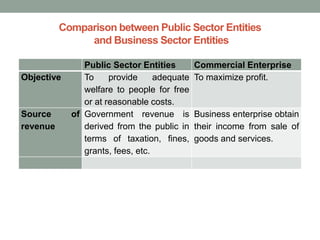

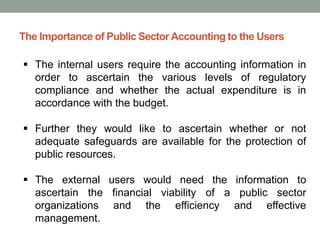

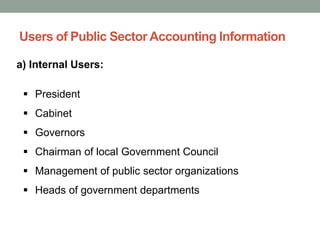

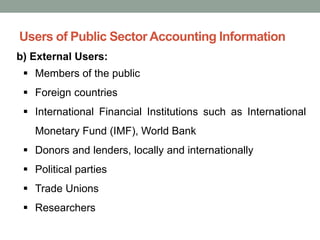

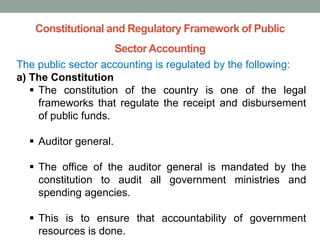

This document provides an overview of public sector accounting. It defines the public sector as organizations established and financed by the government to provide services to the public rather than generate profit. Public sector accounting differs from business accounting in its objectives of providing services rather than maximizing profits. The document discusses the users and objectives of public sector accounting, including stewardship, planning, control, and transparency. It also outlines the constitutional and regulatory frameworks that govern public sector accounting in Yemen.