Estate Planning Case Questions Part 22.1. Mary is considering a gi.docx

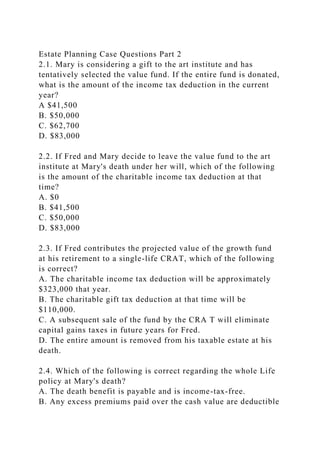

- 1. Estate Planning Case Questions Part 2 2.1. Mary is considering a gift to the art institute and has tentatively selected the value fund. If the entire fund is donated, what is the amount of the income tax deduction in the current year? A $41,500 B. $50,000 C. $62,700 D. $83,000 2.2. If Fred and Mary decide to leave the value fund to the art institute at Mary's death under her will, which of the following is the amount of the charitable income tax deduction at that time? A. $0 B. $41,500 C. $50,000 D. $83,000 2.3. If Fred contributes the projected value of the growth fund at his retirement to a single-life CRAT, which of the following is correct? A. The charitable income tax deduction will be approximately $323,000 that year. B. The charitable gift tax deduction at that time will be $110,000. C. A subsequent sale of the fund by the CRA T will eliminate capital gains taxes in future years for Fred. D. The entire amount is removed from his taxable estate at his death. 2.4. Which of the following is correct regarding the whole Life policy at Mary's death? A. The death benefit is payable and is income-tax-free. B. Any excess premiums paid over the cash value are deductible

- 2. on Mary's final income tax return. C. The cash value is included in Mary's gross estate. D. The excess of the death benefit over the aggregate cost basis is a transfer for value. 2.5. Which of the following is correct regarding Fred's group life policy? A. Fred can avoid imputed income by allocating the cost of his individual term policy as an offset. B. lf Mary predeceases Fred, the benefit is payable to Ted. C. The death benefit is not only income-tax-free, but is also excluded from Fred's gross estate. D. he employer cannot deduct the premium for coverage in excess of$50,000. 2.6. Which of the following is most likely the best strategy for Fred's individual term policy? A. Elect a life-income option with 10-year certain for Mary, to preserve the marital deduction. B. Transfer the policy to the irrevocable trust to remove the proceeds from Fred's estate and to allow for annual exclusion gifts. C. Change the beneficiary to a newly created revocable living trust with reduce-to-zero provisions. D. Gift the policy to Fred's business to effectuate the funding for a cross-purchase buy-sell agreement. 2.7. If Fred's death is prior to Mary's, which of the following asset transfers is a potential terminable interest? A. The group term insurance B. The value fund C. The 401(k) plan balance D. The business 2.8. If Fred dies today, what is the amount of the marital deduction related to the personal residence?

- 3. A. $0 B. $111,000 C. $222,000 D. $450,000 2.9. In the current situation, if Fred dies today and Mary dies four years later, which of the following represents the amount of the prior transfer credit Mary's estate may take? A. 0% B. 20% C. 40% D. 60% 2.10. In order to achieve Fred's objectives regarding his business interest, which of the following techniques is most appropriate? A. Private annuity for Fred's life, exchanging the business to Ted B. Self-canceling installment note, with Ted as purchaser C. One-way buy-sell agreement, with Ted as purchaser D. Placement of the business in the irrevocable trust 2.11. Assuming that Fred and his co-shareholders adopt a stock- redemption agreement, which of the following is correct? A. The value of Fred's interest will be pegged for estate tax purposes but may be more than $10 million. B. $10 million will be the amount included in Fred's estate for the value of his business interest. C. Up to $30 million in business value could be included in Fred's estate due to the attribution rules. D. The amount included in Fred's estate will be $10 million plus the requisite life insurance funding. 2.12. Which of the following is correct regarding debts and expenses paid at Fred's death? A. The mortgage is deductible in full from the gross estate. B The car loan is 50% deductible from the gross estate.

- 4. C. The mortgage is 50% deductible from the gross estate. D. The car loan is not deductible from the gross estate. 2.13. In an effort to reduce the ultimate amount included in Fred's gross estate, which of the following would most likely be an effective technique? A. Corporate recapitalization, using new preferred and common stocks and gifts of stock . B. Transfer of Fred' s business interest to a newly created revocable living trust with reduce-to zero provisions. C. Use of a lack-of-marketability discount to reduce the price in a new corporate stock redemption agreement. D. Employment of a minority discount in a new cross-purchase agreement. 14. If Fred funds his irrevocable trust today with a transfer of the growth fund, which of the following is correct regarding the generation-skipping transfer tax (GSTT)? A. Fred should file a Form 709 to claim the GSTT exemption. B. The transfer will be excluded from gift and GST tax under the annual exclusions. C. The gift to the trust is considered a taxable distribution for GSTT purposes. D. The gift to the trust will be deemed a taxable termination, as Fred's ownership rights are terminated. 2.15. If Fred makes an absolute assignment of his individual term policy to Ted for Ned's special needs, which of the following is correct? A. The transfer qualifies for the GST tax annual exclusion. B. Fred would use up some of his GST tax exemption to eliminate the GST tax. C. The action is deemed to be a taxable distribution under the GSTT rules. D. The transfer is not subject to the GST tax. 2.16. If Fred and Mary transfer the value fund to the private

- 5. special education school for Ned's benefit, which of the following is correct? A. The transfer will be fully excluded from the GST tax. B. Under the GSTT gift-splitting rules, only $55,000 is subject to GSTT. C. The transaction will constitute a taxable, indirect generation skip. D. $83,000 is the measurement of the taxable termination of Fred and Mary's ownership rights. 2.17. At Mary's death, the personal representative (executor) of the will must perform which of the following duties? A. Pay off the car loan. B. Arrange for the transfer of the whole life policy. C. Pour over assets at the conclusion of probate to the irrevocable trust. D. Include the value fund in the probate estate. 2.18. Based on Fred and Mary's objectives, which of the following is the best selection in terms of a post-death fiduciary for Fred's estate? A. Ted, due to his status as the only adult child B. Mary, as the surviving spouse C. Ted and Mary, as co-fiduciaries D. A bank trust department 2.19. At Ted's death, which of the following best represents the duty of the successor-trustee? A. Arrange to collect the life insurance proceeds. B. Merge the trust with Maria's trust for ongoing management. C. Open the probate estate to close off creditors after the statutory period. D. Admit Fred's letter to Ted in the probate process.

- 6. 2.20. If Fred dies today, what total amount is considered IRD? A. $0 B. $160,000 C. $345,000 D. $385,000 2.21. If Fred dies today, which of the following is the amount of the income tax deduction the beneficiary of the IRD assets can deduct? A. $0 B. $17,000 C. $228,000 D. $245,000 2.22. If Fred dies today, which of the following statements concerning the use of a Section 303 redemption by Fred's executor is correct? A. Fred's estate will not qualify unless Ted operates the business after Fred's death. B. The estate can benefit from use of the Section 303 redemption, whether Mary disclaims assets or not. C. Fred's estate cannot receive any benefit from a Section 303 redemption because the business will receive a step-up in basis at Fred's death. D. Fred's estate can benefit from the Section 303 redemption only if Fred completes a buy-sell agreement for the business interest. 2.23. If Fred wishes to add a provision to his will to create flexibility to reduce overall estate costs and taxes for the family, which of the following is most appropriate? A. Qualified disclaimer trust B. Section 2032A special use valuation C. QTIP trust D. Alternate valuation date provision

- 7. 2.24. Which of the following techniques should be used to provide for a child of a previous marriage and still provide for Mary? A. Change Fred's will to leave the business interest in a QTIP trust giving Mary income for life and the remainder to Ted. B. Change Fred's will to leave the house and business interest to his irrevocable trust. C. Set up a revocable trust for Felicity, Harmony, and Ned and transfer the business interest to the trust. D. Sell the business interest now to Ted in an installment sale. 2.25. If F red wants to use the business interest for an inheritance for a child of a previous marriage, which of the following statements concerning a buy-sell agreement is correct? A. The buy-sell agreement should provide for a trust for Ted and Ned to buy the stock. B. The buy-sell agreement should provide for Ted, Felicity, and Harmony to buy the stock. C. The buy-sell agreement should provide for Harold and Gerald to buy Fred’s stock. C. The buy-sell agreement should not be arranged. 4 ESTATE PLANNING Topics 53-73 © 2014 Keir Educational Resources 153 800-795-5347

- 8. FRED AND MARY FERRIS PERSONAL IN FORMA TION Fred and Mary Ferris have engaged your services for the development of a comprehensive financial plan. Their primary concerns, however, revolve around estate planning objectives. Fred, age 52, is a one-third owner of an automobile parts supplier in Michigan. The business has survived the cyclical nature of the auto industry through a combination of high-quality parts, just-in-time delivery, and superior cost containment. Mary, also 52, works part-time at the art institute, mostly to satisfy her aesthetic senses. She expects to continue working until age 60. This is a second marriage for Fred, whose first wife died at age 32 in a car accident. Fred has one son from that marriage, Ted, age 28, who is happily married but has fmancial difficulties due to his one child, Ned, age 3, who has special needs. Together, Fred and Mary have two daughters, both in private high school. Felicity is an honors student in her junior year, and Harmony is a sophomore and has musical talent. Name Relationship Occupation Notes Fred Husband Business Ovner Successful Mary Wife Docent at art institute Charitably inclined

- 9. Ted Son Retail sales Married; special-needs child Felicity Daughter HSjunior Scientifically gifted Harmony Daughter HS sophomore Musically gifted Mary has been generous with her time in helping Ted with his special-needs son Ned. Her assistance has solidified her excellent relationship with Ted and his wife Maria, a Canadian citizen. In addition, Mary is quite interested in leaving substantial amounts to the art institute at her death. Fred's business operates as a C corporation; Fred is an equal one-third owner with Harold Dietz and Gerald Keats. They are seriously contemplating a number of business agreements, including a buy-sell agreement, a non-qualified deferred-compensation plan, and a stock option plan of some kind. All three seek your advice in these matters. A recent business valuation produced a fair market value of $30 million for the business, with an expectation of 8% annual growth in the next 15 years. As all three owners are in their 50s and want to retire at age 66, they are concerned with successor management. Fred recently sent a registered letter to Harold and Gerald, indicating his intent that his son Ted should receive his share ofthe business at Fred's death. At this point, Ted is becoming increasingly interested in his father's business as a career. The owners each draw an annual salary of $150,000 and take equal bonuses, depending on profitability. Bonuses have averaged $50,000 each in the last five years. © 2014 Keir Educational Resources 154 www.keirsuccess.com

- 10. Estate Planning (Topics 53·73) The business has impLemented a 401 (k) plan with a matching contribution of$.50 per dollar on the first 6% of employee contributions. A dozen well-paid factory workers all participate. © 2014 Keir Educational Resources 155 800-795-5347 Estate Planning ITopics 53-73) The employees and their families are all covered by an excellent group health insurance plan, as well as group term life insurance equal to their base salary. A separate employer-paid group long-term disability plan also covers all employees for 60% of base pay, with a 90-day elimination period. The group LTD plan is integrated with Social Security and workers' compensation. ESTATE PLANNING DOCUMENTS Fred and Mary Ferris each have wills, leaving everything to the survivor. Each will contains a 120-day survivorship clause. In a simultaneous death, the will and state law presume that the wife survives. Ifthere is no surviving spouse, the children ofthe testator share equally. They each named their surviving spouse as the executor. Fred executed an unfunded irrevocable trust four years ago for the benefit of his children and grandchildren

- 11. that he hopes to use in the future. There is no withdrawal right in the trust. Fred and Mary have made no prior taxable gifts. At Fred's suggestion, Ted and Maria have created standard revocable living trusts with marital and residuary trusts. Large life insurance policies were also purchased on Ted and Maria ($500,000 each), payable to their respective trusts. LIFE INSURANCE SUMMARY Insured Owner TYP"e Face Amount Premium Beneficiary Fred Fred Group term $150,000 Employer- Primary: Mary paid Secondary: Ted Fred Mary Whole life $250,000 $4,200/year Primary: Mary Secondary: None Fred Fred IS-year terrn $1,000,000 $1,800/year Primary: Mary Secondary: None e 2014 [email protected]' Educational Resources 156 www.keirsueeess.com Cash and cash equivalents: J Cash value of life ins.: W Short-tenn fixed-inc. fund: J Value fund: J Growth fund: HI Global fund: H SPDA: H2

- 12. 401 (k) plan: H3 529 plans: H4 Business: H Residence: J Personal property: J Car:H $ 31,000 36,000 40,000 83,000 110,000 31,000 160,000 225,000 110,000 10,000,000 450,000 75,000 25,000 Total Assets $11,376,000 H=Husband W=Wife Balance Sheet Fred and Mary Ferris December 31, Last Year Liabilities

- 13. Car loan: H Mortgage: J Total Liabilities Net Worth Total Liabilities and $ 17,000 228,000 $ 245,000 $11,131,000 NetWOlth $11,376,000 J = Joint tenancy with right of survivorship IPayable on death: Mary 2Single-premium deferred annuity, issued 7/1/80; the initial premium was $40,000, and the estate is beneficiary. 3Beneficiary: Mary 4Mary is the successor-owner at Fred's death; the average annual return has been 0%. INVESTMENT DETAIL Asset Fair Market Basis Projected Purchased Value Growth Rate Short-tenn fixed- income fund $40,000 $41,000 1% 3 years ago Value fund $83,000 $50,000 7% 2 years ago Growth fund $110,000 $50,000 8% 8 years ago

- 14. Global fund $31,000 $22,000 6% 4 years ago © 2014 Keir Educational Resources 157 800-795-5347 Estate Planning (Topics 53-73) Inflows Salary: Fred Bonus: Fred Salary: Mary Interest/Dividends Total Inflows Outflows Mortgage: principal and interest Real estate tax Homeowners insurance (HO-3) Maintenance/Repairs Food Clothing Utilities Car loan TraveWacationiEntertainment Life insurance Fred and Mary Ferris Cash Flow Projection Current Year $150,000 50,000

- 15. 25,000 Reinvested $225,000 $ 31,200 6,200 820 8,300 7,800 4,000 5,600 7,200 16,000 Educational funding (daughters' 529 plans) 401(k) plan contribution: Fred 6,000 56,000 16,000 10,000 30,000 Charitable contributions Federal income tax State income tax Federal and state payroll taxes Total Outflows Surplus Goals and Objectives (in order of priority)

- 16. 8,000 10,674 $223,794 $1,206 1. Provide $120,000 of annual after-tax cash flow to the surviving family members at the death of either spouse. 2. Pay the remaining mortgage balance at the death of either spouse. 3. Provide adequate college funding for their daughters. 4. Provide assistance to Ted for Ned's care. 5. Eliminate the federal estate tax at the first death. 6. Reduce or eliminate the federal estate tax at the second death. 7. A void probate at death or incapacity. 8. Secure professional financial assistance for the survivors after either spouse's death. 9. Ensure adequate retirement income from all sources, including the sale of the business interest. © 2014 Keir Educational Resources 158 www.keirsuccess.com