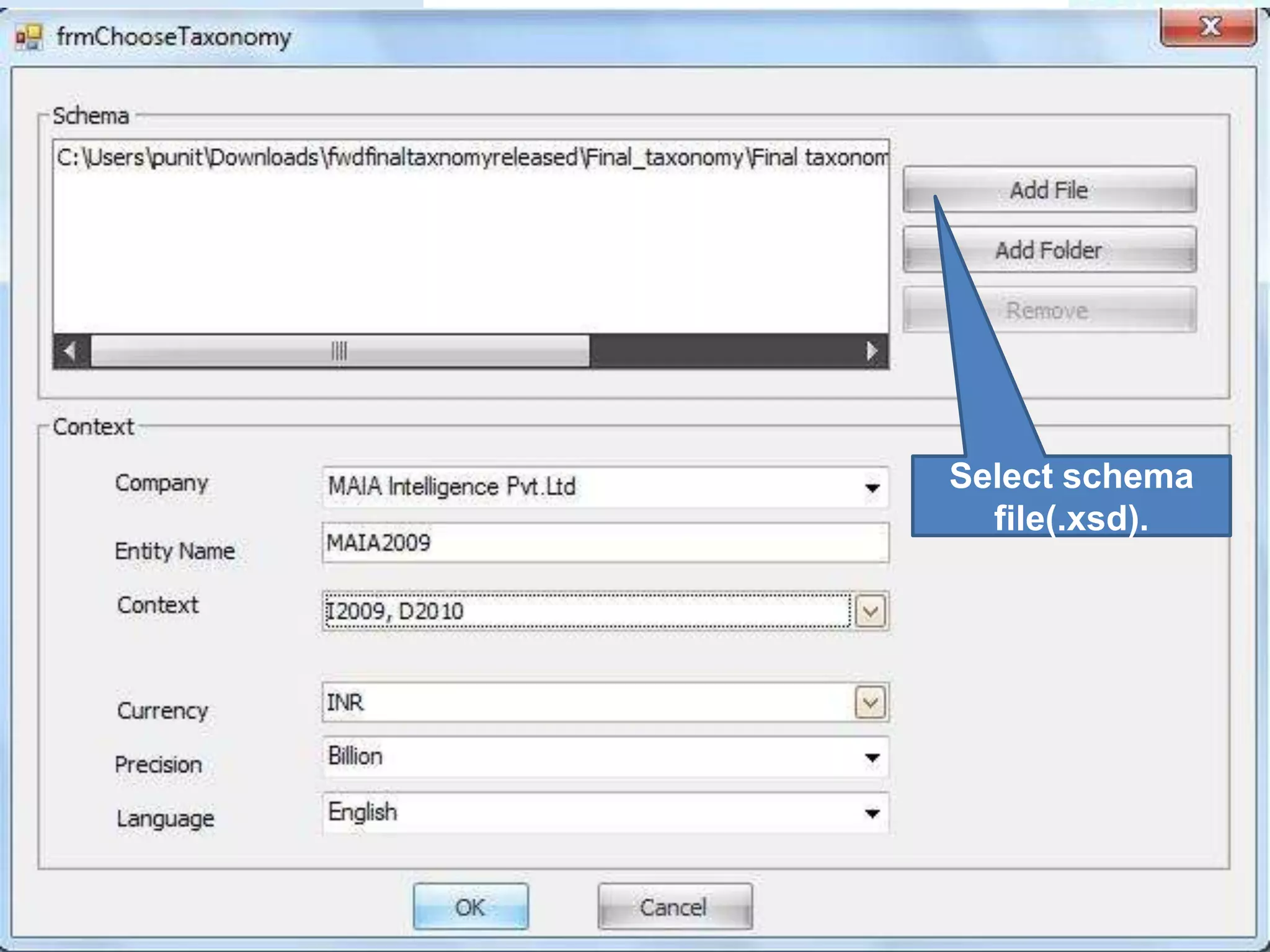

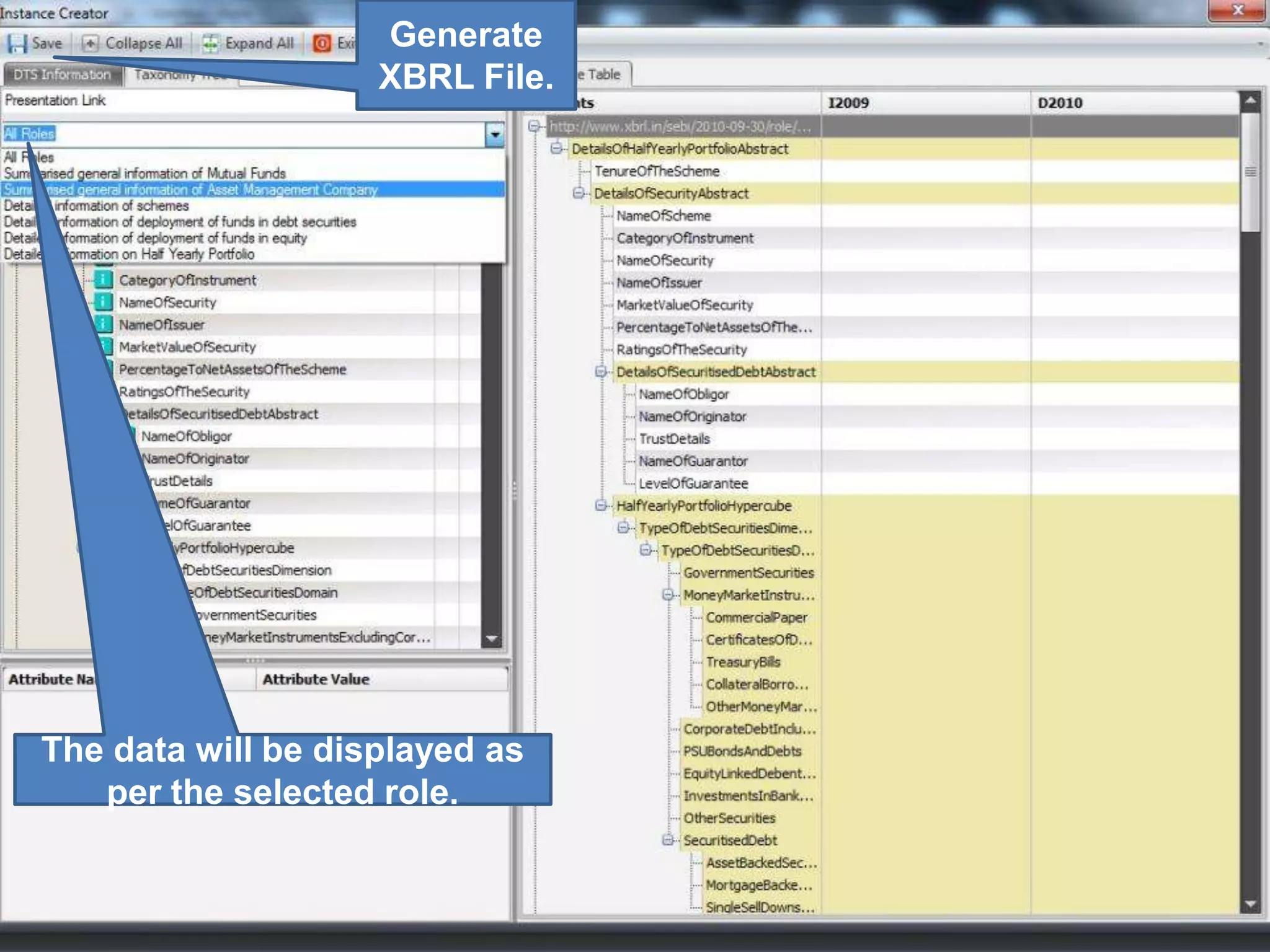

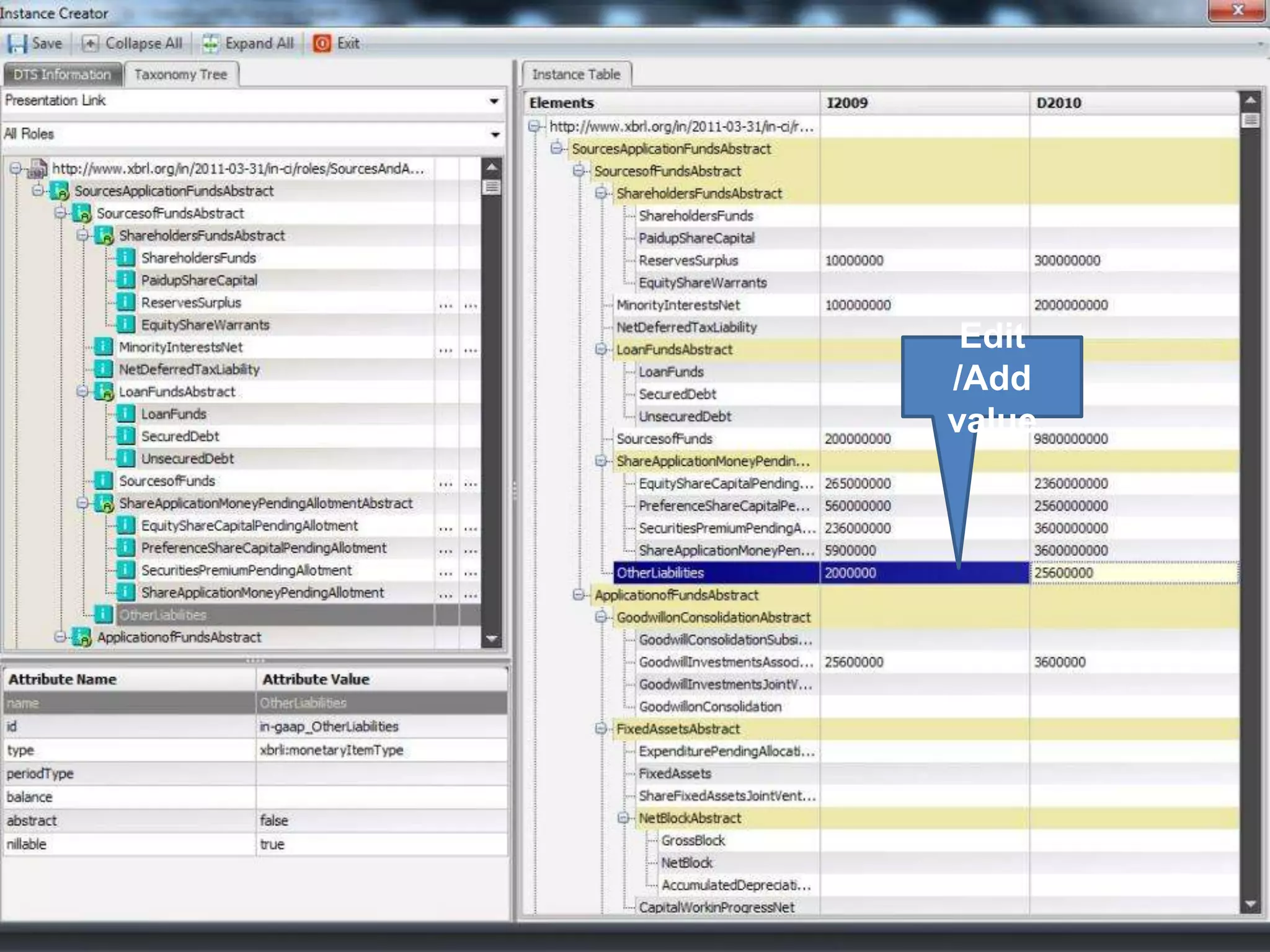

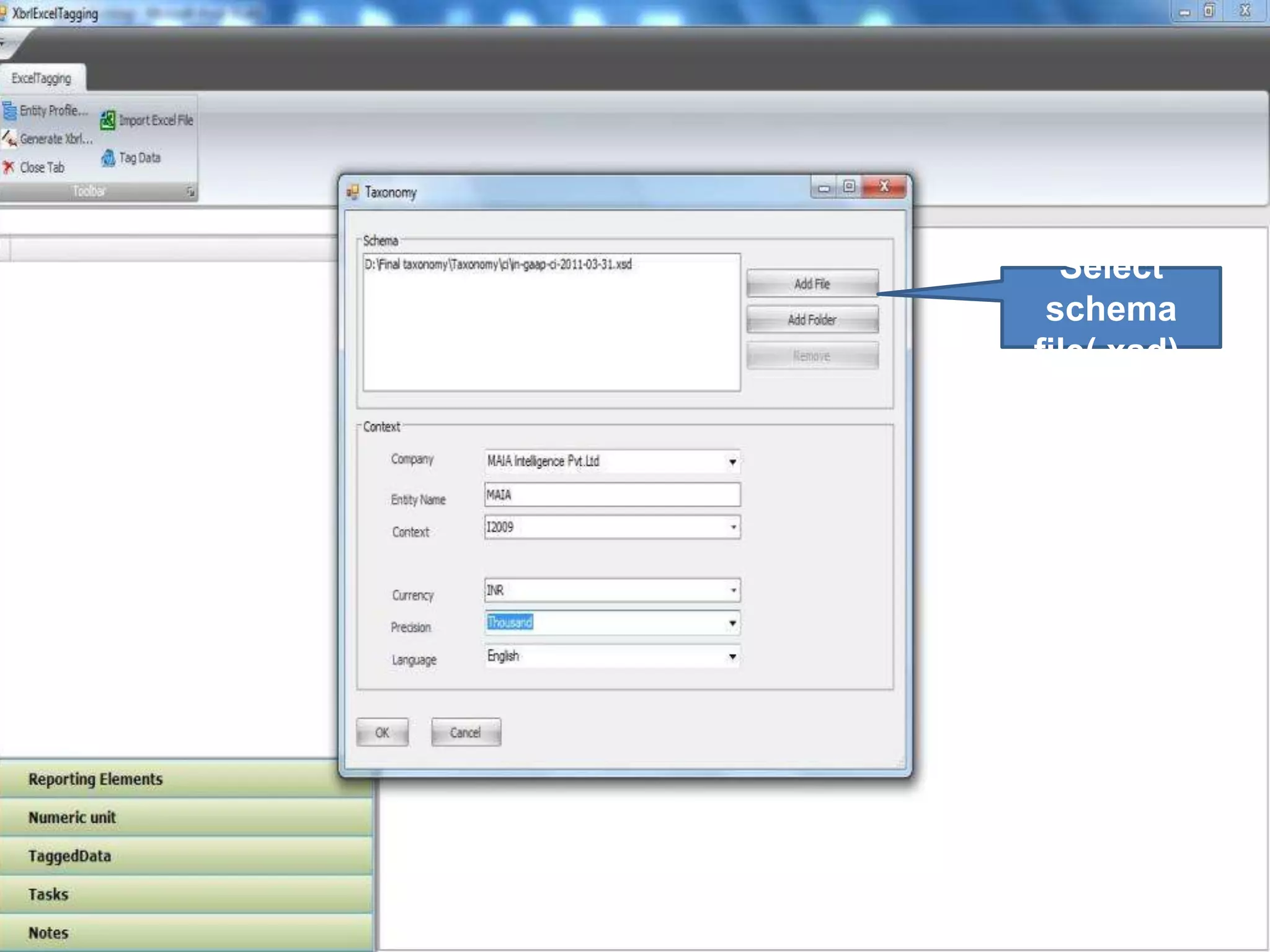

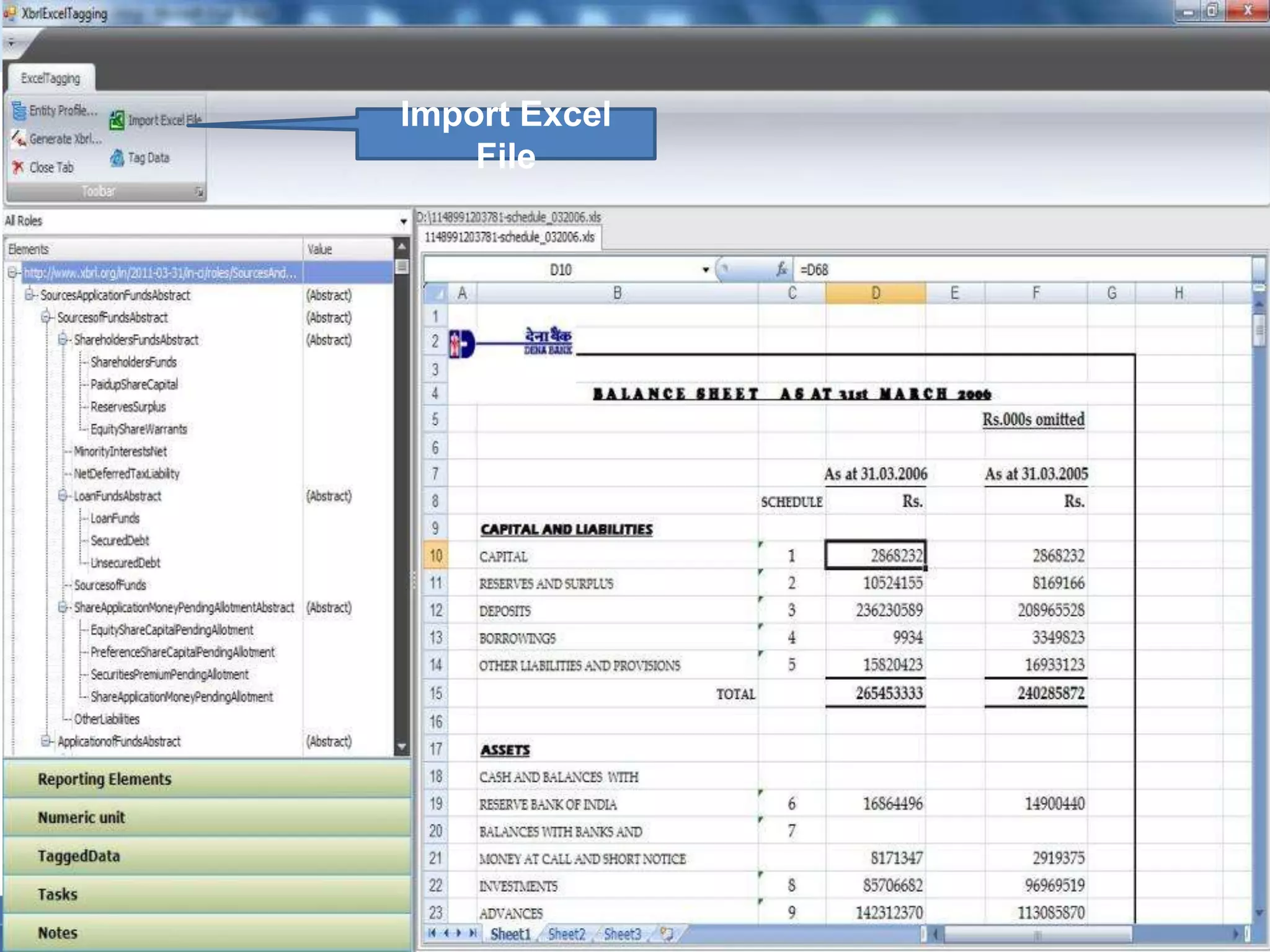

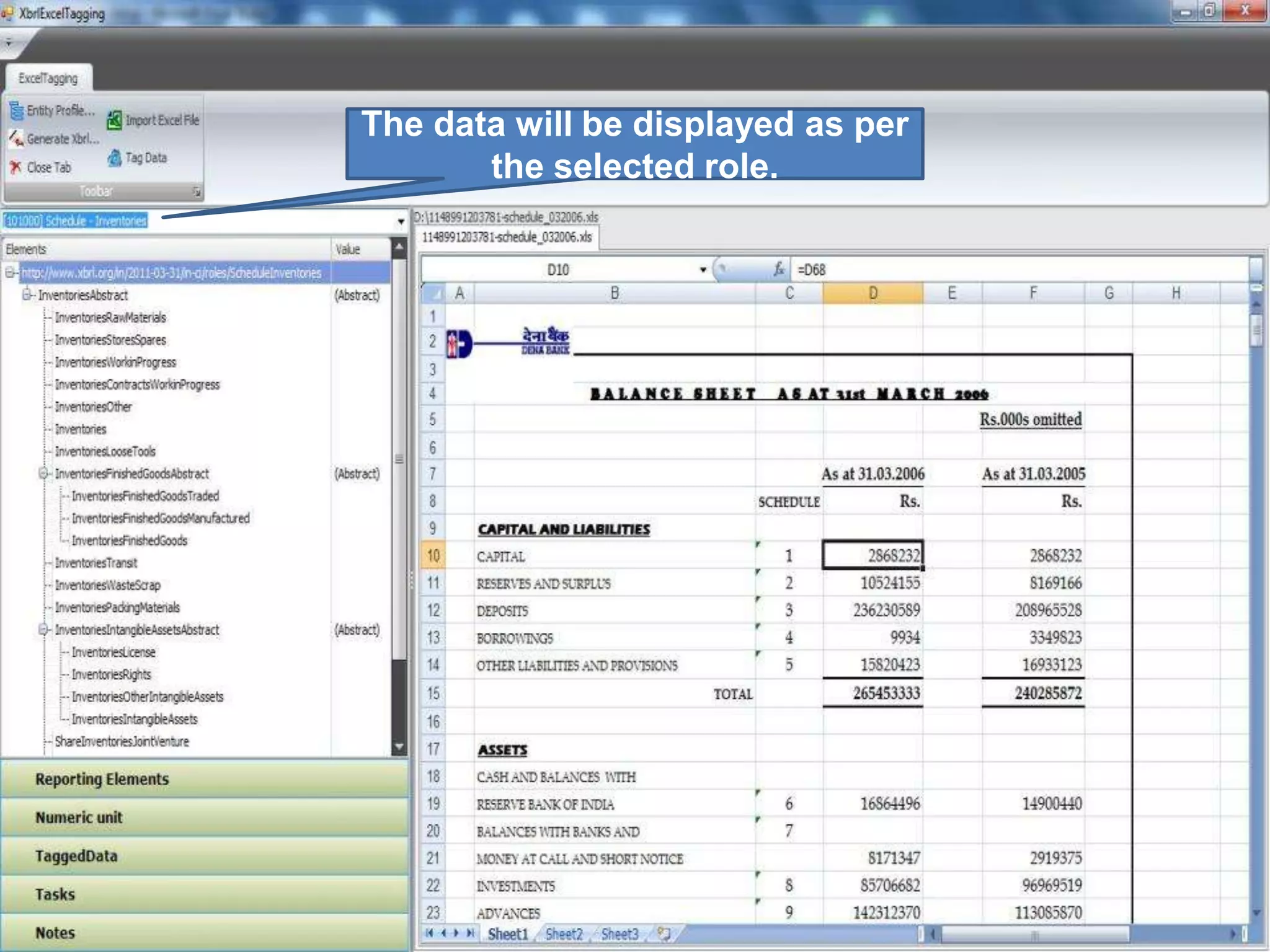

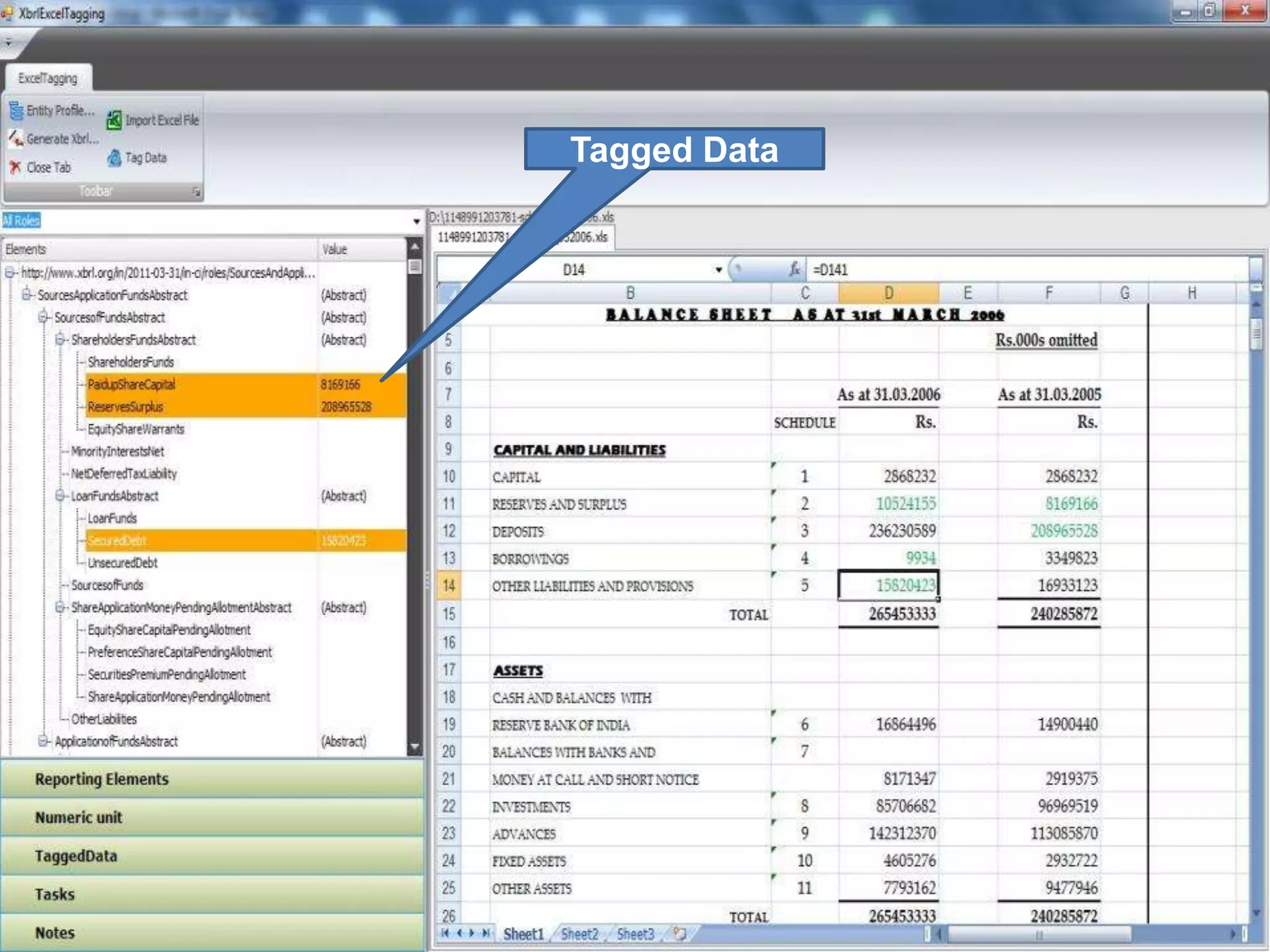

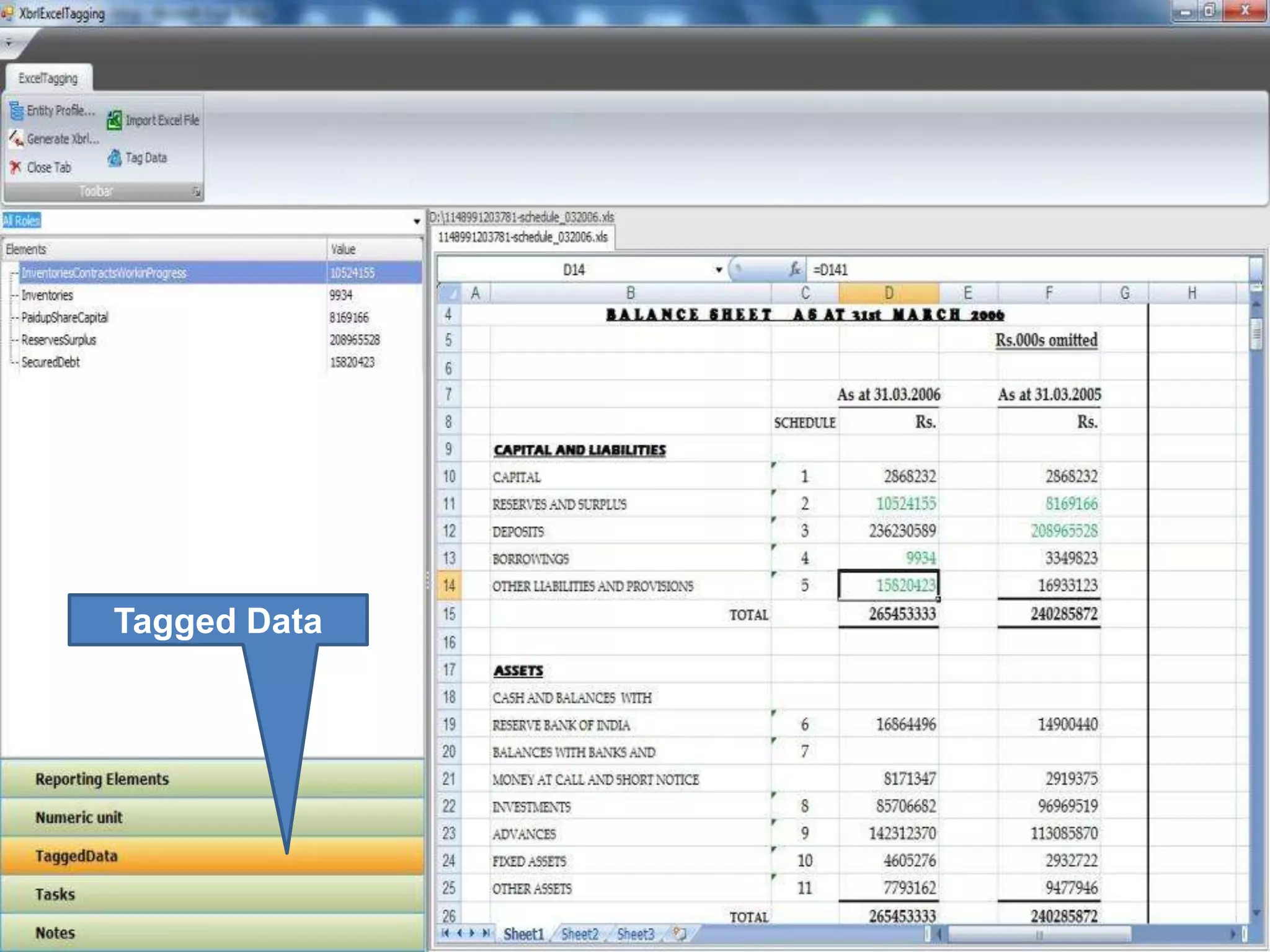

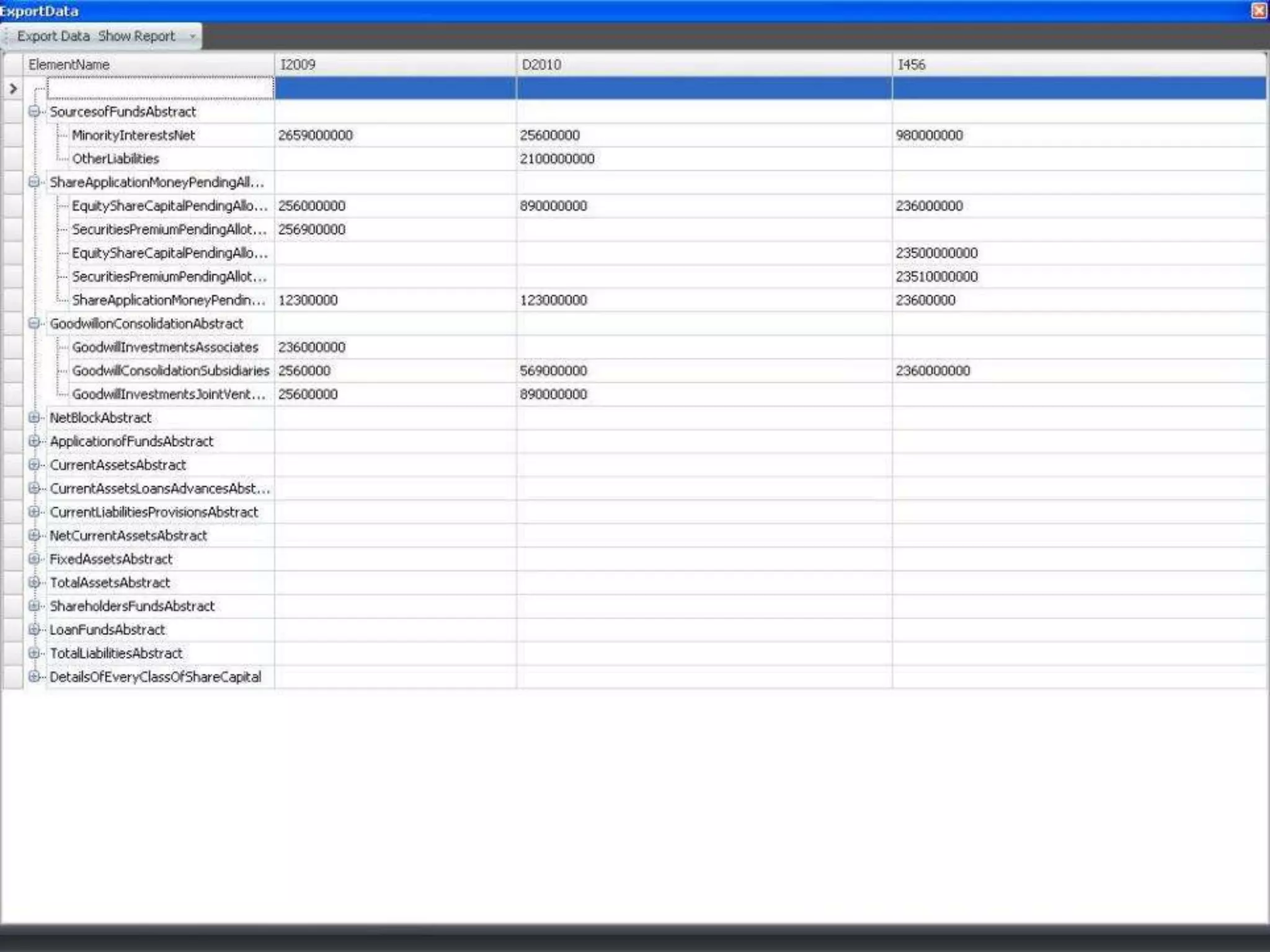

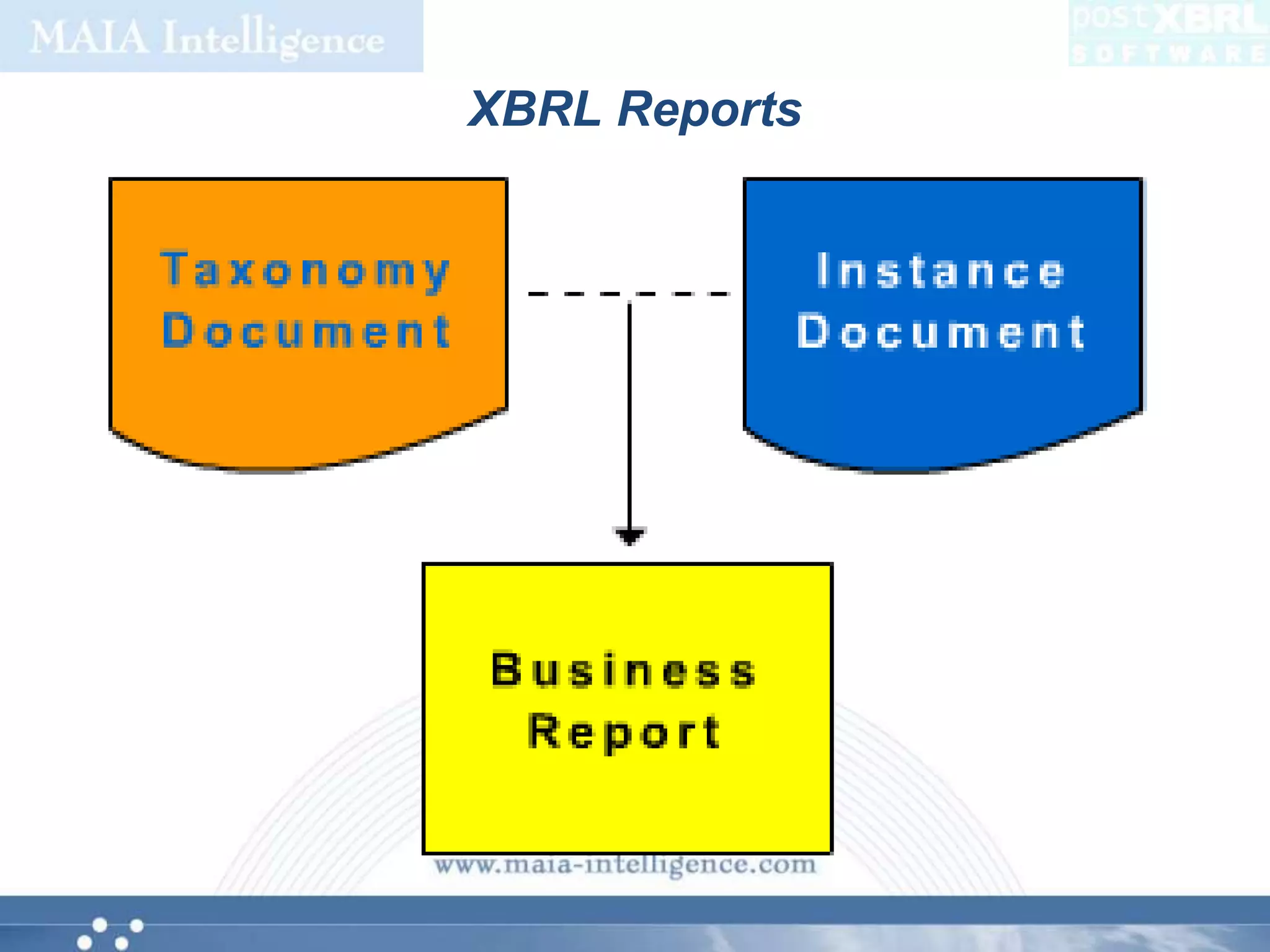

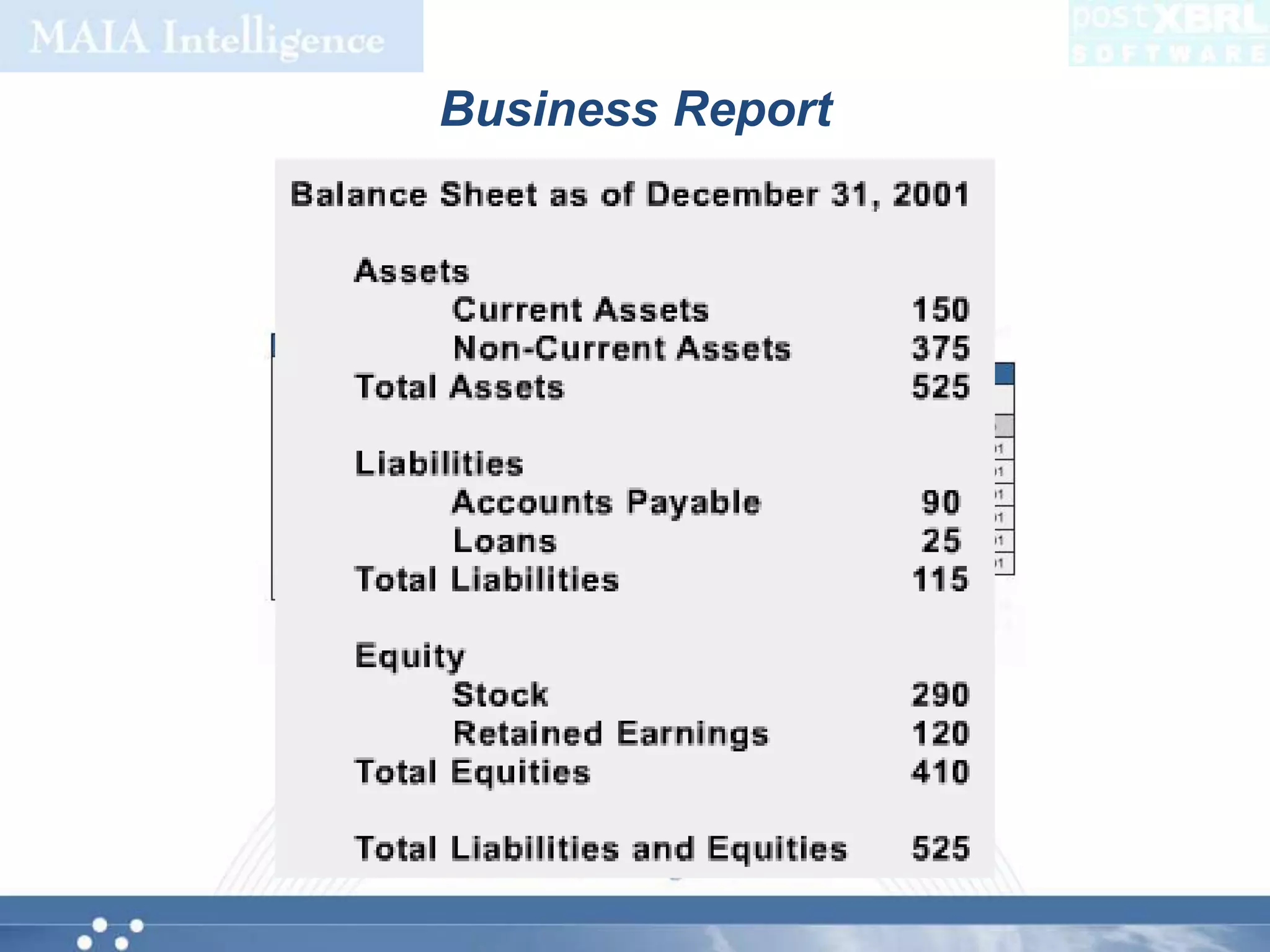

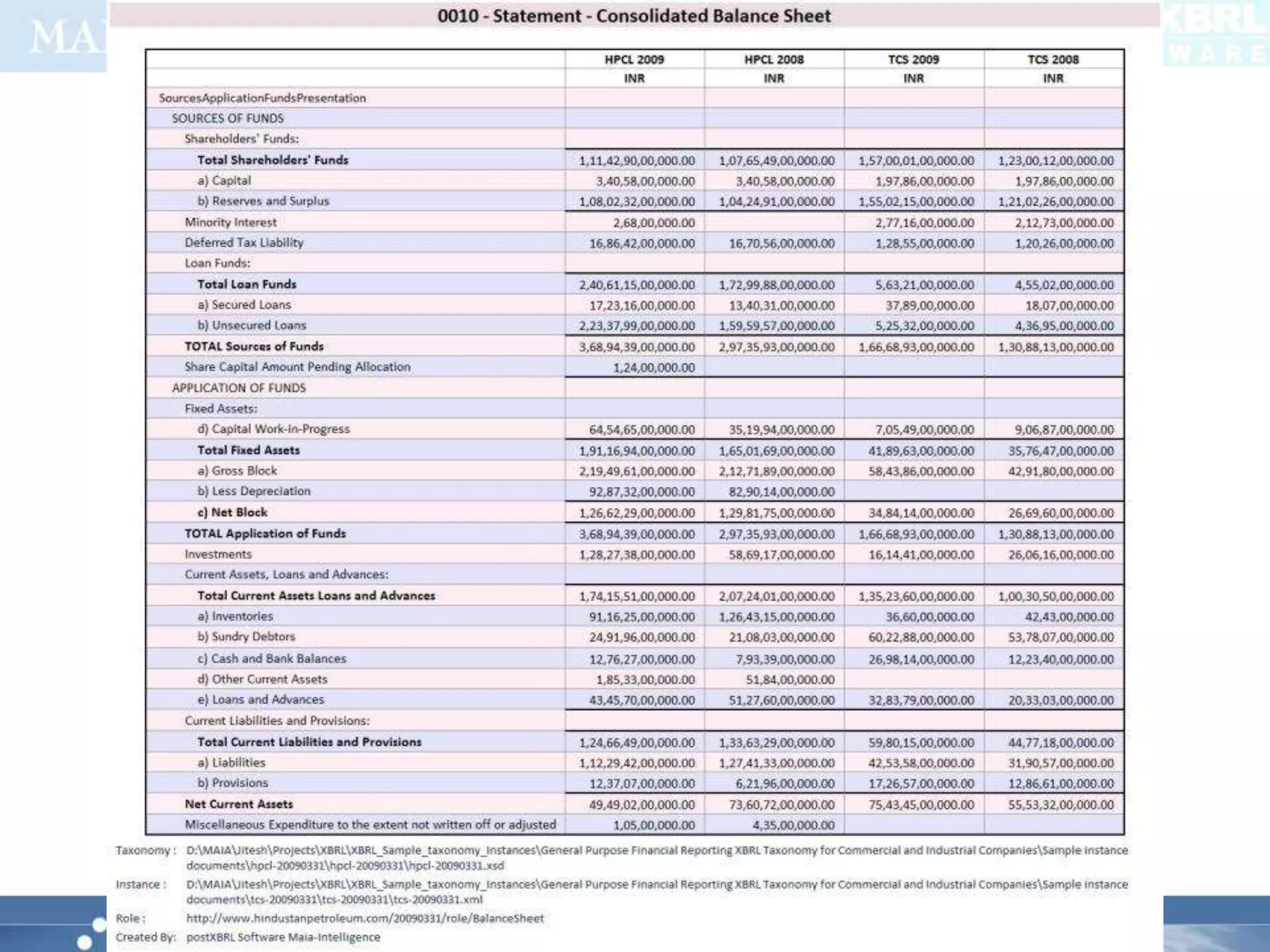

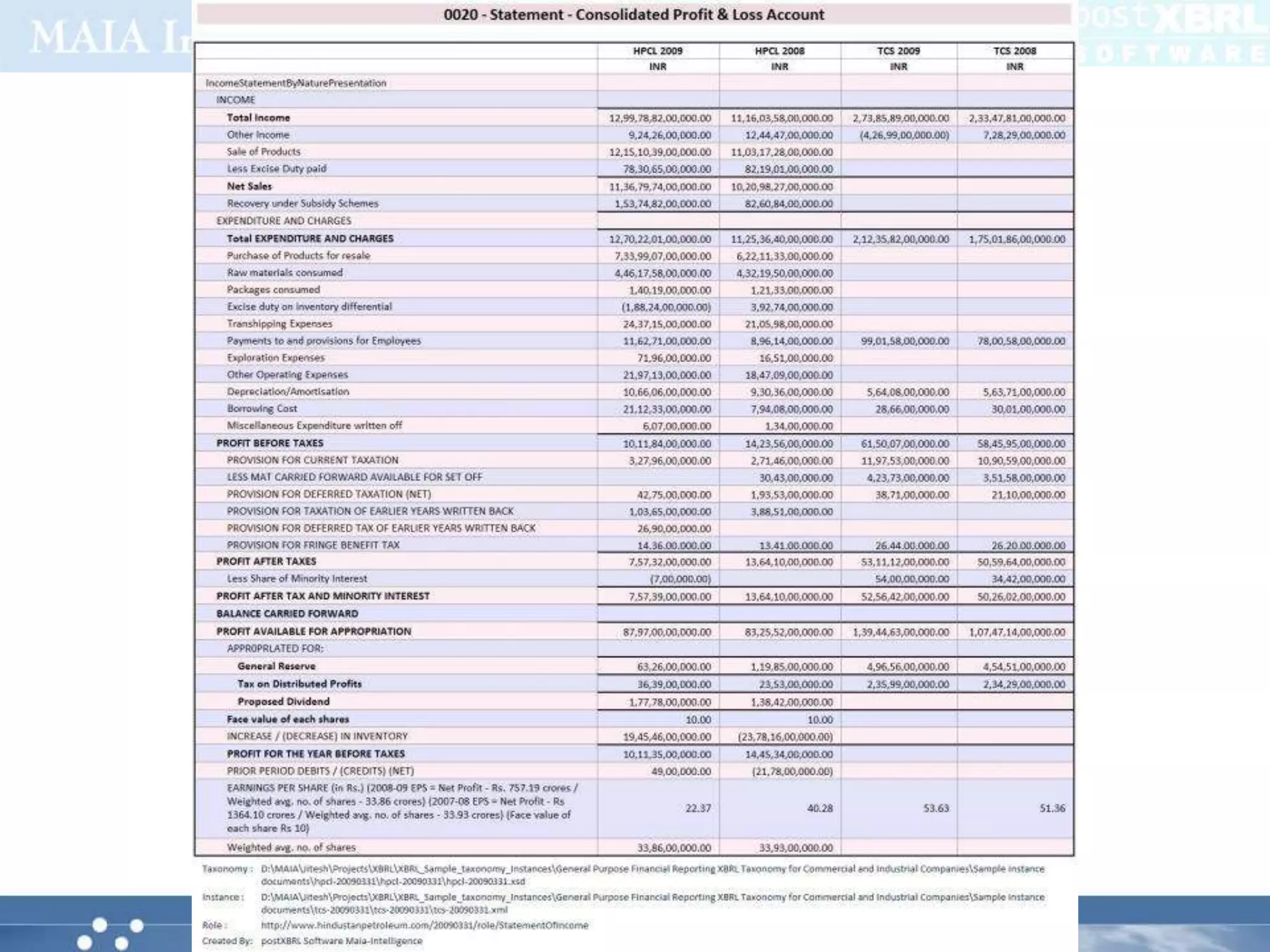

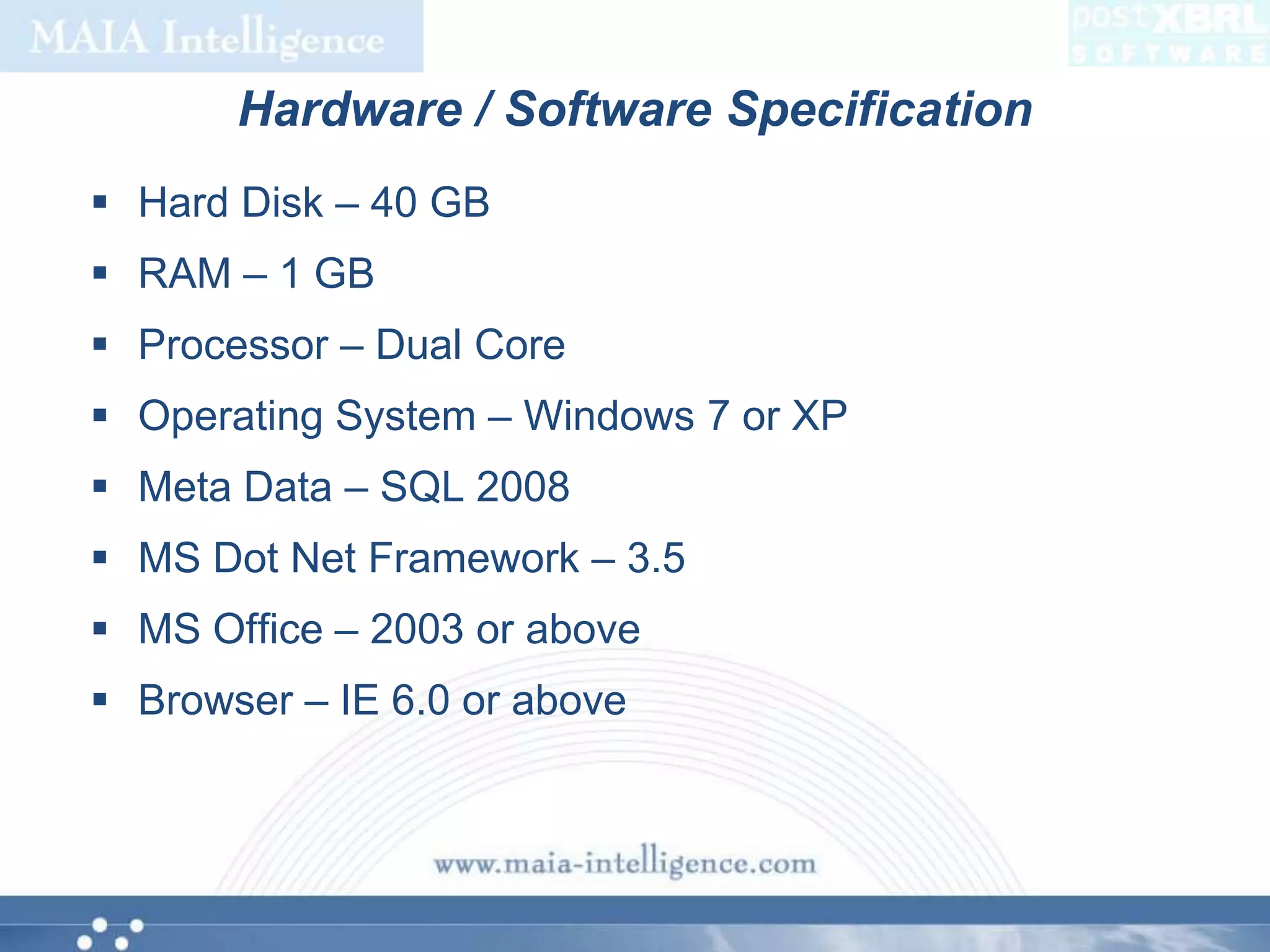

XBRL (Extensible Business Reporting Language) facilitates the electronic communication of business and financial data, providing substantial benefits in efficiency, accuracy, and cost savings for financial reporting. Companies such as those listed in India or with significant capital and turnover are required to file their financial statements in XBRL format starting from FY 2010-2011. The format allows for improved data handling, analysis, and regulatory compliance through the use of specialized software and third-party services.