Problems – 5 points each1. Greg and Justin are forming the G.docx

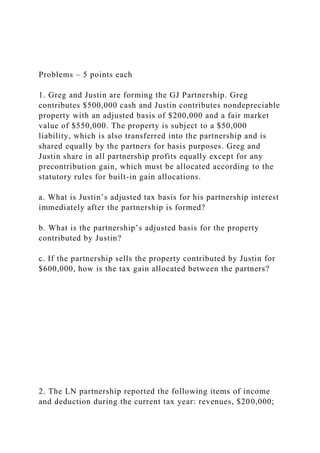

Problems – 5 points each 1. Greg and Justin are forming the GJ Partnership. Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000. The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes. Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations. a. What is Justin’s adjusted tax basis for his partnership interest immediately after the partnership is formed? b. What is the partnership’s adjusted basis for the property contributed by Justin? c. If the partnership sells the property contributed by Justin for $600,000, how is the tax gain allocated between the partners? 2. The LN partnership reported the following items of income and deduction during the current tax year: revenues, $200,000; cost of goods sold, $80,000; tax-exempt interest income, $5,000; salaries to employees, $50,000; and long-term capital gain, $5,000. In addition, the partnership distributed $10,000 of cash to 50% partner Nina and $20,000 of cash to 50% partner Len. What is Nina’s share of ordinary partnership income and separately stated items? 3. In the current year, Derek formed an equal partnership with Cody. Derek contributed land with an adjusted basis of $110,000 and a fair market value of $200,000. Derek also contributed $50,000 cash to the partnership. Cody contributed land with an adjusted basis of $80,000 and a fair market value of $230,000. The land contributed by Derek was encumbered by a $60,000 nonrecourse debt. The land contributed by Cody was encumbered by $40,000 of nonrecourse debt. Assume the partners share debt equally. Immediately after the formation, what is the basis of Cody’s partnership interest? 4. Janet Wang is a 50% owner of a calendar year S corporation. During 2012, the S corporation has ordinary income of $175,000, short-term capital gain of $94,000, tax-exempt income of $22,000, and a charitable contribution of $18,000. What S corporation items must Janet report in 2012? 5. Bidden, Inc., a calendar year S corporation, incurred the following items: Sales $130,000 Depreciation recapture income 12,000 Short-term capital gain 30,000 Cost of goods sold (42,000) Municipal bond interest income 7,000 Administrative expenses (15,000) Depreciation expense (17,000) Charitable contributions (14,000) Calculate Bidden’s nonseparately computed income. 6. During 2012, Ms. Rasic, the sole shareholder of a calendar year S corporation, received a distribution of $16,000. On December 31, 2011, Ms. Rasic’s stock basis was $4,000. The corporation earned $11,000 ordinary income during the year. Calculate the amount and type of income Ms. Rasic recognizes in 2012, assuming there is no C ...

Recommended

Recommended

More Related Content

Similar to Problems – 5 points each1. Greg and Justin are forming the G.docx

Similar to Problems – 5 points each1. Greg and Justin are forming the G.docx (20)

More from wkyra78

More from wkyra78 (20)

Recently uploaded

Recently uploaded (20)

Problems – 5 points each1. Greg and Justin are forming the G.docx

- 1. Problems – 5 points each 1. Greg and Justin are forming the GJ Partnership. Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000. The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes. Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations. a. What is Justin’s adjusted tax basis for his partnership interest immediately after the partnership is formed? b. What is the partnership’s adjusted basis for the property contributed by Justin? c. If the partnership sells the property contributed by Justin for $600,000, how is the tax gain allocated between the partners? 2. The LN partnership reported the following items of income and deduction during the current tax year: revenues, $200,000;

- 2. cost of goods sold, $80,000; tax-exempt interest income, $5,000; salaries to employees, $50,000; and long-term capital gain, $5,000. In addition, the partnership distributed $10,000 of cash to 50% partner Nina and $20,000 of cash to 50% partner Len. What is Nina’s share of ordinary partnership income and separately stated items? 3. In the current year, Derek formed an equal partnership with Cody. Derek contributed land with an adjusted basis of $110,000 and a fair market value of $200,000. Derek also contributed $50,000 cash to the partnership. Cody contributed land with an adjusted basis of $80,000 and a fair market value of $230,000. The land contributed by Derek was encumbered by a $60,000 nonrecourse debt. The land contributed by Cody was encumbered by $40,000 of nonrecourse debt. Assume the partners share debt equally. Immediately after the formation, what is the basis of Cody’s partnership interest? 4. Janet Wang is a 50% owner of a calendar year S corporation. During 2012, the S corporation has ordinary income of $175,000, short-term capital gain of $94,000, tax-exempt income of $22,000, and a charitable contribution of $18,000. What S corporation items must Janet report in 2012?

- 3. 5. Bidden, Inc., a calendar year S corporation, incurred the following items: Sales $130,000 Depreciation recapture income 12,000 Short-term capital gain 30,000 Cost of goods sold (42,000) Municipal bond interest income 7,000 Administrative expenses (15,000) Depreciation expense (17,000) Charitable contributions (14,000)

- 4. Calculate Bidden’s nonseparately computed income. 6. During 2012, Ms. Rasic, the sole shareholder of a calendar year S corporation, received a distribution of $16,000. On December 31, 2011, Ms. Rasic’s stock basis was $4,000. The corporation earned $11,000 ordinary income during the year. Calculate the amount and type of income Ms. Rasic recognizes in 2012, assuming there is no C corporation AEP.

- 5. 7. You are a 60% owner of an S corporation. Calculate your ending stock basis, based upon these facts: Beginning stock basis $42,570 Stock purchases 15,000 Insurance premiums paid (nondeductible) 3,600 Tax-exempt interest income 5,230 Payroll tax penalty 3,770 Increase in AAA 22,400 Increase in OAA 5,800

- 6. Multiple Choice – 3 points each 1. Maple Corporation had $400,000 operating income and $150,000 operating expenses during the current year. In addition, Maple had a $200,000 short-term capital gain and a $300,000 short-term capital loss. What is Maple’s taxable income for the year? a. $350,000 b. $250,000 c. $247,000 d. $150,000 2. Oak Corporation owns 25% of the stock of Redwood Corporation, which pays it a dividend of $40,000. Oak Corporation also owns 10% of the stock of Hickory Corporation, which pays it a dividend of $25,000. Assuming the taxable income limitation does not apply, how much is Oak Corporation’s dividend received deduction for the year? a. $45,500 b. $49,500 c. $52,000 d. $65,000

- 7. 3. Bondi Corporation, a calendar year corporation, has alternative minimum taxable income (before any exemption) of $600,000 for 2012. The company is NOT a small corporation. If the regular corporate tax is $85,000, Bondi’s alternative minimum tax for 2012 is: a. $27,000 b. $35,000 c. $112,000 d. $120,000 4. Marcus and Khalil form Auburn Corporation. Marcus transfers property (basis of $265,000 and fair market value of $200,000) while Khalil transfers $10,000 in cash and land (basis of $80,000 and fair market value of $190,000). Each receives 50% of Auburn Corporation’s stock, which is worth a total of $400,000. As a result of these transfers: a. Marcus has a recognized loss of $65,000 and Khalil has a recognized gain of $110,000. b. Neither Marcus no Khalil has any recognized gain or loss. c. Marcus has no recognized loss, but Khalil has a recognized gain of $10,000. d. Auburn Corporation will have a basis in the land of $190,000. 5. Beige Corporation has a deficit in accumulated E&P of $80,000. For 2012, it has current E&P of $80,000. On March

- 8. 31, 2012, Beige distributes $105,000 to its sole shareholder, Desiree. Desiree has a basis of $10,000 in her stock in Beige Corporation. Which of the following statements is true? a. Desiree has dividend income of $105,000. b. Desiree has dividend income of $80,000, reduces her stock basis to zero, and has a capital gain of $15,000. c. Desiree has dividend income of $80,000 and reduces her stock basis to $5,000. d. Desiree has no dividend income, reduces her stock basis to zero, and has a capital gain of $95,000. 6. Madeline and Noah formed a partnership. Madeline received a 50% interest in the partnership capital and profits in exchange for contributing land with a basis of $140,000 and a fair market value of $300,000. Noah received a 50% interest in partnership capital and profits in exchange for contributing $300,000 in cash. Three years after the contribution date, the land contributed by Madeline is sold by the partnership to a third party for $380,000. How much taxable gain will Madeline recognize from the sale? a. $40,000 b. $120,000 c. $160,000 d. $200,000 7. Beginning in 2012, the AAA of Willow, Inc., an S corporation, has a balance of $325,000. During the year, the

- 9. following items occur: Operating income $172,000 Interest income 6,000 Dividend income 14,050 Municipal bond interest income 6,000 Long-term capital loss from sale of investment land 7,000 Charitable contributions 19,000 Cash distributions to shareholders 57,000 What is Willow’s ending AAA balance as of December 31, 2012. a. $453,150 b. $434,050 c. $427,650 d. $426,750 8. Which of the teams listed below is NOT the reigning champion in their designated sport? a. Baltimore Ravens (NFL) b. Boston Red Sox (MLB) c. Chicago Blackhawks (NHL) d. Miami Heat (NBA) e. New York Mets (MLB)