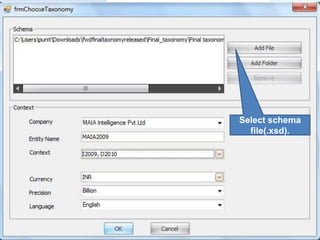

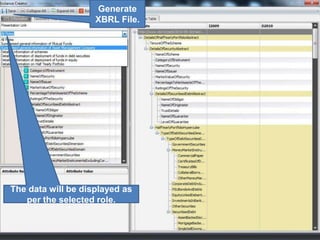

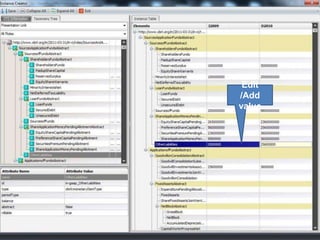

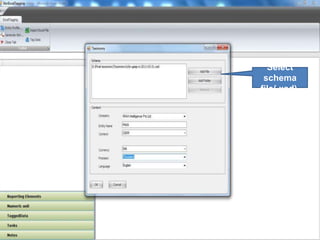

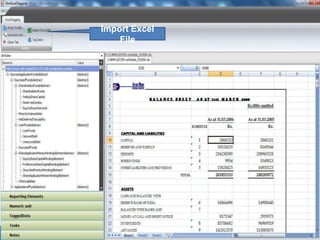

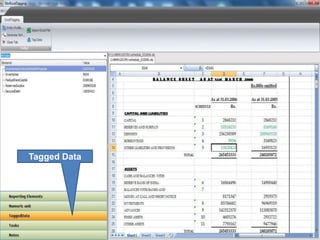

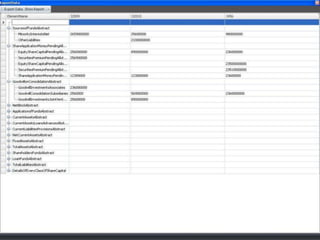

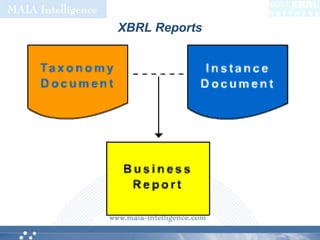

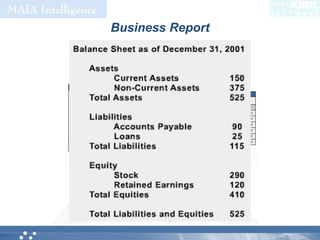

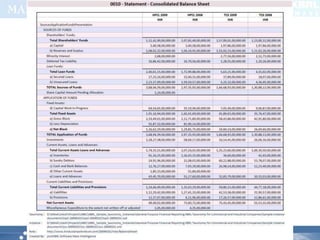

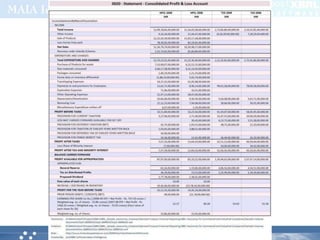

XBRL is a standardized language used to communicate business and financial data. It provides benefits like cost savings, greater efficiency and improved accuracy. XBRL documents filed by companies should include information from their annual reports like the balance sheet, profit and loss statement, cash flow statement, and notes to accounts. Applicable companies are those listed in India, their subsidiaries, and companies with a paid up capital over Rs. 5 Crore or turnover over Rs. 100 crore. XBRL works by using a taxonomy to define reporting elements, which companies then use to generate a valid XBRL instance document mapping their financial data.